Pakistan, Sri Lanka, And Bangladesh To Strengthen Capital Market Ties

Table of Contents

Increased Investment Flows and Regional Integration

Strengthened CMT will unlock substantial benefits by facilitating increased investment flows and promoting deeper regional integration. This collaboration will create a more dynamic and interconnected market, benefiting all participating economies.

Diversification of Investment Portfolios

Strengthened CMT will allow investors in Pakistan, Sri Lanka, and Bangladesh to diversify their portfolios significantly. This diversification reduces reliance on domestic markets and mitigates risks associated with individual country-specific economic fluctuations.

- Access to a wider range of investment instruments: Investors gain access to a broader spectrum of investment options, including equities, bonds, and other financial instruments previously unavailable.

- Reduced reliance on domestic markets: Diversification lessens the impact of domestic market volatility on overall portfolio performance.

- Mitigation of country-specific risks: Exposure to multiple markets reduces the overall risk profile of investment portfolios.

- Enhanced liquidity in regional markets: Increased trading activity across borders improves market liquidity, making it easier to buy and sell assets.

Boosting Foreign Direct Investment (FDI)

Improved CMT will significantly attract Foreign Direct Investment (FDI) by demonstrating the region's collective economic strength and stability. This increased confidence will lead to greater capital inflows.

- Increased investor confidence: A more integrated and regulated market fosters trust and encourages long-term investment.

- Improved market transparency and regulations: Harmonized regulations create a level playing field, attracting investors seeking predictable and transparent markets.

- Easier access to capital for businesses: Businesses in all three nations gain access to a larger pool of capital, fueling growth and innovation.

- Fostering regional economic cooperation: CMT strengthens regional collaboration, creating a more attractive investment destination.

Enhanced Regulatory Cooperation and Harmonization

Harmonizing regulatory frameworks is critical for building strong and sustainable CMT. This involves standardizing rules, improving market surveillance, and promoting investor protection.

Standardizing Regulatory Frameworks

Collaboration on regulatory standards will create a more efficient and transparent investment environment. This includes streamlining processes and establishing common standards.

- Streamlined listing procedures: Easier and faster processes for listing securities on regional exchanges.

- Uniform accounting standards: Adopting common accounting principles ensures transparency and comparability of financial information.

- Common investor protection mechanisms: Harmonized rules protect investors' rights and interests across the region.

- Facilitated cross-border transactions: Simplified procedures reduce the complexities of cross-border investments.

Improving Market Surveillance and Enforcement

Joint efforts to combat market manipulation and improve transparency are essential for building investor confidence. This will require closer cooperation between regulatory bodies.

- Enhanced regulatory oversight: Strengthened monitoring and enforcement mechanisms to maintain market integrity.

- Cooperation in investigations and enforcement: Collaborative efforts to investigate and address market misconduct.

- Increased information sharing: Improved communication between regulatory bodies to identify and address emerging risks.

- Promoting ethical and responsible investing: Promoting ethical practices and investor education to build a responsible and sustainable market.

Development of Regional Infrastructure and Technology

Investing in modern technology and capacity building is vital for realizing the full potential of strengthened CMT. This includes modernizing trading platforms and enhancing expertise.

Modernizing Trading Platforms

Investments in modern technology and integrated trading platforms will facilitate seamless cross-border transactions, significantly improving efficiency and reducing costs.

- Improved trading efficiency: Faster and more efficient execution of trades.

- Reduced transaction costs: Lower costs associated with cross-border trading.

- Enhanced market accessibility: Easier access to regional markets for investors.

- Increased market depth and liquidity: Greater trading volume leads to deeper and more liquid markets.

Capacity Building and Training

Joint initiatives for skills development and training will enhance expertise in capital markets across the three nations. This ensures a skilled workforce capable of managing the evolving market landscape.

- Specialized training programs for market professionals: Developing expertise in areas such as investment analysis, risk management, and regulatory compliance.

- Knowledge sharing and best practice exchange: Facilitating the exchange of information and best practices between market participants.

- Promoting financial literacy among investors: Educating investors on the benefits and risks of investing in regional markets.

- Strengthening institutional capacity: Building the capacity of regulatory bodies and other market institutions.

Conclusion

Strengthening capital market ties between Pakistan, Sri Lanka, and Bangladesh offers a powerful opportunity to boost economic growth, attract FDI, and foster regional integration. By collaborating on regulatory harmonization, infrastructure development, and capacity building, these three nations can unlock considerable economic potential. The enhanced collaboration in capital market ties will result in a more stable, efficient, and integrated South Asian economic landscape. To learn more about the opportunities presented by these strengthened capital market ties, actively follow the development of these initiatives and explore investment options within the region.

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion Tesla Stock Slump And Tariff Issues

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Stock Slump And Tariff Issues

May 10, 2025 -

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery From Lower Body Injury

May 10, 2025 -

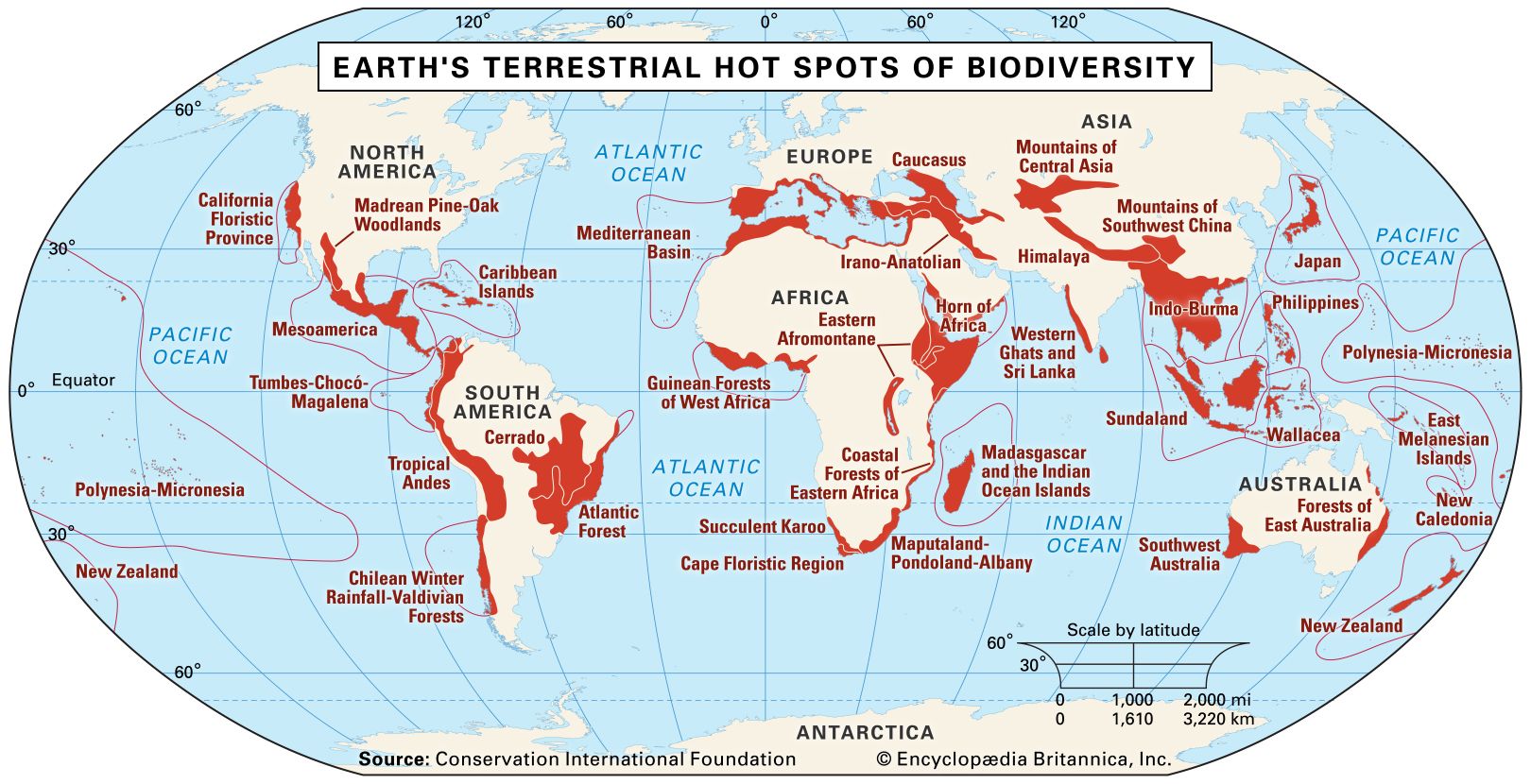

Where To Start Your Business A Map Of The Countrys Hot Spots

May 10, 2025

Where To Start Your Business A Map Of The Countrys Hot Spots

May 10, 2025 -

Divine Mercy In 1889 A Look At Religious Diversity And Gods Grace

May 10, 2025

Divine Mercy In 1889 A Look At Religious Diversity And Gods Grace

May 10, 2025 -

The He Morgan Brother And David 5 Key Theories From High Potential

May 10, 2025

The He Morgan Brother And David 5 Key Theories From High Potential

May 10, 2025