Pakistan, Sri Lanka, And Bangladesh: A New Era Of Capital Market Cooperation

Table of Contents

Economic Rationale for Enhanced Capital Market Cooperation

Enhanced capital market cooperation offers compelling economic advantages for Pakistan, Sri Lanka, and Bangladesh.

Increased Investment Flows

Cooperation can significantly boost foreign direct investment (FDI) and portfolio investment.

- Examples of potential investment opportunities: Infrastructure projects, renewable energy, technology startups, tourism development.

- Benefits of diversification for investors: Reduced risk through exposure to multiple markets, improved portfolio returns.

- Reduced risk profiles: A more integrated regional market reduces the impact of individual country-specific risks.

Joint ventures and cross-border investments will become more viable, facilitating technology transfer and knowledge sharing. This increased capital inflow will stimulate economic activity and create jobs across the region.

Regional Economic Growth

Improved capital markets are crucial for stimulating economic growth.

- Improved access to capital for businesses: Facilitates expansion, innovation, and job creation.

- Increased job creation: Attracting FDI and boosting domestic investment leads to increased employment opportunities.

- Development of specific sectors: Targeted investments can accelerate growth in sectors like tourism, technology, and manufacturing.

Studies suggest that enhanced capital market integration could significantly boost GDP growth rates across the three nations, leading to a more stable and prosperous region. For example, projections indicate a potential increase of X% in regional GDP within Y years due to increased capital flows and improved market efficiency.

Enhanced Financial Inclusion

Collaboration can dramatically improve financial inclusion.

- Expanding access to credit for small and medium-sized enterprises (SMEs): This is crucial for driving economic growth and fostering entrepreneurship.

- Developing microfinance schemes: Reaching underserved communities and providing them with access to financial services.

- Improving financial literacy programs: Empowering individuals to make informed financial decisions.

By working together, Pakistan, Sri Lanka, and Bangladesh can bridge the financial inclusion gap and create a more equitable and prosperous society. Initiatives promoting financial literacy and access to microfinance could significantly improve the lives of millions.

Challenges and Barriers to Cooperation

Despite the significant potential, several challenges hinder capital market cooperation.

Regulatory Differences

Significant regulatory discrepancies exist between the three countries.

- Differing regulations on securities trading: Variations in listing requirements, trading rules, and investor protection mechanisms.

- Inconsistent investor protection: Differences in enforcement of investor rights and protection against fraud.

- Varying accounting standards: Inconsistencies in financial reporting requirements complicate cross-border investment.

Harmonizing regulatory frameworks is crucial to fostering investor confidence and facilitating cross-border investment. This requires a collaborative effort to establish common standards and best practices.

Political and Geopolitical Risks

Political and geopolitical factors pose significant risks.

- Political instability: Internal political conflicts can disrupt market stability and deter investment.

- Cross-border tensions: Geopolitical tensions between the countries can negatively impact investor confidence.

- Economic sanctions: International sanctions imposed on any of the three nations can have spillover effects on the regional market.

Addressing these risks requires political will, diplomatic efforts, and a commitment to regional stability. Building trust and confidence among the nations is paramount for successful capital market integration.

Infrastructure Limitations

Inadequate infrastructure presents a major obstacle.

- Need for improved technology infrastructure: Reliable and secure trading platforms are essential for efficient market operations.

- Reliable communication networks: Efficient communication is vital for facilitating cross-border transactions and information sharing.

- Cybersecurity measures: Protecting sensitive data and ensuring the integrity of the financial system.

Investing in modern technology and enhancing cybersecurity are critical for creating a robust and secure regional capital market.

Potential Models for Cooperation

Several models can facilitate cooperation.

Information Sharing and Exchange

Establishing platforms for information sharing is crucial.

- Data exchange on market trends: Sharing information on economic indicators, market sentiment, and investor behavior.

- Best practice sharing: Exchanging knowledge and expertise on regulatory frameworks, market development, and investor protection.

Regional data centers and analytical platforms can greatly benefit all three nations.

Joint Initiatives and Projects

Joint projects can accelerate market integration.

- Joint investment funds: Pooling resources to invest in regional infrastructure projects and businesses.

- Development of regional stock exchanges: Creating a unified platform for trading securities across the three countries.

- Collaborative research and development initiatives: Jointly funding research and development projects to support innovation and technology transfer.

Public-private partnerships can play a key role in implementing these initiatives.

Harmonization of Regulatory Frameworks

A phased approach to regulatory harmonization is necessary.

- Stages of regulatory harmonization: Identifying areas for convergence, establishing a roadmap for implementation, and implementing changes gradually.

- Potential roadblocks: Addressing political resistance, navigating differing national interests, and ensuring that harmonization does not compromise individual country needs.

- Strategies for successful implementation: Building consensus among stakeholders, seeking technical assistance from international organizations, and establishing a clear timeline for implementation.

International organizations like the World Bank and the Asian Development Bank can provide crucial support in this process.

Conclusion: Building a Stronger Future Through Capital Market Cooperation

Enhancing capital market cooperation between Pakistan, Sri Lanka, and Bangladesh offers significant economic benefits, including increased investment flows, regional economic growth, and enhanced financial inclusion. While challenges related to regulatory differences, political risks, and infrastructure limitations exist, these can be overcome through concerted efforts. To strengthen capital market cooperation, policymakers must prioritize initiatives such as information sharing, joint projects, and regulatory harmonization. Establishing a regional task force and seeking international support will be essential. By working together, these nations can build a brighter economic future, unlocking the immense potential of their combined markets and fostering sustainable and inclusive growth. We urge stakeholders to actively participate in building a stronger regional capital market, promoting cross-border investment and driving shared prosperity.

Featured Posts

-

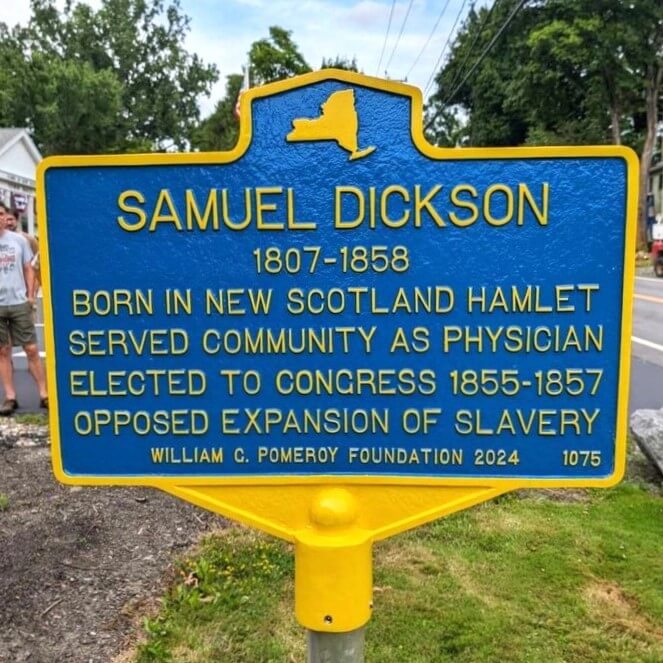

Exploring The Business Empire Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 09, 2025

Exploring The Business Empire Of Samuel Dickson A Canadian Lumber Industry Pioneer

May 09, 2025 -

Unlock Nyt Strands Game 405 Hints For April 12th

May 09, 2025

Unlock Nyt Strands Game 405 Hints For April 12th

May 09, 2025 -

Palantirs Nato Deal Revolutionizing Ai In The Public Sector

May 09, 2025

Palantirs Nato Deal Revolutionizing Ai In The Public Sector

May 09, 2025 -

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025 -

Increased Scrutiny For Asylum Seekers Home Office Action On Three Nations

May 09, 2025

Increased Scrutiny For Asylum Seekers Home Office Action On Three Nations

May 09, 2025