Organic Growth Strategy Leads Cenovus CEO To Dismiss MEG Bid Speculation

Table of Contents

Cenovus's Commitment to Organic Growth

Cenovus is aggressively pursuing an organic growth strategy focused on maximizing the value of its existing assets and expanding its operations strategically. This approach contrasts sharply with the often riskier path of large-scale acquisitions. Their current initiatives demonstrate a commitment to sustainable, long-term value creation.

-

Focus on operational efficiencies and cost reductions: Cenovus is implementing lean manufacturing principles and advanced data analytics to optimize its operations, reducing costs and improving productivity across its oil sands and upstream operations. This includes streamlining processes, improving resource allocation, and leveraging technology to minimize waste.

-

Highlight investments in renewable energy and sustainable practices: The company is actively investing in renewable energy projects and incorporating sustainable practices throughout its operations. This commitment to ESG (Environmental, Social, and Governance) factors is not only environmentally responsible but also enhances their long-term reputation and attracts environmentally conscious investors.

-

Detail expansion of existing oil sands and upstream operations: Cenovus is expanding its existing oil sands operations through incremental projects, focusing on increasing production capacity while minimizing environmental impact. This allows for controlled expansion, leveraging existing infrastructure and expertise.

-

Mention any technological advancements being implemented to boost production: Cenovus is actively exploring and implementing advanced technologies such as enhanced oil recovery techniques and automation to boost production efficiency and optimize resource utilization in its oil sands and upstream operations. This contributes to higher output and lower operating costs.

-

Explain how these initiatives contribute to long-term value creation: By focusing on operational excellence, sustainability, and technological innovation, Cenovus is building a foundation for consistent and predictable growth, creating long-term shareholder value and reducing reliance on unpredictable external factors.

Why an Organic Growth Strategy is Preferred Over Acquisition

In the current energy market, characterized by fluctuating prices and regulatory uncertainty, an organic growth strategy offers several significant advantages over acquisitions, particularly a large undertaking like acquiring MEG Energy.

-

Reduced financial risk compared to a large acquisition like MEG: Acquisitions involve substantial upfront costs and significant integration challenges. An organic growth strategy allows for more controlled spending and minimizes the financial risk associated with large mergers.

-

Greater control over project timelines and execution: Organic growth allows Cenovus to maintain tighter control over project timelines and execution, leading to better predictability and reducing the risk of unforeseen delays or cost overruns often associated with large acquisitions.

-

Avoidance of potential integration challenges and cultural clashes: Merging two companies often results in integration difficulties and cultural clashes, potentially disrupting operations and impacting employee morale. Organic growth avoids these challenges altogether.

-

Better alignment with Cenovus's existing operational expertise and infrastructure: Building upon existing operations allows Cenovus to leverage its existing expertise, infrastructure, and supply chains, leading to more efficient and cost-effective growth.

-

Enhanced shareholder value through focused internal improvements: By focusing on improving operational efficiency and profitability within its existing structure, Cenovus can deliver consistent returns to shareholders more reliably than through the uncertainties of a major acquisition.

The MEG Energy Perspective

MEG Energy, while a significant player in the Canadian oil sands, may currently present challenges that make an acquisition less attractive for Cenovus.

-

MEG's current financial performance and market position: MEG’s recent performance and market position may not align perfectly with Cenovus's strategic objectives, making a takeover less appealing. A thorough due diligence process might have revealed concerns about MEG’s long-term prospects.

-

Potential challenges associated with integrating MEG into Cenovus's operations: Integrating a company of MEG's size would present significant operational challenges, including potential system incompatibilities, cultural clashes, and the need for significant restructuring.

-

Speculation on why MEG might be considered less attractive at this time: Market conditions, MEG's debt levels, or other strategic factors could have influenced Cenovus's decision. Perhaps the price MEG was seeking was considered too high relative to the potential synergies.

-

Alternative strategic options for MEG Energy’s future: MEG may be pursuing its own organic growth strategies, or exploring other partnerships or acquisitions that better fit its long-term goals.

Implications for the Energy Sector

Cenovus's decision to prioritize its organic growth strategy carries significant implications for the wider energy sector.

-

The increasing importance of operational efficiency and sustainability in the energy industry: Cenovus's actions reflect a broader trend in the energy sector towards prioritizing operational efficiency, cost reduction, and environmentally sustainable practices.

-

The potential shift away from large-scale mergers and acquisitions: This decision may signal a shift away from the large-scale mergers and acquisitions that have characterized the energy industry in previous years, with companies increasingly focusing on organic growth.

-

The impact on investor sentiment and expectations: Investors are increasingly rewarding companies that demonstrate a commitment to sustainable and responsible growth. Cenovus's focus on organic growth could positively influence investor sentiment.

-

Future predictions for the energy sector based on this strategic move: We can expect to see more energy companies adopt similar organic growth strategies, focusing on internal improvements and operational efficiencies rather than large-scale acquisitions.

Conclusion

Cenovus Energy's decision to prioritize its organic growth strategy over a potential acquisition of MEG Energy signals a significant shift in the energy industry's approach to expansion. By focusing on internal improvements, operational efficiencies, and sustainable practices, Cenovus aims to build long-term value and reduce financial risk. While the reasons behind dismissing the MEG bid speculation are complex, this strategic move underscores the growing importance of well-executed organic growth strategies in achieving sustainable success in the dynamic energy landscape. For energy companies seeking to navigate the complexities of this sector, embracing a robust organic growth strategy is proving to be a more viable and less risky path toward achieving long-term success. Consider developing your own comprehensive organic growth strategy to ensure your company's future stability and profitability.

Featured Posts

-

I Mercedes Kai I Stratigiki Tis Apenanti Ston Verstappen

May 26, 2025

I Mercedes Kai I Stratigiki Tis Apenanti Ston Verstappen

May 26, 2025 -

Mathieu Van Der Poels Stunning Canyon Aeroad Specifications And Design For Tirreno Adriatico

May 26, 2025

Mathieu Van Der Poels Stunning Canyon Aeroad Specifications And Design For Tirreno Adriatico

May 26, 2025 -

Paris Roubaix Incident Update On Bottle Throwing Attack

May 26, 2025

Paris Roubaix Incident Update On Bottle Throwing Attack

May 26, 2025 -

Martin Compstons Glasgow A Los Angeles Feel In A New Thriller

May 26, 2025

Martin Compstons Glasgow A Los Angeles Feel In A New Thriller

May 26, 2025 -

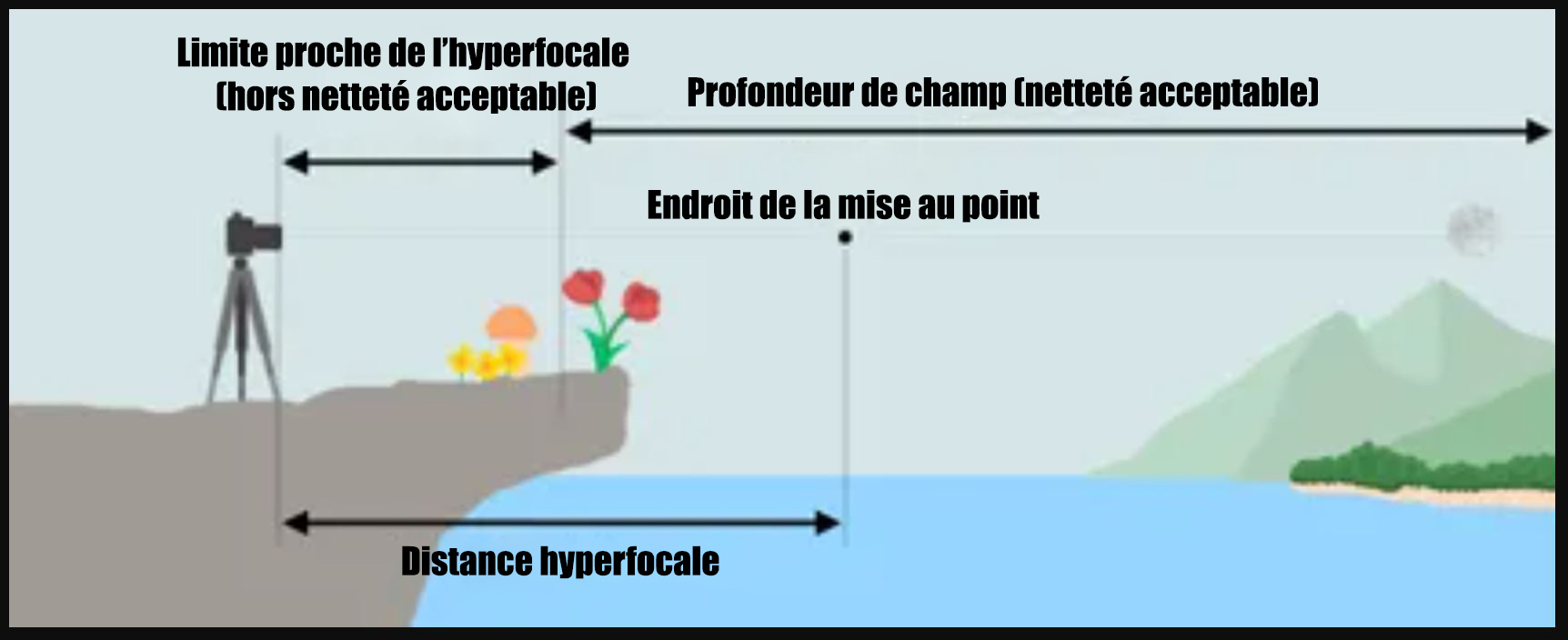

Rtbf Mise Au Point Sur La Possible Suppression De La Semaine Des 5 Heures

May 26, 2025

Rtbf Mise Au Point Sur La Possible Suppression De La Semaine Des 5 Heures

May 26, 2025