OPEC+ Decision Looms As Big Oil Resists Production Increase

Table of Contents

Current Global Oil Market Dynamics

High Demand and Tight Supply

The global oil market is currently characterized by a potent combination of high demand and tight supply, a dynamic that's been the primary driver of the recent surge in crude oil prices. This situation is far from temporary; several factors contribute to this precarious balance.

- Strong economic growth in Asia: The robust economic recovery in several Asian nations has significantly boosted energy consumption, placing considerable strain on global oil supplies.

- Rebound in air travel: The post-pandemic resurgence in air travel has dramatically increased the demand for jet fuel, further exacerbating the tight supply situation.

- Reduced oil inventories: Global oil inventories have fallen to levels that are considered dangerously low, leaving little buffer against unexpected disruptions to supply.

- Geopolitical instability: Ongoing geopolitical tensions in various parts of the world continue to introduce significant uncertainty into the oil market, impacting production and supply chains. The war in Ukraine, for example, has had a profound impact on global energy prices.

Inflationary Pressures and Consumer Impact

The elevated oil prices are not merely a concern for businesses; they're directly impacting consumers worldwide, fueling inflationary pressures and squeezing household budgets. The ripple effects are far-reaching.

- Rising gasoline prices: The most immediate and noticeable impact is the sharp increase in gasoline prices at the pump, impacting commuting costs and overall household expenses.

- Increased cost of goods: Higher oil prices translate to increased transportation costs for a wide array of goods, leading to elevated prices across the board.

- Impact on consumer spending: As energy costs rise, consumers are forced to cut back on spending in other areas, potentially slowing down economic growth.

- Government interventions: Governments around the world are facing immense pressure to intervene, exploring measures to mitigate the impact of high oil prices on their citizens, from subsidies to tax breaks.

Big Oil's Resistance to Production Increases

Profit Maximization Strategies

Major oil companies are hesitant to significantly boost oil production, primarily driven by their focus on profit maximization in this high-price environment. Shareholder pressure plays a pivotal role in these decisions.

- High profit margins: Current oil prices provide exceptionally high profit margins for oil producers, creating little incentive for them to increase production and potentially flood the market.

- Shareholder returns: Oil companies are under pressure from shareholders to prioritize maximizing returns on investment, making production increases a less attractive proposition.

- Capital allocation decisions: Instead of investing in increased production, many oil companies are allocating capital to other ventures, such as renewable energy projects and debt reduction.

- Investment in renewable energy: The transition to renewable energy sources is also a key factor, with many oil companies diversifying their portfolios and reducing their reliance on fossil fuels.

Concerns about Future Demand and Market Volatility

Beyond immediate profit considerations, oil companies harbor significant concerns about the future demand for oil and the inherent risks of overproduction in a rapidly changing energy landscape.

- Uncertainty about economic growth: The global economic outlook remains uncertain, making it difficult for oil companies to accurately predict future demand.

- Potential for renewable energy adoption: The accelerating adoption of renewable energy technologies poses a significant threat to long-term demand for oil.

- Impact of government regulations: Stringent government regulations aimed at reducing carbon emissions could further depress future oil demand.

Potential Scenarios Following the OPEC+ Meeting

Scenario 1: Significant Production Increase

A substantial increase in oil production by OPEC+ could lead to several significant consequences:

- Price decline: A surge in supply would likely push oil prices down, potentially offering relief to consumers and businesses.

- Reduced inflation: Lower oil prices would help to ease inflationary pressures across various sectors.

- Increased supply security: A greater supply of oil would improve energy security for many nations, reducing reliance on volatile markets.

- Potential for oversupply: However, a drastic production increase also carries the risk of creating an oversupply situation, which could lead to price crashes and financial difficulties for oil producers.

Scenario 2: Limited or No Production Increase

Conversely, a decision to maintain current production levels or implement only a minimal increase would result in a continuation of high prices and potential instability:

- Persistent high prices: Oil prices would remain elevated, continuing to exert pressure on consumers and businesses.

- Continued inflationary pressure: Inflationary pressures would persist, potentially leading to further economic hardship.

- Market instability: The lack of increased supply could further destabilize the market, leading to price volatility and uncertainty.

- Potential for geopolitical conflict: Persistent high prices could exacerbate geopolitical tensions, particularly among nations heavily reliant on oil imports.

Scenario 3: Gradual Production Increase

A more moderate approach, involving a gradual and controlled increase in oil production, could offer a compromise solution:

- Moderated price adjustments: A gradual increase would likely result in more moderate price adjustments, minimizing drastic shocks to the market.

- Balanced approach to supply and demand: This strategy aims to gradually bridge the gap between supply and demand, preventing both shortages and surpluses.

- Minimized market volatility: A measured approach could help to stabilize the market and reduce price fluctuations.

Conclusion

The OPEC+ decision regarding oil production holds immense significance for the global economy. Big oil's resistance to increased production underscores the intricate interplay of profit maximization, market volatility, and geopolitical considerations. The meeting's outcome will ultimately determine whether the world faces persistent high energy prices and persistent inflation or a more stable, albeit potentially less lucrative, oil market. Stay informed about the latest developments in the OPEC+ decision and its implications for the oil market by following reputable news sources and industry analysis. Understanding the crude oil production dynamics is crucial for making informed decisions in this volatile energy sector.

Featured Posts

-

Settlement Reached In Farage Nat West Banking Dispute

May 04, 2025

Settlement Reached In Farage Nat West Banking Dispute

May 04, 2025 -

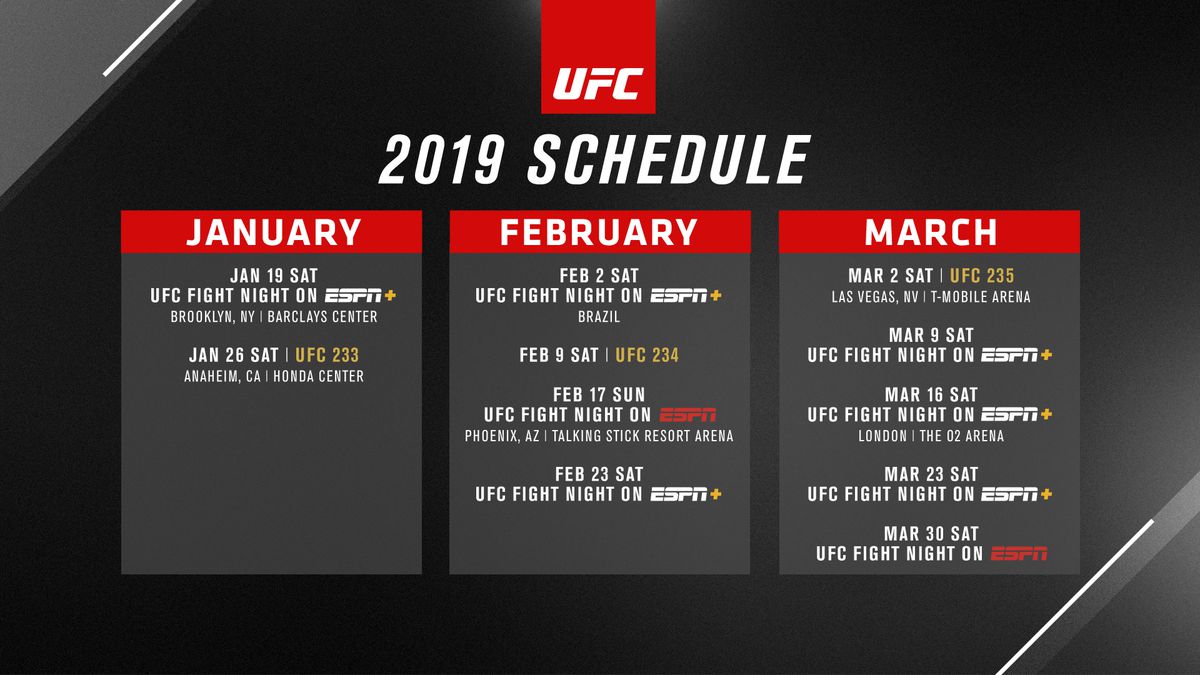

Complete Ufc Fight Schedule For May 2025 Featuring Ufc 315

May 04, 2025

Complete Ufc Fight Schedule For May 2025 Featuring Ufc 315

May 04, 2025 -

Mayotte Et La France Une Histoire Coloniale Persistante L Analyse De Rokhaya Diallo

May 04, 2025

Mayotte Et La France Une Histoire Coloniale Persistante L Analyse De Rokhaya Diallo

May 04, 2025 -

How Google Trains Its Search Ai Even After Opt Out

May 04, 2025

How Google Trains Its Search Ai Even After Opt Out

May 04, 2025 -

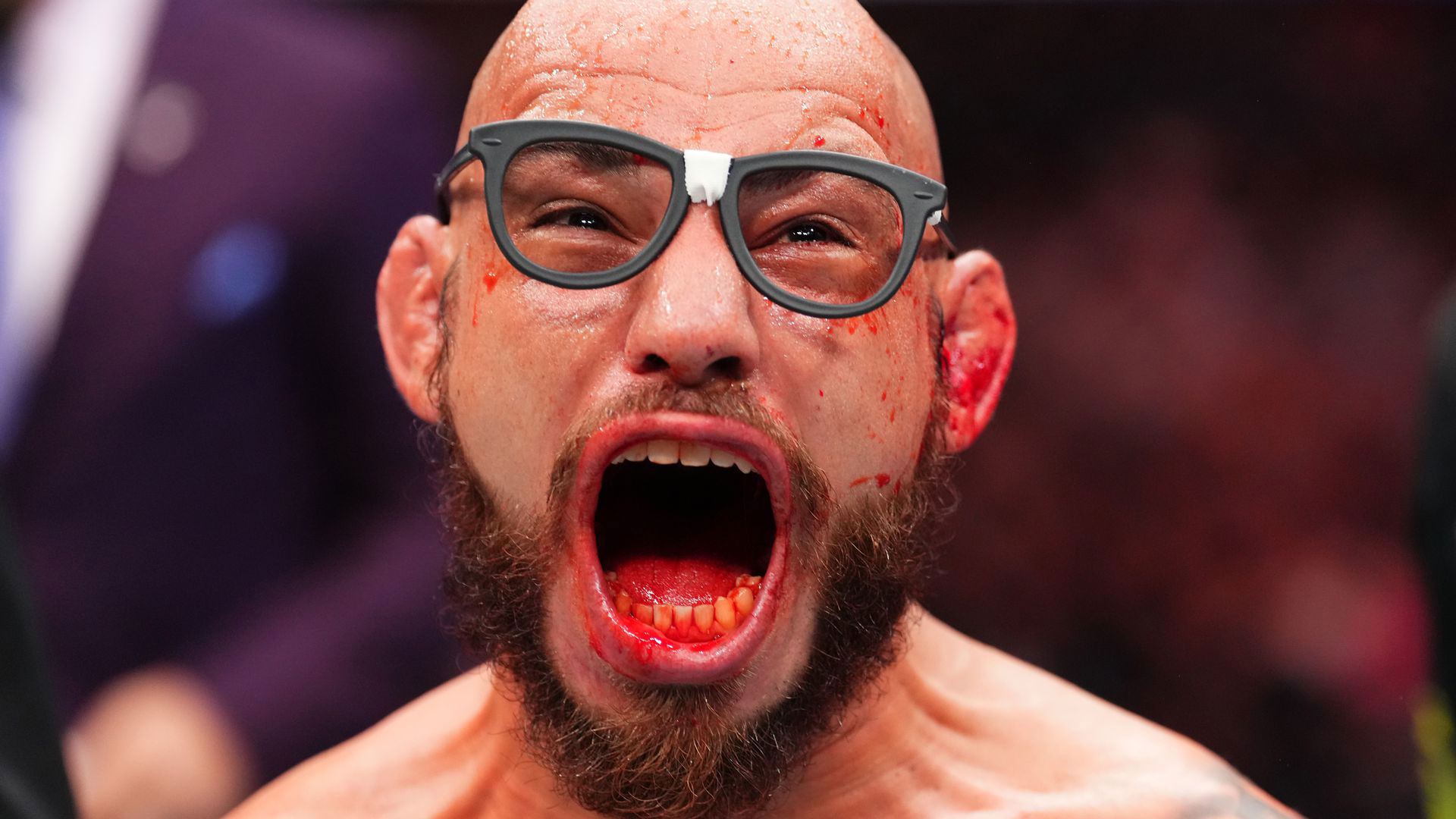

Jean Silvas Upset Win Securing A Ufc Contract

May 04, 2025

Jean Silvas Upset Win Securing A Ufc Contract

May 04, 2025