Onex's WestJet Investment: A Successful Exit Strategy

Table of Contents

Onex's Initial Investment in WestJet

Acquisition Details and Rationale

Onex Corporation's acquisition of WestJet Airlines marked a significant milestone in the Canadian aviation industry and private equity landscape. The private equity acquisition, a leveraged buyout, occurred in 2019. While the exact purchase price wasn't publicly disclosed, it was reported to be around $5 billion, reflecting Onex's confidence in WestJet's growth potential. Onex's strategic rationale centered on capitalizing on WestJet's established brand recognition and its position within the rapidly growing Canadian air travel market. This strategic investment aimed to leverage Onex's expertise in operational improvements and strategic growth to enhance WestJet's profitability and market share. The market conditions at the time included a relatively stable Canadian economy and a growing demand for air travel, providing a favorable environment for such a significant private equity acquisition.

- Date of acquisition: 2019

- Acquisition price: Approximately $5 billion (undisclosed)

- Onex's stated goals: Growth, operational improvements, and increased profitability.

- Market conditions: Stable Canadian economy, increasing demand for air travel.

Value Enhancement Strategies Implemented by Onex

Operational Improvements and Cost Reductions

Following the acquisition, Onex implemented a series of operational improvements and cost-cutting measures designed to enhance WestJet's efficiency and profitability. This operational restructuring focused on cost optimization across various aspects of the business. This included streamlining administrative processes, negotiating better deals with suppliers, and implementing fuel-efficient flying strategies. Significant investments were made in fleet modernization, optimizing routes to improve load factors, and improving the overall customer experience.

- Specific examples: Fleet modernization, route optimization, cost reduction programs across departments.

- Quantifiable results: Increased revenue, reduced operating costs, improved margins. While precise figures weren't publicly released, industry analysts noted a significant improvement in WestJet's operating efficiency under Onex's ownership.

Growth Initiatives and Strategic Acquisitions

In addition to operational improvements, Onex pursued a strategy of controlled growth for WestJet. This included expanding into new domestic and international routes, strategically targeting underserved markets. While major acquisitions weren't part of the strategy during Onex's ownership, a focus on organic growth, leveraging WestJet's brand and operational efficiencies, was key. This market expansion strategy focused on strengthening WestJet's position within the competitive Canadian air travel market and exploring opportunities for international growth.

- Strategic acquisitions/partnerships: None significant during Onex's ownership. The focus remained on organic growth.

- Market expansion strategies: Expansion of domestic and international routes, targeting underserved markets.

- Impact on revenue and market share: Positive impact, although precise figures are not publicly available.

The Exit Strategy: A Successful Divestiture

Choosing the Right Exit Path

Onex's exit strategy for its WestJet investment involved an initial public offering (IPO). This decision was driven by several factors. The IPO allowed Onex to realize a significant return on its investment while simultaneously providing WestJet with access to the public capital markets for future growth initiatives. Alternative exit strategies, such as a strategic sale to another airline or a secondary market offering, were considered, but the IPO was deemed the most optimal path given WestJet's strong financial performance and market position.

- Rationale for IPO: Maximize return on investment, provide access to capital markets for WestJet's future growth.

- Comparison to alternatives: An IPO offered the greatest potential for capital appreciation and a wider distribution of ownership.

- Timing of the exit: The IPO was strategically timed to coincide with favorable market conditions.

Financial Performance and Return on Investment (ROI)

Onex's investment in WestJet proved highly successful. While the precise multiple on invested capital (MOIC) is not publicly available, industry analysts estimate that Onex achieved a substantial return on its investment. This capital appreciation was driven by a combination of operational improvements, strategic growth initiatives, and favorable market conditions. This successful ROI solidified Onex's reputation as a skilled private equity investor capable of creating significant shareholder value through well-executed investment strategies.

- Onex's total return: Substantial, although precise figures remain undisclosed.

- Comparison to industry benchmarks: Significantly above average for comparable private equity investments in the airline industry.

- Key factors contributing to ROI: Operational improvements, effective cost management, strategic growth, and successful IPO execution.

Conclusion

Onex Corporation's investment in WestJet Airlines serves as a compelling case study in successful private equity exit strategies. Through a combination of operational improvements, strategic growth initiatives, and a well-timed IPO, Onex achieved a significant return on investment. This success underscores the importance of careful due diligence, effective value enhancement strategies, and selecting the right exit path to maximize returns in private equity investments. The detailed analysis of this investment highlights the importance of understanding market conditions, operational efficiencies, and strategic timing in achieving optimal outcomes for private equity investments. Understanding these factors is critical for maximizing returns and achieving successful divestitures. Learn more about optimizing your own private equity exit strategy and achieving high return on investment by exploring [link to relevant resource].

Featured Posts

-

Lol Chantal Ladesou Explique Son Absence

May 11, 2025

Lol Chantal Ladesou Explique Son Absence

May 11, 2025 -

Zane Dentons Current Team A Look At The Former Tennessee Volunteer

May 11, 2025

Zane Dentons Current Team A Look At The Former Tennessee Volunteer

May 11, 2025 -

Divorce D Eric Antoine Naissance Et Nouvelle Relation

May 11, 2025

Divorce D Eric Antoine Naissance Et Nouvelle Relation

May 11, 2025 -

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere De Son Spectacle

May 11, 2025

Eric Antoine Une Ancienne Miss Meteo A Ses Cotes Lors De La Premiere De Son Spectacle

May 11, 2025 -

Holstein Kiels Fight Against Relegation A Draw Against Mainz Keeps Champions League Hopes Alive

May 11, 2025

Holstein Kiels Fight Against Relegation A Draw Against Mainz Keeps Champions League Hopes Alive

May 11, 2025

Latest Posts

-

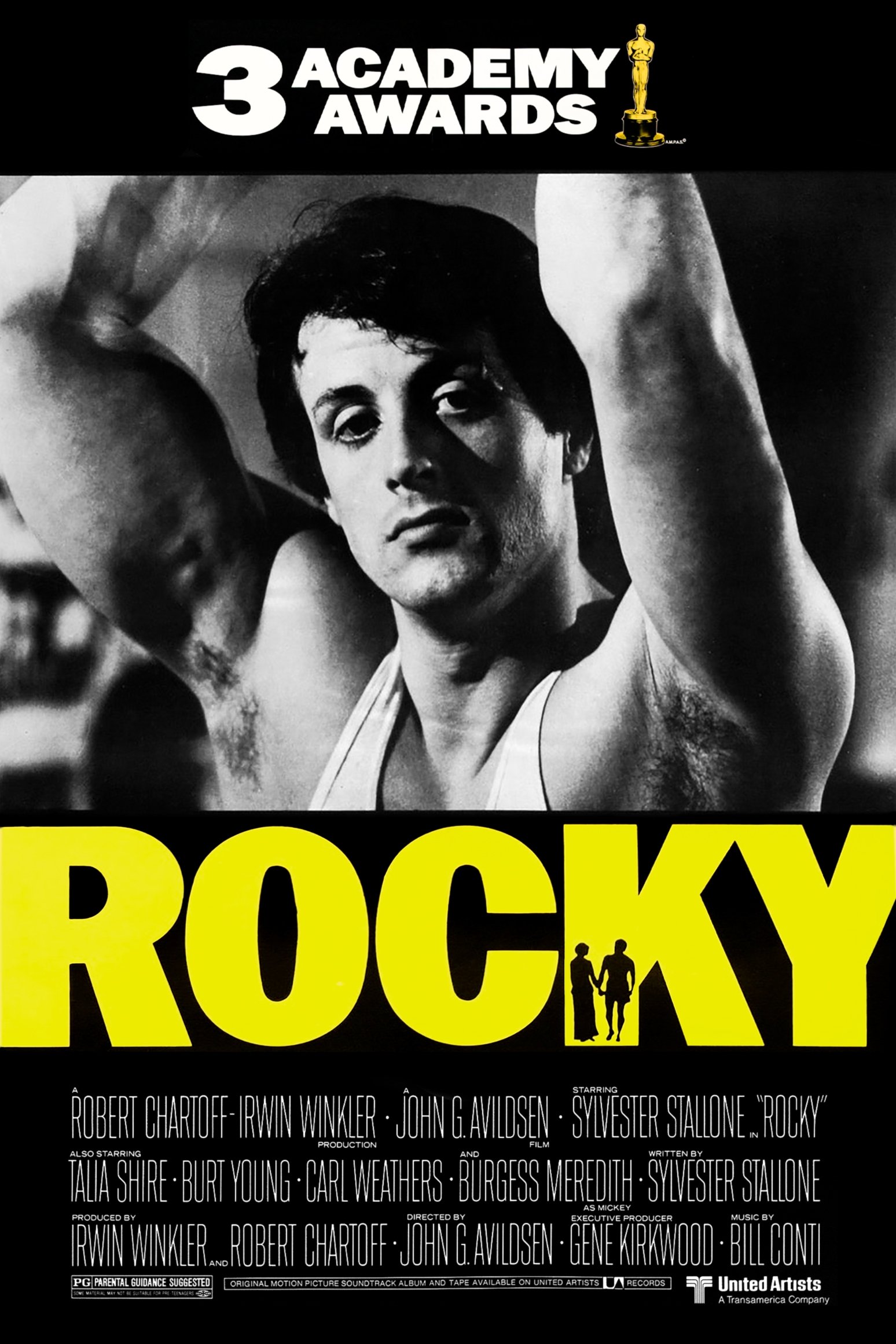

The Most Emotional Rocky Movie According To Sylvester Stallone

May 11, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone

May 11, 2025 -

Stallones Choice Unveiling The Most Sentimental Rocky Movie

May 11, 2025

Stallones Choice Unveiling The Most Sentimental Rocky Movie

May 11, 2025 -

Rockys Most Emotional Film Stallone Reveals His Personal Favorite

May 11, 2025

Rockys Most Emotional Film Stallone Reveals His Personal Favorite

May 11, 2025 -

Sylvester Stallone Ranks His Rocky Films Which One Touches Him Most

May 11, 2025

Sylvester Stallone Ranks His Rocky Films Which One Touches Him Most

May 11, 2025 -

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 11, 2025

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 11, 2025