One Chocolate Bar, Global Inflation: A Story Of Unexpected Demand

Table of Contents

The Rising Cost of Cocoa and Other Ingredients

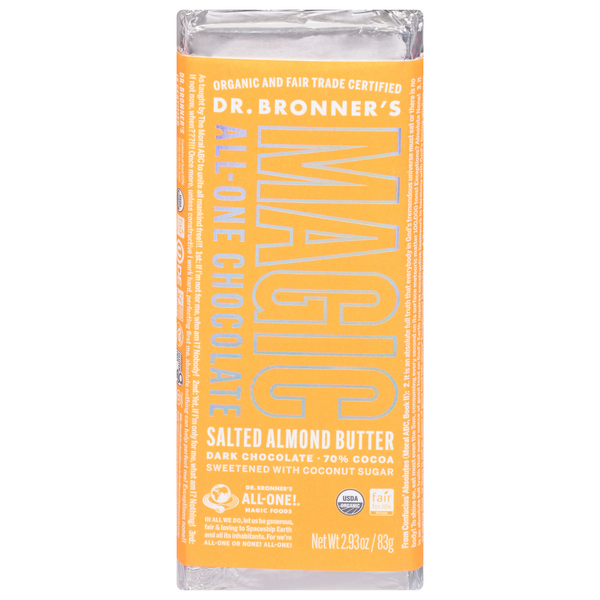

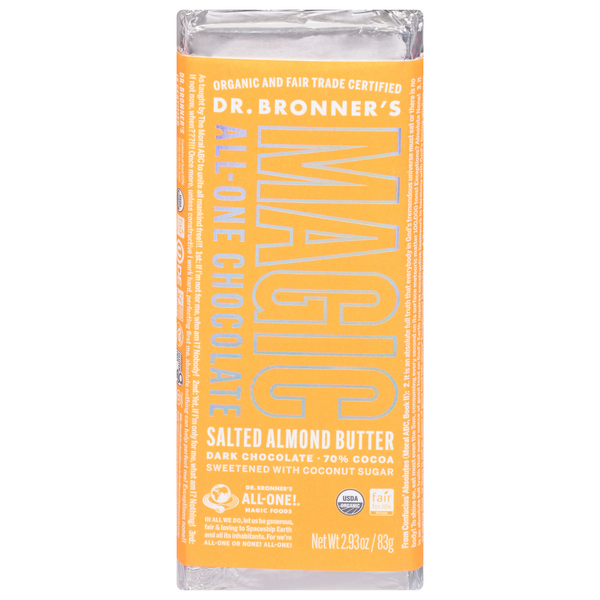

The price of a chocolate bar is directly influenced by the cost of its core ingredients. Fluctuating cocoa prices, driven by weather patterns, disease outbreaks, and geopolitical instability in major cocoa-producing regions, significantly impact the final price. Beyond cocoa, sugar and dairy prices play a crucial role. These ingredients are subject to their own set of challenges, including rising energy costs for farming and processing, impacting the overall cost of chocolate production. Cocoa farmers themselves often face low wages and lack of access to resources, further contributing to the rising prices.

- Cocoa bean prices have increased by 15% in the last year. This surge is partly due to unfavorable weather conditions in West Africa, which significantly reduced the cocoa harvest.

- Sugar prices are up 8% due to reduced sugarcane yields and increased energy costs. These higher costs are passed down the supply chain, affecting the price of chocolate.

- Milk prices have risen 12% due to increased feed costs and a global milk shortage. The cost of dairy products used in milk chocolate significantly impacts its overall price.

Supply Chain Disruptions and Transportation Costs

The journey from cocoa bean to chocolate bar is a complex process involving global supply chains. Recent years have witnessed significant disruptions, impacting the timely and cost-effective delivery of ingredients and finished products. Rising fuel prices, a direct consequence of global energy market fluctuations, have increased transportation costs dramatically. Furthermore, port congestion and labor shortages contribute to significant shipping delays, adding further pressure on production and distribution timelines. These disruptions add considerably to the final price of a chocolate bar, amplifying the impact of global inflation.

- Shipping costs have increased by 40% since the beginning of 2022. This increase is largely due to fuel price hikes and global shipping container shortages.

- Fuel prices have risen by 30% contributing to higher transport costs for cocoa beans, sugar, and finished chocolate products. This directly impacts the final price consumers pay.

- Port congestion has led to delays of up to 4 weeks on average. These delays cause production slowdowns and increase storage costs.

Increased Consumer Demand Despite Higher Prices

Despite the rising prices, demand for chocolate remains relatively high. This reflects the concept of inelastic demand – where changes in price have a relatively small effect on the quantity demanded. Chocolate, for many, is considered a relatively affordable treat and a source of comfort and indulgence. Brand loyalty also plays a significant role. Consumers often remain faithful to their favorite brands, even when faced with price increases. The increased sales of premium chocolate brands further highlights this trend; consumers are willing to pay more for higher-quality products and familiar brands.

- Sales of premium chocolate brands have increased by 10%. This indicates that consumers are willing to absorb price increases for their preferred brands.

- Consumers are willing to pay more for their favorite brands. This illustrates the strong influence of brand loyalty on purchasing decisions.

- The demand for chocolate remains relatively stable despite price increases. This demonstrates the inelastic nature of demand for chocolate for many consumers.

The Psychological Impact of Chocolate Consumption

The continued consumption of chocolate during inflationary periods highlights its psychological significance. Chocolate is often considered a comfort food, providing a sense of indulgence and stress relief. In times of economic uncertainty, consumers may turn to such products as a coping mechanism, even if it means paying a higher price. This emotional spending aspect plays a crucial role in maintaining the demand for chocolate, despite economic pressures.

Conclusion

The seemingly simple chocolate bar provides a fascinating lens through which to view the complexities of global inflation. Rising ingredient costs, supply chain disruptions, and persistent consumer demand all contribute to the increased price. Understanding these interconnected factors helps us comprehend broader economic trends.

Call to Action: Understanding the factors driving the price of a chocolate bar helps us comprehend broader economic trends. Stay informed about global inflation and its impact on everyday goods like chocolate by following [link to relevant resource/website]. Learn more about how global inflation affects your favorite treats and how you can manage your spending effectively during periods of rising prices. Analyze the impact of global inflation on your own spending habits and discover how even a single chocolate bar can tell a powerful economic story.

Featured Posts

-

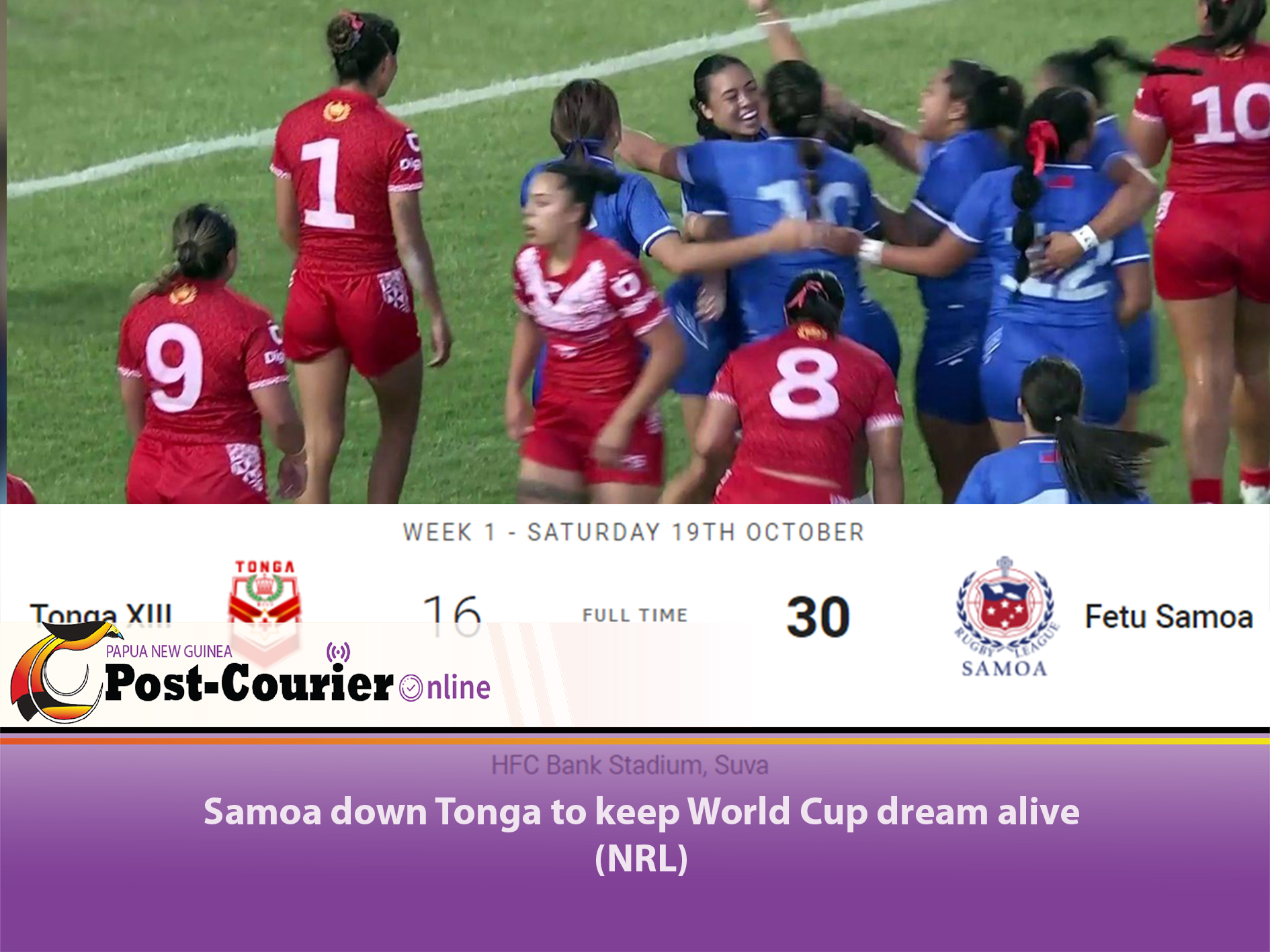

Samoas World Cup Hopes Dashed By Tonga

May 01, 2025

Samoas World Cup Hopes Dashed By Tonga

May 01, 2025 -

Stuttgart In Genis Kapsamli Atff Altyapi Secmeleri

May 01, 2025

Stuttgart In Genis Kapsamli Atff Altyapi Secmeleri

May 01, 2025 -

Zdravko Colic I Njegova Prva Ljubav Inspiracija Za Pjesmu Kad Sam Se Vratio

May 01, 2025

Zdravko Colic I Njegova Prva Ljubav Inspiracija Za Pjesmu Kad Sam Se Vratio

May 01, 2025 -

Cty Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu Trong Goi Thau Cap Nuoc Gia Dinh

May 01, 2025

Cty Tam Hop Chien Thang Thuyet Phuc Truoc 6 Doi Thu Trong Goi Thau Cap Nuoc Gia Dinh

May 01, 2025 -

Premiere Naissance De L Annee Recompensee Par Une Boulangerie Normande

May 01, 2025

Premiere Naissance De L Annee Recompensee Par Une Boulangerie Normande

May 01, 2025

Latest Posts

-

10 Tran Dau Dang Xem Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

10 Tran Dau Dang Xem Nhat Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025 -

Injuries And Walks Plague Angels In Home Opener Defeat

May 01, 2025

Injuries And Walks Plague Angels In Home Opener Defeat

May 01, 2025 -

Lich Thi Dau Chinh Thuc Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 10 Tran Dau Hap Dan

May 01, 2025

Lich Thi Dau Chinh Thuc Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 10 Tran Dau Hap Dan

May 01, 2025 -

Home Opener Loss Angels Stumble Due To Walks And Injuries

May 01, 2025

Home Opener Loss Angels Stumble Due To Walks And Injuries

May 01, 2025 -

Angels Season Starts With Injury And Walk Woes

May 01, 2025

Angels Season Starts With Injury And Walk Woes

May 01, 2025