Oil Supply Shocks: How The Airline Industry Is Feeling The Pinch

Table of Contents

H2: The Direct Impact of Rising Fuel Costs on Airline Profitability

Fuel represents a substantial portion of an airline's operating costs – typically between 20% and 40%, depending on the airline and route. The recent surge in fuel prices due to oil supply shocks has created a significant strain on airline profitability.

H3: Increased Operational Expenses

- Increased fuel costs directly translate to higher operational expenses. This isn't limited to just the fuel itself; maintenance costs also increase as engines require more frequent servicing due to increased strain.

- Ground handling expenses are impacted as more fuel is needed for ground support equipment.

- The percentage increase in fuel costs has outpaced revenue growth in many cases, significantly squeezing profit margins. For example, some major airlines have reported a 15-20% reduction in profit margins due to this factor.

H3: Strategies for Mitigating Fuel Costs

Airlines are actively pursuing various strategies to mitigate the impact of these rising fuel costs:

- Fuel hedging: Many airlines use financial instruments like futures contracts to lock in fuel prices at a predetermined rate, reducing exposure to price volatility. However, hedging isn't foolproof and can be costly if market prices move in an unexpected direction.

- Fuel-efficient aircraft: Investing in newer, more fuel-efficient aircraft models is a long-term strategy that reduces fuel consumption per passenger mile. Airlines are increasingly turning to next-generation aircraft designed for superior fuel economy.

- Route optimization: Airlines are analyzing flight routes to identify the most fuel-efficient paths, considering factors such as wind patterns and altitudes. This might involve adjusting flight schedules or even canceling less profitable routes.

- Technological advancements: Continuous research and development in areas like aerodynamic improvements and lighter aircraft materials offer significant potential for fuel savings in the long run.

H2: The Ripple Effect: How Oil Supply Shocks Affect Passengers and the Broader Economy

The impact of oil supply shocks on the airline industry extends far beyond the balance sheets of airlines. It has significant consequences for passengers and the broader economy.

H3: Increased Airfares

Airlines inevitably pass on increased fuel costs to consumers through higher ticket prices.

- Recent fare increases reflect the escalating fuel costs. Some airlines have seen price hikes of 10-15% on certain routes.

- The demand elasticity of air travel plays a crucial role here. While some travelers may reduce their travel plans due to higher prices, essential business travel and leisure demand often remains relatively inelastic in the short term.

- Reduced air travel is a potential long-term consequence as higher fares erode consumer purchasing power.

H3: Impact on Air Travel Demand and Route Cancellations

As fuel costs rise, airlines might be forced to reduce services.

- Less profitable routes, particularly those serving smaller airports, might be the first to be affected by cancellations or reduced frequency.

- Reduced connectivity and accessibility impact regional economies reliant on air travel for tourism and business.

- The economic consequences of reduced travel are far-reaching, affecting tourism, hospitality, and related industries.

H3: Broader Economic Implications

High fuel prices in the aviation sector have a significant ripple effect across various industries.

- Tourism and hospitality are heavily reliant on air travel, and reduced air travel directly impacts these sectors.

- The overall economic growth can be hampered by reduced consumer spending and decreased business activity due to higher travel costs.

H2: Government Intervention and Industry Response to Oil Supply Shocks

Governments and the airline industry itself are responding to these challenges in various ways.

H3: Government Support and Regulations

Some governments offer support to their national airlines to mitigate the impact of oil supply shocks.

- Subsidies and tax breaks can help airlines offset rising fuel costs, but these measures are not universally applied and often face political and economic constraints.

- Regulations aimed at promoting fuel efficiency can encourage airlines to invest in sustainable solutions.

H3: Industry Collaboration and Innovation

Airlines are collaborating on initiatives to address the challenges posed by oil supply shocks.

- Sustainable aviation fuel (SAF) is gaining traction as a long-term solution to reduce reliance on fossil fuels. This involves using alternative fuels derived from renewable sources.

- Carbon offsetting programs allow airlines to compensate for their carbon emissions, addressing environmental concerns alongside cost pressures.

3. Conclusion

Oil supply shocks are significantly impacting the airline industry, leading to financial strain, increased airfares, potential route cancellations, and broader economic consequences. The severity of the situation highlights the need for proactive solutions. Key takeaways include the significant increase in operational costs for airlines, the ripple effect on consumers and related industries, and the necessity for both government intervention and industry innovation to mitigate future oil supply shocks. Understanding the impact of oil supply shocks is crucial for both airlines and travelers alike. Stay informed about these fluctuations and their effects on your travel plans, and consider supporting airlines that actively invest in sustainable aviation practices to help lessen the impact of future oil price increases and their effect on air travel.

Featured Posts

-

Kentucky Derby And Ford A Long Standing Automotive Partnership

May 04, 2025

Kentucky Derby And Ford A Long Standing Automotive Partnership

May 04, 2025 -

Anna Kendricks Age A Milestone And The Publics Reaction

May 04, 2025

Anna Kendricks Age A Milestone And The Publics Reaction

May 04, 2025 -

Massive V Mware Price Hike Proposed By Broadcom At And T Reports 1 050 Increase

May 04, 2025

Massive V Mware Price Hike Proposed By Broadcom At And T Reports 1 050 Increase

May 04, 2025 -

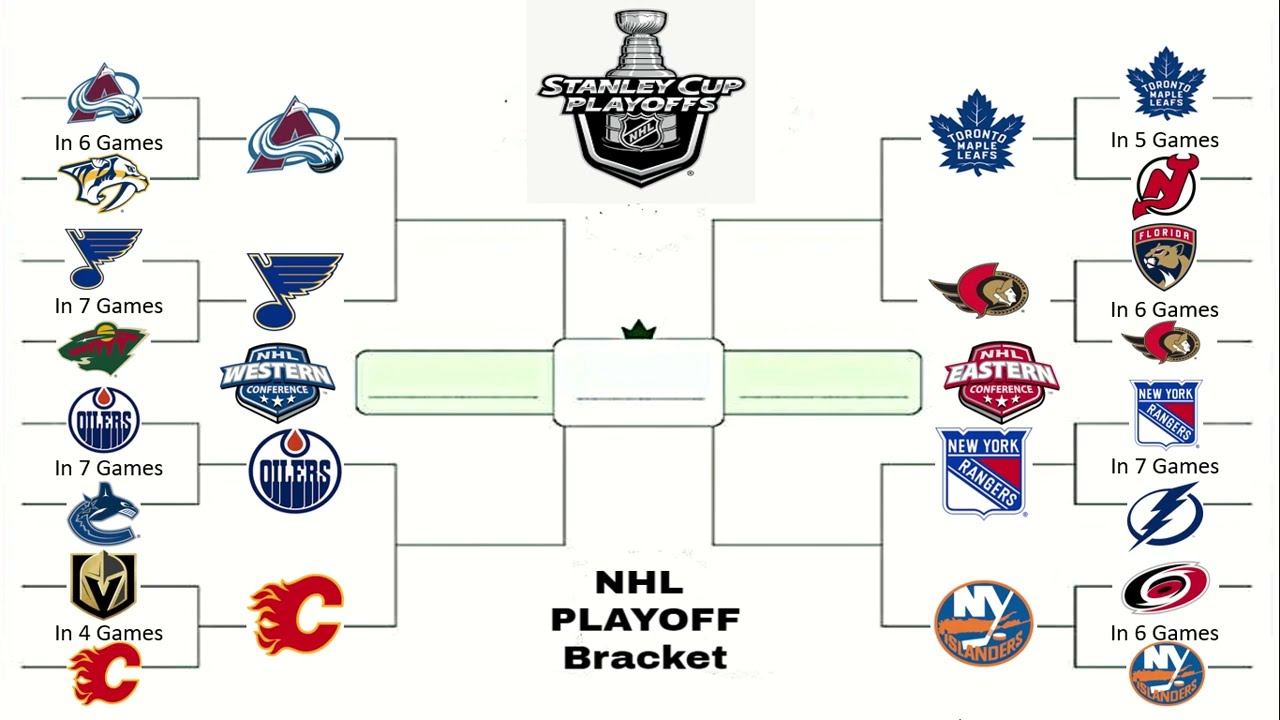

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025 -

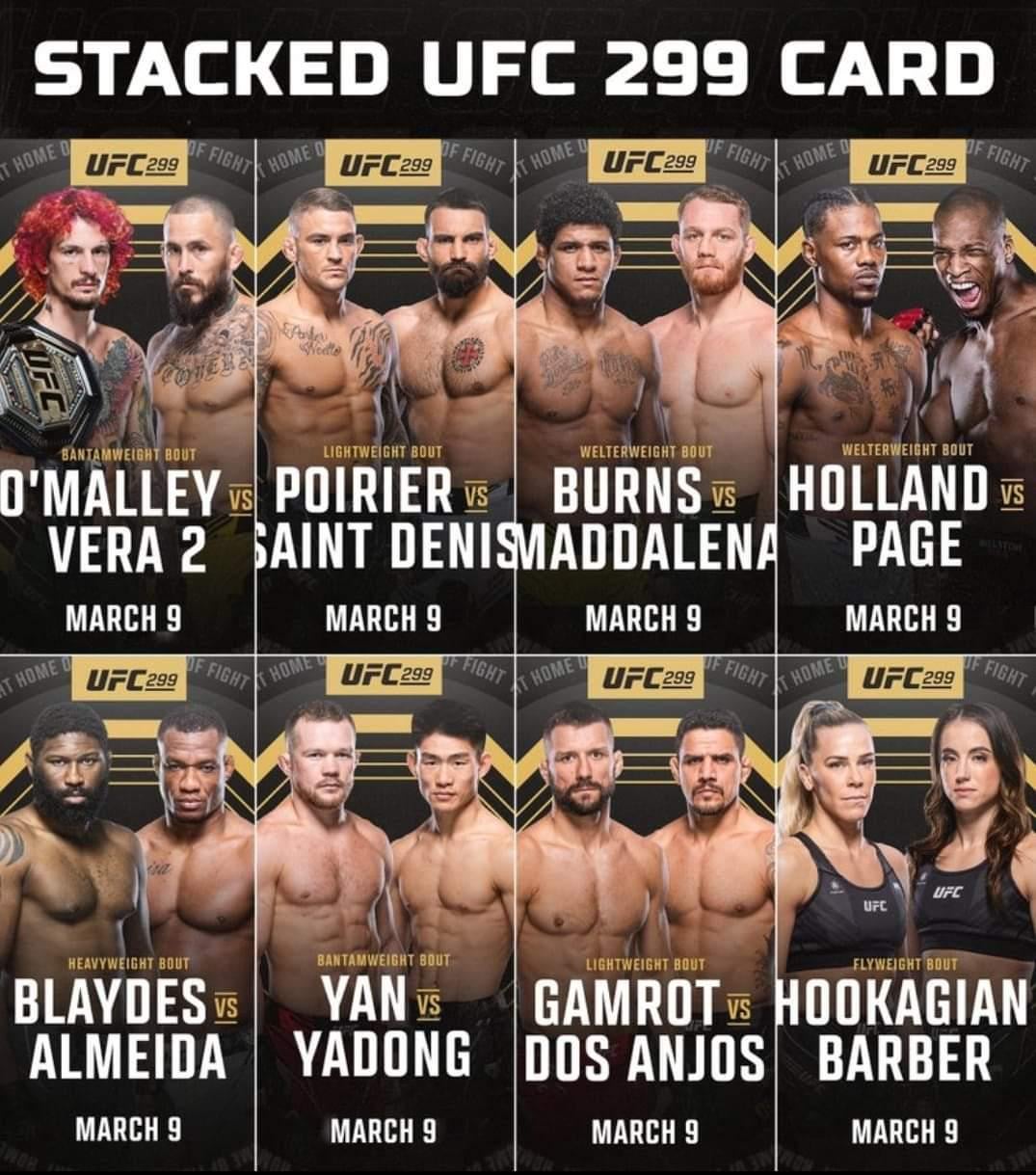

Cory Sandhagen Vs Deiveson Figueiredo Fight Night Prediction And Betting Odds

May 04, 2025

Cory Sandhagen Vs Deiveson Figueiredo Fight Night Prediction And Betting Odds

May 04, 2025

Latest Posts

-

Ufc Fight Card Schedule May 2025 Ufc 315 And Beyond

May 04, 2025

Ufc Fight Card Schedule May 2025 Ufc 315 And Beyond

May 04, 2025 -

Three Months To Success The Monkey Reboots Challenge

May 04, 2025

Three Months To Success The Monkey Reboots Challenge

May 04, 2025 -

Monkey Movie Reboot Faces High Bar Set By 666 M Horror Franchise

May 04, 2025

Monkey Movie Reboot Faces High Bar Set By 666 M Horror Franchise

May 04, 2025 -

Is Tony Todds Return In Final Destination Bloodlines Worth The Hype

May 04, 2025

Is Tony Todds Return In Final Destination Bloodlines Worth The Hype

May 04, 2025 -

Can The Monkey Reboot Surpass The Originals 666 M Box Office

May 04, 2025

Can The Monkey Reboot Surpass The Originals 666 M Box Office

May 04, 2025