OECD 2025 Outlook: Canada's Economy To Stagnate, Recession Averted

Table of Contents

- Stagnant Growth: Key Factors Identified by the OECD

- Weakening Global Demand

- High Interest Rates and Inflation

- Labor Market Challenges

- Factors Preventing a Recession in Canada

- Resilient Domestic Demand

- Diversified Economy

- Government Policies and Support

- Implications for Businesses and Investors

- Strategic Planning and Adaptation

- Investment Strategies in a Stagnant Economy

- Conclusion: OECD 2025 Outlook: Navigating Canada's Economic Landscape

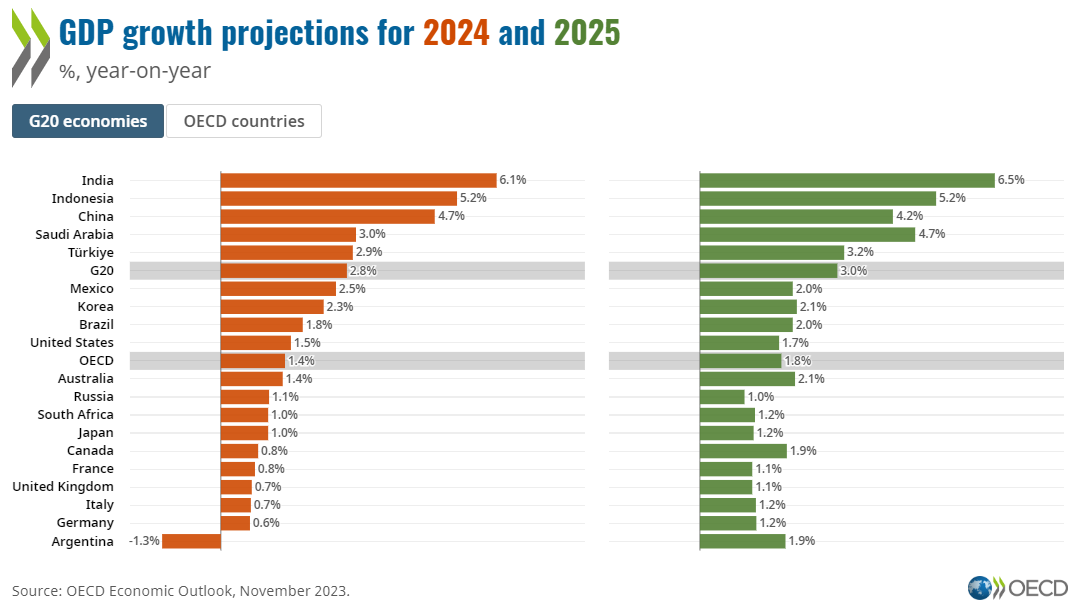

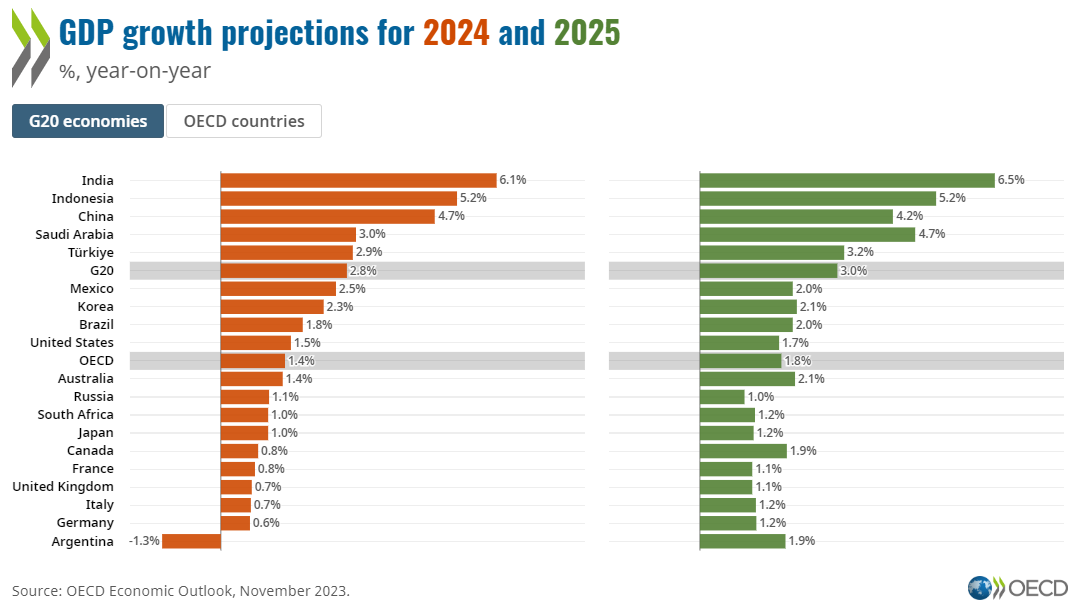

The OECD, a leading international organization, provides invaluable economic analysis and forecasts. Its report on Canada's economic prospects for 2025 carries significant weight, influencing government policies, investment decisions, and business strategies across the country. The OECD predicts economic stagnation for Canada in 2025, but importantly, it also identifies factors that will prevent a full-blown recession.

Stagnant Growth: Key Factors Identified by the OECD

The OECD’s projection of stagnant growth for Canada in 2025 rests on several interconnected factors.

Weakening Global Demand

A significant contributor to Canada's projected economic stagnation is the weakening global demand. This global economic slowdown is impacting Canadian exports and overall GDP growth.

- Decreased demand for Canadian commodities: Reduced global appetite for resources like oil and lumber directly affects Canada's export-oriented industries.

- Impact on manufacturing sector: Lower global demand translates into reduced orders for Canadian manufactured goods, impacting production and employment.

- Challenges for export-oriented businesses: Companies heavily reliant on international markets face decreased revenue and profitability, potentially leading to downsizing or restructuring.

These challenges underscore the vulnerability of the Canadian economy to global economic headwinds. Understanding the dynamics of global economic slowdown and its effect on Canadian exports is critical for navigating the coming year.

High Interest Rates and Inflation

Aggressive interest rate hikes implemented by the Bank of Canada to combat inflationary pressures are significantly impacting consumer spending and business investment.

- Increased borrowing costs: Higher interest rates make borrowing more expensive for both consumers and businesses, dampening spending and investment.

- Reduced consumer confidence: Uncertainty about the future and increased cost of living are impacting consumer confidence, leading to decreased spending.

- Impact on housing market: The housing market, a significant driver of economic activity, is particularly sensitive to interest rate changes, potentially experiencing a prolonged slowdown.

- Effects on business expansion plans: Businesses are less likely to invest in expansion or new projects when borrowing costs are high, impacting job creation and overall economic growth.

The interplay of interest rate hikes and inflationary pressures is a key factor contributing to the OECD's prediction of stagnant growth for the Canadian economy.

Labor Market Challenges

The Canadian labor market, while generally strong, presents complexities that contribute to slower growth.

- Labor shortages in specific sectors: Certain industries, particularly healthcare and technology, are experiencing significant labor shortages, hindering production and service delivery.

- Wage growth and its impact on inflation: While wage growth is positive for workers, it can also fuel inflationary pressures if it outpaces productivity growth.

- Workforce participation rates: Factors like an aging population and changing demographics can impact workforce participation rates, potentially limiting economic growth.

Addressing these labor market challenges is crucial for ensuring sustainable economic growth in Canada.

Factors Preventing a Recession in Canada

Despite the projected stagnation, several factors are preventing a full-blown recession in Canada.

Resilient Domestic Demand

The Canadian economy benefits from relatively resilient domestic demand, mitigating the impact of global headwinds.

- Strong household balance sheets: Many Canadian households entered the current economic climate with relatively strong financial positions, allowing for continued spending.

- Government spending programs: Government investments in infrastructure and social programs are supporting economic activity and employment.

- Continued investment in infrastructure: Large-scale infrastructure projects contribute to economic growth and job creation.

This resilient domestic demand serves as a buffer against a more severe economic downturn.

Diversified Economy

Canada's diversified economic structure offers a degree of protection against a deeper downturn.

- Strong performance in certain sectors like technology and healthcare: These sectors are relatively insulated from the challenges affecting other industries.

- Resilience of the services sector: The services sector, a significant portion of the Canadian economy, tends to be more resilient during economic slowdowns.

This economic diversification helps mitigate the overall impact of negative global events.

Government Policies and Support

Government interventions play a vital role in supporting economic stability and preventing a deeper recession.

- Fiscal stimulus measures: Government spending and tax measures can stimulate economic activity and boost consumer confidence.

- Support for businesses and workers: Government programs can assist businesses in navigating economic challenges and provide support to workers facing job losses.

- Targeted programs to address specific challenges: Targeted initiatives can address specific economic vulnerabilities and promote growth in key sectors.

Implications for Businesses and Investors

The OECD’s forecast requires strategic responses from businesses and investors.

Strategic Planning and Adaptation

Businesses need to adapt to the predicted economic climate.

- Cost-cutting measures: Streamlining operations and identifying areas for efficiency gains are crucial for maintaining profitability.

- Diversification of markets: Reducing reliance on specific markets can help mitigate risks associated with weakening global demand.

- Investment in innovation and technology: Investing in technological advancements can enhance efficiency, productivity, and competitiveness.

Proactive business strategy is paramount for navigating the economic challenges ahead.

Investment Strategies in a Stagnant Economy

Navigating investment decisions in a stagnant economy requires careful consideration.

- Diversification of investment portfolios: Spread investments across different asset classes to mitigate risks.

- Focus on long-term growth: Prioritize investments with long-term growth potential, even if short-term returns are muted.

- Risk assessment: Thorough risk assessment is crucial before making any investment decisions.

A well-diversified and carefully managed investment strategy is crucial for navigating economic uncertainty.

Conclusion: OECD 2025 Outlook: Navigating Canada's Economic Landscape

The OECD 2025 outlook for Canada paints a picture of economic stagnation, not recession. This is driven by factors like weakening global demand, high interest rates, and inflationary pressures. However, the Canadian economy's inherent resilience, fueled by domestic demand, economic diversification, and government support, is preventing a more severe downturn. Understanding these dynamics is crucial. Businesses must adopt proactive strategies, focusing on cost management, market diversification, and innovation. Investors need to prioritize portfolio diversification and long-term growth. Understanding the OECD 2025 outlook for Canada’s economy and preparing your business for Canada's stagnating economy are crucial steps in navigating the coming years successfully. Learn more about the OECD report and develop strategies to navigate this evolving economic landscape.

Cuaca Ekstrem Di Jawa Timur Hujan Lebat Dan Petir Diprediksi 29 Maret 2024

Cuaca Ekstrem Di Jawa Timur Hujan Lebat Dan Petir Diprediksi 29 Maret 2024

Bad Credit Loans Exploring Tribal Lender Options

Bad Credit Loans Exploring Tribal Lender Options

Prediksi Pertandingan Bali United Vs Dewa United Susunan Pemain And Head To Head

Prediksi Pertandingan Bali United Vs Dewa United Susunan Pemain And Head To Head

Housing Corporations To Sue Minister Over Rent Freeze

Housing Corporations To Sue Minister Over Rent Freeze

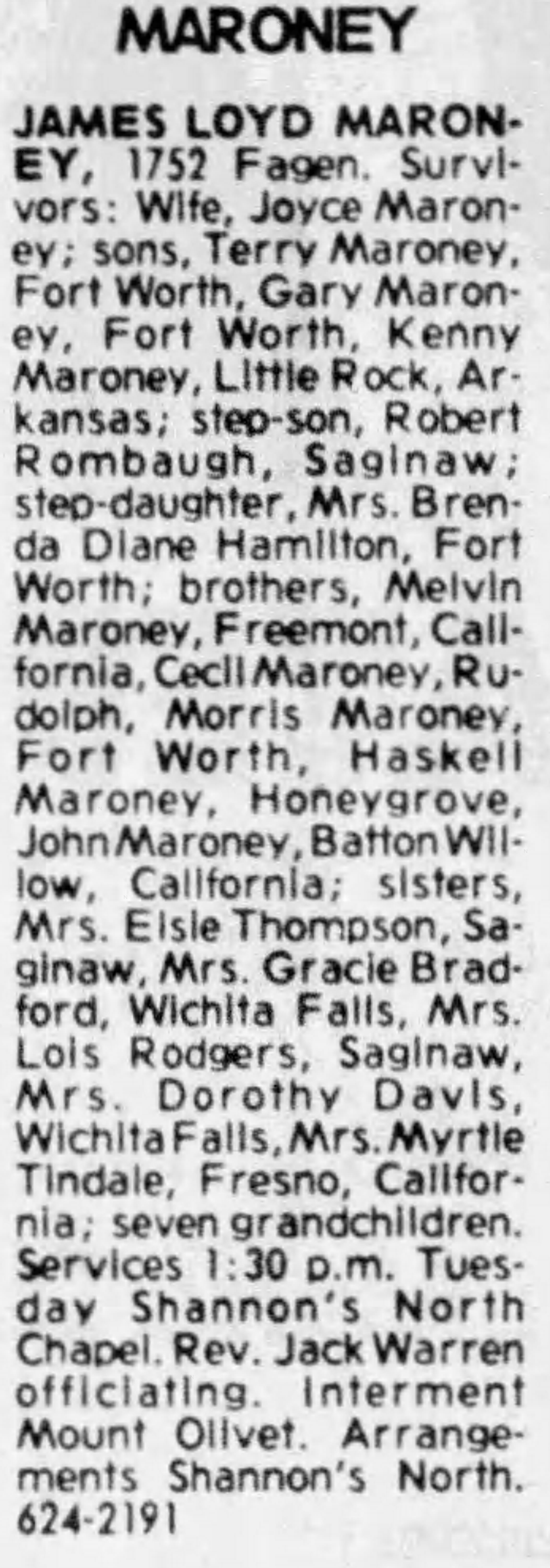

Daywatch The Extraordinary Return Of Wwii Private James Loyd

Daywatch The Extraordinary Return Of Wwii Private James Loyd