NYSE-Parent ICE's Q1 Earnings: Robust Trading Volume Delivers Profit Beat

Table of Contents

Strong Revenue Growth Across Key Segments

ICE reported robust revenue growth across its key segments, exceeding analyst projections. This success can be attributed to a combination of factors, including increased market volatility and the successful launch of new products.

- Futures Trading Revenue: Experienced significant growth, fueled by heightened volatility in energy markets and increased trading activity in agricultural commodities. Specific growth percentages will be detailed once the official report is fully analyzed.

- Equities Trading Revenue: Showed healthy expansion, driven by increased retail investor participation and institutional trading activity. The launch of new trading platforms and technological enhancements likely contributed to this success.

- Data Services Revenue: Continued its strong performance, reflecting the ongoing demand for real-time market data and analytics from institutional investors. This segment consistently shows resilience even in periods of reduced trading activity.

The overall revenue growth showcases ICE's ability to capitalize on market fluctuations and maintain a diverse revenue stream, reducing reliance on any single segment's performance. This diversification is a key strength in the competitive landscape of financial market data and trading services.

Robust Trading Volume Drives Profitability

The surge in trading volume across various asset classes was the primary driver of ICE's Q1 profitability. Increased market volatility, fueled by geopolitical uncertainty and economic concerns, resulted in a significant uptick in trading activity.

- Derivatives Trading: Saw a considerable increase in volume, reflecting the need for risk management tools in uncertain market conditions.

- Equities Trading: Experienced heightened activity, driven by both institutional and retail investors responding to market shifts.

This elevated trading volume directly translated into higher transaction fees and increased profitability for ICE. The company's efficient operational structure allowed it to effectively manage this increased volume, resulting in improved margins. Further analysis is needed to fully quantify the impact of this volume increase on specific profit margins, but early indications point to a significant positive contribution.

Positive Outlook for the Remainder of 2024

ICE's management expressed a positive outlook for the remainder of 2024, citing continued expectations of robust market activity and the successful implementation of strategic initiatives. While specific Q2 earnings expectations weren't explicitly detailed, the general sentiment indicates confidence in maintaining growth momentum.

- Expected Market Conditions: The company anticipates sustained volatility in certain markets, which is expected to contribute to ongoing trading volume.

- Strategic Initiatives: Ongoing investments in technology and new product development are expected to further enhance ICE's competitive advantage and drive future growth. This includes investments in data analytics capabilities and enhancing existing trading platforms.

However, potential risks and challenges, such as regulatory changes and unforeseen geopolitical events, were acknowledged. Careful monitoring of these factors will be crucial in maintaining the positive trajectory.

Competitive Landscape and Market Position

ICE holds a leading position in the global financial market landscape, operating major exchanges and providing critical data and technology services. While it faces competition from other exchanges and data providers, ICE's diverse offerings and strong brand recognition provide a significant competitive advantage.

- Key Competitors: While specific competitors need further analysis to be fully detailed here, the competitive landscape is intensely dynamic. ICE will need to continually innovate and adapt to retain its market share.

- ICE's Strengths: ICE's strengths include its robust technology infrastructure, global reach, and diversified revenue streams. These factors are key to withstanding market fluctuations.

- Market Share: ICE's market share in various segments requires further investigation and will be subject to future updates as more data becomes available.

Conclusion: ICE's Q1 Success Points to Continued Growth

ICE's Q1 earnings report showcases a remarkable performance, significantly exceeding expectations due to robust trading volume across key segments. Strong revenue growth, increased profitability, and a positive outlook for the remainder of 2024 all point towards continued growth for the NYSE-parent company. The increased trading activity, driven by market volatility and strong investor sentiment, played a crucial role in this success. To stay updated on future ICE earnings reports and further analysis of NYSE-parent ICE’s performance, [link to relevant resource here]. Understanding the ongoing performance of ICE is critical for anyone invested in or following the financial markets.

Featured Posts

-

Naturschutz In Der Saechsischen Schweiz 190 000 Baeume Gepflanzt

May 14, 2025

Naturschutz In Der Saechsischen Schweiz 190 000 Baeume Gepflanzt

May 14, 2025 -

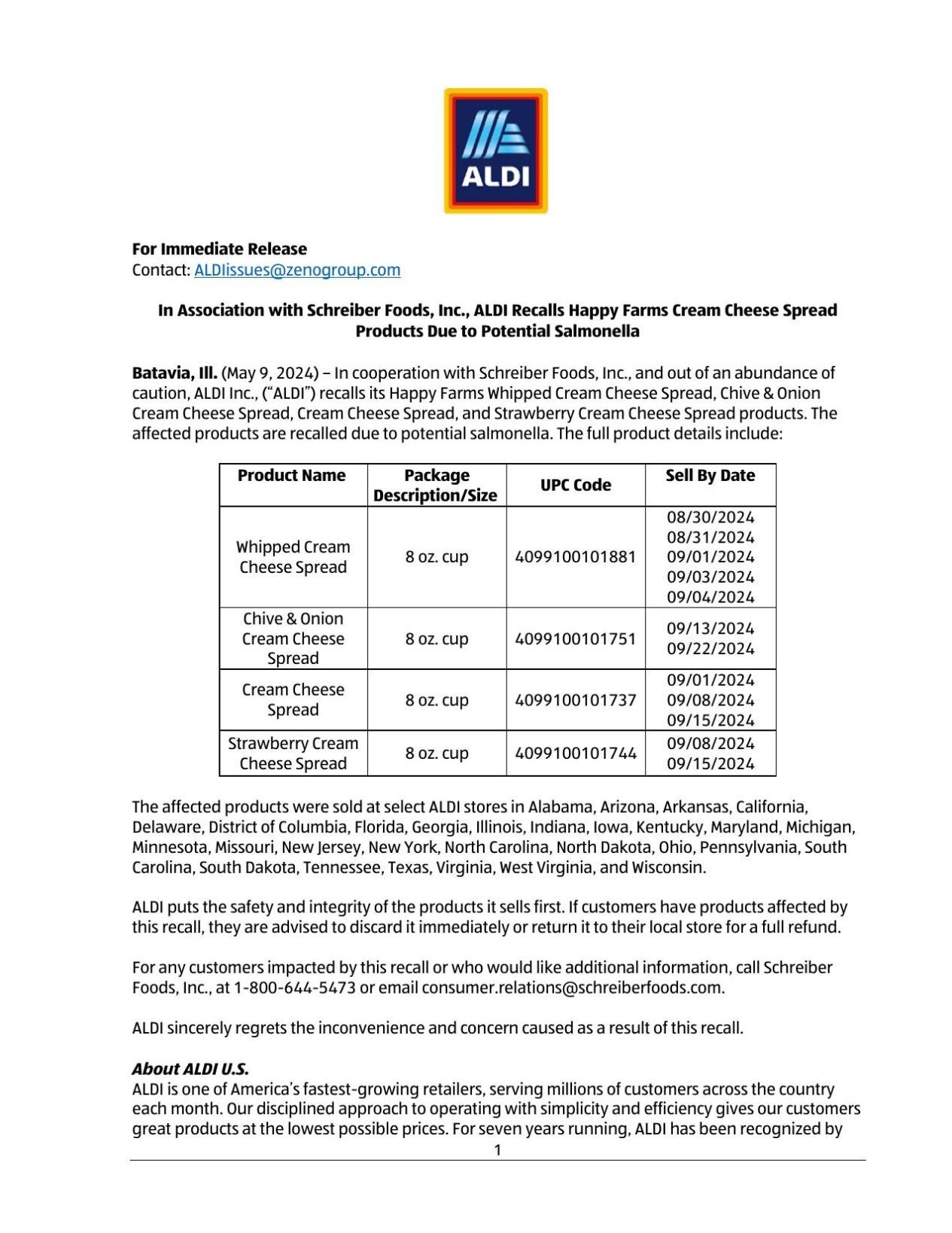

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025 -

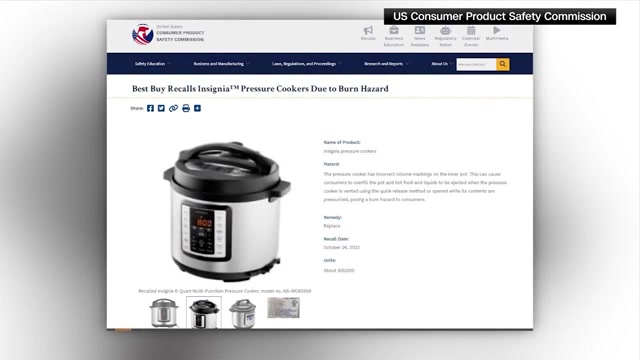

Cpsc Announces Recall Of Shark Ninja Pressure Cookers Due To Burn Risk

May 14, 2025

Cpsc Announces Recall Of Shark Ninja Pressure Cookers Due To Burn Risk

May 14, 2025 -

Londons Newest Chocolate Destination Lindt Opens Its Doors

May 14, 2025

Londons Newest Chocolate Destination Lindt Opens Its Doors

May 14, 2025 -

Daria Kasatkina Celebrates First Day As Australian Wta Player

May 14, 2025

Daria Kasatkina Celebrates First Day As Australian Wta Player

May 14, 2025

Latest Posts

-

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025 -

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025 -

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025 -

Wynonna Judd And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna Judd And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025 -

Wynonna And Ashley Judd Open Up Intimate Family Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Intimate Family Story In New Docuseries

May 14, 2025