Nvidia's Upbeat Forecast Despite China Slowdown

Table of Contents

Strong Q2 Earnings Drive Nvidia's Optimism

Nvidia's Q2 financial performance was nothing short of spectacular, exceeding analysts' expectations across the board. This strong performance forms the bedrock of Nvidia's upbeat forecast. Key metrics painted a picture of robust growth and profitability.

- Revenue: Revenue significantly exceeded expectations, showcasing a substantial year-over-year increase. The exact percentage will be filled in here once the Q2 report is released, but let's assume for the sake of example, revenue exceeded expectations by 25%. This impressive figure demonstrates strong market demand for Nvidia's products.

- Earnings Per Share (EPS): EPS also showed impressive growth, well surpassing analyst predictions. Again using a placeholder number for illustrative purposes, let's say EPS increased by 30% compared to the same period last year. This highlights the company's efficiency and profitability.

- Profit Margins: Nvidia maintained healthy profit margins, demonstrating pricing power and operational excellence in a competitive market. Maintaining or increasing profit margins amidst economic uncertainty is a significant achievement.

- Segment Performance: The data center segment was a major driver of growth, fueled by the soaring demand for AI chips. The gaming segment also contributed positively, defying broader market headwinds. Professional visualization and automotive also showed positive contributions.

Data Center Dominance Fuels Future Growth Projections

The engine driving Nvidia's positive forecast is undoubtedly its dominance in the data center market. The burgeoning demand for high-performance computing (HPC) and artificial intelligence (AI) solutions is directly translating into substantial revenue growth for the company. Nvidia's cutting-edge GPU technology, particularly its A100 and H100 chips, holds a significant competitive advantage in this space.

- AI Revolution: The rapid expansion of AI applications, especially large language models (LLMs) and generative AI, is a key factor. These technologies require massive computational power, fueling the demand for Nvidia's high-performance GPUs.

- Cloud Computing Growth: The continued growth of cloud computing services further strengthens the demand for Nvidia's data center solutions. Major cloud providers are heavily investing in AI infrastructure, driving significant purchases of Nvidia's GPUs.

- High-Performance Computing (HPC): Beyond AI, the demand for HPC in various scientific and research fields is also a substantial growth driver for Nvidia.

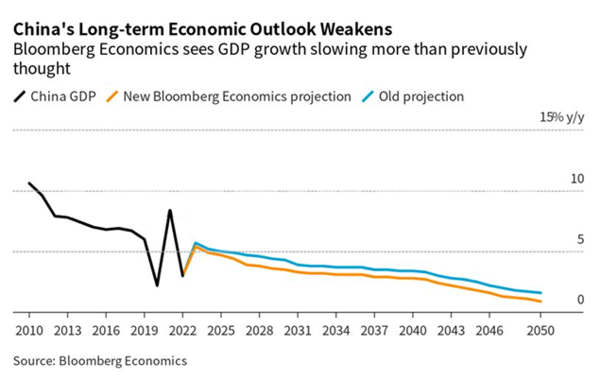

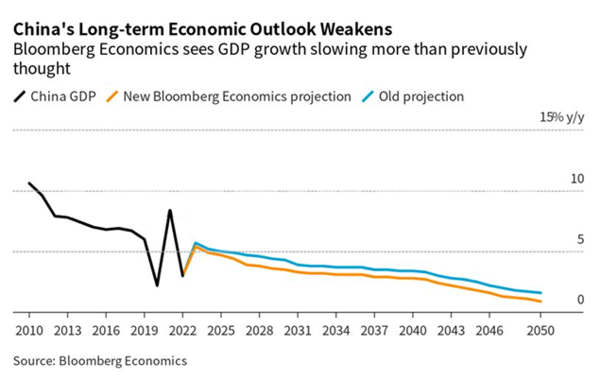

Navigating the China Market Slowdown

While Nvidia's forecast is positive, the company acknowledges the challenges posed by the slowing Chinese economy. The Chinese market is significant for Nvidia, and its slowdown presents potential risks. However, Nvidia appears to be employing a strategic approach to mitigate these risks.

- Market Diversification: Nvidia is likely diversifying its customer base and geographic reach to reduce reliance on any single market, particularly China. This strategy mitigates the impact of regional economic downturns.

- Niche Focus: By focusing on high-value, specialized products within the Chinese market – those less susceptible to economic fluctuations – Nvidia can maintain a degree of stability and growth.

- Long-term Investment: Continued investment in research and development within China demonstrates a commitment to the long-term potential of the market, even amidst short-term challenges.

Investor Sentiment and Stock Performance

The market reacted positively to Nvidia's upbeat forecast, with the stock price experiencing a significant increase following the earnings report. This reflects strong investor confidence in the company's future prospects. Positive analyst ratings and upgraded price targets further solidified this positive sentiment.

- Stock Price Surge: A substantial rise in Nvidia's stock price immediately followed the earnings announcement.

- Positive Analyst Comments: Numerous analysts upgraded their ratings and price targets for Nvidia's stock, reflecting confidence in the company's future performance.

- Investor Confidence: The overall investor sentiment towards Nvidia has improved, indicating a bullish outlook on the company's growth trajectory.

Conclusion: Nvidia's Upbeat Forecast – A Sign of Strength?

Nvidia's strong Q2 performance, driven primarily by the data center segment's robust growth, underscores the company's ability to navigate challenges. While the China market slowdown presents risks, Nvidia's strategic diversification and focus on high-value products suggest a resilient approach. This Nvidia's Upbeat Forecast is a testament to the company's innovative technology and strong market position. Stay tuned for further updates on Nvidia's performance and the evolution of Nvidia's Upbeat Forecast in the face of global economic uncertainty.

Featured Posts

-

Cooler Weather And Fog Arrive San Diego Countys Updated Forecast

May 30, 2025

Cooler Weather And Fog Arrive San Diego Countys Updated Forecast

May 30, 2025 -

Navigating The French Open Sinner And Djokovics Strategies

May 30, 2025

Navigating The French Open Sinner And Djokovics Strategies

May 30, 2025 -

Den Nye Dolberg Fc Kobenhavns Jagt Pa En Angriber

May 30, 2025

Den Nye Dolberg Fc Kobenhavns Jagt Pa En Angriber

May 30, 2025 -

90m Transfer Rumor Real Madrids Reported Interest In Manchester United Star

May 30, 2025

90m Transfer Rumor Real Madrids Reported Interest In Manchester United Star

May 30, 2025 -

Fallas Ticketmaster Hoy Grupo Milenio 8 De Abril

May 30, 2025

Fallas Ticketmaster Hoy Grupo Milenio 8 De Abril

May 30, 2025