Nvidia's Investment Propels CoreWeave (CRWV) Stock Higher

Table of Contents

Nvidia's Strategic Investment in CoreWeave: A Game Changer?

Nvidia's investment in CoreWeave represents a significant strategic move, signaling a strong belief in CoreWeave's potential and the future of GPU-accelerated cloud computing. While the exact financial details haven't been fully disclosed, the investment's strategic importance is undeniable.

-

Strategic Rationale: Nvidia's decision to invest in CoreWeave stems from its desire to expand its reach in the rapidly growing market for AI-focused cloud computing. CoreWeave's expertise in providing high-performance GPU cloud services aligns perfectly with Nvidia's core technology, creating powerful synergies. This partnership allows Nvidia to tap into a rapidly growing market segment without having to build its own extensive cloud infrastructure.

-

Synergies: The synergy between Nvidia's leading GPU technology and CoreWeave's cloud infrastructure is evident. CoreWeave leverages Nvidia's high-performance GPUs to deliver unparalleled computing power to its customers, accelerating AI model training and inference. This combination creates a compelling value proposition for businesses seeking to harness the power of AI.

-

Official Statements: While specific details regarding the partnership may be limited due to ongoing negotiations or non-disclosure agreements, any press releases or official statements from both companies should be closely monitored to gain a deeper understanding of this strategic collaboration. Looking for statements on the investment's purpose and the overall partnership goals can help determine future prospects.

CoreWeave's Position in the Booming AI Cloud Computing Market

CoreWeave has carved a niche for itself in the burgeoning AI cloud computing market. Its business model centers on providing on-demand access to high-performance GPU cloud computing resources, catering to the escalating demands of AI development and deployment.

-

Business Model: CoreWeave offers a scalable and flexible cloud platform tailored for AI workloads. This includes access to a vast pool of GPUs, allowing users to easily scale their computing resources up or down based on their needs, reducing the upfront costs and complexities associated with owning and managing their own data centers.

-

Market Demand: The demand for AI-focused cloud infrastructure is experiencing explosive growth. Enterprises across various industries are increasingly adopting AI solutions, driving the need for powerful and readily available cloud computing resources. CoreWeave is well-positioned to capitalize on this trend.

-

Competitive Advantages: CoreWeave differentiates itself from competitors by offering specialized expertise in GPU-accelerated computing, coupled with a user-friendly platform and scalable infrastructure. Their focus on the AI sector allows them to provide tailored solutions and attract a specific customer base.

-

GPU Acceleration: The use of GPUs is critical for accelerating AI workloads. CoreWeave's expertise in this area allows them to offer significantly faster processing times and improved efficiency compared to traditional CPU-based cloud services, a key competitive advantage in a time-sensitive market.

Impact on CRWV Stock Price and Future Outlook

The announcement of Nvidia's investment has had an immediate and positive impact on CRWV's stock price. While past performance is not indicative of future results, the market reacted favorably to this news, suggesting strong investor confidence in CoreWeave's future.

-

Stock Price Impact: [Insert chart or graph showing CRWV stock price performance around the time of the Nvidia investment announcement]. The chart demonstrates a clear upward trend following the news, indicating a positive market reaction.

-

Short-Term and Long-Term Implications: The short-term impact is a rise in stock price. Long-term implications depend on CoreWeave's ability to execute its business plan, maintain its competitive edge, and further capitalize on the growing AI cloud computing market.

-

Risks and Uncertainties: Investing in CRWV, like any stock, involves risks. These include competition from established cloud providers, fluctuations in the overall market, and the potential for unforeseen technological challenges.

-

Future Growth Prospects: The long-term growth prospects for CRWV are promising, given the continued expansion of the AI and cloud computing sectors. However, success hinges on CoreWeave's ability to adapt to changing market dynamics, innovate, and retain a competitive edge.

Analyzing the Investor Sentiment Surrounding CRWV

Analyzing investor sentiment towards CRWV is crucial for understanding the market's perception of the company's future.

-

Analyst Ratings: [Include a summary of current analyst ratings and price targets for CRWV]. Analyzing these ratings provides insight into how market professionals view the stock’s prospects.

-

Overall Sentiment: The overall sentiment seems positive, driven by the Nvidia investment and the strong growth potential of the AI cloud computing market. However, it's essential to stay informed about any shifts in sentiment.

-

Influence of External Factors: News related to Nvidia, advancements in AI technology, and broader market trends all influence investor sentiment toward CRWV. Monitoring these factors is vital for accurate assessment.

Conclusion

Nvidia's investment in CoreWeave represents a significant development, boosting CRWV stock price and showcasing strong belief in CoreWeave's potential within the AI cloud computing market. CoreWeave's strategic position, combined with Nvidia's technological prowess, suggests promising future growth. However, potential investors should always exercise caution and perform thorough due diligence before making any investment decisions. The inherent risks and uncertainties associated with the stock market must be considered.

Call to Action: Stay informed on the latest developments regarding CoreWeave (CRWV) and Nvidia's ongoing collaboration. Understanding the interplay between these two tech giants is crucial for navigating the dynamic world of AI-powered cloud computing investments. Continue researching CoreWeave stock and related AI cloud computing opportunities to make well-informed investment decisions. Remember that this article is for informational purposes and should not be considered financial advice.

Featured Posts

-

Rutte Ve Sanchez Elektrik Kesintileri Konusunda Goeruestue Nato Nun Rolue

May 22, 2025

Rutte Ve Sanchez Elektrik Kesintileri Konusunda Goeruestue Nato Nun Rolue

May 22, 2025 -

China And Us Trade Navigating The Path To A New Trade Agreement

May 22, 2025

China And Us Trade Navigating The Path To A New Trade Agreement

May 22, 2025 -

Financial Times Bps Chief Executive Targets Valuation Doubling Rejects Us Listing

May 22, 2025

Financial Times Bps Chief Executive Targets Valuation Doubling Rejects Us Listing

May 22, 2025 -

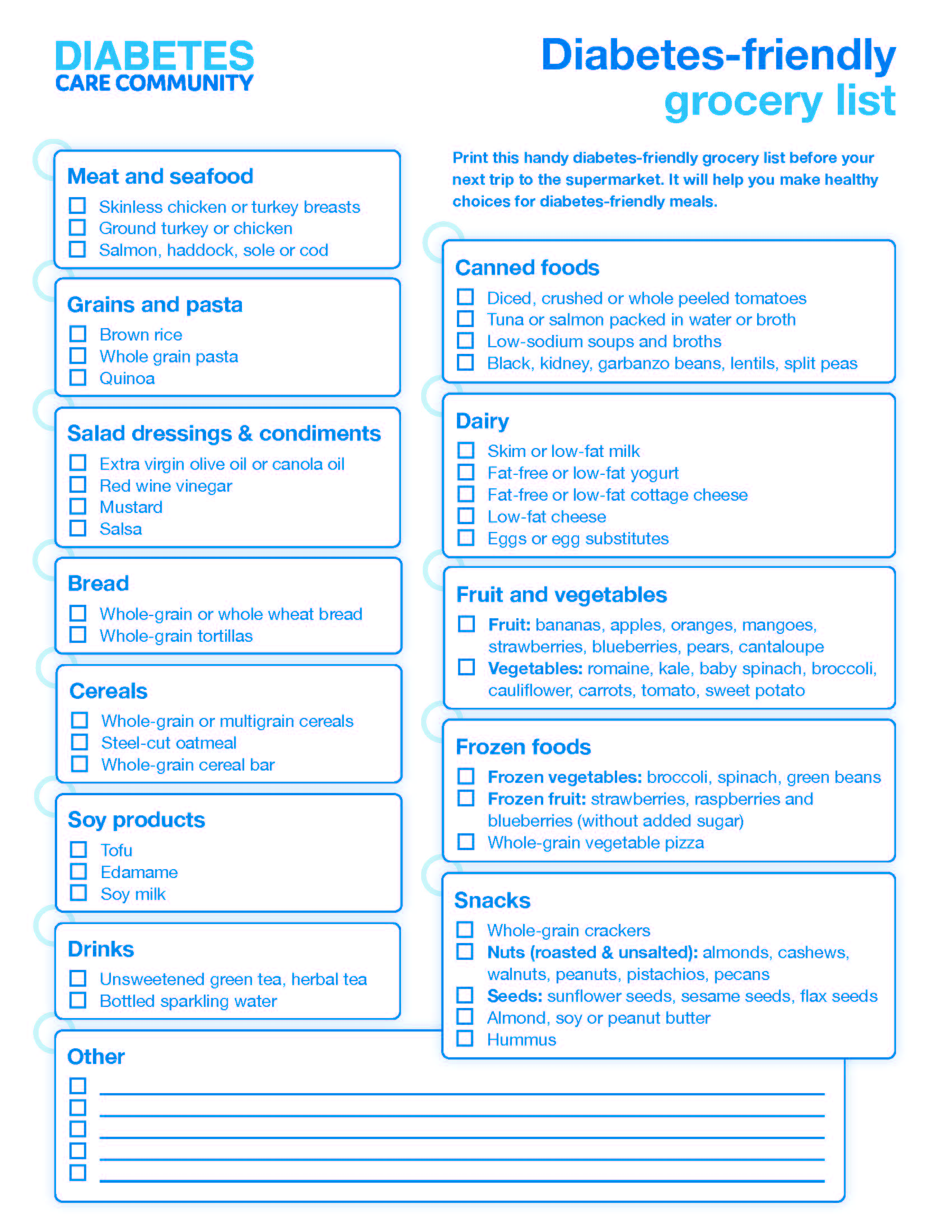

This Weeks Top Gbr News Grocery Shopping Guide 2000 Quarter Found And Doge Poll

May 22, 2025

This Weeks Top Gbr News Grocery Shopping Guide 2000 Quarter Found And Doge Poll

May 22, 2025 -

Blake Livelys Alleged Blackmail Attempt On Taylor Swift Over Leaked Texts Explored

May 22, 2025

Blake Livelys Alleged Blackmail Attempt On Taylor Swift Over Leaked Texts Explored

May 22, 2025

Latest Posts

-

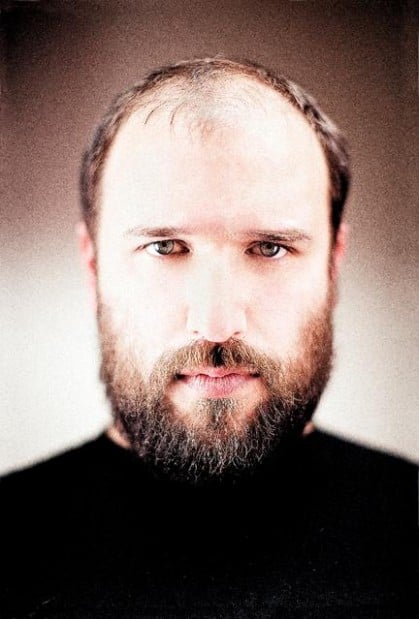

Remembering Frontmans Name Rock Music Loses A Star At 32

May 22, 2025

Remembering Frontmans Name Rock Music Loses A Star At 32

May 22, 2025 -

Frontmans Name Popular Rock Band Frontman Dies At 32 Remembering His Musical Contributions

May 22, 2025

Frontmans Name Popular Rock Band Frontman Dies At 32 Remembering His Musical Contributions

May 22, 2025 -

Rock Icon Dead At 32 Fans Mourn The Loss Of Band Name S Frontman

May 22, 2025

Rock Icon Dead At 32 Fans Mourn The Loss Of Band Name S Frontman

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Dies At 32

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025