Nvidia Stock: Growth Forecast Amidst China's Economic Slowdown

Table of Contents

Nvidia's Dependence on the Chinese Market

Revenue Breakdown: Understanding China's Contribution

China represents a significant portion of Nvidia's global revenue, making its economic health crucial for Nvidia's overall performance. While precise figures fluctuate quarterly, a substantial percentage of Nvidia's sales stem from the Chinese market. This reliance on the Chinese market presents both opportunities and significant risks. Understanding this dependency is critical to accurately predicting future Nvidia stock price movements.

- Specific figures: While exact percentages vary from quarter to quarter and are not always publicly disclosed in granular detail, reports indicate a historically significant contribution from the Chinese market to Nvidia's overall revenue. Investors should consult Nvidia's financial reports for the most up-to-date information.

- Key Chinese clients: Major Chinese technology companies, data centers, and gaming companies represent crucial clients for Nvidia, impacting revenue significantly. A downturn in their spending directly affects Nvidia's bottom line.

- Market share analysis: Nvidia holds a leading position in the Chinese GPU market, but competition from domestic and international players is intense. Maintaining and expanding this market share is vital for continued success in this key region.

The significant contribution of the Chinese market to Nvidia's revenue underscores the vulnerability of Nvidia stock to economic slowdowns in China. Any decrease in demand from this region could significantly impact the Nvidia stock price.

The Impact of Global Economic Slowdown on Semiconductor Demand

Reduced Demand for GPUs: A Ripple Effect

A global economic slowdown, particularly impacting China, will likely reduce demand for Nvidia's GPUs across various sectors. This interconnectedness is crucial when analyzing Nvidia stock projections.

- Gaming market impact: The Chinese gaming market, once a major growth engine, faces potential contraction due to economic headwinds. This directly affects demand for Nvidia's gaming GPUs.

- Data center investments: Global economic uncertainty often leads to decreased investments in data centers, impacting demand for Nvidia's high-performance computing GPUs used in these facilities.

- AI development slowdown: While AI remains a significant growth driver, economic slowdowns can lead to reduced investment in AI research and development, which in turn affects demand for Nvidia's AI-focused hardware.

The ripple effect of a global economic slowdown can significantly reduce demand for semiconductors, impacting Nvidia’s growth and subsequently influencing the Nvidia stock price.

Nvidia's Strategic Responses and Diversification Efforts

Investment in AI and Data Centers: Future-Proofing Growth

Nvidia is actively mitigating its reliance on the Chinese market through strategic investments and diversification. Their commitment to AI and data centers positions them for growth even amidst economic uncertainties.

- Initiatives and partnerships: Nvidia's partnerships with major cloud providers and investments in AI infrastructure are strengthening its position in the growing AI market, reducing dependence on any single geographical region.

- Growth in other regions: Expanding its market share in the US, Europe, and other regions helps to diversify its revenue streams and lessen the impact of economic downturns in specific markets.

- Long-term implications: These diversification efforts are crucial for ensuring the long-term health of Nvidia and promoting stability for Nvidia stock.

By strategically diversifying its operations and focusing on high-growth sectors like AI, Nvidia aims to mitigate the risks associated with economic slowdowns in individual markets.

Potential Growth Drivers Despite Economic Headwinds

AI Boom and Technological Advancements: Sustaining Momentum

The ongoing boom in artificial intelligence presents a significant opportunity for Nvidia, potentially offsetting the negative impacts from China's economic slowdown.

- AI applications: Nvidia's GPUs are crucial for training and running AI models in various applications, including autonomous vehicles, medical imaging, and financial modeling. The continued growth of AI ensures continued demand for Nvidia's products.

- New product releases: Nvidia consistently releases new and improved GPUs, maintaining its technological leadership and fueling demand from various sectors.

- Long-term AI outlook: The long-term prospects for AI are exceptionally positive, suggesting continued strong growth for Nvidia even in challenging economic environments.

The continued expansion of the AI industry and Nvidia's technological advancements act as powerful buffers against potential negative impacts from the Chinese economy, providing a solid foundation for future Nvidia stock growth.

Conclusion

Forecasting Nvidia stock growth amidst China's economic slowdown presents a complex challenge. While China remains a significant market for Nvidia, the company's strategic diversification efforts, particularly its focus on the rapidly expanding AI market, offer a strong counterbalance. The long-term prospects for AI, coupled with Nvidia's technological leadership and innovation, suggest a resilient future for the company, though careful consideration of global economic factors remains paramount. To stay informed on Nvidia stock performance and the evolving market landscape, continue researching, following financial news, and conducting your own due diligence before making any investment decisions related to Nvidia stock.

Featured Posts

-

Measles Outbreak Warning Virus Found In Sacramento County Wastewater

May 30, 2025

Measles Outbreak Warning Virus Found In Sacramento County Wastewater

May 30, 2025 -

Analyzing The Taco Trade Agreement Causes Of Trumps Outrage

May 30, 2025

Analyzing The Taco Trade Agreement Causes Of Trumps Outrage

May 30, 2025 -

Torwart Transfer Perfekt Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025

Torwart Transfer Perfekt Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025 -

Biographie Et Mandat De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie Et Mandat De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

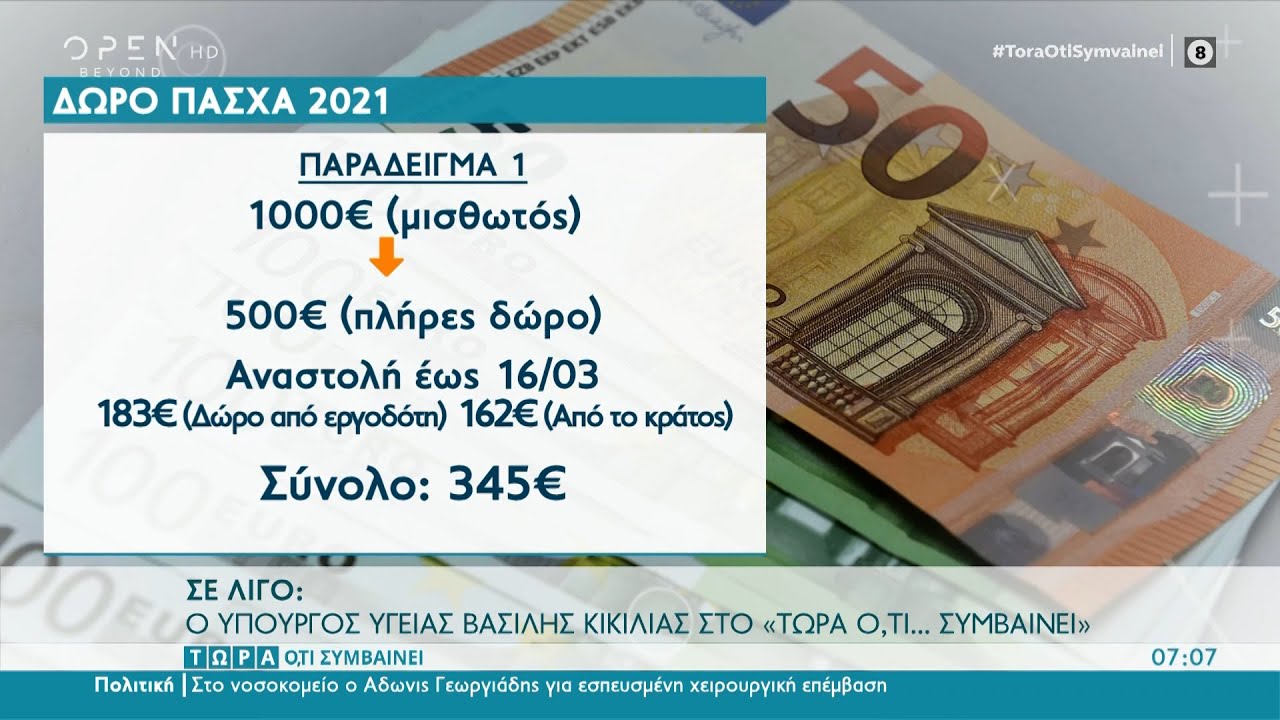

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 12 4

May 30, 2025