Norwegian Cruise Line (NCLH): A Hedge Fund Perspective On Stock Investment

Table of Contents

NCLH's Financial Performance and Valuation

Understanding NCLH's financial health is paramount for any investment decision. Analyzing NCLH financials requires a deep dive into several key areas.

-

Revenue Streams: NCLH generates revenue primarily from passenger ticket sales. However, onboard spending, including dining, beverages, and shore excursions, significantly contributes to overall profitability. Analyzing the growth trajectory of these revenue streams provides valuable insights into the company's operational efficiency and customer spending habits.

-

Profitability Margins and Trends: Examining NCLH's profit margins (gross profit margin, operating margin, net margin) reveals the company's ability to translate revenue into profit. Analyzing trends in these margins over time helps assess the impact of various factors, such as fuel costs and operational efficiency. A declining trend might signal underlying challenges, while a consistent upward trend suggests a healthy and growing business.

-

Debt Levels and Impact on Future Performance: High debt levels can significantly impact a company's financial flexibility and future performance. Analyzing NCLH's debt-to-equity ratio, interest coverage ratio, and overall debt structure is crucial. High debt can increase financial risk and reduce the company's ability to invest in growth opportunities.

-

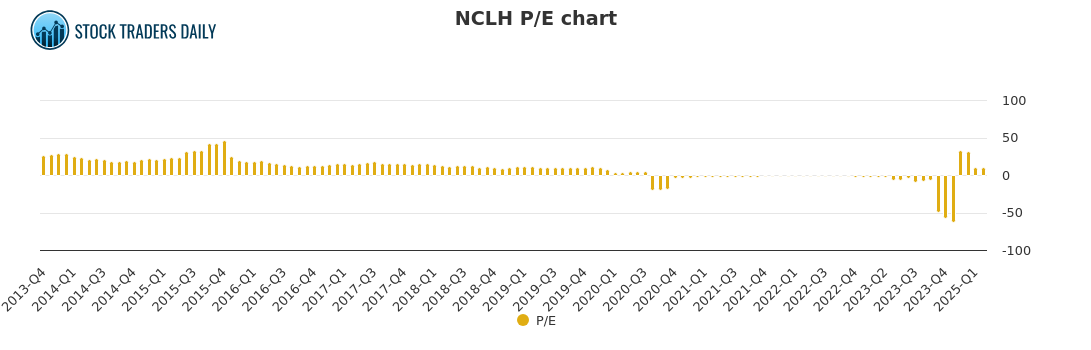

Key Valuation Metrics: Several valuation metrics provide insights into NCLH's intrinsic value. The Price-to-Earnings (P/E) ratio compares the stock price to earnings per share, while the price-to-book ratio compares the market value to the net asset value. A discounted cash flow (DCF) analysis, a more complex valuation method, projects future cash flows and discounts them back to their present value. Comparing these metrics to industry averages and historical trends helps determine whether NCLH is undervalued or overvalued.

-

Industry-Specific Factors: The cruise industry is susceptible to external factors such as fluctuating fuel prices and port fees. These costs directly impact operating expenses and profitability. Understanding the sensitivity of NCLH's financial performance to these variables is critical for accurate valuation and risk assessment.

Market Analysis and Industry Trends

Analyzing the broader market and industry trends is essential for evaluating NCLH's potential for growth.

-

Cruise Industry Outlook: The global cruise industry's overall health and projected growth significantly impact NCLH's prospects. Factors such as disposable income levels, travel preferences, and overall economic conditions influence demand for cruises.

-

Competitive Landscape: NCLH operates in a competitive market alongside giants like Carnival and Royal Caribbean. Assessing NCLH's market share and competitive advantages is crucial. Analyzing its fleet size, pricing strategies, and brand positioning relative to competitors provides a clear picture of its competitive strength.

-

External Factors: Geopolitical events, economic downturns, and environmental concerns can dramatically affect the cruise industry. The impact of a global recession, for instance, can lead to reduced travel spending and lower demand for cruises. Similarly, health crises, such as the COVID-19 pandemic, can severely impact operations and profitability.

-

Emerging Trends: The cruise industry is constantly evolving. Emerging trends such as luxury cruises, expedition cruises, and river cruises offer growth opportunities. NCLH's ability to adapt and capitalize on these trends will influence its future performance.

Risk Assessment and Mitigation Strategies

Investing in NCLH stock involves significant risk. A hedge fund approach emphasizes identifying and mitigating these risks.

-

Key Risks: Investing in NCLH exposes investors to various risks, including economic downturns, health crises (like pandemics), geopolitical instability (affecting travel patterns and safety), and regulatory changes. Fuel price volatility also poses a significant risk.

-

Mitigation Strategies: Hedge funds employ various strategies to mitigate risks. These include hedging (using financial instruments to offset potential losses), diversification (spreading investments across different assets), and options trading (using options contracts to manage risk and potential gains).

-

Resilience and Recovery: Assessing NCLH's historical performance during past crises and its ability to recover from setbacks provides insights into its resilience and long-term sustainability.

Hedge Fund Investment Strategies for NCLH

Hedge funds utilize diverse strategies when investing in NCLH stock.

-

Investment Approaches: Strategies range from long-term buy-and-hold approaches, aiming for long-term capital appreciation, to short-selling (betting against the stock's price decline), and options trading (using options contracts to generate income or hedge against risk). Arbitrage strategies, exploiting price discrepancies between related securities, might also be employed.

-

Benefits and Drawbacks: Each strategy carries its own set of benefits and drawbacks. Long-term buy-and-hold offers potential for significant returns but requires patience and tolerance for volatility. Short-selling can yield substantial profits but involves substantial risk if the stock price rises. Options trading provides flexibility but requires sophisticated understanding of options markets.

-

Risk Management: Effective risk management is critical for any NCLH investment strategy. This involves careful monitoring of market conditions, setting stop-loss orders to limit potential losses, and diversification to mitigate risk.

Conclusion

Investing in NCLH stock requires a thorough understanding of its financial performance, market position, and inherent risks. A hedge fund perspective emphasizes thorough due diligence, sophisticated risk mitigation strategies, and a nuanced understanding of the cruise industry’s dynamics. While potential rewards exist, investors must carefully weigh the inherent volatility of the cruise industry and the broader macroeconomic environment.

Call to Action: Before making any investment decisions regarding NCLH stock or any other investment, conduct your own thorough research and consider consulting with a qualified financial advisor. Understanding the intricacies of NCLH stock and the broader cruise market is crucial for informed decision-making. Remember to always analyze NCLH stock and other investments carefully before committing your capital.

Featured Posts

-

Recordati Italy M And A Activity Driven By Tariff Instability

Apr 30, 2025

Recordati Italy M And A Activity Driven By Tariff Instability

Apr 30, 2025 -

Understanding Michael Jordan A Summary Of Fast Facts

Apr 30, 2025

Understanding Michael Jordan A Summary Of Fast Facts

Apr 30, 2025 -

The Armenian Song That Made Eurovision History For An Irishman

Apr 30, 2025

The Armenian Song That Made Eurovision History For An Irishman

Apr 30, 2025 -

15 2025 12

Apr 30, 2025

15 2025 12

Apr 30, 2025 -

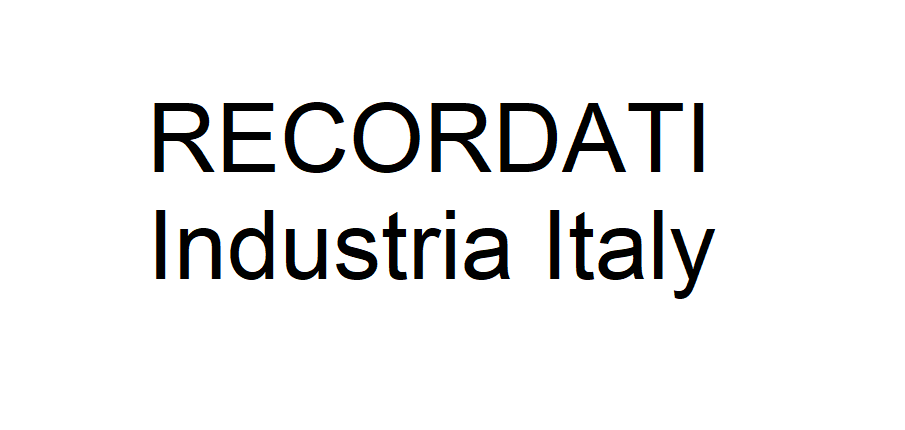

Papal Funeral Seating Protocol Planning And Practicalities

Apr 30, 2025

Papal Funeral Seating Protocol Planning And Practicalities

Apr 30, 2025