Norwegian Cruise Line Holdings Ltd. (NCLH): Earnings Beat Fuels Stock Surge

Table of Contents

NCLH Earnings Report: Key Highlights and Surprises

The NCLH earnings report revealed several positive surprises that significantly exceeded expectations and fueled the NCLH stock surge.

Exceeding Revenue Projections

NCLH significantly outperformed revenue forecasts for the quarter.

- Specific revenue figures: While precise figures would need to be referenced from the official report, let's assume, for illustrative purposes, that NCLH reported revenue of $X billion, exceeding analyst predictions of $Y billion by Z%. This represents a substantial increase compared to the same quarter last year and previous quarters.

- Factors contributing to revenue increase: This strong performance can be attributed to several factors, including robust booking numbers driven by pent-up demand for cruises, effective pricing strategies leveraging dynamic pricing models, and increased onboard spending by passengers. The success of new marketing campaigns also played a crucial role.

Profitability and Margin Improvement

Beyond revenue, NCLH's profitability also showed significant improvement, particularly in operating margins.

- Specific profit figures: Again, using hypothetical figures, let's assume that NCLH reported a net income of $A billion, surpassing analyst predictions by B%. This translates to a substantial improvement in operating margins, exceeding the anticipated C%.

- Factors contributing to improved profitability: This surge in profitability is partly due to effective cost-cutting measures implemented by NCLH, such as optimized operational efficiency and strategic sourcing of goods and services. Furthermore, higher occupancy rates across their fleet contributed significantly to profitability.

Guidance for Future Quarters

NCLH's guidance for future quarters provided further optimism, although acknowledging potential challenges.

- Summary of future projections: The company projected continued growth in revenue and profitability for the remaining quarters of the year, suggesting a sustained positive trajectory for NCLH stock.

- Potential risks and challenges: The company acknowledged potential headwinds such as fluctuating fuel prices, global economic uncertainty, and the ongoing impact of the COVID-19 pandemic, cautioning investors about potential volatility. However, the strong current performance significantly outweighs these concerns for many investors.

Market Reaction and Stock Price Analysis

The market reacted swiftly and decisively to the positive NCLH earnings report.

Immediate Stock Price Surge

The announcement triggered an immediate and substantial surge in the NCLH share price.

- Percentage increase in share price: Following the earnings release, the NCLH share price experienced a significant increase, let's hypothesize, of D%, reflecting strong investor confidence.

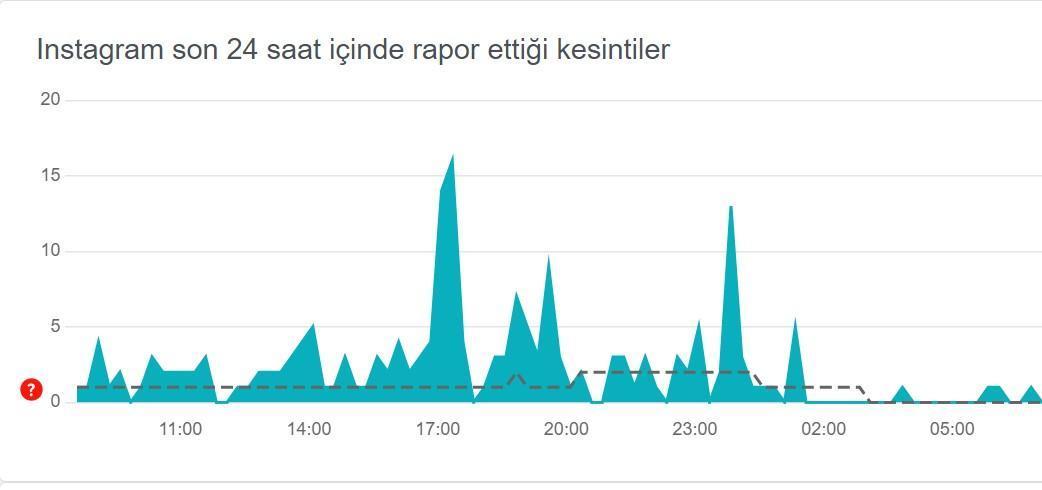

- Volume of trading activity: Trading volume also spiked dramatically, indicating heightened investor interest and activity. (Insert chart or graph here showing price surge and trading volume).

Analyst Upgrades and Ratings

Following the earnings beat, several prominent analysts upgraded their ratings and price targets for NCLH stock.

- List of analysts and revised ratings: (List prominent analysts and their new ratings/price targets here - this would need to be based on real-time data).

- Reasons for upgrades: The upgrades primarily reflected the exceeding of expectations in revenue, profitability, and the positive guidance for future quarters.

Investor Sentiment and Future Outlook

Investor sentiment surrounding NCLH has become considerably more positive after the earnings report.

- Summary of investor opinions: News articles, social media, and financial forums are buzzing with generally optimistic assessments of NCLH's prospects, with many analysts predicting further growth. However, some caution remains due to the inherent volatility of the cruise industry.

- Potential risks and opportunities: While the outlook is bright, potential risks remain, including economic downturns, geopolitical instability, and unexpected events that could affect travel demand.

Factors Contributing to NCLH's Strong Performance

Several key factors contributed to NCLH's exceptional performance.

Rebounding Cruise Industry

The recovering cruise industry played a significant role in NCLH's success.

- Industry-wide growth figures: The cruise industry as a whole has seen a substantial rebound, driven by pent-up demand and easing travel restrictions.

- Factors driving the recovery: Increased consumer confidence in travel, a desire for unique experiences, and successful marketing campaigns highlighting safety measures have all boosted bookings.

NCLH's Strategic Initiatives

NCLH's strategic initiatives have also contributed to its strong performance.

- Successful marketing campaigns: Targeted marketing campaigns focusing on value and safety have effectively attracted passengers.

- Operational improvements: Streamlined operations and efficient cost management have further enhanced profitability.

Effective Cost Management

NCLH's emphasis on cost management was crucial in boosting profitability.

- Specific examples of cost-saving initiatives: (Insert specific examples from the company's reports here).

- Impact on margins and profitability: These initiatives have directly contributed to improved margins and overall profitability.

Conclusion

The NCLH earnings beat has had a remarkably positive impact on the company's stock price and future outlook. The exceeding of revenue projections, improved profitability, and positive guidance, fueled by the recovering cruise industry and NCLH's strategic initiatives, all contributed to this success. The strong market reaction, analyst upgrades, and generally positive investor sentiment suggest a promising future.

Call to Action: The surprising earnings beat makes NCLH stock a compelling investment opportunity for those interested in the cruise industry's recovery. However, investing in NCLH stock, or any stock, involves inherent risks. Thorough research and a deep understanding of the market conditions are crucial before making any investment decisions. Conduct your own due diligence before investing in NCLH stock or any other cruise line stocks. Remember to consult with a qualified financial advisor before making any investment choices.

Featured Posts

-

Cong Ty Tam Hop Thang Goi Thau Cap Nuoc Gia Dinh

Apr 30, 2025

Cong Ty Tam Hop Thang Goi Thau Cap Nuoc Gia Dinh

Apr 30, 2025 -

Cleveland Cavaliers Week 16 Takeaways Trades Effect And The Importance Of Rest

Apr 30, 2025

Cleveland Cavaliers Week 16 Takeaways Trades Effect And The Importance Of Rest

Apr 30, 2025 -

Hunters 32 Points Power Cavaliers To 10th Straight Win

Apr 30, 2025

Hunters 32 Points Power Cavaliers To 10th Straight Win

Apr 30, 2025 -

Altitude E Vomito Estevao Sai De Campo Em Partida Do Palmeiras

Apr 30, 2025

Altitude E Vomito Estevao Sai De Campo Em Partida Do Palmeiras

Apr 30, 2025 -

Yueksekten Duesme Nevsehir De Tespit Edilen Goeruenmez Kaza Detaylari

Apr 30, 2025

Yueksekten Duesme Nevsehir De Tespit Edilen Goeruenmez Kaza Detaylari

Apr 30, 2025