Nippon-U.S. Steel Deal Receives Trump Administration Approval

Table of Contents

Key Details of the Nippon-U.S. Steel Deal

The acquisition involves Nippon Steel acquiring a substantial portion of U.S. Steel's assets, though the exact details of the financial terms remain partially undisclosed due to confidentiality agreements. This merger represents a significant consolidation within the global steel industry.

- Assets Involved: While the precise list of assets remains somewhat opaque, reports suggest the deal includes several key U.S. Steel mills and production facilities strategically located across the United States, focusing on high-demand steel products. Specific locations haven't been publicly disclosed to protect competitive interests.

- Estimated Deal Value: While the exact deal value has not been officially confirmed, industry analysts estimate it to be in the billions of dollars, reflecting the significant size and strategic importance of the acquired assets.

- Key Stakeholders: Besides Nippon Steel and U.S. Steel, several other stakeholders are involved, including financial institutions providing funding for the acquisition, legal firms handling the complex regulatory processes, and various government agencies involved in the review and approval process.

- Timeline of Acquisition: The acquisition process spanned several months, involving extensive due diligence, regulatory reviews, and negotiations. The final approval by the Trump administration marked the culmination of this lengthy process.

Trump Administration's Rationale for Approval

The Trump administration's approval of the Nippon-U.S. Steel deal was undoubtedly influenced by several key factors. The review involved a careful consideration of potential impacts on national security and the broader U.S. economy.

- National Security Concerns: Initial concerns centered on potential vulnerabilities in the U.S. steel supply chain. However, the administration appears to have been satisfied with assurances from Nippon Steel regarding maintaining domestic production levels and safeguarding critical infrastructure.

- Conditions Placed on the Acquisition: While specific details remain confidential, it's likely the approval was contingent on certain conditions imposed by the administration. These conditions may include commitments to maintaining U.S. jobs, upholding certain production quotas, and investing in American infrastructure within the acquired assets.

- Administration Statement: The official statement from the Trump administration likely emphasized the deal's potential benefits to the U.S. economy, such as increased efficiency, technological advancements, and the preservation of American jobs within the steel industry. The statement likely framed the deal as beneficial to both countries.

- Benefits for the U.S. Economy: The administration likely highlighted the potential for enhanced competitiveness in the global steel market, increased investment in U.S. facilities, and the creation of high-skilled jobs as benefits derived from this merger.

Implications for the U.S. and Japanese Steel Industries

The Nippon-U.S. Steel deal has far-reaching implications for both the U.S. and Japanese steel industries. The short-term and long-term effects will need further analysis, however, preliminary projections reveal the potential impacts.

- Impact on U.S. Steel Production and Employment: The deal could lead to increased efficiency and modernization of U.S. Steel facilities, potentially boosting production and, ideally, employment in the long term. However, there’s also the possibility of job displacement in the short term due to streamlining processes.

- Effect on Competition Within the U.S. Steel Market: The merger may reduce competition in certain segments of the U.S. steel market, requiring antitrust considerations. Increased market share for the combined entity might lead to price adjustments.

- Potential Benefits for Nippon Steel's Global Market Position: This acquisition significantly strengthens Nippon Steel's global market position, giving them access to a larger market share and potentially lowering costs through economies of scale.

- Changes in Trade Relations Between the U.S. and Japan: While the deal might not overtly alter trade relations, it could influence future trade negotiations and agreements between the two countries, highlighting the importance of ongoing bilateral cooperation.

Reactions and Future Outlook

Reactions to the Nippon-U.S. Steel deal approval have been mixed. While some industry experts express optimism about increased efficiency and competitiveness, others raise concerns about potential job losses and reduced competition.

- Quotes from Industry Leaders and Analysts: Industry leaders and analysts provided varied opinions, ranging from cautious optimism to expressions of concern regarding monopolization and the potential suppression of innovation due to reduced market competition.

- Predictions Regarding the Future of the Combined Company: Predictions for the merged entity vary, with some analysts predicting increased profitability and market share, while others express concerns about the potential challenges of integrating two distinct corporate cultures and operational strategies.

- Potential Challenges and Opportunities: Integrating two large corporations presents significant challenges, including operational harmonization, cultural differences, and potential labor disputes. However, the combined entity also benefits from significant opportunities for economies of scale, technological advancements, and market expansion.

- Discussion of Any Potential Antitrust Concerns: The deal's approval might face scrutiny from antitrust regulators, who will monitor the combined company's market behavior for any signs of anti-competitive practices.

Conclusion

The Trump administration's approval of the Nippon-U.S. Steel deal marks a significant turning point for the global steel industry. This decision, reached after careful consideration of national security and economic factors, holds profound implications for both U.S. and Japanese steel production, competition, and trade relations. The long-term impact remains to be seen, but the deal’s potential for restructuring the steel industry landscape is undeniable.

Call to Action: Stay informed about the ongoing developments in the Nippon-U.S. Steel merger and its impact on the steel market. Follow us for further updates on this landmark Nippon-U.S. Steel deal and other crucial developments in the steel industry. Learn more about the intricacies of this significant acquisition and its future implications for global trade.

Featured Posts

-

Naomi Campbells Alleged Met Gala Ban Truth Behind The Wintour Dispute

May 26, 2025

Naomi Campbells Alleged Met Gala Ban Truth Behind The Wintour Dispute

May 26, 2025 -

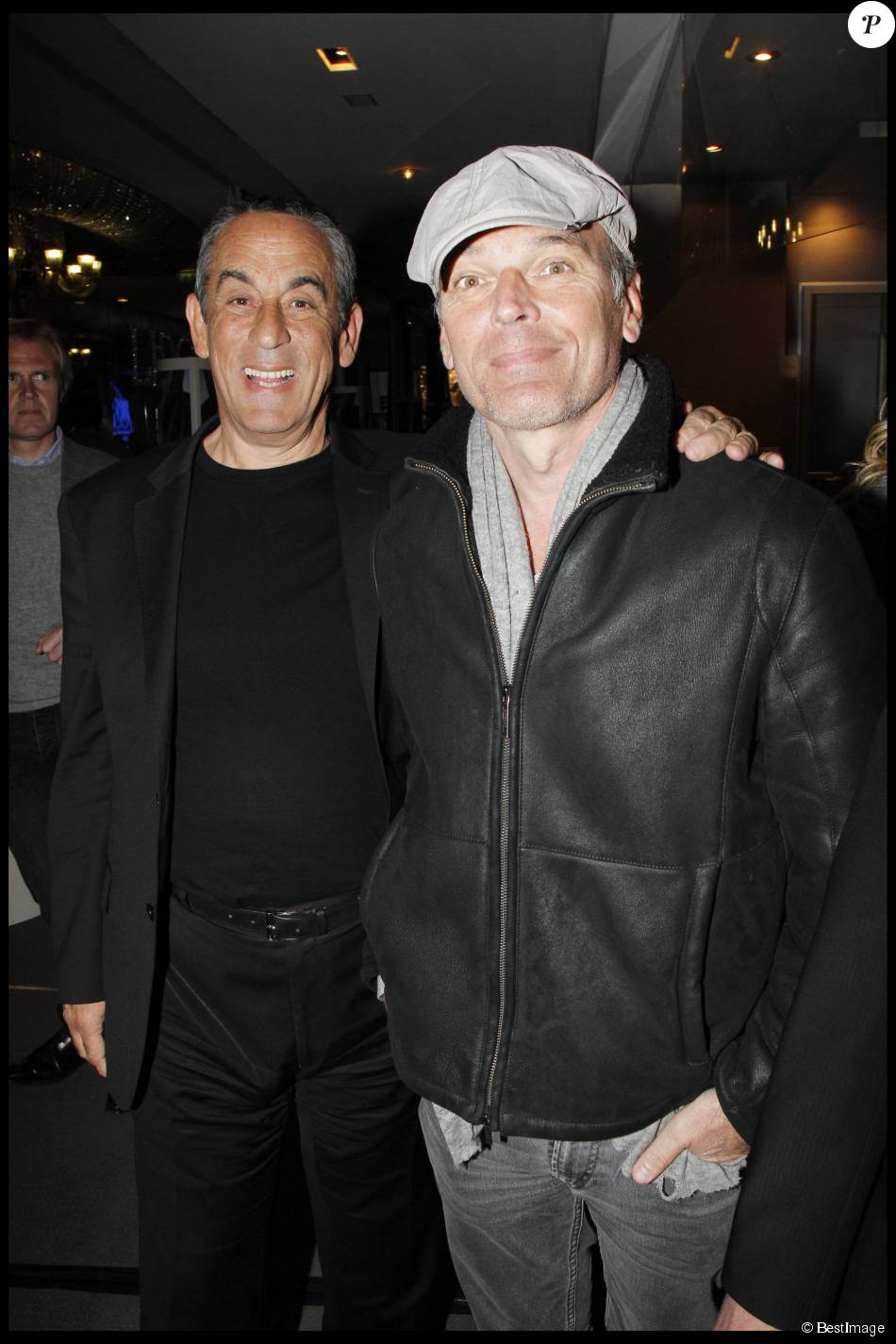

Thierry Ardisson Et Laurent Baffie Une Dispute Explosive Il Vient Cracher Dans La Soupe

May 26, 2025

Thierry Ardisson Et Laurent Baffie Une Dispute Explosive Il Vient Cracher Dans La Soupe

May 26, 2025 -

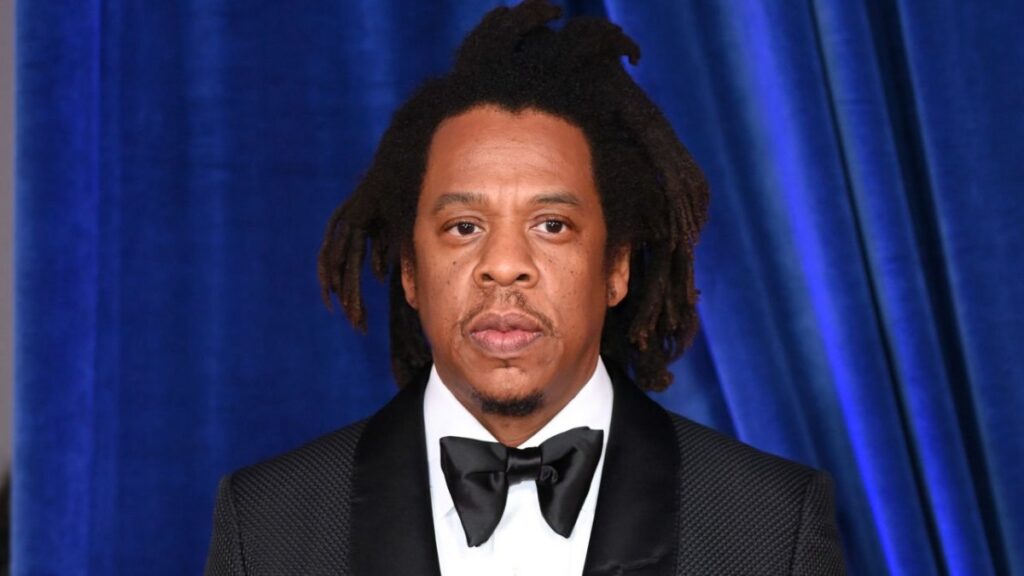

All Star Weekend Controversy Surrounding Robert Downey Jr S Role

May 26, 2025

All Star Weekend Controversy Surrounding Robert Downey Jr S Role

May 26, 2025 -

Inside The Hells Angels A Look At Their Culture And Operations

May 26, 2025

Inside The Hells Angels A Look At Their Culture And Operations

May 26, 2025 -

High Profile Lawsuit Against Elite Firms Fails For Trump

May 26, 2025

High Profile Lawsuit Against Elite Firms Fails For Trump

May 26, 2025