Nigeria's Fuel Market: A Deep Dive Into NNPC And Dangote's Influence

Table of Contents

NNPC's Role in Nigeria's Fuel Market

The Nigerian National Petroleum Company (NNPC) has historically dominated Nigeria's fuel importation and distribution. As the national oil company, it plays a pivotal role in the petroleum products supply chain, from importation to regulation and pricing. For decades, NNPC has been the primary importer of refined petroleum products, a situation largely attributed to the country's limited refining capacity. This dominance, however, has not been without its challenges.

-

Government Subsidies and Their Impact: The Nigerian government's fuel subsidy program has profoundly impacted NNPC's operations and the national budget. While intended to keep fuel prices affordable for consumers, the subsidy has placed a considerable strain on public finances, often leading to budget deficits and accusations of mismanagement. The effectiveness and long-term sustainability of the subsidy remain subjects of intense debate.

-

NNPC's Refining Efforts and Import Reduction: Recognizing the need to reduce reliance on imported fuel, NNPC has embarked on various initiatives to improve its refining capacity. However, progress has been slow, hampered by operational inefficiencies, technical challenges, and a lack of adequate investment. The success of these refining efforts will be crucial in determining NNPC's future role in the market.

-

Challenges Faced by NNPC: NNPC has faced numerous challenges, including operational inefficiencies, allegations of corruption, and a lack of transparency. These issues have contributed to instability in the fuel supply chain, leading to periodic fuel shortages and price hikes. Overcoming these challenges is vital for NNPC to maintain its position and contribute effectively to Nigeria's energy security.

-

Key Data Points:

- NNPC currently holds a significant, although declining, market share in fuel distribution. Precise figures fluctuate, but a thorough analysis of recent data would be necessary for precise quantification.

- Recent government policies, including deregulation efforts, have significantly impacted NNPC's operations, forcing it to adapt to a more competitive market.

- NNPC's downstream investment strategies are under scrutiny, with calls for greater transparency and efficiency in its operations.

Dangote Refinery's Impact and Potential

The Dangote Refinery represents a significant private sector investment in Nigeria's oil and gas sector, marking a potential turning point for the country's energy landscape. This massive refinery, once fully operational, is expected to significantly alter the dynamics of Nigeria's fuel market.

-

Reducing Reliance on Imports: The Dangote Refinery's projected refining capacity is substantial, potentially eliminating or drastically reducing Nigeria's reliance on imported fuel. This self-sufficiency could have profound implications for the nation's economy and energy security.

-

Impact on Fuel Prices and Competition: The refinery's entry into the market is expected to increase competition, potentially leading to lower fuel prices for consumers. The extent of this price reduction will depend on various factors, including the refinery's operational efficiency and the pricing strategies of other market players.

-

Stimulating Economic Growth: The refinery's construction and operation have already created numerous jobs, and its continued operation is expected to stimulate further economic growth. This includes job creation in related industries and increased revenue generation for the government.

-

Challenges and Hurdles: Despite its immense potential, the Dangote Refinery faces challenges, including logistical hurdles related to transportation and distribution, as well as infrastructure limitations. Addressing these challenges will be key to realizing the refinery's full potential.

-

Key Data Points:

- The Dangote Refinery's projected refining capacity is substantial, potentially exceeding the nation's current demand for refined petroleum products.

- Analysts predict a significant reduction in fuel prices once the refinery reaches full capacity, although the exact extent remains subject to market forces.

- The refinery's contribution to job creation and overall economic growth in Nigeria is anticipated to be substantial.

The Future of Nigeria's Fuel Market

The future of Nigeria's fuel market is intricately linked to the ongoing debate surrounding market liberalization, the role of NNPC, and the impact of the Dangote Refinery.

-

Market Liberalization: The liberalization of Nigeria's fuel market is a complex and ongoing process. Increased competition, fostered by deregulation, is expected to enhance efficiency and drive down prices. However, this transition also presents challenges, including the need for robust regulatory frameworks and the potential for market manipulation.

-

Increased Competition and Consumer Impact: Increased competition in the fuel market, fueled by private sector investment and a potential reduction in NNPC's dominance, is predicted to benefit consumers through lower prices and improved service. However, safeguarding consumer interests requires careful monitoring and regulation.

-

Private Sector Investment and Innovation: The increased involvement of the private sector, as exemplified by the Dangote Refinery, is a crucial driver of innovation and efficiency in the fuel sector. This private investment can lead to improvements in infrastructure, technology, and overall service quality.

-

Energy Security and Economic Development: The transformation of Nigeria's fuel market has significant implications for the nation's energy security and overall economic development. Reduced reliance on imports, increased efficiency, and lower prices can all contribute positively to economic growth and stability.

-

Key Predictions:

- Future fuel prices in Nigeria are expected to be influenced by several factors, including global oil prices, the performance of the Dangote Refinery, and the extent of market liberalization.

- In a liberalized market, NNPC's role will likely evolve, shifting from a dominant player to a more competitive entity, potentially focusing on strategic investments and infrastructure development.

- The Dangote Refinery's impact in the coming years is projected to be significant, with potential for substantial market share capture and significant influence on fuel prices.

Conclusion

Nigeria's fuel market is undergoing a period of significant transformation. The interplay between NNPC's historical dominance and the emergence of the Dangote Refinery is reshaping the sector, presenting both opportunities and challenges. While NNPC retains a crucial role, increased private sector participation promises enhanced competition and the potential for lower fuel prices. The success of these changes will profoundly impact Nigeria's energy security and economic growth. The Nigerian fuel market’s future trajectory relies heavily on effective management of these changes and the implementation of sound policies.

Call to Action: Stay informed about the evolving dynamics of Nigeria's fuel market by following our updates on NNPC and Dangote's continued impact. Understanding these key players is critical to navigating the future of Nigeria's energy landscape and the future of Nigeria's fuel market.

Featured Posts

-

Revised Palantir Stock Price Predictions Following Recent Market Gains

May 10, 2025

Revised Palantir Stock Price Predictions Following Recent Market Gains

May 10, 2025 -

Omada Health Seeks Us Listing Details On Andreessen Horowitz Investment And Ipo Plans

May 10, 2025

Omada Health Seeks Us Listing Details On Andreessen Horowitz Investment And Ipo Plans

May 10, 2025 -

Mdkhnw Krt Alqdm Asmae Wmsarat Mhnyt

May 10, 2025

Mdkhnw Krt Alqdm Asmae Wmsarat Mhnyt

May 10, 2025 -

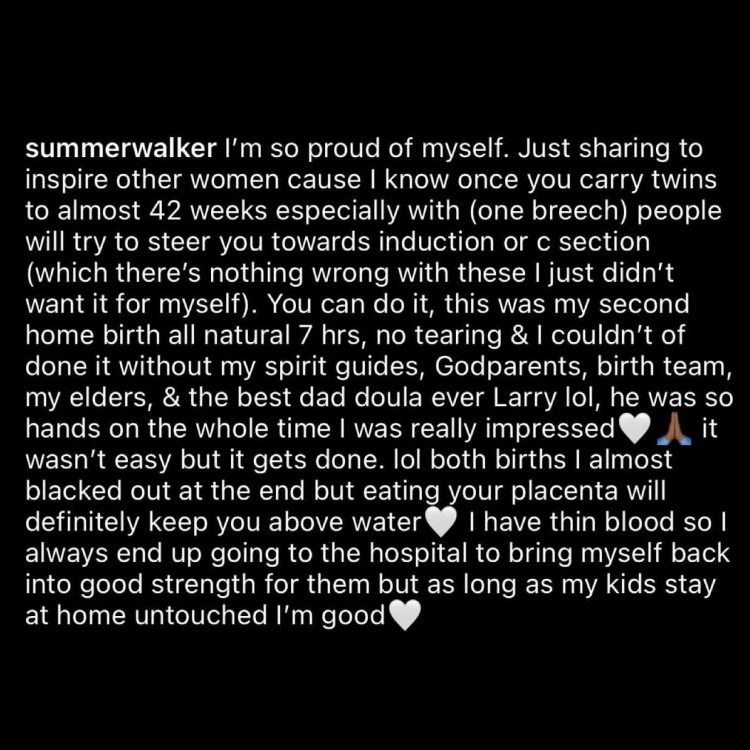

Summer Walkers Near Fatal Childbirth Experience

May 10, 2025

Summer Walkers Near Fatal Childbirth Experience

May 10, 2025 -

New Spring Collection Elizabeth Stewart X Lilysilk

May 10, 2025

New Spring Collection Elizabeth Stewart X Lilysilk

May 10, 2025