Nicki Chapman's Seven-Figure Property Investment: A Case Study In Rural Property

Table of Contents

Nicki Chapman's Investment Strategy: Targeting Undervalued Rural Properties

Nicki Chapman's success in the UK property market hinges on a well-defined property investment strategy focused on identifying undervalued rural properties with significant growth potential. Her approach involves meticulous research and a keen eye for opportunities often overlooked by other investors. This strategy incorporates several key elements:

-

Focus on Undervalued Assets: She doesn't chase the most expensive properties. Instead, she meticulously researches the rural property market, focusing on areas with potential for future appreciation but currently offering properties below market value. This requires a deep understanding of local demographics, infrastructure developments, and future planning permissions.

-

Thorough Market Analysis: Before any property acquisition, Nicki undertakes comprehensive due diligence. This involves analyzing local demographics, infrastructure development plans (new roads, schools, broadband access), and future trends impacting property values. Understanding these factors is crucial for identifying areas poised for growth.

-

Strategic Acquisition: Her acquisitions aren't random. She looks for properties with potential for renovation or development, adding value through strategic improvements and capitalizing on the increasing demand for renovated rural properties.

-

Expert Advisory Team: Nicki doesn't go it alone. She leverages a team of experts, including surveyors for accurate valuations, solicitors for legal advice, and property managers for ongoing maintenance and tenant relations. This team provides crucial support and reduces risks associated with rural property investment.

-

Shrewd Negotiation: Negotiating favorable purchase prices is a key element of her success. She identifies motivated sellers and employs skillful negotiation tactics to secure properties below their true market value. This significantly improves her return on investment.

The Appeal of Rural Property Investment: Beyond the Seven-Figure Mark

The allure of rural property investment extends beyond simply accumulating a seven-figure property portfolio. Nicki Chapman’s success highlights the numerous benefits associated with this investment strategy:

-

Higher Capital Appreciation: Rural properties often demonstrate higher capital appreciation compared to urban areas, particularly in desirable locations. This is driven by limited supply and increasing demand from those seeking a lifestyle change or a country retreat.

-

Strong Rental Yields: Many rural areas experience strong rental yields, especially those with high tourism or second-home ownership. This provides a consistent income stream, supplementing capital appreciation and boosting the overall return on investment.

-

Lifestyle Benefits: Owning rural properties offers significant lifestyle advantages, from peaceful surroundings to access to outdoor activities. This adds a non-monetary aspect to the investment, making it attractive to many investors.

-

Portfolio Diversification: Including rural properties in a wider property portfolio reduces overall risk. This diversification strategy mitigates the impact of market fluctuations in urban areas.

-

Future Development Potential: Some rural properties offer the potential for future development, further enhancing their value. This may include extending existing buildings, creating additional dwellings (subject to planning permission), or developing the land for alternative uses.

Overcoming Challenges in Rural Property Investment

While rural property investment offers many benefits, several challenges must be addressed:

-

Distance and Transaction Times: Managing properties in remote locations requires more travel time and can lead to slower transaction times.

-

Property Maintenance and Repairs: Finding reliable tradespeople and managing maintenance in rural areas can be more complex than in urban locations. This requires proactive planning and a robust property management strategy.

-

Planning Regulations: Understanding local planning regulations is vital for any development or renovation projects. Navigating these regulations requires expertise and patience.

-

Property Management: Securing reliable and responsive property management services in rural areas can be a challenge. This requires careful selection and close monitoring of the management company.

-

Lower Tenant Demand (Potentially): Depending on the location, finding tenants for rural properties may take longer compared to urban areas. Effective marketing and competitive rental rates are crucial.

Analyzing Nicki Chapman's Portfolio: Building a Seven-Figure Empire

Nicki Chapman's seven-figure property portfolio is a testament to her long-term investment strategy. Examining her portfolio provides valuable insights for aspiring investors:

-

Portfolio Composition: Her portfolio likely consists of a mix of property types, from renovated farmhouses and charming cottages to potentially larger land holdings. The diversification within her portfolio mitigates risk.

-

Growth and Profitability: Analyzing the growth and profitability of her investments over time reveals the effectiveness of her strategy, highlighting the power of consistent, strategic investment in the rural property market.

-

Factors Contributing to Success: Key success factors include her meticulous market research, shrewd negotiation skills, expert advisory team, and long-term investment perspective.

-

Property Management Approach: Her approach to property management is crucial. Efficient management minimizes voids, maximizes rental income, and maintains the value of her assets.

-

Long-Term Growth Strategy: Her success is not just about short-term gains; it's a result of a well-defined, long-term strategy focused on building wealth through sustainable property investment.

Conclusion

Nicki Chapman's seven-figure success in rural property investment provides a compelling case study for aspiring investors. Her strategic approach, combining thorough market research, shrewd negotiation, and a long-term vision, demonstrates the potential for significant returns in the rural property market. This case study highlights both the advantages and challenges of investing in rural areas, offering valuable insights for those seeking to build their own property portfolio and secure their financial future.

Call to Action: Inspired by Nicki Chapman's success? Start your own journey in profitable rural property investment today. Learn more about maximizing returns in the rural property market and building your own seven-figure property portfolio. Explore opportunities in undervalued rural properties and secure your financial future. Don't miss out on the potential of strategic rural property investment!

Featured Posts

-

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 24, 2025 -

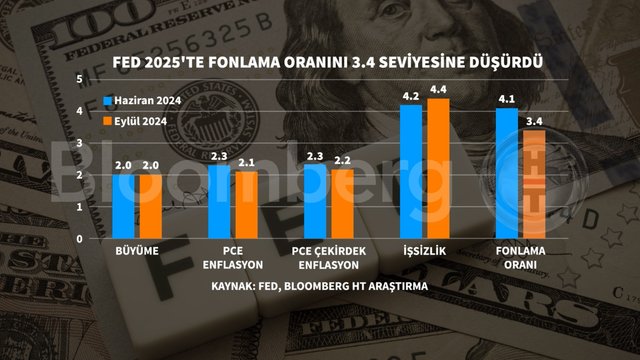

Faiz Indirimi Sonrasi Avrupa Borsalarinin Performansi

May 24, 2025

Faiz Indirimi Sonrasi Avrupa Borsalarinin Performansi

May 24, 2025 -

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025

Essen Uniklinikum Nachrichten Und Ereignisse Die Beruehren

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025 -

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025

Latest Posts

-

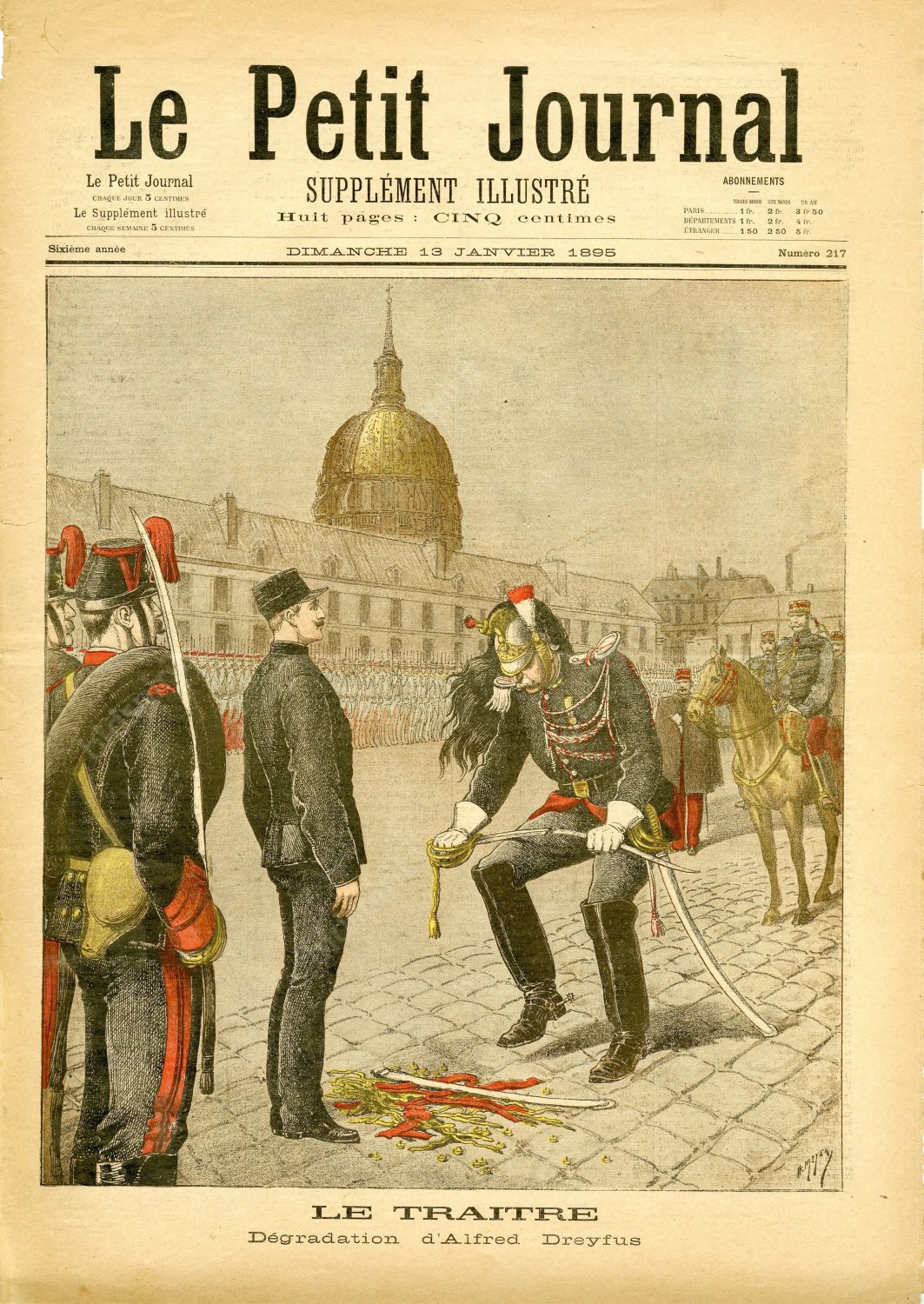

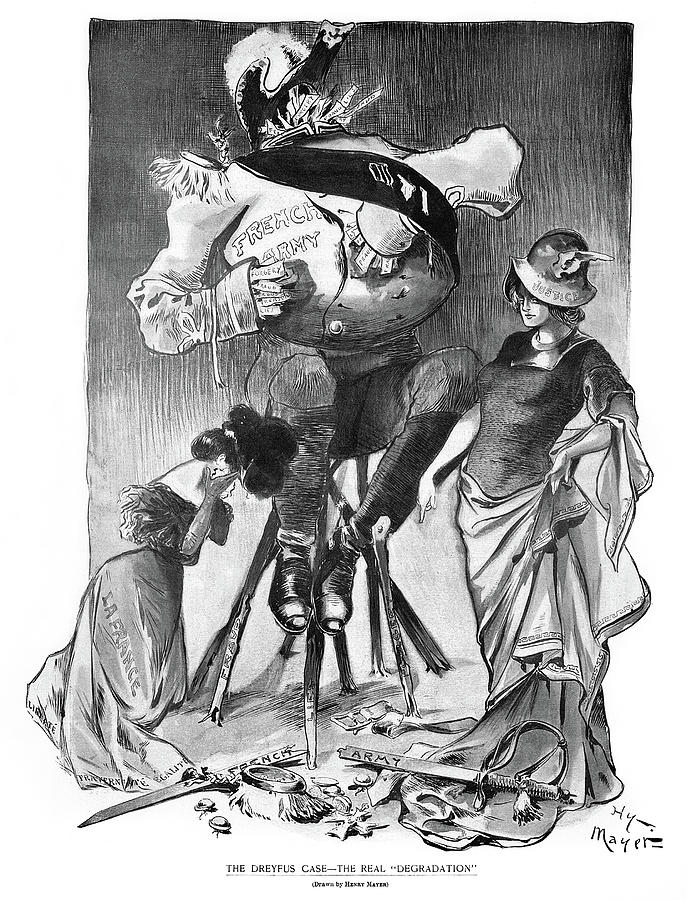

The Dreyfus Affair A Legacy Of Injustice And A Call For Redemption

May 24, 2025

The Dreyfus Affair A Legacy Of Injustice And A Call For Redemption

May 24, 2025 -

France Revisits The Dreyfus Affair Lawmakers Seek Promotion

May 24, 2025

France Revisits The Dreyfus Affair Lawmakers Seek Promotion

May 24, 2025 -

130 Years After The Dreyfus Affair A Push For Recognition

May 24, 2025

130 Years After The Dreyfus Affair A Push For Recognition

May 24, 2025 -

Macrons Policies Face Criticism From Former French Prime Minister

May 24, 2025

Macrons Policies Face Criticism From Former French Prime Minister

May 24, 2025 -

Dreyfus Affair Renewed Calls For Posthumous Promotion

May 24, 2025

Dreyfus Affair Renewed Calls For Posthumous Promotion

May 24, 2025