New Tax Code From HMRC: What It Means For Your Savings

Table of Contents

The new HMRC tax code introduces several adjustments to tax rates and allowances, impacting how your savings and investments are taxed. This article aims to clarify these implications, empowering you to make informed decisions about your personal finances.

Key Changes in the New HMRC Tax Code

The recent amendments to the HMRC tax code bring significant alterations to how savings and investments are taxed. These changes aim to simplify the tax system but will inevitably impact your personal finances. Let's explore the key modifications:

- Changes to Tax-Free Allowances: The new code may adjust the annual ISA allowance, potentially affecting how much you can save tax-free each year. Understanding these changes is essential for maximizing your tax-efficient savings.

- Modifications to Tax Rates for Savings Accounts and Investments: Tax rates on savings interest and investment returns might have been altered. This could mean either higher or lower tax burdens depending on your income bracket and the type of investment.

- New Rules Regarding Tax-Efficient Savings Schemes: The government may have introduced new rules or modified existing ones for tax-advantaged savings schemes. This could impact the attractiveness of certain investment vehicles.

- Impact on Dividend Taxation: Dividend taxation might have undergone changes, affecting the return on your dividend-paying investments. It's crucial to understand the updated rates and how they affect your overall investment strategy.

- Changes Related to Capital Gains Tax: The new tax code may include modifications to capital gains tax, affecting the tax you pay on profits from selling assets like stocks or property. Careful planning is needed to mitigate potential tax liabilities.

Example: Previously, you might have enjoyed a higher personal savings allowance. Now, with the updated HMRC tax code, this allowance could be reduced, meaning you'll pay tax on a larger portion of your savings interest. This highlights the importance of understanding the specific changes and adjusting your savings strategy accordingly. The new tax rates on dividends could also significantly impact returns from share investments.

How the New Tax Code Affects Different Savings Vehicles

The new HMRC tax code's impact varies across different savings vehicles. Let's break down the key implications for several common options:

ISAs (Individual Savings Accounts):

- Changes to the annual ISA allowance limit.

- Potential alterations to the types of assets eligible for ISA investment.

- Impact on existing ISA holdings.

Pensions:

- Changes to annual contribution limits.

- Potential adjustments to tax relief on pension contributions.

- Impact on pension withdrawal rules.

Savings Accounts:

- Revised tax rates on savings interest.

- Potential impact on the attractiveness of different savings accounts (e.g., high-interest accounts versus easy-access accounts).

Investment Accounts:

- Changes to capital gains tax rates.

- Revised dividend tax rates.

- Impact on the tax-efficiency of different investment strategies.

Planning for the Future Under the New HMRC Tax Code

Navigating the updated HMRC tax code requires proactive financial planning. Here are actionable steps to adapt your savings strategy:

- Review Existing Savings and Investment Plans: Assess your current portfolio and understand how the new tax code affects your existing investments and savings accounts.

- Consider Diversifying Investments: Diversification can help mitigate the impact of tax changes on your overall investment portfolio.

- Explore Tax-Efficient Savings Options: Research and consider tax-efficient savings options like ISAs and pensions to minimize your tax burden.

- Seek Professional Financial Advice: Consult a qualified financial advisor for personalized guidance on adapting your financial plan to the new HMRC tax code. They can provide tailored advice based on your individual circumstances and financial goals.

Making the Most of Your Savings with the New HMRC Tax Code

The new HMRC tax code introduces significant changes impacting personal savings, particularly affecting ISA allowances, tax rates on savings interest and dividends, and capital gains tax. Understanding these changes is paramount for effective financial planning. The impact on different savings vehicles, from ISAs and pensions to savings and investment accounts, requires careful consideration. To optimize your savings in light of the new HMRC tax code, review your current financial plans, explore tax-efficient options, and, if necessary, seek professional financial advice. Stay informed about future HMRC announcements concerning the HMRC tax code and its implications for your savings. Don’t let these changes catch you off guard; proactively manage your finances and secure your financial future.

Featured Posts

-

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025 -

Rio De Janeiro Incendio Em Escola Na Tijuca Gera Comocao

May 20, 2025

Rio De Janeiro Incendio Em Escola Na Tijuca Gera Comocao

May 20, 2025 -

4eme Pont D Abidjan Delais Cout Et Depenses Un Decryptage Complet

May 20, 2025

4eme Pont D Abidjan Delais Cout Et Depenses Un Decryptage Complet

May 20, 2025 -

Biarritz Le Bo Cafe Une Reprise Prometteuse Dans Le Monde De L Hotellerie

May 20, 2025

Biarritz Le Bo Cafe Une Reprise Prometteuse Dans Le Monde De L Hotellerie

May 20, 2025 -

Abidjan Guide Pratique Du Systeme De Numerotation Des Batiments

May 20, 2025

Abidjan Guide Pratique Du Systeme De Numerotation Des Batiments

May 20, 2025

Latest Posts

-

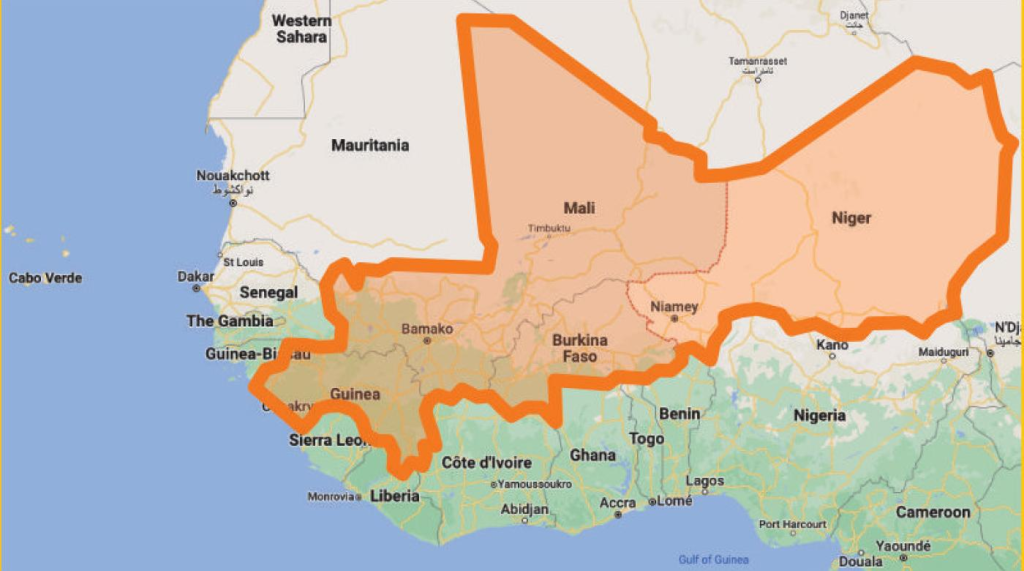

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025 -

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025 -

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025 -

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025 -

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025