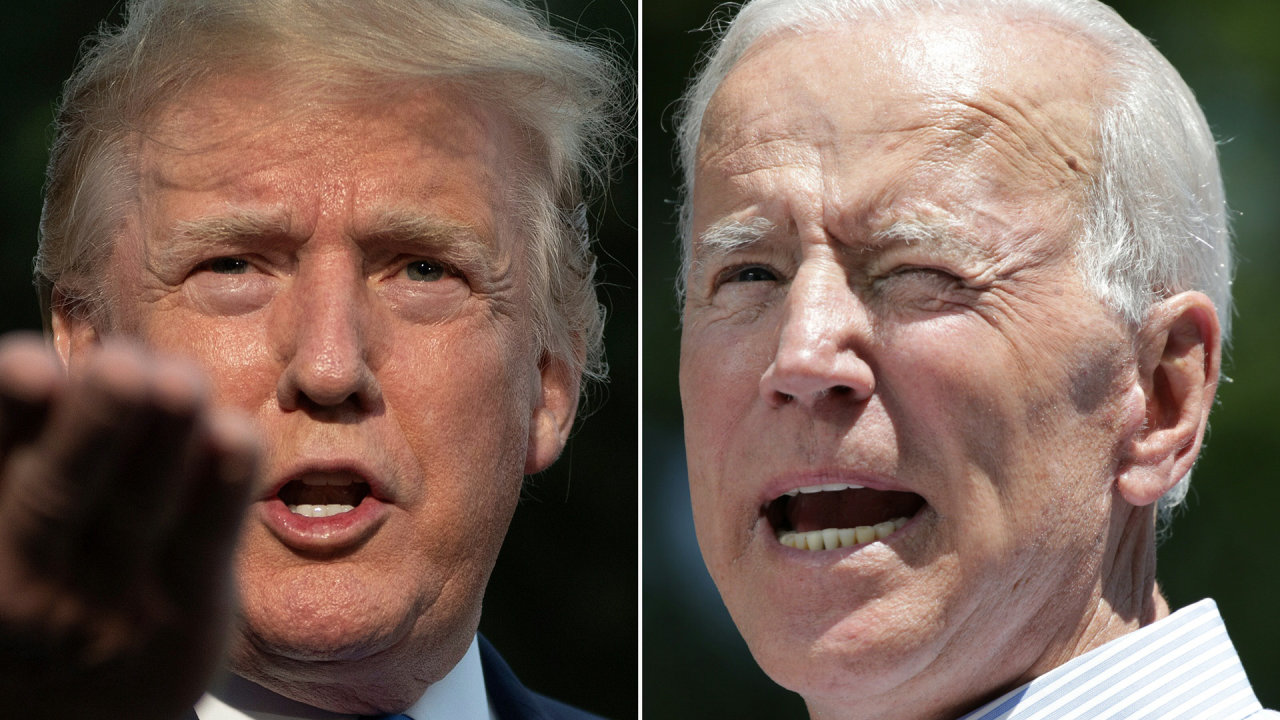

New Details Emerge: House Republicans Outline Trump's Tax Plan

Table of Contents

Proposed Individual Income Tax Rate Changes in Trump's Tax Plan

The proposed Trump's Tax Plan outlines significant changes to individual income tax brackets. While specific numbers can fluctuate depending on the legislative process, the core principle generally involves a simplification of the tax brackets and potential adjustments to the rates themselves. Understanding these changes is key to assessing the plan's impact on your personal finances.

-

Comparison to Current Rates: The proposed plan often suggests a reduction in the number of tax brackets, potentially consolidating several existing brackets into fewer, broader ranges. This simplification aims to streamline the tax process, but the actual rates within those brackets are subject to ongoing debate and revision.

-

Impact on Different Income Levels: The effects of the proposed changes vary significantly depending on income level. Higher-income earners might see a decrease in their effective tax rate due to lower bracket rates, while the impact on lower and middle-income earners is more complex and depends heavily on the specifics of any proposed changes to deductions and credits.

-

Potential for Tax Increases or Decreases: While the overall goal is often presented as tax cuts, the reality is more nuanced. Certain provisions, like changes to deductions or the elimination of certain credits, could result in tax increases for some individuals, even if the bracket rates themselves are lowered. Careful analysis of the fine print is essential.

-

Changes to Deductions and Credits: The proposed Trump's Tax Plan often includes adjustments to various deductions and credits available to taxpayers. These changes can significantly affect the final tax liability, regardless of the applicable tax bracket. For example, modifications to the standard deduction or itemized deductions can have a considerable impact on individuals' overall tax burden. Keep an eye out for details on these alterations.

Corporate Tax Rate Reductions in Trump's Tax Plan

A central feature of the proposed Trump's Tax Plan involves substantial reductions in the corporate tax rate. This is a key element intended to boost economic activity and attract investment.

-

Current vs. Proposed Rate: The current corporate tax rate in the US is significantly higher than the rate proposed under many iterations of the Trump's Tax Plan. The proposed plan often aims for a considerably lower rate, making the US more competitive globally in attracting businesses and investment.

-

Potential Economic Impacts: Proponents of the lower corporate tax rate argue it will stimulate economic growth through increased investment, job creation, and higher wages. The idea is that businesses, with more profits after taxes, will reinvest those funds, leading to broader economic benefits.

-

Arguments For and Against: The debate surrounding lower corporate taxes often centers on the potential economic benefits versus concerns about its impact on the national debt and income inequality. While lower rates might spur investment, critics raise concerns that the tax cuts primarily benefit large corporations and high-income individuals, exacerbating existing disparities.

-

Potential Downsides and Unintended Consequences: Concerns exist about potential unintended consequences, such as tax avoidance schemes by multinational corporations and a widening income gap. A thorough analysis of these potential downsides is crucial for a balanced understanding of the proposed changes.

Impact of Trump's Tax Plan on Small Businesses

The Trump's Tax Plan often contains provisions specifically designed to affect small businesses and the self-employed. The impact can vary greatly depending on the business structure and specific provisions.

-

Changes to Deductions for Small Businesses: Proposed changes to deductions relevant to pass-through entities (like sole proprietorships, partnerships, and S corporations) are particularly important for small business owners. These deductions often directly impact their taxable income.

-

Advantages and Disadvantages: The plan may offer advantages through simplified tax structures or increased deductions. However, potential disadvantages could arise from changes in other areas, such as limitations on certain expenses or an overall shift in the tax burden.

-

Comparison to the Current System: Analyzing the proposed changes in the context of the current tax system for small businesses is vital. This comparison highlights the potential advantages and disadvantages and allows for a more informed assessment of the overall impact.

-

Impact on Small Business Growth and Job Creation: Proponents argue that the plan's provisions for small businesses will encourage growth and job creation. However, a critical assessment should examine whether these benefits are evenly distributed across all types of small businesses and their impact on the broader economy.

Controversial Aspects and Potential Economic Consequences of Trump's Tax Plan

Several aspects of the Trump's Tax Plan have sparked considerable debate and controversy.

-

Increased National Debt: A major concern revolves around the potential for a significant increase in the national debt due to the revenue loss from tax cuts. This long-term consequence has significant implications for the nation's fiscal health.

-

Distribution of Tax Benefits: The distribution of tax benefits across different income groups is a key point of contention. Concerns remain about whether the tax cuts primarily benefit high-income earners and corporations, while leaving low and middle-income families with minimal benefits.

-

Fairness and Equity Concerns: Questions about the fairness and equity of the proposed tax plan are central to the ongoing debate. Critics argue that the plan exacerbates income inequality and doesn't sufficiently address the needs of low and middle-income households.

-

Expert Opinions: Economists and other experts offer diverse viewpoints on the potential economic consequences of the Trump's Tax Plan. Understanding these differing perspectives is essential for a comprehensive understanding of the issue.

Conclusion

The newly unveiled details of House Republicans' Trump's Tax Plan offer a complex picture, with potential benefits and drawbacks for various segments of the population and the economy. Understanding the proposed changes to individual and corporate tax rates, as well as their impact on small businesses, is crucial for informed decision-making. While the plan aims to stimulate economic growth, concerns remain about its potential long-term effects on the national debt and income inequality. For further analysis and up-to-date information on Trump's Tax Plan and its implications, continue to seek out reliable financial news sources and consult with a tax professional. Stay informed about the ongoing developments regarding Trump's Tax Plan to make the best decisions for your financial future.

Featured Posts

-

Dial 108 Ambulance Contract Bombay High Court Ruling

May 15, 2025

Dial 108 Ambulance Contract Bombay High Court Ruling

May 15, 2025 -

Jimmy Butlers Status Will He Play For The Warriors Today

May 15, 2025

Jimmy Butlers Status Will He Play For The Warriors Today

May 15, 2025 -

Vance Criticizes Bidens Silence On Trump Administrations Russia Ukraine Actions

May 15, 2025

Vance Criticizes Bidens Silence On Trump Administrations Russia Ukraine Actions

May 15, 2025 -

Creatine Supplements Everything You Need To Know

May 15, 2025

Creatine Supplements Everything You Need To Know

May 15, 2025 -

12 Milyon Avroluk Kktc Karari Tuerk Devletlerinin Rolue Ve Uzman Goeruesleri

May 15, 2025

12 Milyon Avroluk Kktc Karari Tuerk Devletlerinin Rolue Ve Uzman Goeruesleri

May 15, 2025

Latest Posts

-

Portugal Gana A Belgica 1 0 Resumen Completo Del Partido

May 15, 2025

Portugal Gana A Belgica 1 0 Resumen Completo Del Partido

May 15, 2025 -

Cronica Del Partido Belgica 0 1 Portugal Resumen Y Goles

May 15, 2025

Cronica Del Partido Belgica 0 1 Portugal Resumen Y Goles

May 15, 2025 -

New York Knicks Face Crucial Test Without Jalen Brunson

May 15, 2025

New York Knicks Face Crucial Test Without Jalen Brunson

May 15, 2025 -

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen

May 15, 2025

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen

May 15, 2025 -

The Jalen Brunson Injury Highlighting The Knicks Depth Issues

May 15, 2025

The Jalen Brunson Injury Highlighting The Knicks Depth Issues

May 15, 2025