Negotiations Fail: JBS's Banco Master Asset Bid Abandoned

Table of Contents

Key Reasons Behind the Failed Negotiation

The collapse of the JBS-Banco Master deal wasn't a sudden event; it was the culmination of several interconnected factors. Analyzing these issues provides valuable insights into the intricacies of high-stakes asset bids.

Valuation Discrepancies

A significant difference in valuation between JBS and Banco Master's stakeholders proved to be a major stumbling block. While precise figures remain undisclosed, sources suggest a substantial valuation gap existed.

- Methodology Differences: JBS's valuation likely relied heavily on a discounted cash flow (DCF) analysis, projecting future earnings based on their own strategic plans for Banco Master's assets. Banco Master's stakeholders, however, may have employed a more conservative approach, perhaps emphasizing the immediate market value of individual assets.

- Due Diligence Findings: The due diligence process, a critical step in any acquisition, likely uncovered discrepancies in asset values or liabilities that further widened the gap. Unforeseen liabilities or less-than-optimal asset performance could have played a role in lowering the perceived value for JBS.

- Price Disagreement: Ultimately, the inability to bridge this valuation gap, often referred to as a price disagreement, proved insurmountable, leading to the breakdown of negotiations.

Regulatory Hurdles

Navigating the regulatory landscape in Brazil is notoriously complex, and this deal was no exception. Several regulatory challenges contributed to its failure.

- Central Bank of Brazil Approval: Securing approval from the Central Bank of Brazil (BACEN) is crucial for any significant financial transaction. Delays or stringent conditions imposed by BACEN could have prolonged the negotiation process and ultimately led to its collapse.

- Antitrust Concerns: The acquisition might have raised antitrust concerns, especially if it resulted in a dominant market position for JBS within a specific sector. Extensive investigations and potential concessions required to address these concerns could have proved too burdensome.

- Compliance Issues: Meeting all necessary compliance requirements, including those related to data privacy and financial reporting, is essential for such acquisitions. Any failures in this area could have created significant legal hurdles and contributed to the deal's demise.

Unforeseen Market Conditions

The macroeconomic environment plays a crucial role in the success of M&A deals. Unforeseen market volatility impacted the viability of the JBS-Banco Master transaction.

- Interest Rate Risk: Changes in interest rates, particularly upward movements, can significantly impact the valuation of financial assets and increase borrowing costs, influencing the attractiveness of the deal for JBS.

- Currency Fluctuations: Fluctuations in the Brazilian Real against other major currencies could have impacted the overall cost of the acquisition and made the deal less attractive for JBS.

- Global Economic Uncertainty: The broader global economic uncertainty, including geopolitical tensions and potential recessions, likely increased risk aversion among investors, influencing the appetite for such large-scale transactions.

Implications of the Failed Acquisition

The abandonment of the JBS-Banco Master asset bid has significant repercussions for the involved parties and the Brazilian financial market at large.

Impact on JBS

For JBS, the failed acquisition represents a setback in its strategic growth plans.

- JBS Stock Price: The news likely impacted JBS's stock price negatively, at least temporarily, as investors reassess the company’s future growth prospects.

- Strategic Implications: JBS will now need to reconsider its expansion strategies and explore alternative avenues for diversification and growth.

- Reputational Effects: While not necessarily damaging, the failed acquisition might raise questions about JBS's M&A capabilities and strategic decision-making.

Impact on Banco Master

Banco Master faces uncertainty following the failed acquisition.

- Financial Stability: The failure of the deal could create challenges for Banco Master's financial stability, especially if it relies on the potential proceeds from the sale to address existing liabilities.

- Restructuring: Banco Master might need to consider restructuring its operations or explore alternative strategies to secure its financial future, perhaps including finding a different buyer or implementing cost-cutting measures.

- Banco Master Future: The long-term future of Banco Master will depend heavily on its ability to adapt and navigate the current financial climate.

Broader Market Impact

The failed acquisition sends a ripple effect throughout the Brazilian financial market.

- Market Sentiment: The collapse of this high-profile deal could negatively affect investor sentiment, potentially dampening enthusiasm for future M&A activities in the Brazilian financial sector.

- M&A Activity: The failed transaction might serve as a cautionary tale, impacting future dealmaking, particularly in the financial services sector. Increased scrutiny and more stringent due diligence processes are likely.

- Brazilian Financial Market: The overall impact on the Brazilian financial market depends on the broader economic context and the reactions of other stakeholders.

Conclusion

The failed acquisition of Banco Master's assets by JBS highlights the complexities inherent in large-scale mergers and acquisitions. Valuation disagreements, regulatory hurdles, and unforeseen market conditions all played significant roles in the deal's collapse, resulting in significant consequences for both companies and the broader Brazilian financial landscape. The incident underscores the need for thorough due diligence, careful consideration of regulatory environments, and an understanding of market volatility when undertaking such ambitious transactions.

Call to Action: Stay informed on the latest developments in the Brazilian financial market and the ongoing impact of this failed JBS acquisition. Follow our updates for further analysis on the evolving situation and potential future developments concerning JBS's acquisition strategies. Learn more about the complexities of large-scale asset bids and their implications for market stability.

Featured Posts

-

Stream Damiano Davids Next Summer Today

May 18, 2025

Stream Damiano Davids Next Summer Today

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025 -

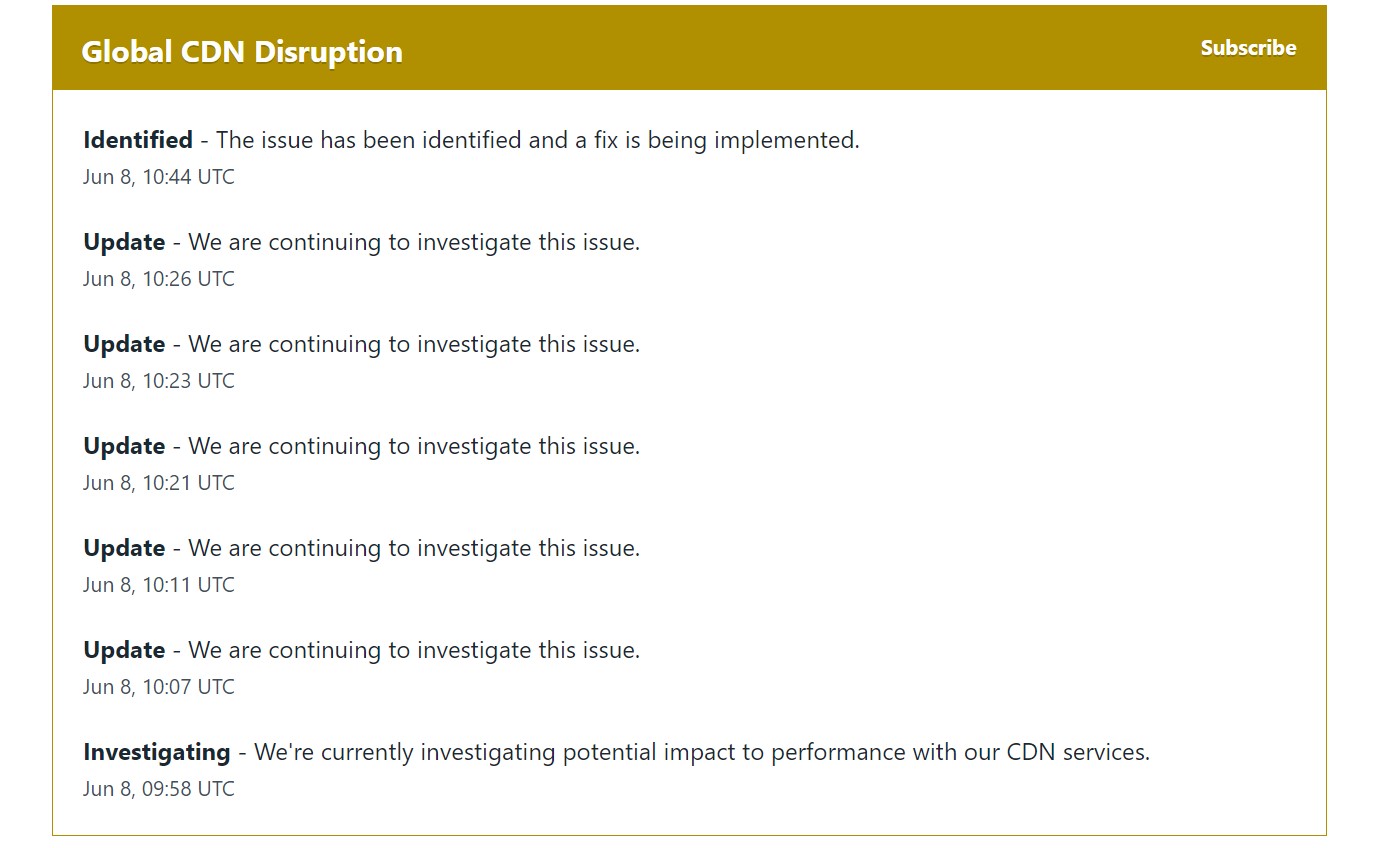

Major Reddit Outage Affecting Users Worldwide

May 18, 2025

Major Reddit Outage Affecting Users Worldwide

May 18, 2025 -

Russia Imprisons Australian For 13 Years Over Ukraine Conflict

May 18, 2025

Russia Imprisons Australian For 13 Years Over Ukraine Conflict

May 18, 2025 -

Reddit Outage Widespread Report Of Service Disruption

May 18, 2025

Reddit Outage Widespread Report Of Service Disruption

May 18, 2025

Latest Posts

-

Ohio Train Derailment The Long Term Impact Of Toxic Chemical Exposure On Buildings

May 18, 2025

Ohio Train Derailment The Long Term Impact Of Toxic Chemical Exposure On Buildings

May 18, 2025 -

Ohio Train Derailment Toxic Chemical Residues In Buildings Months Later

May 18, 2025

Ohio Train Derailment Toxic Chemical Residues In Buildings Months Later

May 18, 2025 -

Millions In Losses Office365 Executive Inbox Compromise Investigated

May 18, 2025

Millions In Losses Office365 Executive Inbox Compromise Investigated

May 18, 2025 -

Inside The Office365 Heist Millions Stolen From Executive Inboxes

May 18, 2025

Inside The Office365 Heist Millions Stolen From Executive Inboxes

May 18, 2025 -

Execs Office365 Accounts Breached Millions Made Feds Say

May 18, 2025

Execs Office365 Accounts Breached Millions Made Feds Say

May 18, 2025