NCLH Stock: Is It A Good Investment Based On Hedge Fund Holdings?

Table of Contents

Understanding Hedge Fund Activity in the Cruise Industry

What are Hedge Funds and Why Do We Analyze Their Holdings?

Hedge funds are alternative investment vehicles employing a range of sophisticated strategies, often involving both long and short positions, to generate returns for their investors. They represent a significant segment of institutional investors, and their investment decisions are closely scrutinized by many. Analyzing their portfolio choices, particularly in sectors like the cruise industry, can offer valuable insights, though not necessarily guarantees, into market sentiment and future potential. Understanding hedge fund investment strategies is crucial for interpreting their actions regarding NCLH.

- Extensive Research: Hedge funds dedicate considerable resources to in-depth research and analysis before making investment decisions, often employing teams of experts.

- Market Trend Indicators: Their collective actions can sometimes foreshadow market trends or indicate a perceived shift in a company's prospects. Significant purchases or divestments can send strong signals.

- Not Foolproof: It’s crucial to remember that hedge fund decisions are not infallible. Their strategies can fail, and their actions shouldn't be the sole basis for an investment decision.

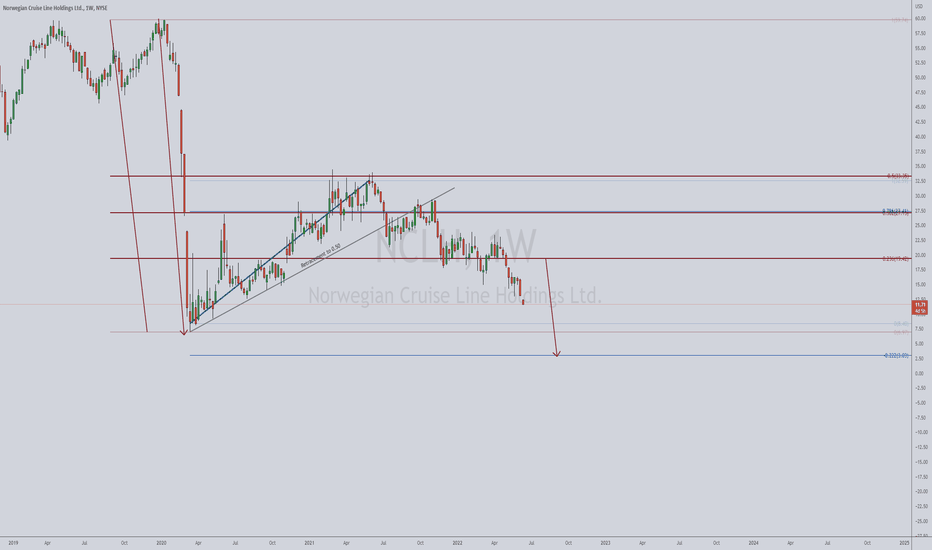

Analyzing Recent NCLH Stock Holdings by Major Hedge Funds

Identifying Key Players

Several prominent hedge funds have held, or continue to hold, substantial stakes in NCLH stock. Identifying these key players and tracking their investment activity provides a clearer picture of institutional sentiment. While specific holdings can change rapidly, reviewing public filings (such as 13F filings with the SEC) offers a snapshot of institutional ownership.

- Data Analysis: [Insert data here on specific hedge funds holding NCLH stock, including names, approximate share count, and percentage of total shares. Source the data from reputable financial websites like Yahoo Finance, Bloomberg, or similar sources. Include hyperlinks to relevant financial news articles or SEC filings.]

- Recent Activity: [Analyze any recent buy or sell activity by these hedge funds. Describe the magnitude of the transactions and any possible reasons behind them, referencing relevant news or financial reports.]

- Contextualization: Interpret these changes in holdings in light of NCLH's recent financial performance, market conditions (e.g., economic growth, fuel prices, travel trends), and any relevant news impacting the cruise industry.

NCLH's Financial Performance and Future Outlook

Recent Financials and Earnings Reports

Analyzing NCLH's recent financial performance is crucial to understanding the rationale behind hedge fund activity. Examining revenue figures, profitability metrics, and debt levels helps gauge the company's financial health and future prospects. Consulting NCLH's quarterly and annual earnings reports (available on their investor relations website and the SEC's EDGAR database) is essential.

- Pandemic Impact: Assess the impact of the COVID-19 pandemic on NCLH's financial performance, including revenue losses, operational challenges, and debt accumulation.

- Growth Prospects: Analyze NCLH's projected growth, considering factors such as booking trends, expansion plans, and the overall recovery of the cruise industry.

- Strategic Initiatives: Examine any new strategic initiatives or cost-cutting measures implemented by NCLH to enhance its competitiveness and profitability. [Insert data on recent financials, citing specific sources like SEC filings and financial news.]

Risks and Considerations

Evaluating the Investment Risks

Investing in NCLH stock, like any investment, carries inherent risks. It’s vital to understand these potential risks before making any investment decisions.

- Market Volatility: The stock market is inherently volatile, and NCLH stock is subject to fluctuations based on broader market trends, investor sentiment, and company-specific news.

- Industry Competition: The cruise industry is competitive, and NCLH faces competition from other major cruise lines. Changes in the competitive landscape can impact NCLH's market share and profitability.

- Economic Downturns: Economic downturns can significantly impact the travel industry, reducing demand for cruises and potentially harming NCLH's performance.

- Geopolitical Events: Global events, such as pandemics, geopolitical instability, or major weather events, can disrupt cruise operations and impact NCLH's financial performance.

- Fuel Prices and Operating Costs: Fluctuations in fuel prices and other operational costs can significantly affect NCLH's profitability.

- Regulatory Risks and Environmental Concerns: The cruise industry faces increasing regulatory scrutiny and environmental concerns, which can lead to increased costs or operational limitations.

- Cyclical Nature: The cruise industry is cyclical, with demand fluctuating seasonally and over longer economic cycles.

Conclusion

Analyzing NCLH stock based on hedge fund holdings and the company's financial performance provides a nuanced perspective on its investment potential. While hedge fund activity can offer valuable insights into market sentiment and potential future trends, it's not a foolproof predictor of success. Investors must carefully weigh the potential risks associated with NCLH stock, including market volatility, industry competition, and economic factors, against the potential for future growth. Thorough due diligence, considering your individual risk tolerance and financial goals, is paramount before making any investment decisions. Learn more about NCLH stock and make informed investment decisions. Investing in NCLH stock requires careful consideration of all available information. NCLH stock analysis should be a comprehensive process. Is NCLH a good investment for you? Only your own research can answer that question.

Featured Posts

-

Artfae Ghyr Msbwq Fy Asthlak Alraklyt Bswysra

Apr 30, 2025

Artfae Ghyr Msbwq Fy Asthlak Alraklyt Bswysra

Apr 30, 2025 -

Upcoming Vote Germanys Spd Campaigns For Coalition Agreement Support

Apr 30, 2025

Upcoming Vote Germanys Spd Campaigns For Coalition Agreement Support

Apr 30, 2025 -

Processo Becciu Appello Dal 22 Settembre Dichiarazione Di Innocenza

Apr 30, 2025

Processo Becciu Appello Dal 22 Settembre Dichiarazione Di Innocenza

Apr 30, 2025 -

Maikel Garcia Homer Witt Jr S Rbi Double Power Royals Past Guardians

Apr 30, 2025

Maikel Garcia Homer Witt Jr S Rbi Double Power Royals Past Guardians

Apr 30, 2025 -

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 30, 2025

Louisville Downtown Evacuations Dangerous Natural Gas Levels

Apr 30, 2025