Navigating The Private Credit Boom: 5 Do's And Don'ts To Land Your Dream Job

Table of Contents

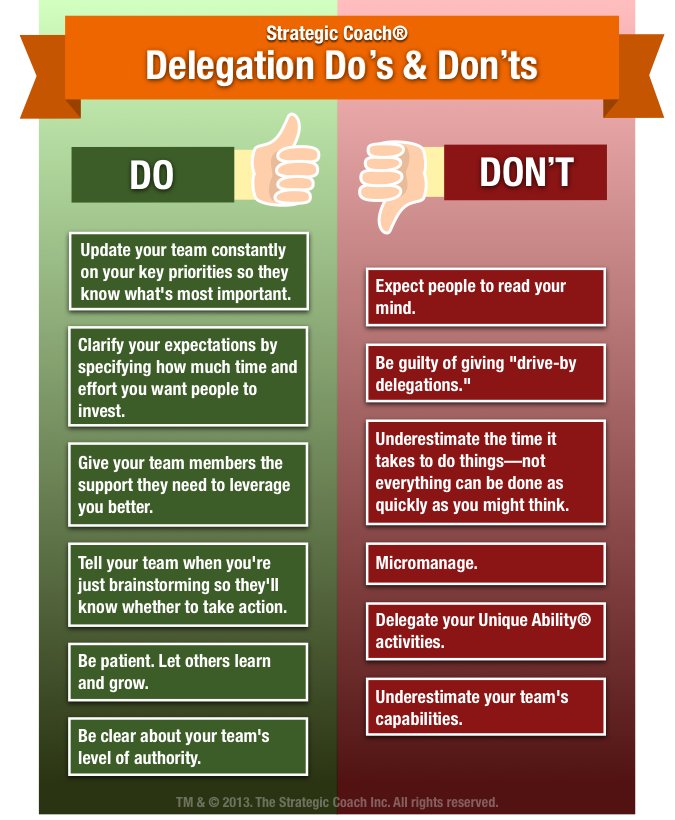

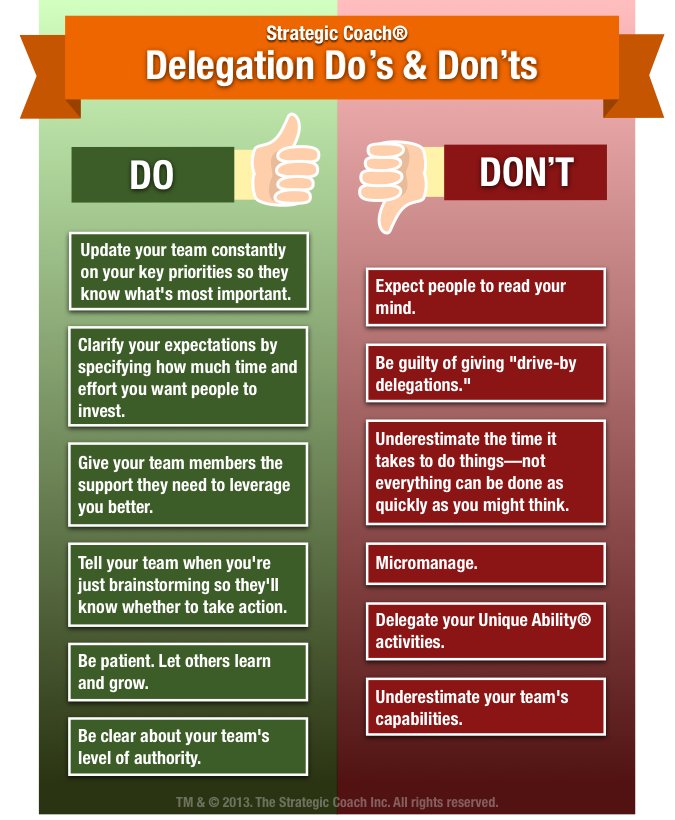

Do's for Securing a Private Credit Job

Develop Specialized Skills

The private credit industry demands a robust skillset. To stand out, master these key areas:

- Master fundamental financial modeling techniques: Become proficient in Discounted Cash Flow (DCF) analysis, Leveraged Buyout (LBO) modeling, and other crucial valuation methods. These are the cornerstones of credit analysis in private credit.

- Become proficient in credit analysis and underwriting: Develop a deep understanding of credit risk assessment, including financial statement analysis, covenant compliance, and industry benchmarking. This is vital for evaluating potential borrowers.

- Develop expertise in specific asset classes within private credit: Specializing in areas like direct lending, real estate debt, or infrastructure finance can significantly enhance your marketability. Understanding the nuances of each asset class is key.

- Gain experience with financial software and databases: Proficiency in tools like the Bloomberg Terminal and Argus is essential for efficient data analysis and reporting, commonly used in private credit jobs.

Network Strategically

Networking is paramount in the private credit world. Don't underestimate the power of building relationships:

- Attend industry conferences and events: These events provide opportunities to meet key players, learn about industry trends, and showcase your expertise. Look for conferences focused on private credit, alternative lending, or related fields.

- Join relevant professional organizations: Membership in organizations like the CFA Institute or the AIIM (Association for Information and Image Management - relevant for data analysis aspects) can provide access to networking events and resources.

- Leverage LinkedIn to connect with professionals in private credit: Actively engage with professionals in your target firms and industries. Share insightful content and participate in relevant discussions.

- Informational interviews are key: Reach out to professionals for informational interviews to learn about their roles, career paths, and the firms they work for. This demonstrates your initiative and allows for valuable insights.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count:

- Highlight relevant experience and skills: Focus on achievements that demonstrate your capabilities in areas like financial modeling, credit analysis, and risk management.

- Quantify your achievements whenever possible: Use numbers and data to showcase your impact. Instead of saying "Improved efficiency," say "Improved efficiency by 15%."

- Tailor your resume and cover letter to each specific job application: Generic applications rarely succeed. Customize your materials to reflect the specific requirements and culture of each firm.

- Use keywords from the job description: Employ relevant keywords to ensure your application gets noticed by applicant tracking systems (ATS) and recruiters. Carefully review the job posting for appropriate terms.

Don'ts for a Successful Private Credit Job Search

Underestimate the Importance of Networking

While online job boards are helpful, they shouldn't be your sole strategy:

- Avoid relying solely on online job boards: Networking significantly increases your chances of finding hidden opportunities and making valuable connections.

- Don't underestimate the power of personal connections: Leverage your existing network and actively expand it through targeted outreach.

- Don't be afraid to reach out to people you don't know: Informational interviews can be incredibly valuable, even if you don't have a direct connection.

Neglect Your Financial Literacy

A strong understanding of finance is non-negotiable:

- Don't apply for jobs without a solid understanding of financial statements: Master the balance sheet, income statement, and cash flow statement. This is fundamental to credit analysis.

- Don't skip learning about different debt structures and investment strategies: Familiarize yourself with various debt instruments, including senior secured loans, subordinated debt, and mezzanine financing.

- Don't underestimate the importance of understanding risk management: Grasp credit risk, market risk, and operational risk to effectively assess investment opportunities.

Submit Generic Applications

Each application should be tailored and demonstrate genuine interest:

- Don't send the same resume and cover letter to every firm: Take the time to research each firm's investment strategy, portfolio companies, and culture.

- Don't fail to research each company thoroughly: Demonstrate your understanding of their business and how your skills align with their needs.

- Don't miss opportunities to demonstrate your genuine interest: Show enthusiasm and a genuine interest in the firm and the specific role.

Conclusion

The private credit boom presents exceptional opportunities for ambitious professionals. By following these do's and don'ts, you can significantly increase your chances of landing your dream job in this dynamic field. Remember to hone your specialized skills, network strategically, and present yourself effectively. Don't delay your pursuit of a fulfilling career in private credit. Start implementing these strategies today and navigate the boom to success!

Featured Posts

-

Pekanbaru Incar Rp 3 6 Triliun Investasi Target Bkpm Tahun Ini

May 01, 2025

Pekanbaru Incar Rp 3 6 Triliun Investasi Target Bkpm Tahun Ini

May 01, 2025 -

The Inflation Causing Chocolate Bar A Global Cravings Unforeseen Consequences

May 01, 2025

The Inflation Causing Chocolate Bar A Global Cravings Unforeseen Consequences

May 01, 2025 -

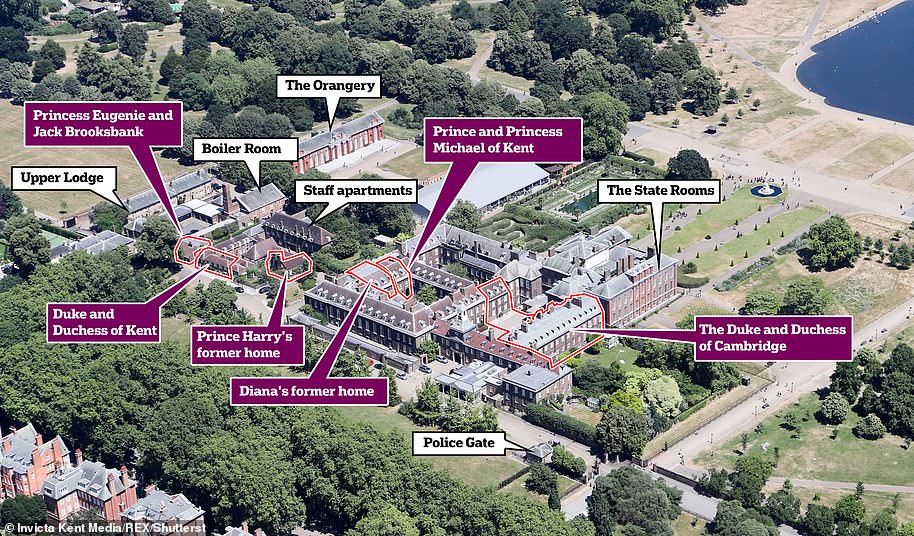

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025 -

Japanese Financial Giant Sbi Rewards Shareholders With Xrp

May 01, 2025

Japanese Financial Giant Sbi Rewards Shareholders With Xrp

May 01, 2025 -

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 01, 2025

Latest Posts

-

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025 -

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025 -

Rodons Strong Start Yankees Salvage Series Finale Against Guardians

May 01, 2025

Rodons Strong Start Yankees Salvage Series Finale Against Guardians

May 01, 2025 -

Yankees Beat Guardians To Avoid Series Sweep

May 01, 2025

Yankees Beat Guardians To Avoid Series Sweep

May 01, 2025 -

Yankees Salvage Series Finale Carlos Rodons Strong Start Key To 5 1 Win

May 01, 2025

Yankees Salvage Series Finale Carlos Rodons Strong Start Key To 5 1 Win

May 01, 2025