Navigating The Long Game: When Startups Stall Before An IPO

Table of Contents

Identifying the Signs of a Stalled Startup

Recognizing the warning signs of a stalled startup is the first critical step towards recovery. Ignoring these indicators can lead to irreversible damage and ultimately prevent the company from reaching its IPO goals.

Slow or Stagnant Growth

A significant indicator of a stalled startup is slow or stagnant growth. This manifests in several key metrics:

- Decreasing month-over-month revenue: A consistent decline in monthly revenue signals a serious problem that needs immediate attention. This could indicate a flawed business model, ineffective marketing, or a loss of market share.

- Flat user acquisition: If your user base isn't expanding, it's a clear sign that your growth engine is sputtering. This requires a thorough analysis of your customer acquisition strategies.

- Lack of market share expansion: Even with consistent revenue, a lack of market share expansion suggests that you're not capturing the full potential of your target market. This points to a need for competitive analysis and strategic adjustments.

- Failure to achieve key performance indicators (KPIs): Missing key performance indicators, such as customer lifetime value (CLTV) or customer acquisition cost (CAC) targets, reveals underlying weaknesses in your business model that must be addressed.

These metrics collectively indicate a lack of momentum and the need for a comprehensive strategic reassessment. Failure to address these issues early can significantly hamper your chances of a successful IPO.

Funding Challenges and Cash Flow Issues

Securing adequate funding is vital for sustained growth and eventual IPO readiness. Difficulties in this area are a major red flag:

- Difficulty securing further funding rounds: Investors are discerning; struggling to secure funding indicates a lack of confidence in the company's future prospects.

- Increasing burn rate exceeding revenue: A high burn rate, where expenses consistently outpace revenue, is unsustainable in the long run and signals a critical need for cost optimization.

- Reliance on short-term debt: Over-reliance on short-term debt creates financial instability and increases vulnerability to market fluctuations.

Sustainable funding and efficient cash management are paramount. A solid financial plan, including detailed projections and realistic growth targets, is crucial for attracting investors and navigating the challenges of the long game to an IPO.

Internal Conflicts and Management Issues

Internal friction can severely hinder a startup's progress. Signs of this include:

- Lack of clear vision and strategy: Without a unified vision and well-defined strategy, the company lacks direction and focus, making it difficult to attract investors and achieve consistent growth.

- Disagreements among founders: Internal conflicts among founders can cripple decision-making and create an unstable environment.

- Ineffective leadership: Weak leadership fails to inspire, motivate, and guide the team effectively, leading to decreased productivity and morale.

- High employee turnover: High turnover rates indicate deeper issues such as poor management, low morale, or a toxic work environment, all detrimental to long-term success.

A unified team with strong leadership is essential for navigating the complexities of scaling a business towards an IPO. A clear, shared vision and effective communication are key ingredients for success.

Market Saturation and Competitive Pressures

The market landscape is dynamic, and startups must adapt to survive:

- Emergence of strong competitors: New competitors can quickly erode market share and revenue if a startup fails to innovate and differentiate itself.

- Decreased market demand: Changes in consumer preferences or economic downturns can drastically impact market demand, necessitating strategic adaptation.

- Failure to adapt to changing market conditions: Inflexibility and a failure to adapt to evolving market conditions can quickly render a business model obsolete.

Continuous market analysis, competitive differentiation through innovation, and a commitment to adapting to changing market conditions are crucial for maintaining a strong market position and achieving IPO readiness.

Strategies for Overcoming Challenges and Achieving IPO Readiness

Addressing the challenges identified above requires a proactive and strategic approach.

Refocusing the Business Strategy

A successful turnaround often involves a strategic pivot:

- Market research and analysis: Conduct thorough market research to identify new opportunities and underserved customer segments.

- Product innovation and diversification: Develop new products or services to expand your offerings and cater to a wider audience.

- Targeting new customer segments: Explore new markets and customer demographics to expand your reach and revenue streams.

- Refining the value proposition: Clearly define and communicate the unique value your product or service offers to potential customers.

Many successful companies have demonstrated the power of strategic pivots. Netflix, initially a DVD rental service, transformed into a streaming giant by adapting to changing market demands.

Optimizing Operations and Finances

Improving operational efficiency and financial management is essential:

- Implementing cost-cutting measures: Identify areas for cost reduction without compromising quality or innovation.

- Improving operational efficiency: Streamline processes, optimize workflows, and leverage technology to increase productivity.

- Strengthening cash flow management: Implement robust cash flow management practices to ensure sufficient funds for operations and growth.

- Exploring strategic partnerships: Collaborate with other companies to leverage resources, expertise, and market access.

Lean management principles and strategic alliances can significantly improve operational efficiency and financial stability, making the startup more attractive to potential investors.

Strengthening the Leadership Team and Company Culture

A strong leadership team and positive company culture are critical:

- Hiring experienced executives: Bring in experienced leaders with proven track records to guide the company towards its goals.

- Improving communication and collaboration: Foster open communication and collaboration within the team to improve efficiency and decision-making.

- Fostering a positive work environment: Create a supportive and engaging work environment that attracts and retains top talent.

- Employee retention strategies: Implement strategies to reduce employee turnover and maintain institutional knowledge.

A strong leadership team and positive company culture significantly impact investor confidence and long-term success, ultimately increasing the chances of a successful IPO.

Preparing for the IPO Process

The IPO process itself is complex and demanding:

- Engaging investment banks: Partner with reputable investment banks with experience in managing IPOs.

- Conducting due diligence: Thoroughly review all aspects of the company's operations and finances to ensure transparency and compliance.

- Preparing financial statements: Prepare accurate and comprehensive financial statements according to regulatory requirements.

- Complying with regulatory requirements: Ensure full compliance with all relevant Securities and Exchange Commission (SEC) filings and regulations.

The Initial Public Offering (IPO) process involves several key steps, and professional guidance from experienced investment bankers and legal counsel is crucial for a smooth and successful outcome.

Conclusion

Navigating the path to an IPO requires strategic planning, adaptability, and a long-term vision. By recognizing the signs of a stalled startup early, proactively addressing challenges, and implementing effective strategies, entrepreneurs can significantly increase their chances of success. Don't let your startup stall – master the long game and achieve your IPO goals. Learn more about overcoming challenges and preparing for your Initial Public Offering by [link to relevant resource/service].

Featured Posts

-

Nolte Reports Snow Whites Continued Box Office Struggle

May 14, 2025

Nolte Reports Snow Whites Continued Box Office Struggle

May 14, 2025 -

Russia Ukraine And The Trump Administration A Change In Western Pressure

May 14, 2025

Russia Ukraine And The Trump Administration A Change In Western Pressure

May 14, 2025 -

Nationwide Product Recall Walmart Recalls Orvs Oysters And Electric Scooters

May 14, 2025

Nationwide Product Recall Walmart Recalls Orvs Oysters And Electric Scooters

May 14, 2025 -

Yevrobachennya 2024 Mozhlive Povernennya Damiano Davida

May 14, 2025

Yevrobachennya 2024 Mozhlive Povernennya Damiano Davida

May 14, 2025 -

Emma Raducanu Parts Ways With Coach Following Short Trial Period

May 14, 2025

Emma Raducanu Parts Ways With Coach Following Short Trial Period

May 14, 2025

Latest Posts

-

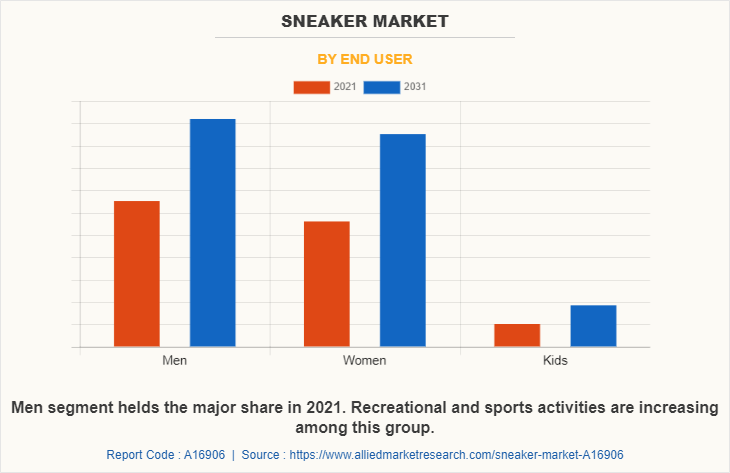

Swiss Sneaker Brand Sees Stock Surge Following Increased Global Sales

May 14, 2025

Swiss Sneaker Brand Sees Stock Surge Following Increased Global Sales

May 14, 2025 -

Federerova Zhelja Za Povratak Puni Stadioni I Publika Su Mu Potrebni

May 14, 2025

Federerova Zhelja Za Povratak Puni Stadioni I Publika Su Mu Potrebni

May 14, 2025 -

Federer Ob Ashnjava Svo Povratak Puni Stadioni I Publika Mu Nedosta U

May 14, 2025

Federer Ob Ashnjava Svo Povratak Puni Stadioni I Publika Mu Nedosta U

May 14, 2025 -

Povratak Ro Era Federera Njegove Rechi O Publitsi I Stadionima

May 14, 2025

Povratak Ro Era Federera Njegove Rechi O Publitsi I Stadionima

May 14, 2025 -

Federer Se Vra A Iz Ava O Zhelji Za Punim Stadionima

May 14, 2025

Federer Se Vra A Iz Ava O Zhelji Za Punim Stadionima

May 14, 2025