Navigating The Dragon's Den: Tips For Success

Table of Contents

Crafting a Compelling Pitch Deck

A well-structured pitch deck is your first impression and often the deciding factor in securing funding. It needs to be more than just a presentation; it needs to be a persuasive narrative that resonates with investors.

Understanding Your Audience (Dragons' Investment Criteria)

Before you even begin designing your pitch deck, thorough research is paramount. You need to understand your target audience – the investors themselves.

- Researching individual investors: Explore their past investments, portfolio companies, and stated investment preferences. What industries do they favor? What are their typical investment sizes?

- Identifying their investment preferences: Look for patterns in their investments. Do they prefer early-stage startups or more established businesses? What are their risk tolerances?

- Aligning your pitch to their interests: Tailor your pitch deck to showcase the aspects most relevant to each specific investor or panel. This demonstrates due diligence and shows you understand their investment criteria.

Tailoring your pitch deck is vital. For example, if an investor has a strong history in sustainable energy, highlighting your company's commitment to eco-friendly practices will significantly improve your chances. Generic pitch decks rarely succeed.

The Power of a Strong Narrative

Your pitch deck shouldn't just present data; it should tell a compelling story. This narrative arc needs to clearly articulate the problem your company solves, your innovative solution, and the immense market opportunity you're capitalizing on.

- Crafting a concise and engaging story: Structure your presentation around a clear narrative, moving from problem to solution to market opportunity, culminating in your ask.

- Highlighting the problem, solution, and market opportunity: Use strong visuals and data to support your claims, emphasizing the urgency and scale of the problem, the effectiveness of your solution, and the potential for significant market share.

- Elevator pitch mastery: Be able to succinctly summarize your business and its value proposition in a few short sentences.

Remember, investors are not just looking at numbers; they're investing in people and their vision. Passion is contagious, and a captivating narrative will significantly enhance your chances of securing funding.

Data-Driven Projections and Financial Modeling

While a compelling story is crucial, your pitch must also be grounded in solid financial data. Investors need to see a clear path to profitability and a realistic assessment of your market potential.

- Presenting realistic financial forecasts: Your financial projections should be well-researched and supported by market analysis. Avoid over-optimistic projections.

- Demonstrating market analysis: Clearly articulate your understanding of the market, including your target audience, competition, and market size.

- Showcasing clear revenue streams: Outline your revenue model and demonstrate how you will generate income. Explain your pricing strategy and projected growth.

Financial modeling is essential; however, it's just as crucial to explain your assumptions clearly and be prepared to answer questions about potential risks and challenges. Avoiding common mistakes like unrealistic growth projections is key to maintaining credibility.

Mastering the Art of the Pitch Presentation

Having a brilliant pitch deck is only half the battle; you need to deliver it effectively. Your presentation skills can make or break your chances of securing investment.

Confident and Engaging Delivery

Your delivery should be confident, engaging, and enthusiastic. Rehearsing your presentation extensively is crucial to mastering your delivery.

- Practicing extensively: Practice in front of a mirror, record yourself, and get feedback from trusted advisors.

- Maintaining eye contact: Make eye contact with each investor to build rapport and demonstrate confidence.

- Managing nerves: Techniques like deep breathing and visualization can help manage pre-presentation anxiety.

- Handling Q&A effectively: Anticipate potential questions and prepare concise, well-reasoned answers.

Body language speaks volumes. Maintain good posture, use natural hand gestures, and modulate your tone to keep your audience engaged. Projecting confidence is essential, even when facing difficult questions.

Handling Difficult Questions and Objections

Investors will likely ask challenging questions to assess your knowledge and preparedness. Be ready to address potential criticisms head-on.

- Anticipating potential criticisms: Brainstorm possible objections and prepare thoughtful responses.

- Preparing concise and well-reasoned responses: Practice delivering your responses calmly and confidently.

- Turning objections into opportunities: Frame objections as opportunities to clarify your position and showcase your understanding of the challenges.

Remain calm and professional, even when facing aggressive questioning. Demonstrating your ability to handle pressure and respond thoughtfully will build investor confidence.

Negotiating Terms and Closing the Deal

Securing funding is only the first step; negotiating favorable terms is just as crucial. Know your worth and your walk-away point.

- Understanding your valuation: Conduct thorough research to determine a fair valuation for your company.

- Knowing your walk-away point: Establish your minimum acceptable terms before entering negotiations.

- Preparing for counter-offers: Anticipate potential counter-offers and have strategies for responding.

- Securing favorable terms: Negotiate diligently to secure terms that are advantageous for your company.

Having a clear understanding of your needs and goals before you enter negotiations is paramount. Knowing your bottom line empowers you to make informed decisions throughout the process.

Post-Pitch Strategies and Follow-Up

The pitching process doesn't end with your presentation. Effective follow-up is vital for building lasting relationships and maximizing your chances of securing funding.

Following Up with Investors

Maintain consistent communication with investors, even if the initial pitch was unsuccessful.

- Sending thank-you notes: Express your gratitude for their time and consideration.

- Providing additional information as requested: Respond promptly and thoroughly to any requests for further information.

- Maintaining consistent communication: Keep investors updated on your progress and any significant milestones.

Building relationships is crucial, even if the initial pitch didn't result in an investment. These relationships can prove invaluable in the future.

Learning from Feedback

Regardless of the outcome, seek feedback from investors to identify areas for improvement.

- Seeking constructive criticism: Ask investors for specific feedback on your pitch and business model.

- Identifying areas for improvement: Use feedback to refine your pitch and strengthen your business strategy.

- Refining your pitch for future opportunities: Iterate on your pitch based on the feedback you received.

View rejection as an opportunity for growth and learning. Analyze the feedback you received, refine your pitch, and use this experience to increase your chances of success in future endeavors.

Conclusion

Successfully navigating the Dragon's Den, or any similar investment pitch scenario, requires a multifaceted approach. Crafting a compelling pitch deck that speaks to your audience, mastering the art of presentation, and employing effective post-pitch strategies are all vital for success. Remember to research your investors, tell a captivating story, present robust financial data, and effectively handle questions and negotiations. By following these tips and continuously learning and refining your approach, you will significantly improve your chances of securing the investment you need to propel your business forward. Continue learning about successful pitching strategies and refining your own approach. Your journey to securing funding starts now!

Featured Posts

-

Kareena Kapoor And Gillian Anderson Honest Talk On Aging Beauty And Cosmetic Surgery

May 01, 2025

Kareena Kapoor And Gillian Anderson Honest Talk On Aging Beauty And Cosmetic Surgery

May 01, 2025 -

Dragons Den Backs Omnis Plant Based Dog Food Venture

May 01, 2025

Dragons Den Backs Omnis Plant Based Dog Food Venture

May 01, 2025 -

Xrp Explained Uses Value And Future Potential

May 01, 2025

Xrp Explained Uses Value And Future Potential

May 01, 2025 -

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025

1 Billion Us Factory Merck Expands Domestic Production Of Blockbuster Drug

May 01, 2025 -

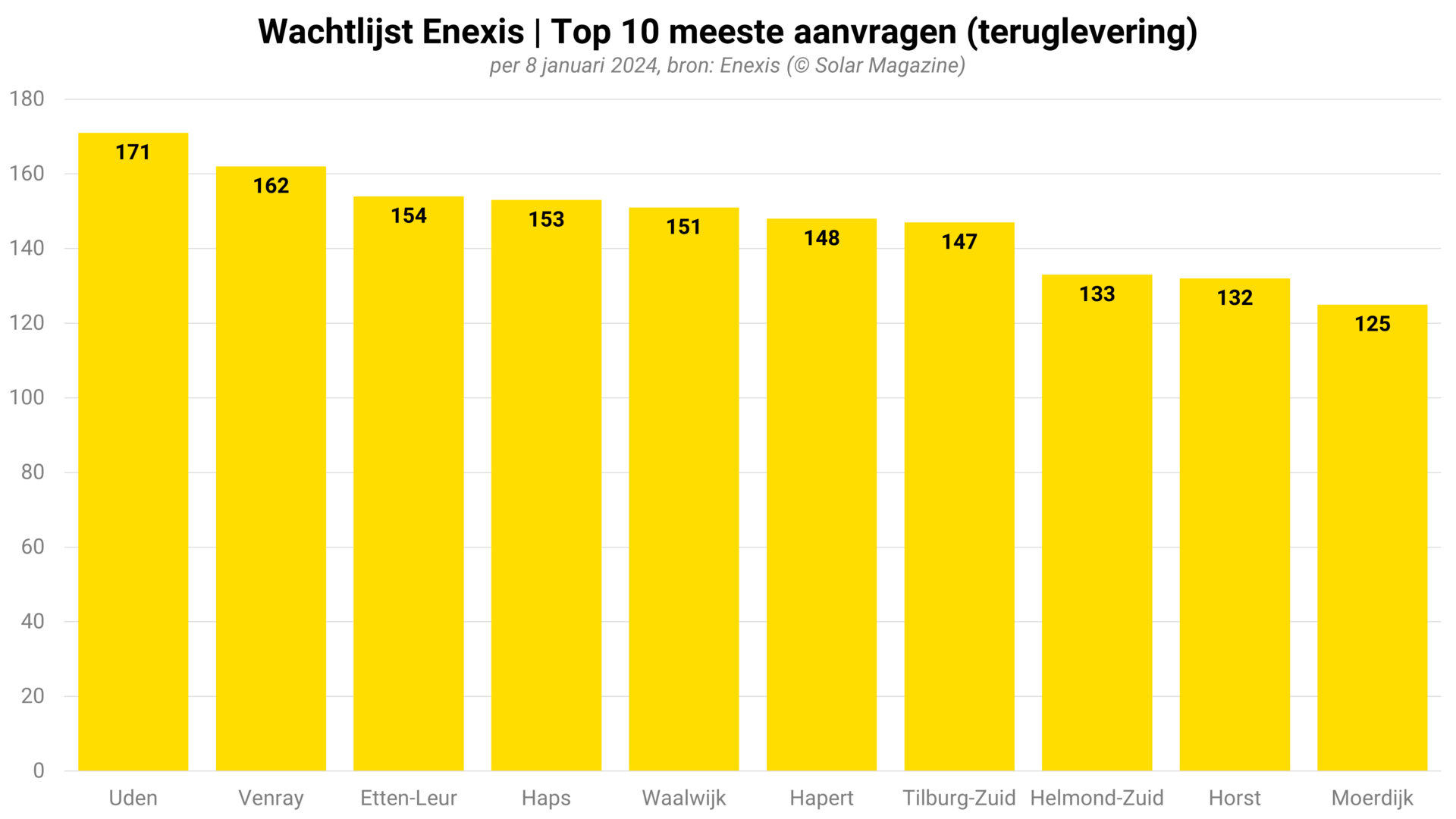

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025

Duizenden Limburgse Bedrijven Op Wachtlijst Voor Enexis Aansluiting

May 01, 2025