Navigate The Private Credit Job Market: 5 Dos And Don'ts

Table of Contents

DO: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about who you know, but also about cultivating meaningful relationships that can lead to opportunities.

Leverage LinkedIn Effectively:

- Optimize your profile: Use relevant keywords like "private credit," "private debt," "alternative lending," "structured finance," "direct lending," "mezzanine finance," and "distressed debt" throughout your profile. Highlight your experience in credit analysis, portfolio management, and financial modeling.

- Engage actively: Join relevant LinkedIn groups focused on private credit, alternative lending, and investment management. Participate in discussions, share insightful articles, and comment thoughtfully to establish yourself as a knowledgeable professional.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. Express genuine interest in their work and the industry, and ask insightful questions. This demonstrates your initiative and passion.

Attend Industry Events:

- Conferences and workshops: Attend conferences and workshops focused on private credit, private equity, and alternative investments. These events offer excellent networking opportunities.

- Networking events: Private credit firms often host or sponsor industry events. These are invaluable opportunities to make direct connections with hiring managers and other professionals.

- Follow-up: After attending an event, follow up with new contacts via email or LinkedIn, referencing your conversation and reiterating your interest in the private credit industry.

Utilize Your Existing Network:

- Tap into your connections: Let your existing network know you're actively seeking a role in private credit, private debt, or alternative lending. You might be surprised at the hidden connections within your reach.

- Inform your network of your career goals: Be specific about the type of role you're seeking (e.g., Analyst, Associate, Portfolio Manager) and the areas of private credit that interest you most.

DO: Showcase Specialized Skills and Experience

The private credit job market is highly competitive. You need to demonstrate clearly why you're the ideal candidate.

Highlight Relevant Experience:

Emphasize any experience in financial modeling, credit analysis, due diligence, portfolio management, loan origination, or legal aspects related to private credit transactions. Quantify your accomplishments whenever possible.

Quantify Your Achievements:

Use numbers to show the impact you've made. For instance, instead of saying "improved portfolio performance," say "increased portfolio returns by 15% through strategic credit selection and risk management." This demonstrates your ability to add value.

Tailor Your Resume and Cover Letter:

Customize your resume and cover letter to match each specific job description. Highlight the skills and experiences most relevant to the particular role and the firm's investment strategy. Generic applications rarely stand out.

DO: Understand the Different Sectors within Private Credit

The private credit landscape encompasses various strategies and investor types. Demonstrate your understanding of these nuances.

Research Private Debt Strategies:

Familiarize yourself with different private debt strategies, including direct lending, mezzanine finance, distressed debt, special situations, and unitranche lending. Understanding the risks and returns associated with each strategy is crucial.

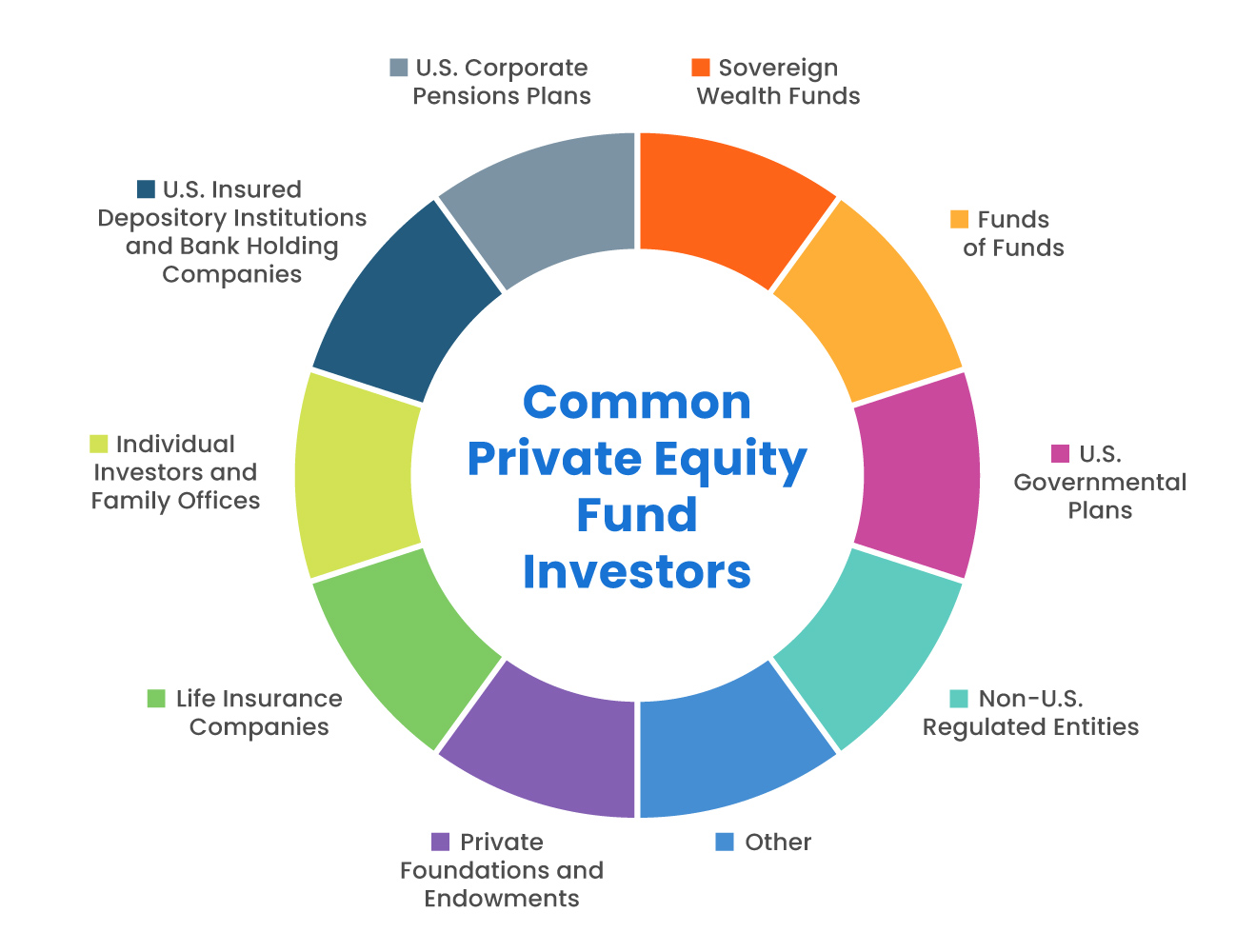

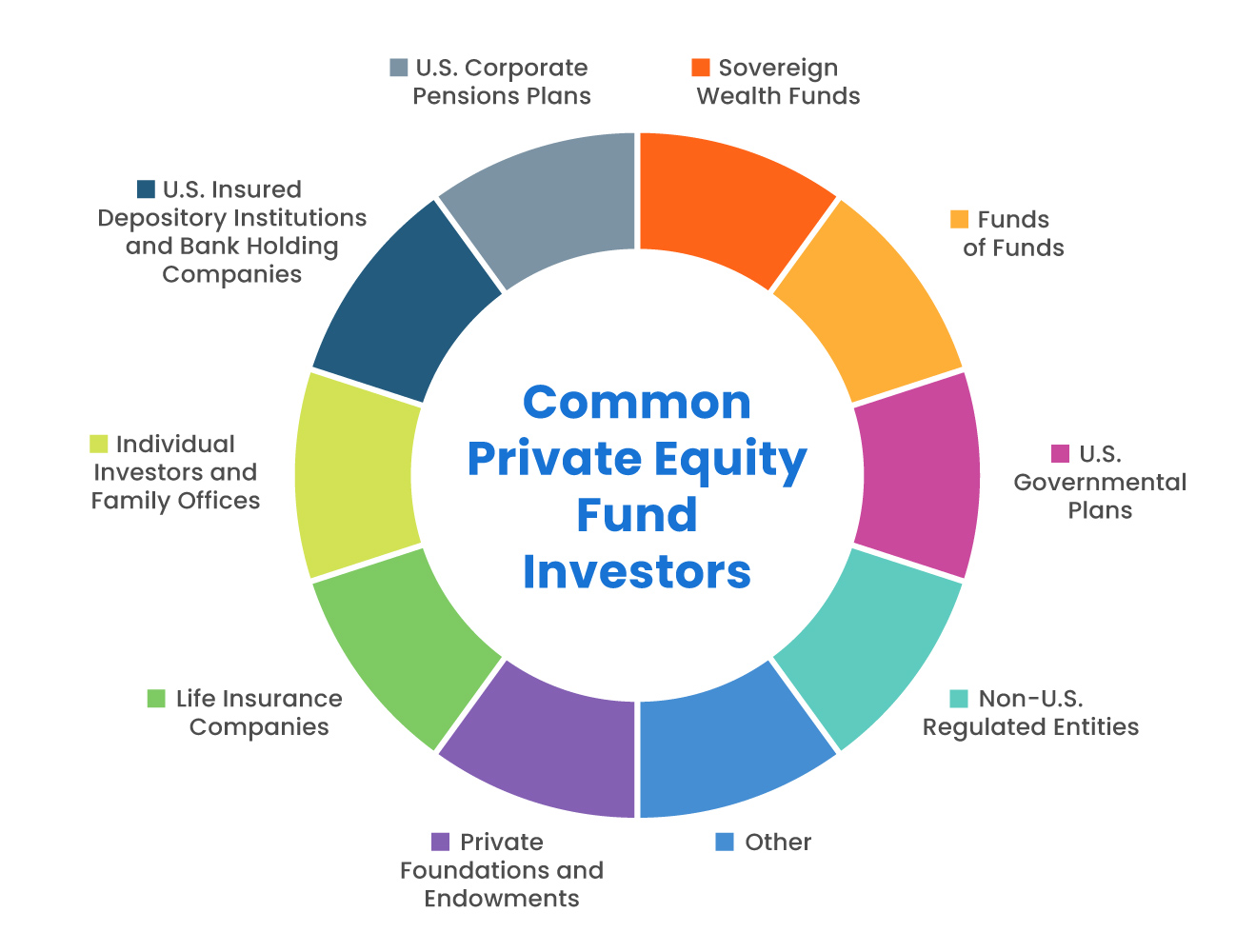

Explore Different Investor Types:

Understand the differences between private equity firms with credit arms, dedicated credit funds, hedge funds, and other institutional investors active in the private credit market. Each has a unique investment approach and risk tolerance.

Stay Updated on Market Trends:

Keep abreast of industry news, regulations, and market dynamics impacting private credit. Follow reputable financial news sources and industry publications to stay informed about current trends and challenges.

DON'T: Neglect the Fundamentals of Finance

Strong foundational skills are essential for success in private credit.

Brush up on Your Financial Modeling Skills:

Proficiency in financial modeling using Excel, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation techniques, is crucial.

Strengthen Your Understanding of Credit Analysis:

A deep understanding of credit risk assessment, underwriting, covenant compliance, and portfolio management is essential. You need to be able to evaluate the creditworthiness of borrowers and manage portfolio risk effectively.

Overlook Accounting and Valuation Principles:

A solid grasp of accounting principles (GAAP, IFRS) and valuation techniques is vital for analyzing financial statements, constructing financial models, and making informed investment decisions.

DON'T: Rush the Application Process

Take your time and be thorough in your application process.

Thoroughly Research Each Firm:

Before applying to a private credit firm, research their investment strategy, team, culture, and recent transactions. This demonstrates your interest and allows you to tailor your application effectively.

Prepare for Behavioral Questions:

Practice answering common interview questions, emphasizing your soft skills, teamwork abilities, and problem-solving skills. Behavioral questions assess your personality and how you might fit into the firm's culture.

Neglect Follow-up:

After each interview, send a thank-you note reiterating your interest and highlighting key aspects of the conversation. Following up demonstrates your professionalism and enthusiasm.

Conclusion

Successfully navigating the private credit job market requires a strategic and well-prepared approach. By following these "dos" and "don'ts," you'll significantly improve your chances of securing a position in this competitive yet rewarding field. Remember to network effectively, showcase your specialized skills, and thoroughly research the private credit landscape. Start your journey to a successful career in private credit today by applying these tips and actively pursuing opportunities in private debt and alternative lending!

Featured Posts

-

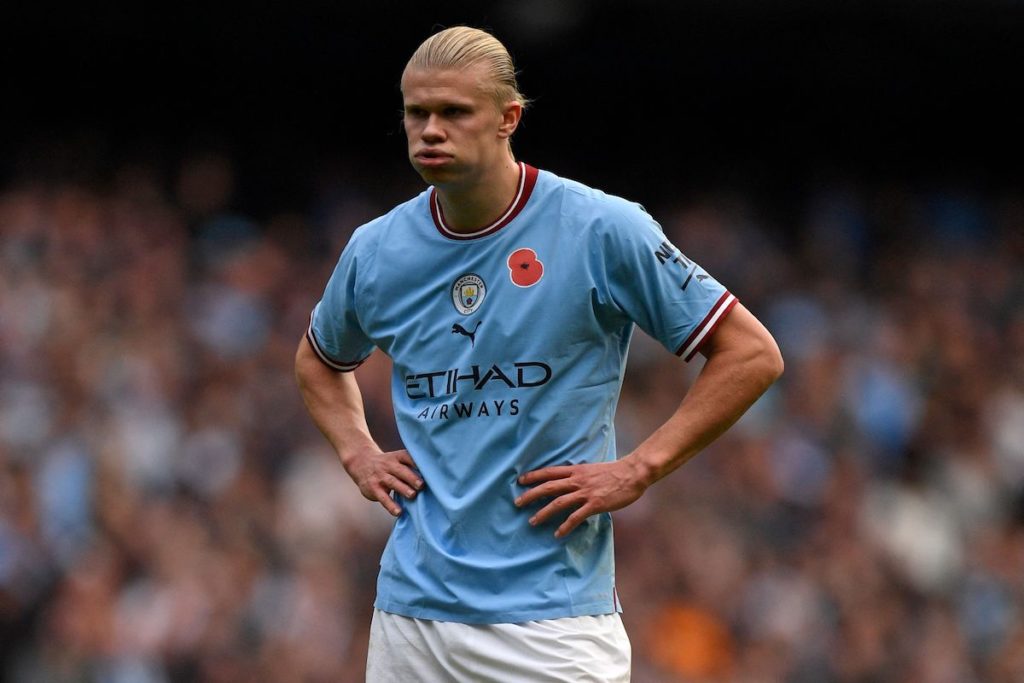

Erling Haaland Injury Update Man City Strikers Return

May 19, 2025

Erling Haaland Injury Update Man City Strikers Return

May 19, 2025 -

Police Investigating Erling Haaland Following Man City Mascots Whiplash Injury

May 19, 2025

Police Investigating Erling Haaland Following Man City Mascots Whiplash Injury

May 19, 2025 -

Complete Guide Nyt Mini Crossword Answers March 12 2025

May 19, 2025

Complete Guide Nyt Mini Crossword Answers March 12 2025

May 19, 2025 -

El Apoyo Ciudadano Permite La Declaratoria Un Mensaje De Ana Paola Hall

May 19, 2025

El Apoyo Ciudadano Permite La Declaratoria Un Mensaje De Ana Paola Hall

May 19, 2025 -

Mlb Trade Rumors Latest On Luis Robert Jr Pittsburgh Pirates And Nolan Arenado

May 19, 2025

Mlb Trade Rumors Latest On Luis Robert Jr Pittsburgh Pirates And Nolan Arenado

May 19, 2025