National HMRC Website Issues: Account Access Problems Across The United Kingdom

Table of Contents

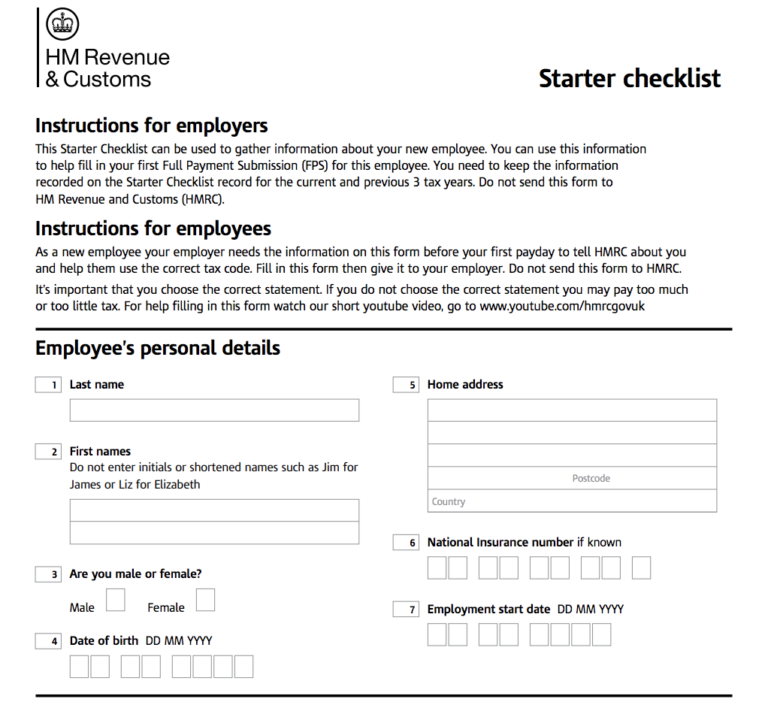

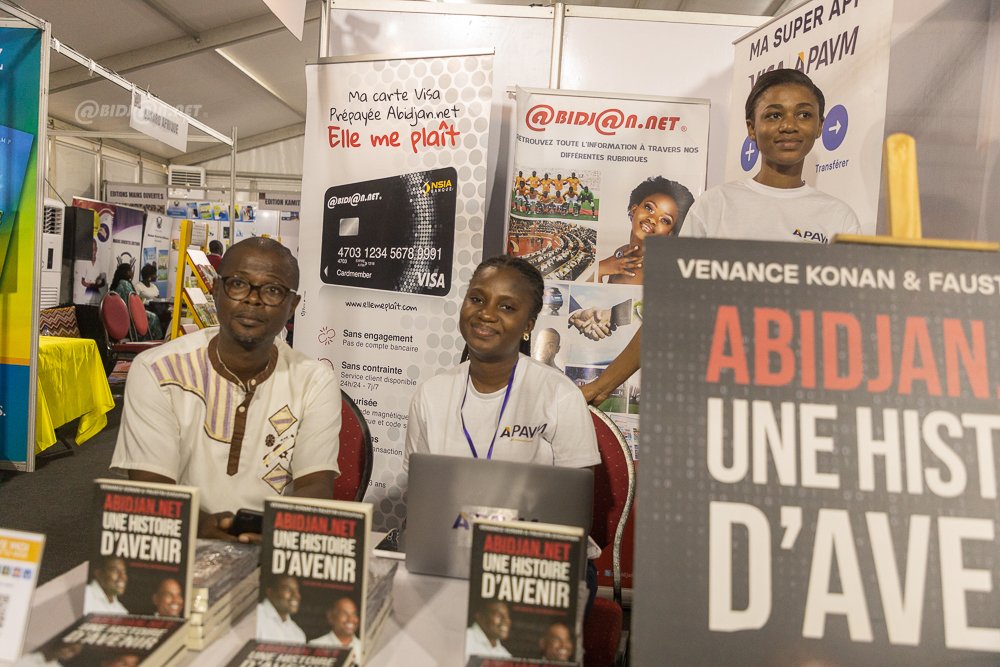

Common HMRC Website Access Problems Experienced by UK Taxpayers

Numerous reports highlight a range of frustrating HMRC login problems. Taxpayers across the UK have experienced a variety of issues accessing their online accounts. These HMRC website issues include:

- Login Failures: Many users report repeated HMRC login problems due to incorrect passwords, suspected account lockouts, or unknown technical errors. This often prevents access to crucial tax information and the ability to file returns.

- Website Slowdowns and Unresponsiveness: Experiences of extremely slow loading times, pages that freeze, and general website unresponsiveness are frequently reported, making even simple tasks extremely difficult. This is often exacerbated during peak periods, such as tax deadlines.

- Error Messages: Cryptic error messages preventing access to specific sections of the HMRC website are common, leaving taxpayers uncertain about how to proceed. These errors often lack clear guidance on troubleshooting.

- Inability to Submit Tax Returns or Access Important Tax Documents: Perhaps the most critical problem is the inability to file tax returns online or access essential documents like P60s or self-assessment details. This can lead to missed deadlines and potential penalties.

- Problems with the HMRC App: Users of the HMRC app also report experiencing similar difficulties, including login failures and functionality issues. This highlights broader systemic problems within HMRC's digital infrastructure.

Anecdotal evidence from online forums and social media suggests these HMRC tax return issues and other access problems affect a significant portion of UK taxpayers, causing widespread anxiety and uncertainty.

Potential Causes of the HMRC Website Issues

The reasons behind these widespread HMRC website issues are multifaceted and likely interconnected. Several factors may contribute to the problems experienced by UK taxpayers:

- Increased Website Traffic: The surge in website traffic during tax deadlines invariably strains the system's capacity. This high volume of simultaneous users can overwhelm servers and lead to slowdowns or complete outages.

- System Outages or Maintenance: Planned or unplanned maintenance periods, while necessary, can disrupt access and cause frustration among taxpayers. A lack of clear communication regarding these HMRC system outage periods further exacerbates the problem.

- Cybersecurity Attacks or Breaches: Although not confirmed in all instances, the possibility of cybersecurity attacks or breaches cannot be ruled out as a potential cause of some HMRC server issues.

- Software Glitches or Bugs: Software bugs or glitches within the website’s code can lead to unexpected errors and prevent proper functioning. These HMRC technical difficulties are often difficult to pinpoint and resolve quickly.

- Server Overload: Simply put, the HMRC servers may be insufficiently powerful to handle the demand placed upon them, particularly during peak periods. This HMRC server issues highlights the need for ongoing investment in infrastructure.

HMRC itself usually releases official statements or updates regarding any major service disruptions through their website and social media channels. However, clear and timely communication regarding the nature and duration of these disruptions is crucial.

Solutions and Workarounds for HMRC Website Access Problems

While waiting for HMRC to resolve the underlying HMRC website issues, taxpayers can try several troubleshooting steps:

- Troubleshooting Steps: Clearing your browser cache and cookies, checking your internet connection, and trying a different browser are basic steps that may resolve temporary glitches.

- Contacting HMRC Customer Service: While call waiting times might be long, contacting HMRC customer service through alternative channels such as email or their online contact form might provide some assistance.

- Checking HMRC's Social Media Accounts or Website: Regularly checking HMRC’s official channels for updates and announcements concerning service disruptions is essential. This can provide crucial information on potential fixes and estimated resolution times.

- Understanding HMRC's Timeframes for Resolving Issues: While frustrating, understanding that resolving widespread technical difficulties takes time can help manage expectations.

- Using the HMRC App (if applicable): The HMRC app can sometimes provide a smoother experience, but it’s not a guaranteed solution and suffers from similar problems occasionally.

Preventing Future HMRC Website Access Problems

Taking proactive steps can help minimize the impact of future HMRC website issues:

- Password Security: Using strong, unique passwords and regularly updating them is essential for account security. Poor password management can leave accounts vulnerable.

- Browser Updates: Keeping your web browser software up-to-date ensures compatibility and improved security. Outdated browsers may not function correctly with HMRC's systems.

- Early Tax Return Submission: Submitting tax returns well in advance of deadlines reduces the pressure on the system during peak periods. This mitigates the risk of being affected by HMRC website problems during crucial times.

- Staying Informed: Regularly checking for HMRC updates and announcements allows taxpayers to stay informed about potential service disruptions and planned maintenance.

- Understanding HMRC's Digital Security Measures: Familiarizing yourself with HMRC's digital security measures and best practices helps in protecting your personal information and safeguarding your online account.

Addressing Ongoing National HMRC Website Issues

The widespread HMRC website issues experienced by UK taxpayers highlight the significant challenges associated with reliance on digital infrastructure for essential government services. The numerous problems experienced – login failures, slowdowns, and the inability to access crucial tax information – underscore the need for robust systems and effective communication from HMRC. Understanding the potential causes – from increased traffic to potential technical glitches – is crucial in developing solutions. Utilizing the troubleshooting steps outlined above, along with proactive measures to safeguard accounts and stay informed of updates, can help to mitigate the impact of these ongoing HMRC website problems. Share your experiences, stay updated on HMRC announcements, and remember to submit your tax information on time despite these difficulties. Be prepared for potential future difficulties and continue to check for further HMRC updates.

Featured Posts

-

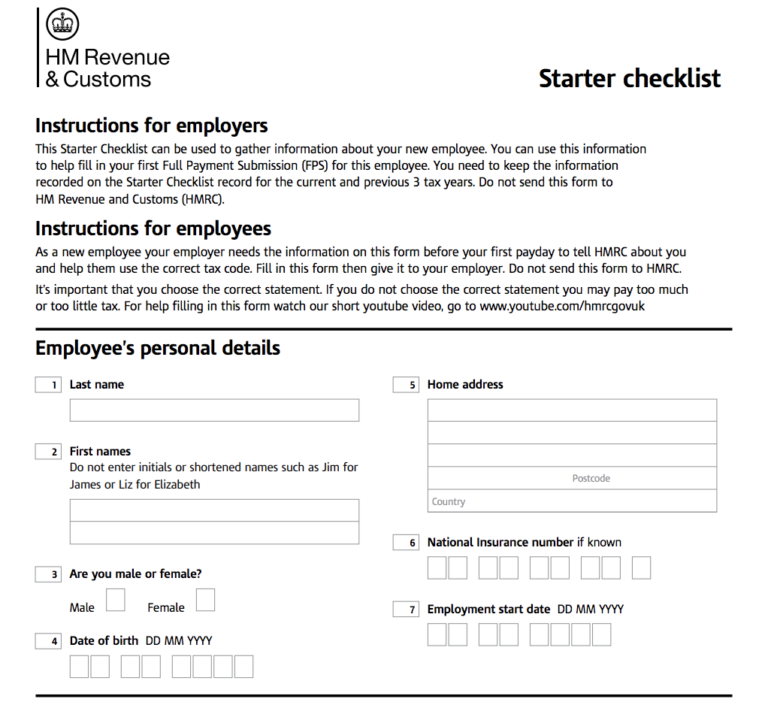

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025 -

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En Una App De Citas

May 20, 2025 -

How Agatha Christie Inspired M Night Shyamalans The Village

May 20, 2025

How Agatha Christie Inspired M Night Shyamalans The Village

May 20, 2025 -

Man Utds Forward Line Bolstered Amorims Strategic Coup

May 20, 2025

Man Utds Forward Line Bolstered Amorims Strategic Coup

May 20, 2025 -

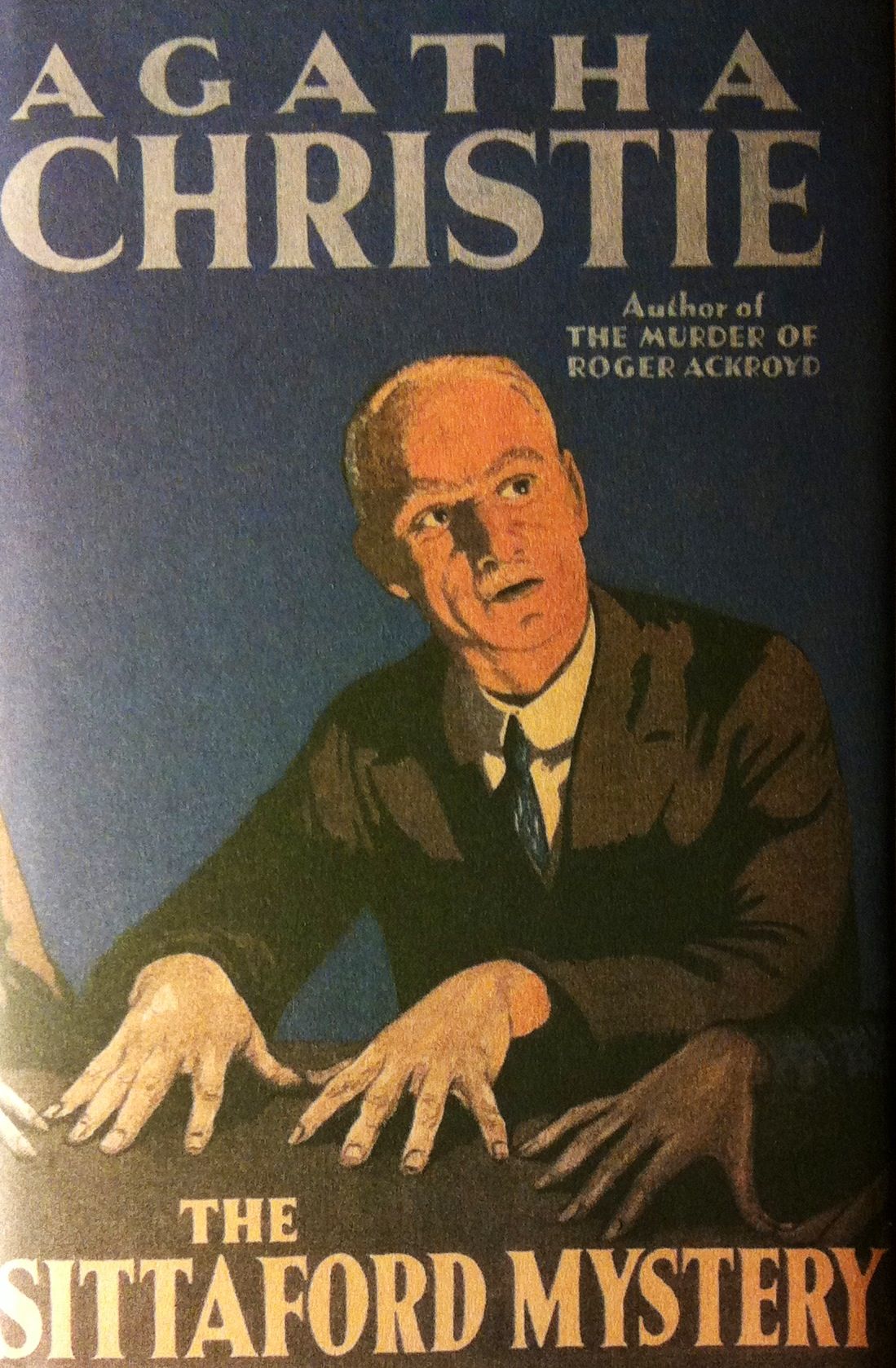

15eme Edition Du Salon International Du Livre D Abidjan Conference De Presse

May 20, 2025

15eme Edition Du Salon International Du Livre D Abidjan Conference De Presse

May 20, 2025

Latest Posts

-

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025 -

Strategic Planning For West African Economic Development An Ecowas Niger Retreat Report

May 20, 2025

Strategic Planning For West African Economic Development An Ecowas Niger Retreat Report

May 20, 2025 -

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025 -

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025 -

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025