Musk's X: Financial Implications Of The Recent Debt Financing Round

Table of Contents

The Details of the Debt Financing Round

Securing substantial funding is a crucial aspect of any large-scale business operation, especially for a platform as dynamic as X. Understanding the specifics of this debt financing round is crucial to assessing its overall implications.

The Amount Secured

While precise figures are still emerging and subject to confirmation from official sources, reports suggest X secured a significant amount of debt financing in a recent round. Reputable financial news outlets like the Wall Street Journal and Bloomberg are key sources to follow for the most up-to-date and accurate information. As these figures become publicly available, further analysis will be necessary to fully understand the implications.

Lenders and Terms

Identifying the specific lenders and terms of this debt financing is vital to fully assess the risks and opportunities it presents for X. Currently, the identities of the main lenders are yet to be officially confirmed, making it impossible to provide a comprehensive analysis at this stage. However, as this information becomes public, we can analyze the following crucial factors:

- Interest Rate and its Implications for X's Profitability: A high interest rate could severely impact X's profitability, potentially reducing net income margins and limiting its ability to invest in future growth.

- Repayment Schedule and Potential Strain on X's Cash Flow: A demanding repayment schedule could put significant strain on X's cash flow, potentially impacting its operational flexibility and long-term sustainability.

- Any Collateral Securing the Loan and Potential Risks: The use of collateral, if any, significantly impacts the risk associated with this debt. If the collateral is insufficient to cover the debt, X could face significant financial difficulties.

Reasons Behind the Debt Financing

The reasons behind X seeking this substantial debt financing are multifaceted and require careful consideration. Several potential factors could be at play:

- Acquisition Costs and Integration Challenges: The acquisition of X likely involved substantial upfront costs, and ongoing integration challenges may require additional funding.

- Funding for Ongoing Operations and Investments: X's daily operations, including maintaining its infrastructure, paying employees, and investing in new features, require significant financial resources.

- Debt Refinancing or Restructuring: The debt financing could be used to refinance existing debt or restructure existing financial obligations, potentially securing more favorable terms.

Impact on X's Financial Health

The debt financing round significantly impacts X's financial health, potentially altering its long-term trajectory and stability.

Increased Debt Burden

The new debt significantly increases X's overall debt-to-equity ratio. This heightened leverage exposes X to increased financial risk:

- Potential Credit Rating Downgrades: Rating agencies may downgrade X's credit rating, making it more expensive to secure future financing.

- Increased Financial Risk: A higher debt burden increases the vulnerability of X to economic downturns and unexpected events.

- Impact on Investor Confidence: The increased debt could negatively influence investor confidence, potentially reducing the valuation of X.

Interest Expense and Profitability

The substantial interest expense associated with the new debt will directly impact X's profitability:

- Impact on Net Income Margins: Higher interest payments will reduce net income margins, potentially leading to lower profitability.

- Potential Need for Cost-Cutting Measures: To offset the increased interest expense, X may be forced to implement cost-cutting measures, potentially impacting its services or workforce.

- Effects on Future Investment Plans: The need to service the debt could limit X's ability to invest in future growth opportunities and technological advancements.

Implications for X's Future Strategy

The debt financing significantly shapes X's future strategic direction and its competitive standing in the rapidly evolving social media landscape.

Strategic Choices and Priorities

The debt burden will inevitably influence X's strategic choices:

- Focus on Revenue Generation: X will likely prioritize revenue generation strategies to ensure it can service its debt obligations.

- Cost-Cutting Measures: Implementing cost-cutting measures will be crucial to maintain financial stability.

- Potential Divestment of Assets: X might consider divesting non-core assets to generate cash and reduce its debt load.

Competition and Market Position

The financial burden from the debt financing could negatively impact X's ability to compete:

- X may find it challenging to invest aggressively in innovation and features, hindering its competitiveness.

- Attracting and retaining top talent might be difficult, especially with budget constraints.

- The increased debt burden can impact X's negotiating power with partners and advertisers.

Long-Term Sustainability

The long-term sustainability of X’s business model is now inextricably linked to its ability to manage its increased debt. Future success depends on its ability to execute its strategic plan, control costs, generate substantial revenue, and maintain investor confidence. Failure to do so could result in significant financial distress.

Conclusion: Navigating the Financial Landscape of Musk's X

The recent debt financing round for Musk's X presents a complex financial picture. The increased debt burden, potential impact on profitability, and the resulting pressure on future strategic decisions all require careful monitoring. The long-term viability of X hinges on its ability to navigate this challenging financial landscape successfully.

Key Takeaways: X's recent debt financing significantly increases its financial risk, potentially impacting profitability, strategic choices, and long-term sustainability. Its future success depends on effective debt management, revenue generation, and strategic adaptation to the competitive market.

Call to Action: Stay informed on the financial journey of Musk's X and its long-term implications by subscribing to our newsletter! Follow us on social media for the latest updates and in-depth analysis on Musk's X and its evolving financial situation. Engage with our site’s content featuring analysis of “Musk’s X” financial performance for a comprehensive understanding of this critical period for the platform.

Featured Posts

-

Estudio Del Impacto De Alberto Ardila Olivares En El Gol

Apr 29, 2025

Estudio Del Impacto De Alberto Ardila Olivares En El Gol

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025 -

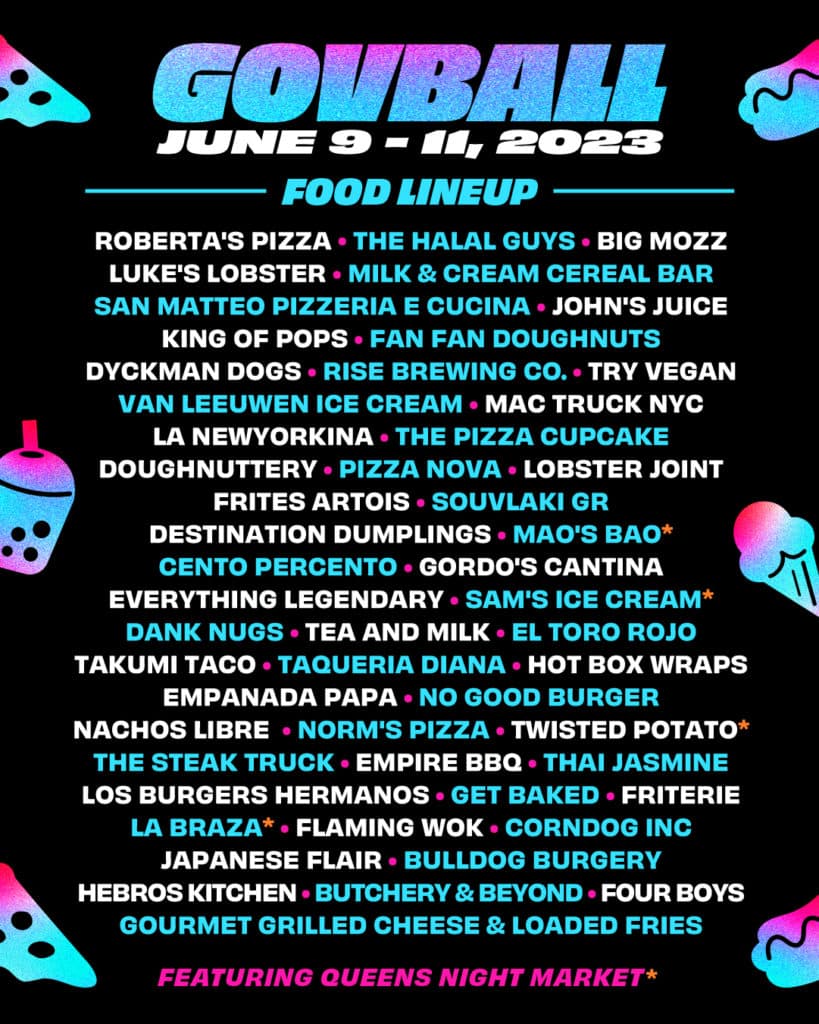

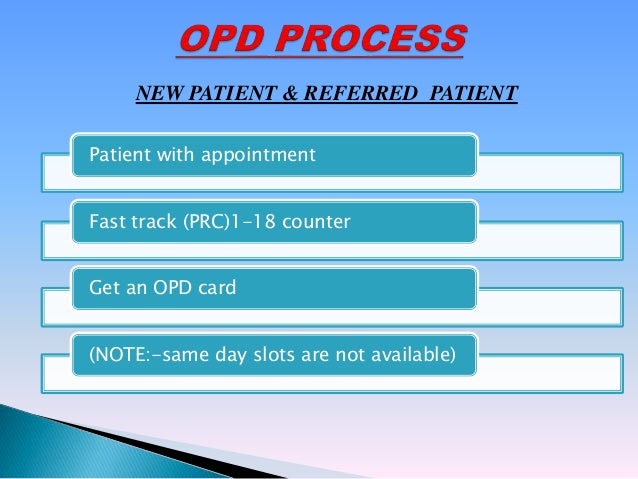

Young Adults And Adhd Aiims Opd Data Reveals A Concerning Trend

Apr 29, 2025

Young Adults And Adhd Aiims Opd Data Reveals A Concerning Trend

Apr 29, 2025 -

Kentucky Congressman Criticizes Usps For Lack Of Transparency Regarding Mail Delays

Apr 29, 2025

Kentucky Congressman Criticizes Usps For Lack Of Transparency Regarding Mail Delays

Apr 29, 2025 -

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025