Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

The Details of the X Debt Sale

The X debt sale represents a significant financial undertaking, the specifics of which are crucial for understanding its impact.

Amount and Terms of the Debt

While precise figures may vary depending on the source and the ongoing nature of the financing, the debt sale involved a substantial amount of capital. Reports suggest a figure in the billions of dollars, though the exact amount and breakdown remain somewhat opaque. The type of debt likely includes a mix of high-yield bonds and potentially bank loans, reflecting the high-risk, high-reward nature of the investment. Interest rates are expected to be relatively high, reflecting the current market conditions and the perceived risk associated with X's current trajectory. Maturity dates are also crucial for understanding the long-term financial burden on the company. Finally, covenants—specific conditions attached to the debt—will impose certain financial constraints and performance targets X must meet.

- Specific figures: While exact numbers remain fluid, the overall debt raised is substantial and potentially in the billions.

- Involved institutions: Major investment banks and potentially private equity firms likely participated in the debt financing.

- Favorability of terms: The terms likely reflect a balance between the urgency of securing funding and the long-term financial health of X. Negotiating favorable terms, given the perceived risk, was a critical challenge.

The complexity of the debt structure necessitates careful consideration of its implications for X's long-term financial health and its ability to implement Musk’s ambitious plans.

How the Debt Sale Impacts X's Financial Position

The X debt sale significantly alters the company's financial landscape, with clear implications for its risk profile and future funding capabilities.

Impact on X's Debt-to-Equity Ratio

The substantial debt injection will inevitably increase X's debt-to-equity ratio. This metric, representing the proportion of debt to equity financing, is a key indicator of a company's financial risk. A higher ratio suggests a greater reliance on debt, potentially increasing vulnerability to economic downturns or operational challenges. Analyzing the pre- and post-debt sale ratios provides a clearer picture of this shift in risk profile.

Implications for Credit Ratings

Credit rating agencies will closely scrutinize the X debt sale and its impact on the company's financial stability. A downgrade in X's credit rating could make it more expensive to raise capital in the future, limiting its ability to fund growth initiatives.

- Before and after ratios: A detailed comparison of financial statements will reveal the exact impact on the debt-to-equity ratio and other key metrics.

- Industry comparison: Comparing X's financial health to its competitors provides crucial context and allows for a more informed assessment of its risk.

- Investor confidence: The debt sale's impact on investor confidence is also a key consideration, with potential consequences for the company's valuation and access to further funding.

The success of Musk's strategy hinges on his ability to manage this increased debt load and leverage it effectively to achieve his ambitious goals for X.

X's Transformation Under Musk's Leadership

The funds from the X debt sale are intrinsically linked to Musk’s transformative vision for the platform.

Strategic Goals and Initiatives

Musk's vision for X extends beyond its current functionalities, envisioning a more integrated and versatile platform. The funds from the debt sale will likely fuel several key initiatives, including potential investments in new technologies such as artificial intelligence, augmented reality, or blockchain integration. Further investments in product development, improving the user experience, and bolstering content moderation systems are all likely priorities.

Restructuring and Cost-Cutting Measures

To achieve profitability and financial stability amidst the significant debt, Musk has implemented various cost-cutting measures. These measures have included staff reductions, renegotiating contracts with vendors, and streamlining operational processes. This approach aims to improve efficiency and reduce expenses, crucial for servicing the newly acquired debt.

- Specific initiatives: Details on specific investments in AI, AR, or other technologies remain to be seen, but their potential is significant.

- Cost-cutting details: Publicly available information on staff reductions and other cost-saving measures provides insights into the extent of Musk's restructuring efforts.

- Contribution to transformation: Analyzing how these strategies contribute to X's overall transformation provides crucial context for understanding the long-term effects of the debt sale.

The ultimate success of this transformation hinges on the effectiveness of these strategies in driving revenue growth and improving operational efficiency.

Market Reactions and Future Outlook

The market's response to the X debt sale is an essential factor in assessing its success.

Investor Sentiment and Stock Performance (if applicable)

While X is a privately held company, the debt sale's impact on investor sentiment, especially among those holding private equity or debt instruments, will be significant. Analyzing investor reactions provides valuable insights into the market's assessment of the risk and potential reward associated with Musk’s vision for X.

Predictions and Projections for X's Future

The future of X is contingent on several factors. The ability to effectively manage the increased debt, successfully execute its strategic initiatives, and navigate the challenging technological and regulatory landscape will determine its ultimate success. Analyst forecasts and expert opinions will offer valuable insights into the likelihood of success and potential challenges.

- Stock price movement (if applicable): Even without public trading, an analysis of private market valuations and indications of investor interest is crucial.

- Expert opinions: Monitoring commentary from financial analysts and industry experts provides valuable insights into the future trajectory of X.

- Challenges and opportunities: The evolving competitive landscape, regulatory changes, and potential technological disruptions present both challenges and opportunities for X in the years to come.

The X debt sale represents a high-stakes gamble on Musk's vision for the platform. Its success hinges on effective execution, careful management of the increased debt burden, and the ability to navigate a complex and competitive market.

Conclusion

Musk's X debt sale is a pivotal moment in the company's history. The substantial debt acquired significantly impacts X's financial position, requiring careful management and strategic execution to achieve the ambitious goals outlined by Elon Musk. The company's transformation under Musk's leadership is a high-stakes endeavor, and the long-term success hinges on balancing aggressive growth strategies with sustainable financial stability. The coming years will be critical in determining whether this debt-fueled transformation will ultimately succeed. Stay tuned for further updates on Musk's X and its evolving financial landscape.

Featured Posts

-

Red Sox Breakout Star Unexpected Player Poised For Success

Apr 28, 2025

Red Sox Breakout Star Unexpected Player Poised For Success

Apr 28, 2025 -

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025 -

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 28, 2025

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 28, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Contact

Apr 28, 2025 -

Dwyane Wade On Doris Burkes Insightful Thunder Vs Timberwolves Commentary

Apr 28, 2025

Dwyane Wade On Doris Burkes Insightful Thunder Vs Timberwolves Commentary

Apr 28, 2025

Latest Posts

-

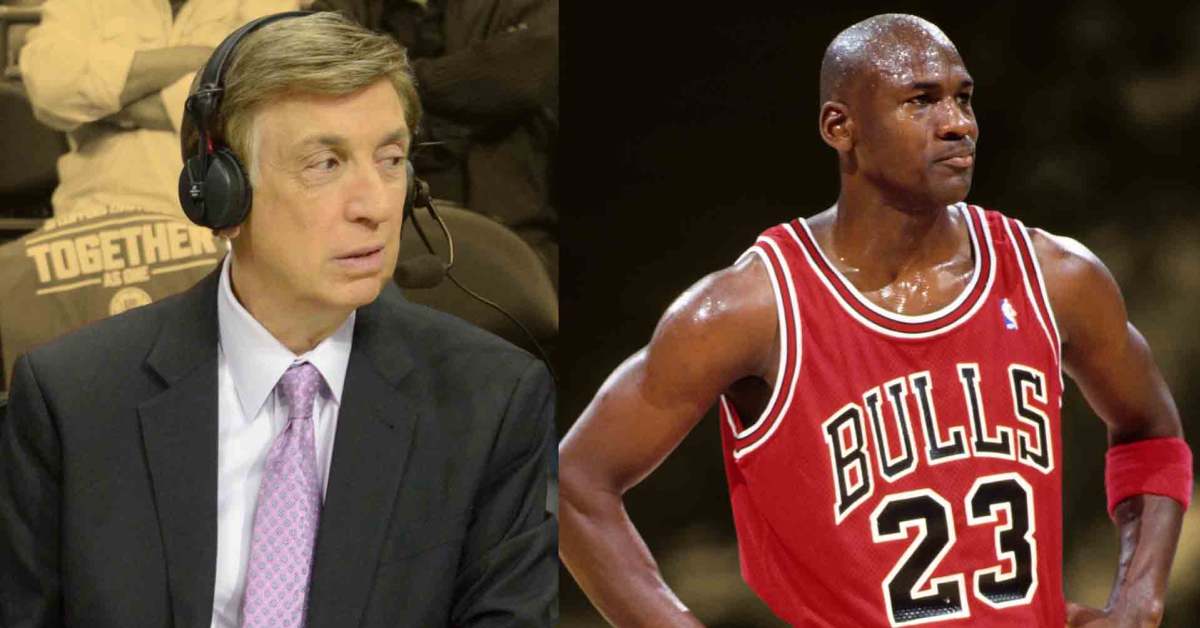

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025

Mike Breen On Marv Albert A Legacy Of Great Basketball Announcing

Apr 28, 2025 -

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breen Weighs In

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

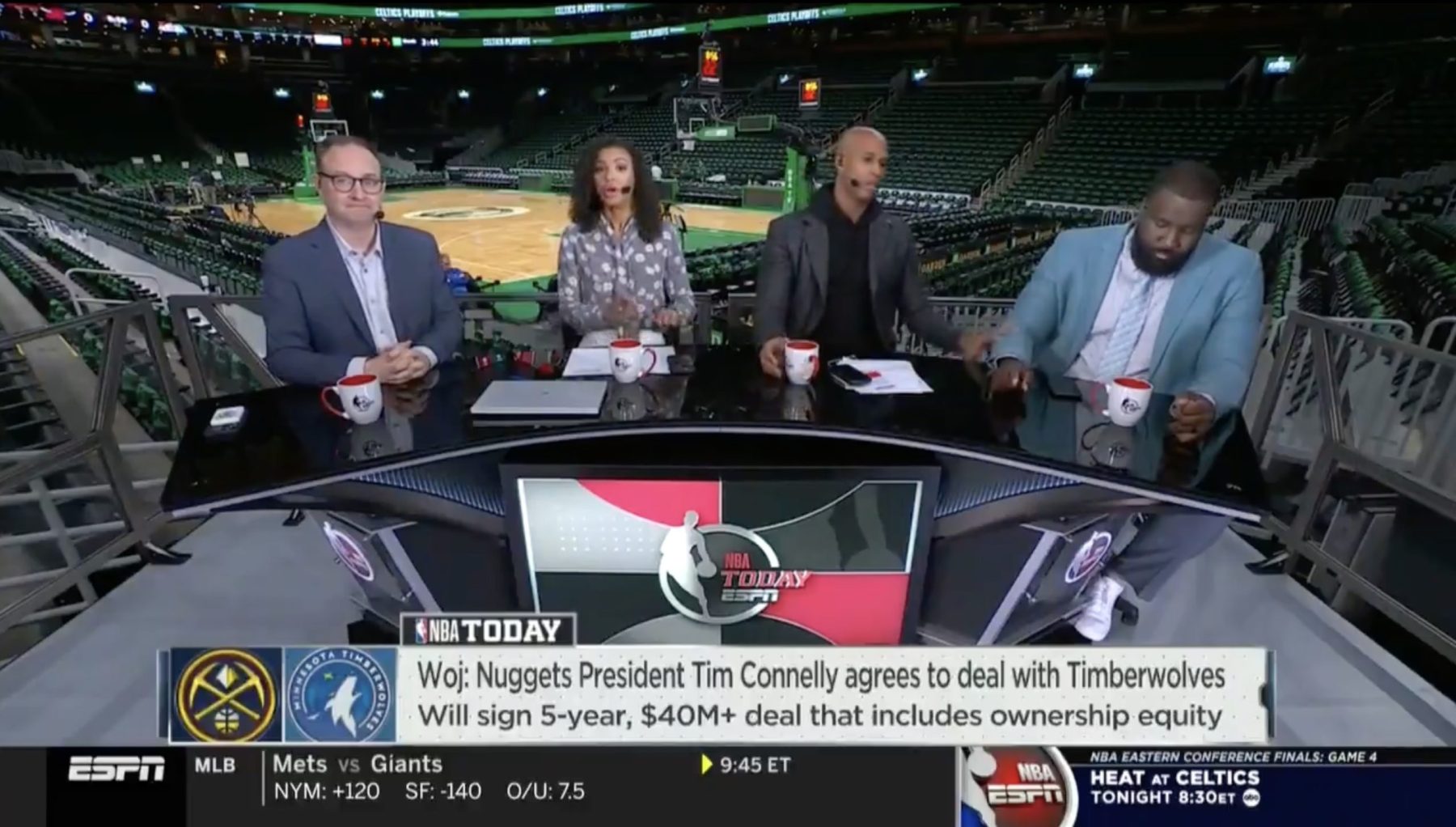

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Comments On Richard Jeffersons Espn News Segment

Apr 28, 2025 -

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Dwyane Wade Applauds Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025