More Than Just China: Analyzing Nvidia's Expanded Geopolitical Risks

Table of Contents

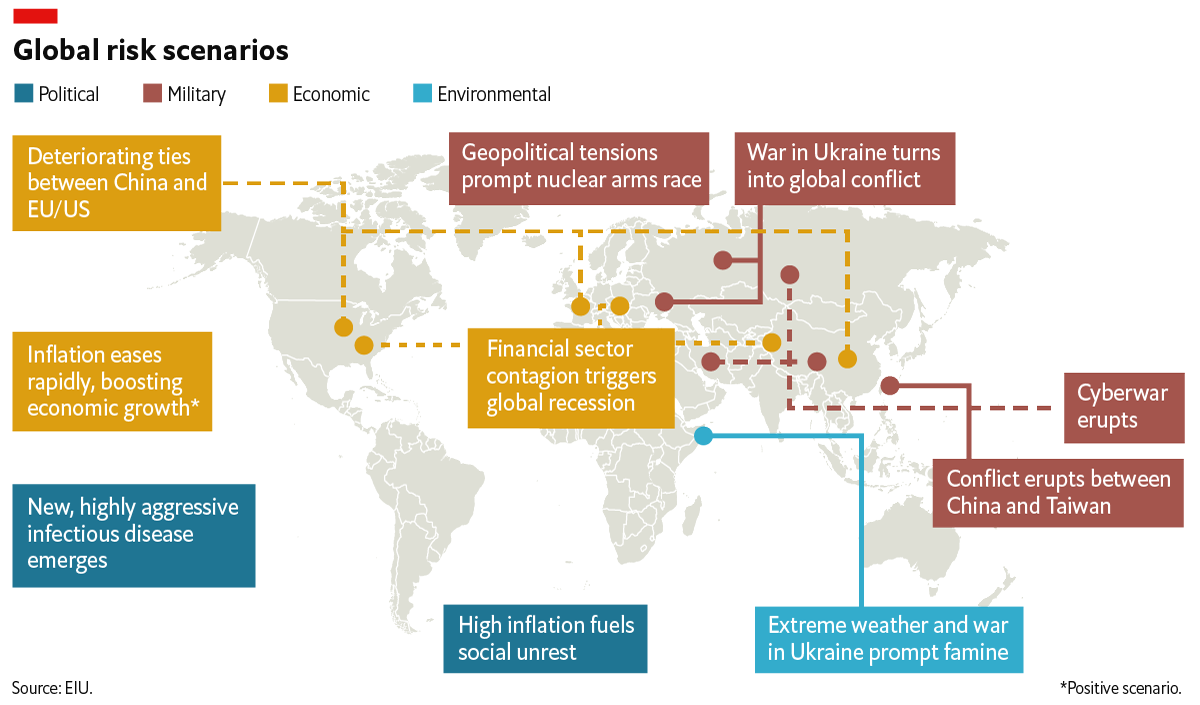

The China Factor: Beyond Export Controls

Nvidia's dependence on the Chinese market, a significant revenue source for its high-performance GPUs and AI chips, makes it particularly vulnerable to the complexities of US-China relations. The ongoing tensions significantly impact the semiconductor industry, and Nvidia is no exception.

Navigating the Shifting Sands of US-China Relations:

The ongoing US-China trade war and the resulting export controls have already impacted Nvidia's sales and supply chains in China. The restrictions on advanced AI chip exports represent a major challenge. Further escalations in US-China relations could lead to more stringent restrictions, severely impacting Nvidia's ability to operate within the Chinese market.

- Impact on AI chip sales: Restrictions on high-end AI chip exports to China have directly affected Nvidia's revenue streams, forcing the company to adapt its product offerings and explore alternative markets.

- Potential for further restrictions: The possibility of broader export controls targeting other Nvidia technologies remains a significant concern, increasing the geopolitical risks for the company.

- Diversification strategies: In response, Nvidia is actively diversifying its customer base and exploring new markets to reduce reliance on China. This includes focusing on other high-growth regions and strengthening partnerships outside of China.

The Rise of Domestic Chinese Competitors:

The Chinese government's significant investment in its domestic semiconductor industry is fostering the rise of powerful competitors. These companies are increasingly challenging Nvidia's dominance in the AI chip market, fueled by government subsidies and a focus on technological self-reliance.

- Competition in the AI chip market: Chinese companies are rapidly developing their own AI chips, creating a more competitive landscape and potentially eroding Nvidia's market share in China and beyond.

- Government support for domestic players: The Chinese government provides substantial financial and regulatory support to its domestic chipmakers, giving them a competitive edge against international players like Nvidia.

- Long-term market share implications: The sustained growth of Chinese semiconductor companies poses a long-term threat to Nvidia's market share, particularly within the strategically important Chinese market.

Geopolitical Risks Beyond China: A Multipolar World

The geopolitical risks facing Nvidia are not limited to China. A multipolar world with increasingly assertive regional powers introduces a complex web of challenges for global businesses, especially in the strategically vital semiconductor industry.

The European Union's Tech Sovereignty Push:

The European Union's ambitious "Chips Act" aims to bolster its own semiconductor industry and reduce its dependence on foreign suppliers. This initiative, while beneficial for European technological independence, could create new regulatory hurdles for Nvidia and other international chipmakers operating within the EU.

- EU chip act: The EU's ambitious plan to become a major player in semiconductor manufacturing could necessitate changes in Nvidia's European operations to comply with new regulations and standards.

- Potential for regulatory hurdles: Navigating the intricacies of EU regulations, potentially including data localization requirements and stringent environmental standards, adds complexity to Nvidia's European strategy.

- Diversification into European markets: Nvidia will need to adapt to the changing landscape, possibly increasing investments in European manufacturing and R&D to maintain its market presence.

The Growing Influence of Other Global Powers:

Countries like India, Japan, and South Korea are also actively developing their domestic semiconductor industries and implementing policies that could impact Nvidia's global operations. These policies may involve regional trade agreements, national security concerns, and investment restrictions.

- Regional trade agreements: The growing number of regional trade agreements could create both opportunities and challenges for Nvidia, requiring careful navigation of varying regulations and standards.

- National security concerns: Governments are increasingly prioritizing national security considerations, potentially leading to restrictions on technology transfers and investments from foreign companies.

- Investment restrictions: Increased scrutiny of foreign investments in sensitive sectors like semiconductors may hinder Nvidia's ability to expand its global operations.

Mitigating Geopolitical Risks: Strategies for Nvidia

To mitigate these multifaceted geopolitical risks, Nvidia needs to adopt proactive strategies that ensure its long-term sustainability and competitiveness in a volatile global environment.

Diversification of Manufacturing and Supply Chains:

Reducing dependence on any single country for manufacturing and sourcing is critical for Nvidia. This requires a multi-pronged approach encompassing onshoring, nearshoring, and diversifying its supplier base.

- Onshoring: Bringing manufacturing capabilities back to the US or other trusted regions can reduce reliance on potentially unstable supply chains.

- Nearshoring: Relocating manufacturing to nearby countries with stable political environments offers a balance between cost-effectiveness and reduced geopolitical risk.

- Diversification of suppliers: Establishing relationships with multiple suppliers across diverse geographic locations mitigates the impact of disruptions in any single region.

- Investment in multiple regions: Investing in manufacturing and R&D capabilities across multiple regions will enable Nvidia to adapt more readily to shifting geopolitical landscapes.

Strategic Partnerships and Alliances:

Strategic partnerships and alliances with other companies and governments can help Nvidia navigate geopolitical challenges and strengthen its position in key markets.

- Joint ventures: Collaborating with local companies in different regions could provide access to local expertise, regulatory knowledge, and market insights.

- Technology licensing agreements: Licensing technology to local companies can help establish a presence in new markets while mitigating some geopolitical risks.

- Lobbying efforts: Engaging in effective lobbying efforts to influence policy decisions affecting the semiconductor industry is crucial for protecting Nvidia's interests.

- Public-private partnerships: Collaborating with governments on research and development projects can foster innovation and strengthen relationships with key stakeholders.

Conclusion

Nvidia's success hinges not only on technological innovation but also on its ability to navigate a complex and increasingly volatile geopolitical landscape. The risks extend far beyond China, encompassing a multitude of international factors that demand strategic foresight and adaptation. Understanding and managing Nvidia's expanded geopolitical risks is crucial for investors, industry analysts, and the company itself. Key takeaways include the significant challenges posed by US-China relations, the rise of domestic Chinese competitors, the impact of the EU's tech sovereignty push, and the influence of other global powers. Nvidia's response involves diversifying its manufacturing, supply chains, and forging strategic partnerships. Further research and analysis are needed to fully grasp the implications of this evolving situation. Stay informed about the latest developments in the semiconductor industry and global politics to better understand the future of Nvidia and the wider tech landscape.

Featured Posts

-

Charlotte Jordan Exits Coronation Street Daisy Midgeleys Final Scenes

Apr 30, 2025

Charlotte Jordan Exits Coronation Street Daisy Midgeleys Final Scenes

Apr 30, 2025 -

Valur Vs Andstaedingur Dagskra Og Spa Fyrir Leikinn

Apr 30, 2025

Valur Vs Andstaedingur Dagskra Og Spa Fyrir Leikinn

Apr 30, 2025 -

Arkema Decryptage Du Document Amf Cp 2025 E1027752

Apr 30, 2025

Arkema Decryptage Du Document Amf Cp 2025 E1027752

Apr 30, 2025 -

Analyzing The Cavaliers Week 16 Trade Rest And Future Outlook

Apr 30, 2025

Analyzing The Cavaliers Week 16 Trade Rest And Future Outlook

Apr 30, 2025 -

Malades Informes Chirurgie Hemorroidaire Et Risques En Franche Comte

Apr 30, 2025

Malades Informes Chirurgie Hemorroidaire Et Risques En Franche Comte

Apr 30, 2025