Moody's Downgrade: Impact On Dow Futures And Dollar

Table of Contents

Keywords: Moody's downgrade, Dow futures, US dollar, credit rating, economic impact, market volatility, investment strategy, global economy, risk assessment

The recent Moody's downgrade of the United States' credit rating sent shockwaves through global financial markets, immediately impacting Dow futures and the US dollar. This unprecedented move has significant implications for investors and the global economy, prompting a reassessment of risk and investment strategies. Understanding the ramifications of this Moody's downgrade is crucial for navigating the current turbulent market landscape.

Understanding Moody's Downgrade and its Significance

Moody's, a leading credit rating agency, plays a vital role in assessing the creditworthiness of governments and corporations. Its downgrade of the US's AAA rating carries immense weight, signaling increased concerns about the country's fiscal health and its ability to repay its debts. This action isn't taken lightly and reflects a serious assessment of the current economic situation.

- Reasons for the Downgrade:

- Escalating US national debt.

- Political gridlock hindering effective fiscal policy implementation.

- Erosion of governance strength and fiscal strength.

- Potential for further deterioration of the fiscal strength.

The downgrade is not an isolated event; it follows a pattern of increasing concerns about the US's fiscal trajectory. Historically, similar downgrades of sovereign debt have led to increased market volatility, higher borrowing costs for the government, and a decline in investor confidence.

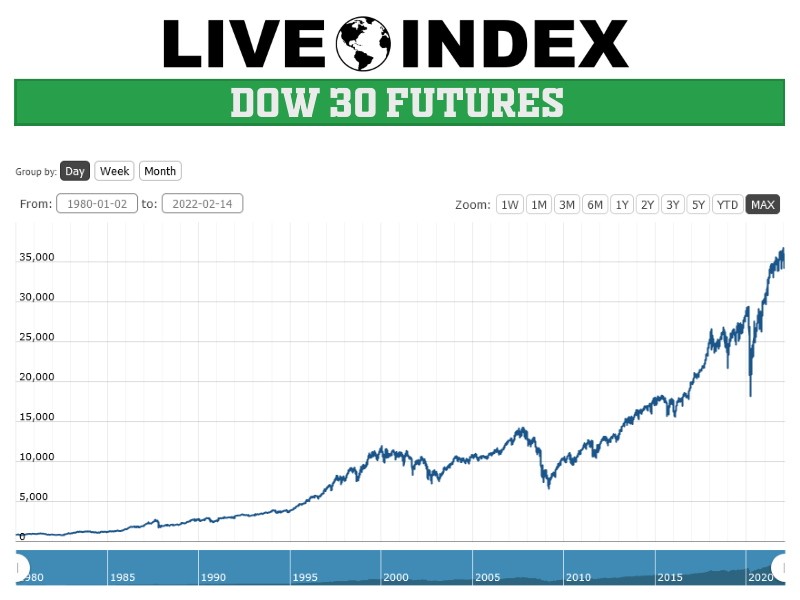

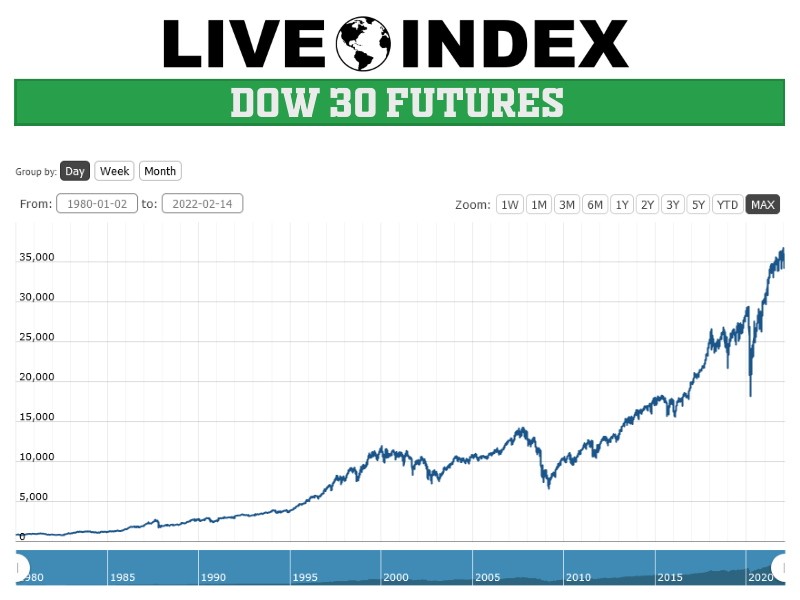

Immediate Impact on Dow Futures

The announcement of the Moody's downgrade triggered an immediate and palpable reaction in the market. Dow futures, contracts representing the future value of the Dow Jones Industrial Average, experienced significant price fluctuations.

- Market Reaction: A sharp decline in Dow futures prices was observed immediately following the news.

- Mechanics of Impact: The downgrade signals increased risk, leading to reduced investor confidence and prompting a sell-off in equities, including Dow futures.

- Volatility: Trading volume increased substantially as investors reacted to the unexpected news. Price swings were dramatic, showcasing heightened market uncertainty.

The short-term implications for Dow Jones Industrial Average investors include potential losses due to decreased asset values. Long-term implications depend on how the US government addresses the underlying fiscal challenges, influencing investor sentiment and future market direction.

The Downgrade's Ripple Effect on the US Dollar

The Moody's downgrade also had a noticeable effect on the US dollar. The value of the dollar relative to other major currencies experienced fluctuations, reflecting a shift in investor confidence and perception of risk.

- Relationship between Credit Rating and Currency: A lower credit rating reduces investor confidence in the US economy, making the dollar less attractive. This can lead to capital outflows and a weakening of the currency.

- Currency Fluctuations: Following the downgrade, the US dollar experienced some depreciation against currencies like the Euro and the Yen.

- Consequences: Weakening of the dollar can affect international trade by making US exports more competitive but imports more expensive. It can also impact capital flows, as investors may seek safer havens for their investments.

The long-term impact on the US dollar depends on various factors, including the government's response to the fiscal challenges, global economic conditions, and investor sentiment.

Analyzing the Flight to Safety

The Moody's downgrade triggered a classic "flight to safety," a phenomenon where investors shift their assets from riskier investments towards those considered safer havens during times of uncertainty.

- Investor Behavior: Investors often seek assets perceived as less vulnerable to economic downturns.

- Safe Haven Assets: This typically includes assets such as government bonds (especially those of countries with strong credit ratings), gold, and other precious metals.

Conclusion

The Moody's downgrade has had a significant and multi-faceted impact, affecting Dow futures through decreased investor confidence and influencing the US dollar's value. Understanding the implications of credit rating changes is paramount for informed investment decision-making. While the short-term outlook remains uncertain, the long-term trajectory will largely depend on the US government's response to the fiscal challenges and the broader global economic climate. Stay informed about the evolving situation and its implications for your investment strategy. Monitor the Moody's downgrade impact on Dow futures and the dollar closely by subscribing to our newsletter. Learn more about mitigating risk in a post-downgrade market by [link to relevant resource].

Featured Posts

-

Switzerland Condemns Pahalgam Terrorist Attack Cassis Statement

May 21, 2025

Switzerland Condemns Pahalgam Terrorist Attack Cassis Statement

May 21, 2025 -

Kamerbrief Verkoopprogramma Certificaten Abn Amro De Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro De Complete Gids

May 21, 2025 -

Unexpected Interruption Bbc Breakfast Guest Disrupts Live Show

May 21, 2025

Unexpected Interruption Bbc Breakfast Guest Disrupts Live Show

May 21, 2025 -

Peppa Pig Fans Stunned 21 Year Old Mystery Solved

May 21, 2025

Peppa Pig Fans Stunned 21 Year Old Mystery Solved

May 21, 2025 -

Why Is There Skepticism Around This Australian Trans Influencers Record

May 21, 2025

Why Is There Skepticism Around This Australian Trans Influencers Record

May 21, 2025

Latest Posts

-

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025

School District Procedures For Winter Weather Advisories And Delays

May 21, 2025 -

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025

Winter Weather Advisory Planning For School Cancellations And Delays

May 21, 2025 -

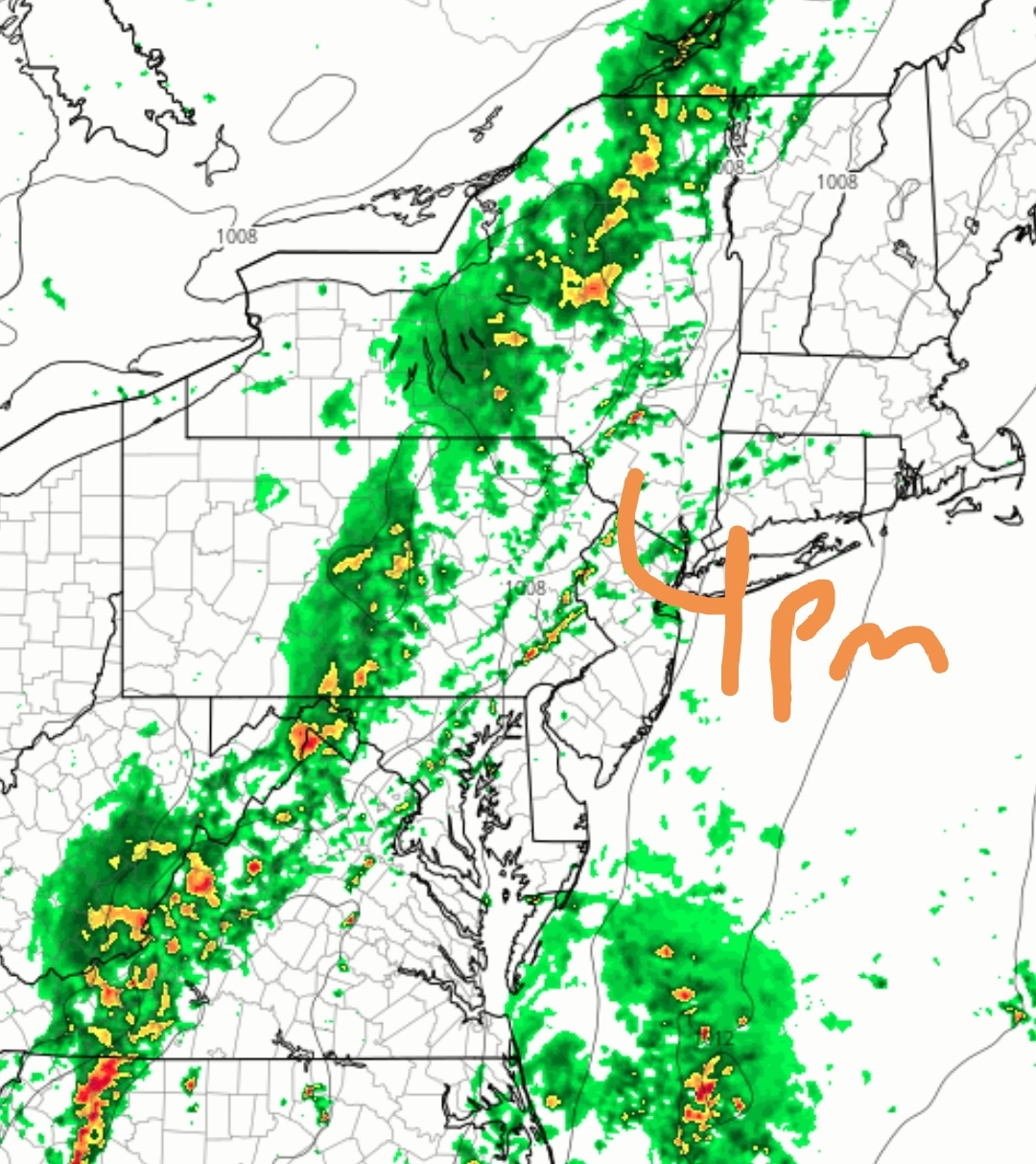

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025

Updated Rain Forecast Precise Timing Of Showers

May 21, 2025 -

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025

How Winter Weather Impacts School Decisions Delays And Closures Explained

May 21, 2025 -

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025

The 12 Most Popular Ai Stocks On Reddit A Guide For Investors

May 21, 2025