Moody's Downgrade And The Resurgence Of "Sell America": 30-Year Yield Hits 5%

Table of Contents

Moody's Downgrade and its Impact on Investor Confidence

Understanding Moody's Rationale Behind the Downgrade:

Moody's cited several key factors for its downgrade of the US credit rating. These include:

- Persistent Fiscal Challenges: The US faces a growing national debt, fueled by increasing government spending and a lack of bipartisan consensus on fiscal responsibility. The ongoing political gridlock further exacerbates this issue, hindering the implementation of necessary fiscal reforms.

- Erosion of Governance Strength: Concerns regarding the effectiveness and predictability of US governmental policies contributed to the downgrade. The repeated near-misses on debt ceiling negotiations underscore this weakness, highlighting the risk of future defaults.

- Long-Term Implications for US Debt: The downgrade raises concerns about the long-term sustainability of the US debt, potentially impacting borrowing costs and the overall health of the US economy. The increased risk associated with holding US debt could lead to higher interest rates.

These factors collectively paint a picture of increasing fiscal fragility, leading Moody's to conclude that the US's fiscal strength is weakening.

Market Reaction to the Downgrade:

The immediate market reaction to Moody's downgrade was swift and significant:

- Stock Market Volatility: Stock markets experienced heightened volatility following the announcement, with significant price fluctuations reflecting investors' uncertainty.

- Increased Bond Yields: The yield on US Treasury bonds, including the crucial 30-year yield, surged, reflecting a decrease in investor confidence and an increased demand for safety.

- Flight to Safety: Investors sought refuge in safe-haven assets like gold and other government bonds perceived as less risky than US Treasuries. This flight to safety further impacted asset prices across various markets. This shift in investor sentiment reflects a broader concern about the stability of the US economy and the global financial system.

The 30-Year Treasury Yield Hitting 5%: A Sign of "Sell America"?

Analyzing the Surge in 30-Year Treasury Yields:

The increase in the 30-year Treasury yield to 5% is directly linked to the Moody's downgrade and reflects:

- Increased Risk Perception: Investors demand higher yields to compensate for the increased perceived risk associated with holding US government debt.

- Higher Borrowing Costs: This rise in yields translates to higher borrowing costs for businesses and consumers, potentially slowing down economic growth. This can have a ripple effect, impacting everything from mortgages to corporate expansion plans.

- Potential for Further Increases: Depending on future economic developments and fiscal policy decisions, there is a potential for further yield increases, potentially leading to more significant economic consequences.

The "Sell America" Narrative and its Validity:

The "Sell America" narrative refers to a scenario where foreign and domestic investors reduce their holdings of US assets, leading to a decline in the value of the dollar and potentially impacting economic growth. The validity of this narrative is a subject of ongoing debate:

- Capital Flight Concerns: The Moody's downgrade could trigger some degree of capital flight, particularly if investors lose confidence in the long-term stability of the US economy.

- Alternative Interpretations: Some analysts argue that the market reactions are overblown and that the fundamentals of the US economy remain strong. They believe the current situation is a temporary adjustment.

- Foreign Investment: The impact on foreign investment will depend on the global economic climate and the relative attractiveness of other investment options.

Implications for the US Economy and Investors

Potential Economic Consequences:

The Moody's downgrade and the rise in Treasury yields carry several potential economic consequences:

- Slower Economic Growth: Higher borrowing costs could dampen economic activity, reducing business investment and consumer spending.

- Inflationary Pressures: Increased interest rates may help control inflation but also risk triggering a recession if rates rise too quickly.

- Recession Risk: The combined impact of slower growth, higher interest rates, and decreased investor confidence increases the risk of a recession.

Strategies for Investors:

Given the current market uncertainty, investors should consider the following strategies:

- Risk Management: A thorough review of investment portfolios to ensure appropriate risk levels is crucial. Investors may want to rebalance their portfolios based on their risk tolerance and investment goals.

- Diversification: Diversifying investments across different asset classes is essential to reduce overall portfolio volatility and risk.

- Professional Advice: Seeking guidance from a qualified financial advisor is crucial to develop a tailored investment strategy that considers individual circumstances and risk tolerance. A financial advisor can help you navigate these complex market conditions effectively.

Conclusion: Navigating the Aftermath of Moody's Downgrade and the "Sell America" Concerns

Moody's downgrade, the surge in the 30-year Treasury yield to 5%, and the resurgence of "Sell America" concerns represent a complex and evolving situation. The implications for the US economy and investors are significant and require careful consideration. While the long-term impact remains uncertain, it's crucial to stay informed about developments and to make informed decisions based on a thorough understanding of the risks and opportunities. Seek professional financial advice to navigate the complexities of the Moody's downgrade and the evolving "Sell America" narrative, tailoring your investment strategy to mitigate potential risks and capitalize on emerging opportunities in the market.

Featured Posts

-

Build Voice Assistants With Ease Key Announcements From Open Ais 2024 Developer Event

May 20, 2025

Build Voice Assistants With Ease Key Announcements From Open Ais 2024 Developer Event

May 20, 2025 -

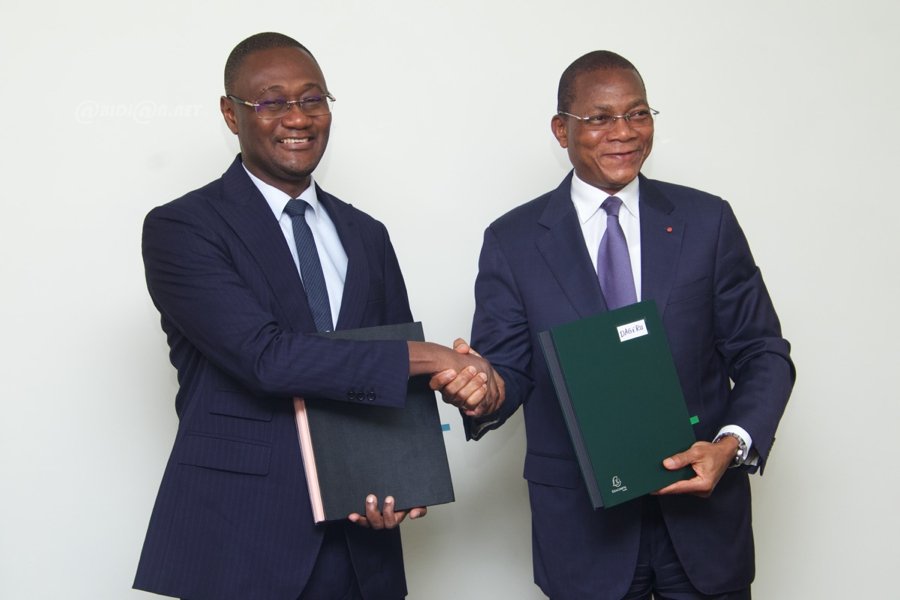

Projet D Adressage D Abidjan Comment Identifier Les Numeros De Batiments

May 20, 2025

Projet D Adressage D Abidjan Comment Identifier Les Numeros De Batiments

May 20, 2025 -

First Day Of Sinners Monte Carlo Training Postponed Due To Rain

May 20, 2025

First Day Of Sinners Monte Carlo Training Postponed Due To Rain

May 20, 2025 -

Apo Ta Tampoy Stin Eytyxia I Peripeteia Tis Marthas

May 20, 2025

Apo Ta Tampoy Stin Eytyxia I Peripeteia Tis Marthas

May 20, 2025 -

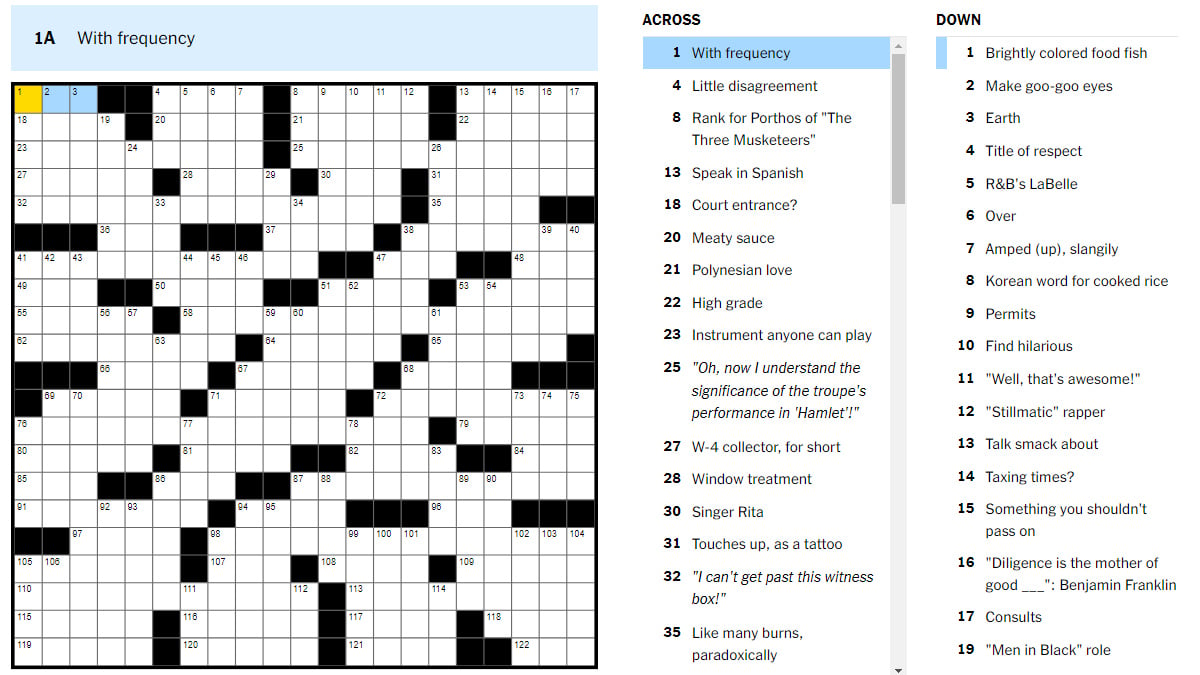

March 13 2025 Nyt Mini Crossword Complete Solutions And Hints

May 20, 2025

March 13 2025 Nyt Mini Crossword Complete Solutions And Hints

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025