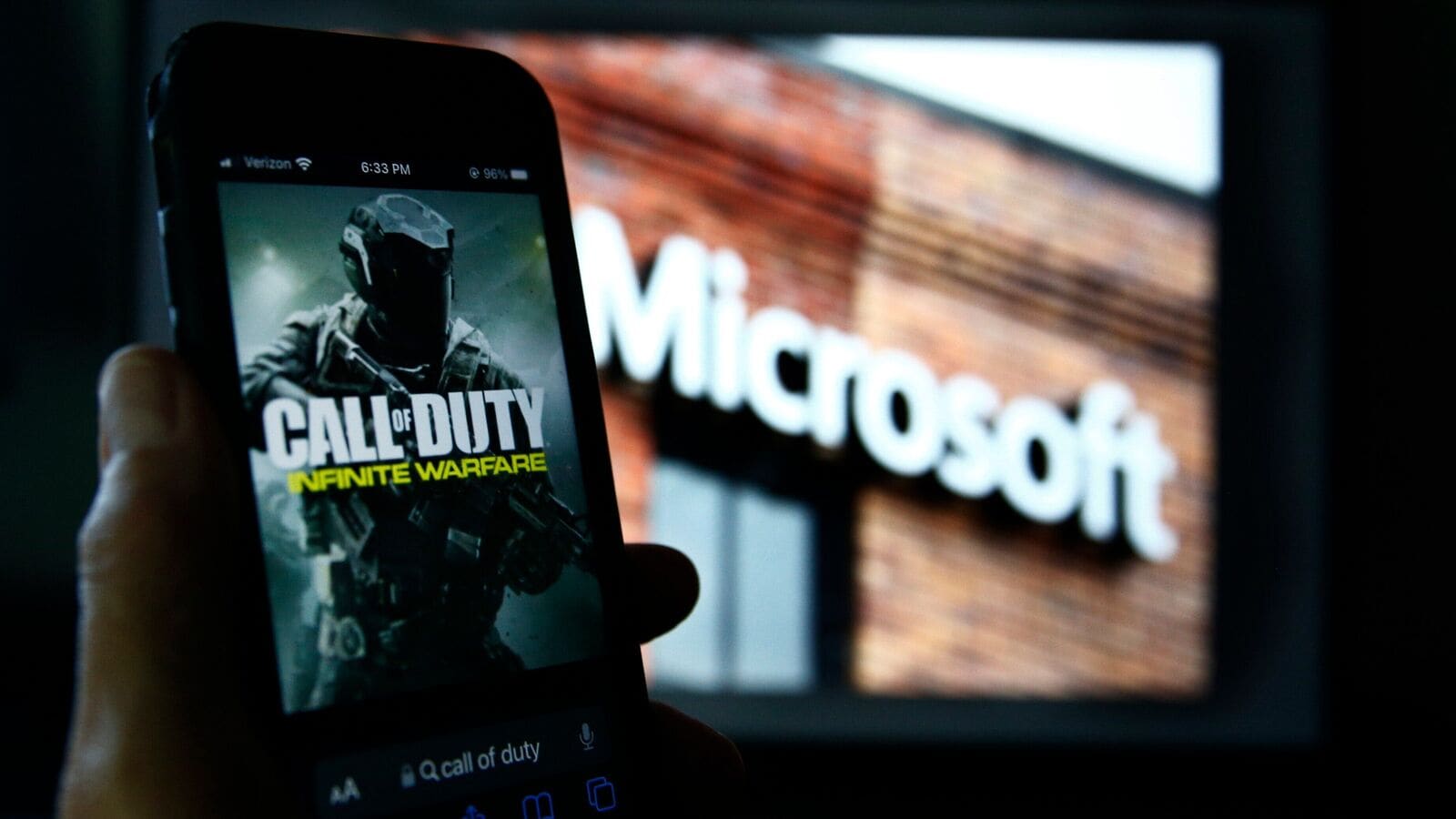

Microsoft-Activision Deal In Jeopardy: FTC Files Appeal

Table of Contents

The FTC's Case Against the Microsoft-Activision Merger

The FTC's primary concern centers on the potential reduction of competition within the gaming market if the Microsoft-Activision deal proceeds.

Concerns Regarding Competition in the Gaming Market

The FTC argues that Microsoft's acquisition of Activision Blizzard would significantly reduce competition, particularly impacting the market for console games, PC games, and cloud gaming services. Their central argument hinges on the exclusive rights to popular franchises, most notably Call of Duty.

- Impact on Console Market: The FTC worries about Microsoft potentially making Call of Duty exclusive to Xbox, giving it an unfair advantage over competitors like Sony PlayStation.

- PC Gaming Dominance: The FTC also expresses concerns about Microsoft's potential to leverage its ownership of Call of Duty and other Activision Blizzard titles to dominate the PC gaming market.

- Cloud Gaming Market Control: Microsoft's Game Pass subscription service, combined with Activision Blizzard's extensive catalog, could create an insurmountable barrier to entry for smaller cloud gaming providers.

The FTC claims this would stifle innovation, limit consumer choice, and potentially lead to higher prices for gamers. While the FTC hasn't released specific data to quantify the extent of these potential negative effects, their argument relies heavily on the qualitative significance of Call of Duty's popularity and market penetration.

The FTC's Proposed Remedies and Their Feasibility

The FTC initially sought a preliminary injunction to block the merger entirely. While the initial injunction was denied by a judge, the appeal signals the FTC's continued commitment to preventing the acquisition. Specific remedies proposed by the FTC beyond blocking the merger remain unclear pending the full appeal process. The feasibility of any proposed remedy would hinge on its ability to demonstrably maintain fair competition without unduly burdening either Microsoft or Activision Blizzard.

The Legal Precedents and the FTC's Likelihood of Success

The FTC's appeal relies on establishing a precedent of anti-competitive practices. They may point to past cases involving mergers deemed detrimental to the competitive landscape. However, the specifics of the Microsoft-Activision case are unique, making a direct comparison to previous rulings challenging. The success of the FTC's appeal hinges on the judge's interpretation of the existing antitrust laws and their application to the evolving gaming market. Relevant past cases will undoubtedly be cited by both parties, adding another layer of complexity to the legal battle.

Microsoft's Defense and Counterarguments

Microsoft vehemently denies the FTC's claims, arguing that the merger will ultimately benefit consumers and the gaming industry as a whole.

Microsoft's Stance on Competition and Consumer Impact

Microsoft counters that the acquisition will increase competition, not stifle it. They highlight plans to bring Call of Duty and other Activision Blizzard titles to more platforms, including Nintendo Switch, further expanding access for gamers. They also emphasize the benefits of integrating Activision Blizzard's studios into their ecosystem, potentially fostering greater innovation and the creation of new and exciting games.

- Increased Game Availability: Microsoft repeatedly emphasizes its commitment to maintaining Call of Duty availability across multiple platforms, including Playstation.

- Investment in Game Development: Microsoft argues the deal will allow them to invest more in game development, leading to higher-quality titles and a more diverse gaming landscape.

- Expansion of Game Pass: The integration of Activision Blizzard's games into Xbox Game Pass is presented as a significant benefit to consumers, offering more value for money.

Microsoft's Proposed Solutions and Concessions

Throughout the legal process, Microsoft has made significant concessions, offering long-term contracts to ensure continued access to Call of Duty on Playstation and other platforms. The effectiveness of these concessions remains a point of contention. While Microsoft claims they are addressing the FTC’s concerns, the FTC may argue that these concessions are insufficient to fully mitigate the risk of anti-competitive behavior.

The Wider Implications of the Microsoft-Activision Appeal

The outcome of this appeal has far-reaching consequences beyond the Microsoft-Activision deal itself.

Impact on the Gaming Industry and Future Mergers

The ruling could set a precedent for future mergers and acquisitions within the gaming industry and beyond. A successful FTC appeal might discourage future large-scale mergers in the tech sector, leading to a more fragmented market or greater regulatory scrutiny.

- Increased Regulatory Scrutiny: The appeal could prompt stricter antitrust regulations for future tech mergers, particularly in the gaming and entertainment sectors.

- Reduced M&A Activity: A negative outcome for Microsoft could decrease the frequency of large-scale mergers, potentially hindering innovation and consolidation within the industry.

- Shifted Market Dynamics: The outcome will inevitably reshape the competitive landscape, influencing the strategies of gaming companies and their approaches to expansion.

Influence on Regulatory Oversight of Tech Mergers

The Microsoft-Activision case is a significant test of regulatory authorities' ability to effectively oversee and manage mergers in the rapidly evolving tech landscape. The decision will have ramifications for how governments worldwide approach antitrust issues involving large technology companies.

- Global Regulatory Harmonization: The case could spur discussions regarding greater international cooperation and harmonization of antitrust regulations across jurisdictions.

- Increased Resources for Regulators: The complexity of this case highlights the need for increased resources and expertise within regulatory bodies to tackle future tech mergers effectively.

The Impact on Activision Blizzard Shareholders and Employees

The ongoing uncertainty significantly impacts Activision Blizzard shareholders and employees. A successful appeal could lead to a significant drop in stock value, impacting investor confidence. For employees, a failed merger could affect job security and future career prospects.

- Share Price Volatility: Uncertainty surrounding the appeal's outcome creates significant volatility in Activision Blizzard’s share price, impacting investor portfolios.

- Potential for Layoffs: Depending on the final decision, there is the potential for job losses within Activision Blizzard, leading to uncertainty for employees.

Conclusion: The Future of the Microsoft-Activision Deal – What to Expect Next

The Microsoft-Activision deal remains in a precarious position. The FTC's appeal highlights significant concerns regarding the potential impact on competition within the gaming market. While Microsoft argues the merger will benefit consumers, the FTC's counterarguments are compelling and highlight the complexities of regulating mergers in a rapidly evolving industry. The outcome of the appeal will undoubtedly shape the future of the gaming industry and serve as a landmark case for future tech mergers. We can only wait and see what the courts decide. Stay informed about this evolving situation by following the official statements from Microsoft, Activision Blizzard, and the FTC, and keep an eye on reputable news sources covering the legal proceedings for further developments in the Microsoft-Activision deal.

Featured Posts

-

Can Apple Revitalize Siri With Large Language Models

May 20, 2025

Can Apple Revitalize Siri With Large Language Models

May 20, 2025 -

Ruling Over London Festivals A Dark New Era For Live Music

May 20, 2025

Ruling Over London Festivals A Dark New Era For Live Music

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Methods And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Methods And Enduring Legacy

May 20, 2025 -

Todays Nyt Mini Crossword March 15 Solutions

May 20, 2025

Todays Nyt Mini Crossword March 15 Solutions

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Latest Posts

-

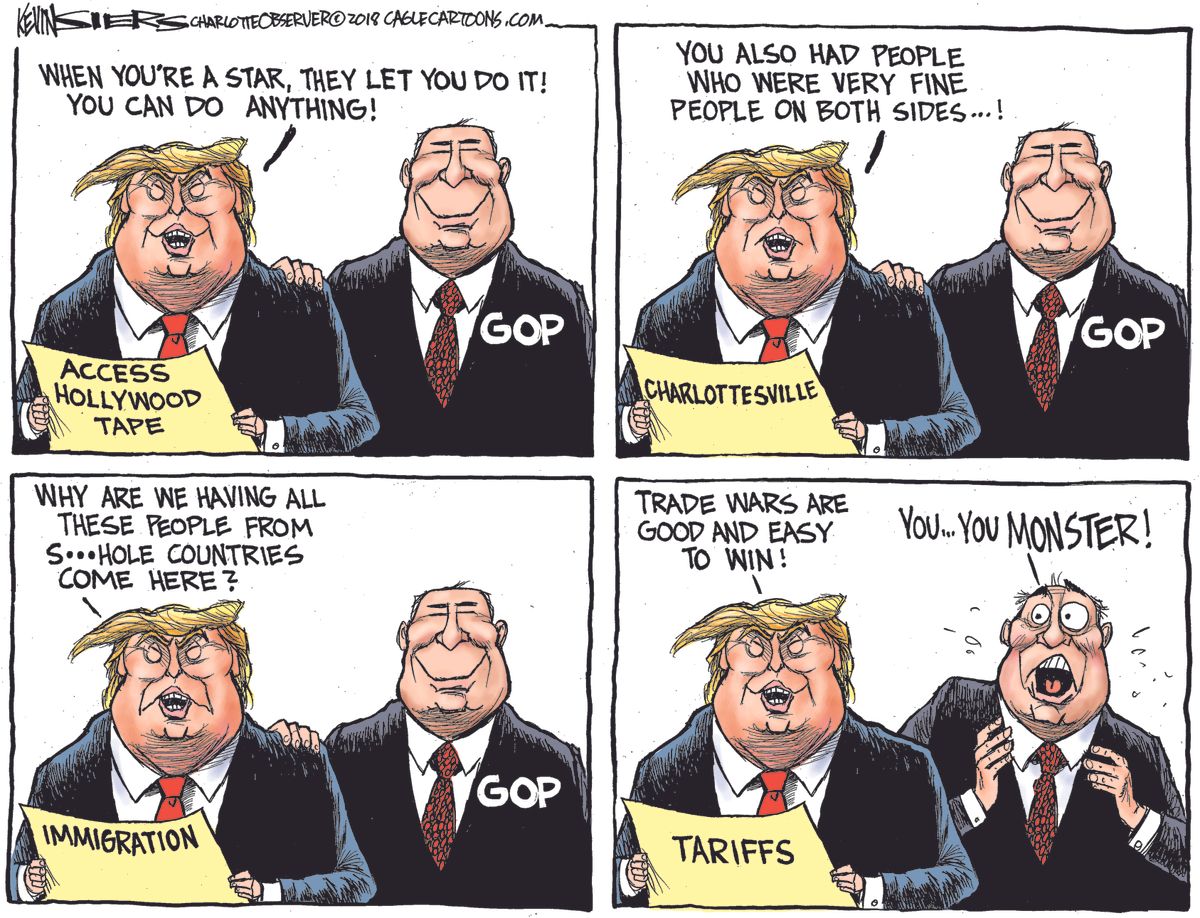

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025 -

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025