Microsoft-Activision Deal: FTC's Appeal And Future Implications

Table of Contents

The FTC's Arguments Against the Merger

The FTC's appeal hinges on several key concerns regarding the potential anti-competitive effects of the Microsoft-Activision merger.

Concerns about Market Domination

The FTC argues that Microsoft's acquisition of Activision Blizzard would grant it undue market dominance, significantly harming competition. Their concerns are based on several factors:

- Control over key gaming franchises: Activision Blizzard owns immensely popular franchises like Call of Duty, World of Warcraft, and Candy Crush, which, under Microsoft's control, could be leveraged to stifle competitors.

- Potential for anti-competitive practices: The FTC worries Microsoft could engage in anti-competitive practices, such as making Call of Duty exclusive to Xbox, raising prices, or deliberately degrading the performance of competing games.

- Impact on competitors and consumer choice: Restricting access to popular games or raising prices could harm competing game developers and publishers, ultimately reducing consumer choice and innovation. Keywords: market dominance, anti-competitive practices, exclusive content, price hikes, Call of Duty, World of Warcraft, Candy Crush.

Impact on Game Streaming and Subscription Services

The FTC also expresses significant concern about the impact on the burgeoning game streaming and subscription service market. Microsoft's Game Pass, a subscription service offering a vast library of games, is central to this argument:

- Stifling competition in game streaming: Adding Activision Blizzard's titles to Game Pass could significantly enhance its appeal, potentially driving competitors out of the market. The FTC argues this could create a monopoly, harming innovation and consumer choice.

- Impact on rival subscription services: Services like PlayStation Plus and others would face increased competition, potentially hindering their growth and ability to offer comparable value to consumers. Keywords: Game Pass, game streaming, subscription services, PlayStation Plus, competition.

The Role of Cloud Gaming

The FTC’s concerns extend to the cloud gaming market. Microsoft’s acquisition of Activision Blizzard significantly boosts their presence in this rapidly expanding sector.

- Microsoft's cloud gaming ambitions: Microsoft's ambition to become a leading cloud gaming provider is well-documented. Acquiring Activision Blizzard’s extensive catalog strengthens this position considerably.

- Potential implications for other cloud gaming providers: This consolidation of power could severely disadvantage other cloud gaming providers, potentially limiting innovation and consumer choice in this emerging sector. Keywords: cloud gaming, Xbox Cloud Gaming, market share, competition, innovation.

Microsoft's Defense and Counterarguments

Microsoft counters the FTC's arguments, emphasizing its commitment to fair competition and the benefits of the merger for gamers.

Microsoft's Commitment to Maintaining Competition

Microsoft has actively attempted to alleviate the FTC’s concerns, presenting several arguments:

- Agreements with competitors: Microsoft has entered into agreements with competitors such as Nintendo, guaranteeing the continued availability of Call of Duty on their platforms for several years.

- Arguments regarding the benefits of the merger: Microsoft argues the merger will ultimately benefit gamers, leading to increased innovation, wider game access, and potentially lower prices due to economies of scale. Keywords: competition, consumer benefits, gaming ecosystem, Nintendo, agreements.

Predictions for the Future of the Deal

The outcome of the FTC's appeal remains uncertain. Several scenarios are possible:

- FTC wins the appeal: This would block the merger, potentially setting a significant precedent for future tech acquisitions.

- FTC loses the appeal: This would allow the merger to proceed, potentially leading to significant market consolidation.

- Settlement reached: A negotiated settlement between Microsoft and the FTC could also occur, involving concessions from Microsoft to address the FTC's concerns. Keywords: merger outcome, antitrust law, gaming industry future, regulatory impact.

Conclusion: The Ongoing Battle Over the Microsoft-Activision Deal and its Broader Implications

The Microsoft-Activision deal represents a landmark case in antitrust law and its implications for the future of the gaming industry are far-reaching. The FTC’s appeal highlights the complex interplay between market dominance, competition, and innovation in the rapidly evolving digital landscape. The outcome will not only affect the fate of the merger itself but also serve as a precedent for future mergers and acquisitions in the tech industry. Stay informed about the ongoing developments in the Microsoft-Activision deal and its impact on the future of gaming. Follow updates on this landmark antitrust case and its implications for competition in the video game market.

Featured Posts

-

American Cyclist Jorgenson Victorious At Paris Nice

Apr 26, 2025

American Cyclist Jorgenson Victorious At Paris Nice

Apr 26, 2025 -

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025

Fugro And Damen Partner To Bolster Royal Netherlands Navy Capabilities

Apr 26, 2025 -

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

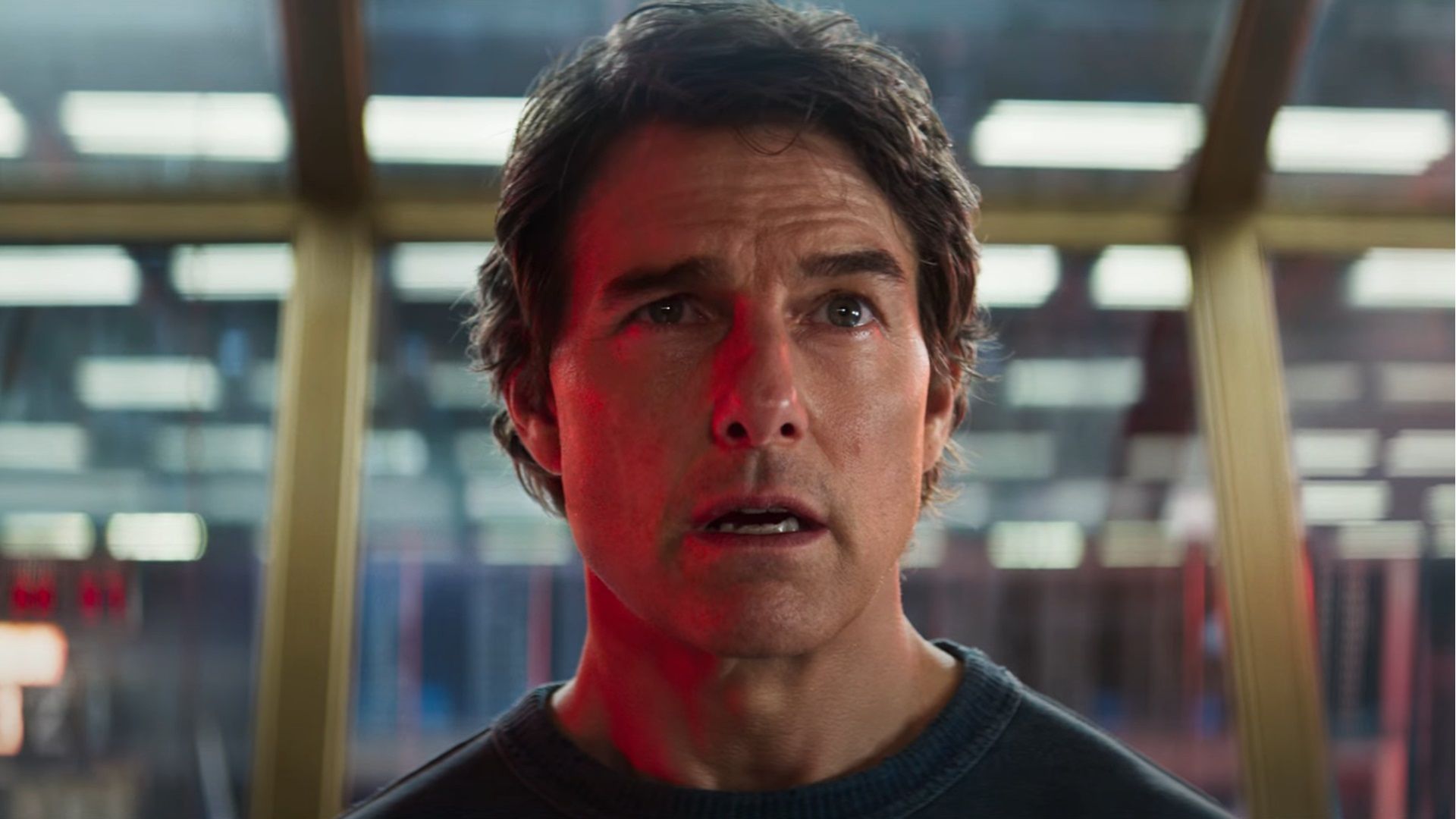

Mission Impossible Final Reckonings Omission Of Two Sequels

Apr 26, 2025

Mission Impossible Final Reckonings Omission Of Two Sequels

Apr 26, 2025 -

The Worlds Tallest Abandoned Skyscraper Project Construction To Continue

Apr 26, 2025

The Worlds Tallest Abandoned Skyscraper Project Construction To Continue

Apr 26, 2025

Latest Posts

-

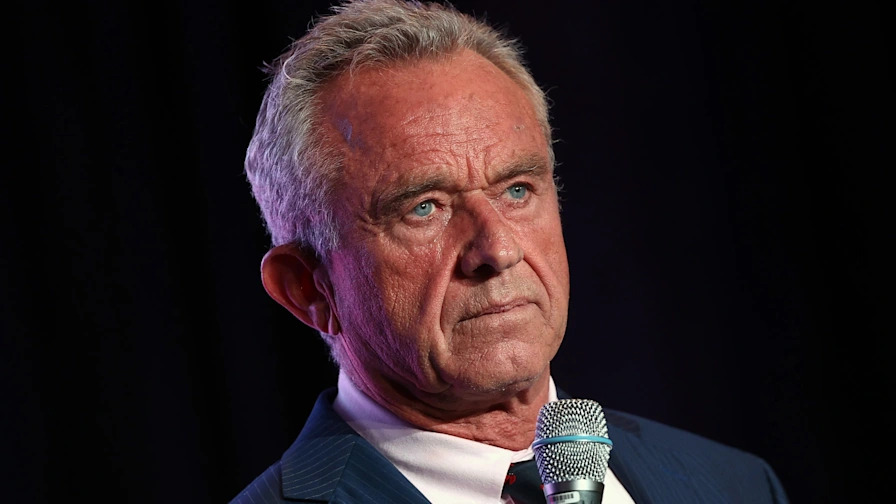

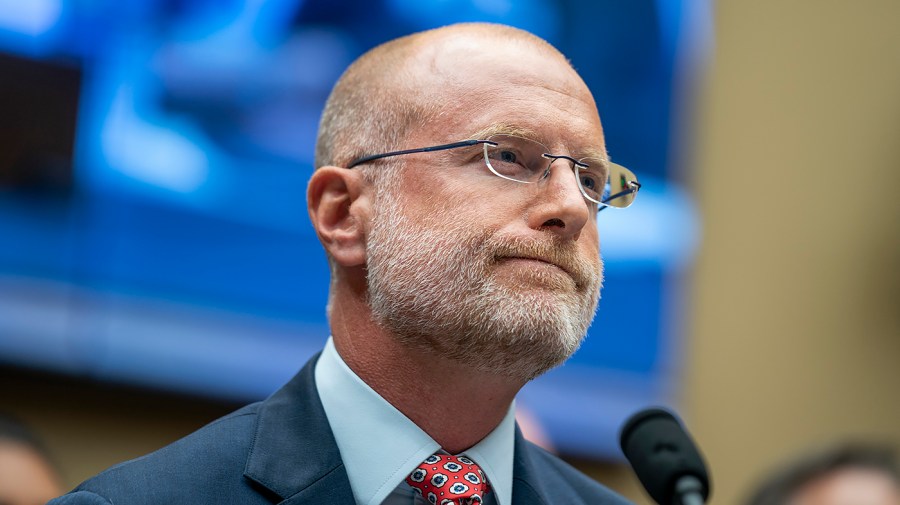

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025 -

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025 -

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025