MicroStrategy Vs Bitcoin: Predicting The Better Investment For 2025

Table of Contents

MicroStrategy (MSTR) Investment Analysis

Understanding MicroStrategy's Business Model

MicroStrategy's core business revolves around providing enterprise analytics and business intelligence software. However, the company's strategy shifted significantly with its massive investment in Bitcoin. Understanding this pivot is crucial for evaluating MSTR as an investment.

- Revenue Streams: Primarily generated from software licenses, subscription services, and consulting.

- Market Position: A recognized player in the business intelligence market, but facing stiff competition from larger tech companies.

- Competition: Companies like Tableau, Salesforce, and Qlik pose significant competitive challenges.

- Recent Financial Performance: While software revenue fluctuates, the impact of Bitcoin's price on the company's balance sheet is undeniable and significantly impacts its financial reporting. Analyzing MSTR's quarterly reports reveals the complex interplay between its core business and its Bitcoin holdings. Tracking MicroStrategy stock price alongside Bitcoin's performance is essential.

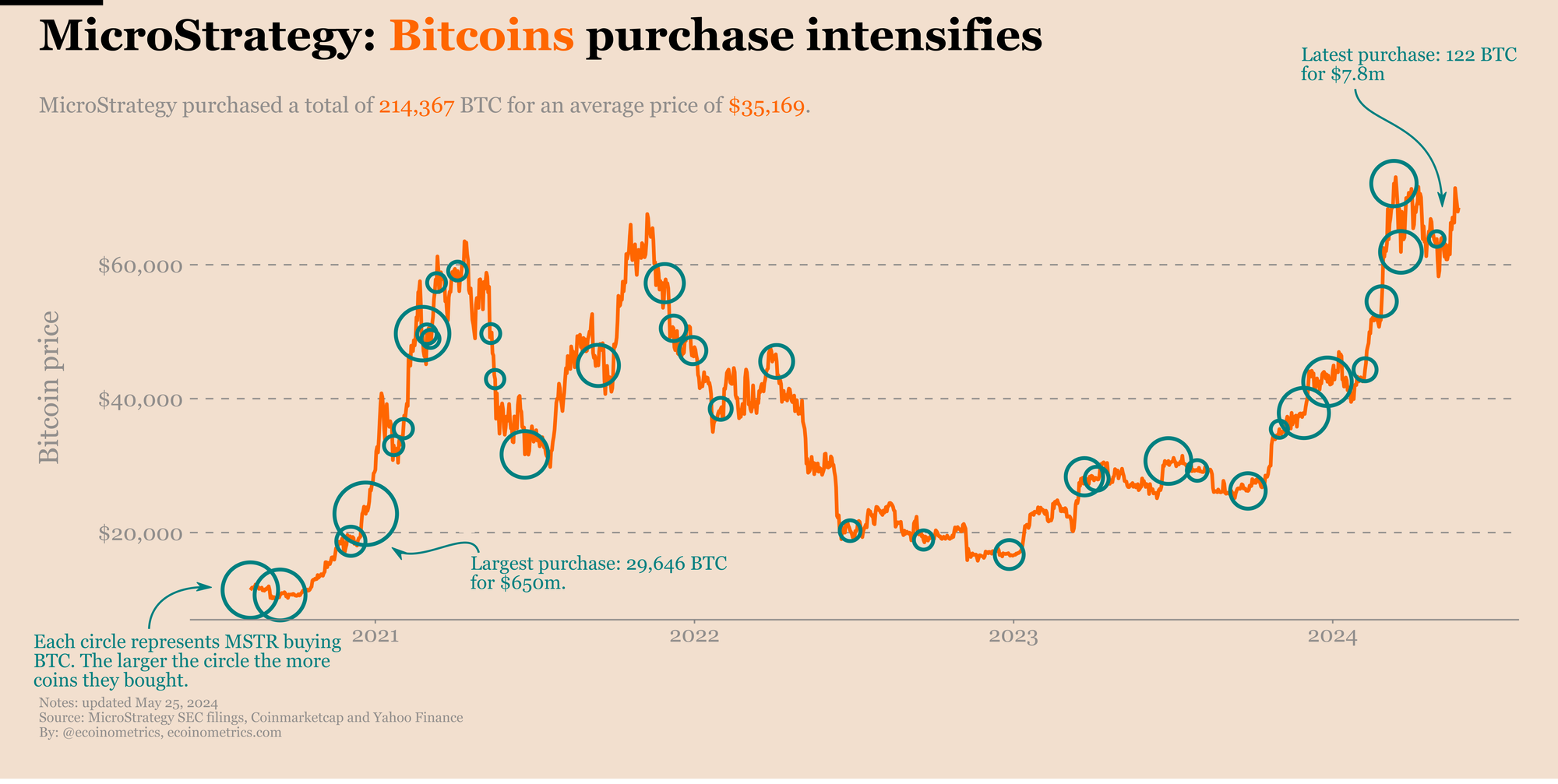

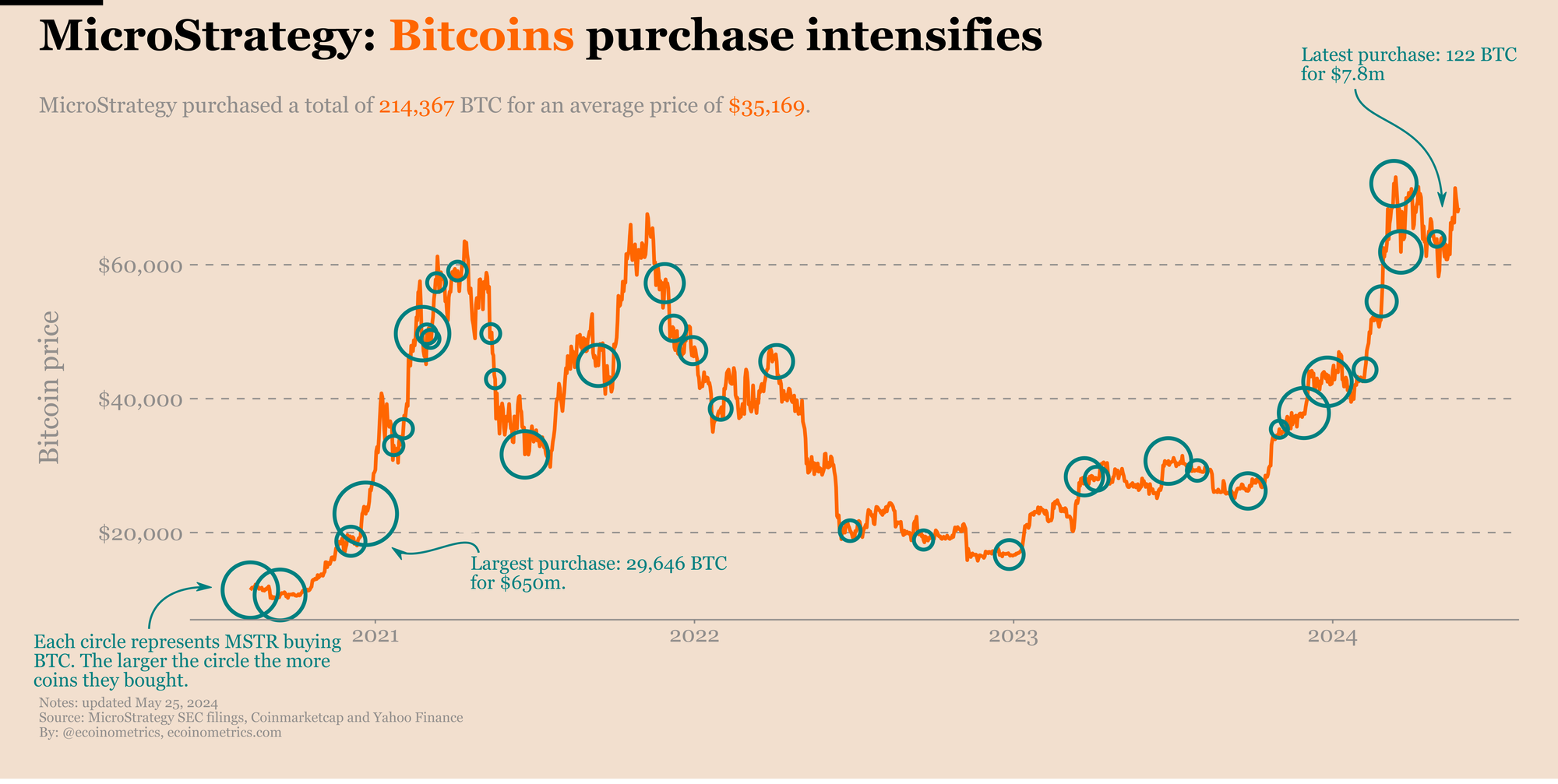

MSTR's Bitcoin Holdings and Strategy

MicroStrategy has made a bold bet on Bitcoin, accumulating a substantial amount of BTC. This strategy represents a significant departure from its traditional business model and introduces considerable risk and reward.

- Total BTC Holdings: Their holdings fluctuate with purchases, but tracking the total amount held is critical for understanding MSTR's Bitcoin exposure.

- Average Purchase Price: The average price at which MicroStrategy acquired its Bitcoin significantly impacts its profitability.

- Potential Impact of BTC Price Fluctuations on MSTR's Balance Sheet: A drop in Bitcoin's price directly impacts MSTR's reported financial figures, creating volatility in its stock price. This MicroStrategy Bitcoin strategy is high-risk, high-reward.

Risk Assessment for MSTR Investment

Investing in MicroStrategy carries inherent risks, mainly tied to its significant Bitcoin holdings and its position within a competitive tech landscape.

- Market Risk: The overall performance of the technology sector directly impacts MSTR's software business.

- Regulatory Risk: Changes in regulations surrounding Bitcoin could negatively affect MicroStrategy's investment.

- Bitcoin Price Volatility Risk: The fluctuating value of Bitcoin is the primary risk, potentially leading to significant losses.

- Competition Risk: Intense competition in the business intelligence software market presents ongoing challenges. Analyzing MSTR risk factors requires a holistic approach, considering the interplay of these variables.

Bitcoin (BTC) Investment Analysis

Bitcoin's Market Position and Adoption

Bitcoin's position as the leading cryptocurrency is undeniable. Its growing adoption by institutions and individuals globally is a key factor influencing its future value.

- Market Capitalization: Bitcoin maintains a substantial market capitalization compared to other cryptocurrencies.

- Network Effects: The size and security of the Bitcoin network enhance its value and adoption.

- Technological Advancements: Ongoing development and upgrades of the Bitcoin protocol contribute to its longevity.

- Regulatory Landscape: The evolving regulatory landscape globally will play a crucial role in shaping Bitcoin's future.

Factors Influencing Bitcoin's Price

Numerous factors contribute to Bitcoin's price volatility. Understanding these influences is essential for predicting its future value.

- Adoption Rate: Increased adoption by institutional investors and wider public use drives price appreciation.

- Regulatory Changes: Favorable or unfavorable regulations in major markets directly affect Bitcoin's price.

- Technological Developments: Innovations and upgrades to the Bitcoin network can positively influence its price.

- Macroeconomic Factors: Global economic conditions, inflation, and interest rates influence investor sentiment towards Bitcoin. Analyzing Bitcoin price volatility requires monitoring these interconnected elements.

Bitcoin's Long-Term Potential and Risks

Bitcoin's limited supply and potential for mainstream adoption are key drivers of its long-term value proposition. However, risks remain.

- Scarcity: Bitcoin's limited supply of 21 million coins creates inherent scarcity, potentially driving long-term value.

- Potential for Mainstream Adoption: Growing acceptance as a store of value and medium of exchange could propel its price higher.

- Competition from Altcoins: The emergence of competing cryptocurrencies poses a challenge to Bitcoin's dominance.

- Security Risks: Although the Bitcoin network is considered secure, vulnerabilities remain a potential concern. Assessing Bitcoin future price requires carefully considering both its potential and its risks.

Comparing MicroStrategy and Bitcoin for 2025

Direct Comparison of Potential Returns

Predicting which investment will perform better by 2025 requires considering various market scenarios.

- Potential ROI for both investments under different market conditions: A bullish Bitcoin market significantly benefits both MSTR and BTC, while a bearish market would negatively impact both. A sideways market would likely see relatively smaller gains for both. (Charts and graphs could visually represent these scenarios). Comparing MSTR vs BTC requires analyzing their performance under differing market assumptions.

Diversification and Risk Management

Diversification is key to mitigating investment risks. Both MicroStrategy and Bitcoin offer unique risk profiles.

- Strategies for managing risk when investing in both assets: Diversifying across different asset classes reduces the overall portfolio risk. Understanding the correlation (or lack thereof) between MSTR and BTC is crucial for effective diversification. For example, while some correlation exists due to MSTR's Bitcoin holdings, it's not a perfect one-to-one relationship, enabling some degree of diversification within the portfolio.

Conclusion

MicroStrategy and Bitcoin present distinct investment opportunities with varying levels of risk and reward. MicroStrategy's success is intrinsically linked to Bitcoin's performance, adding a layer of complexity not present in a direct Bitcoin investment. While both offer substantial potential for gains, they also carry the risk of significant losses. Based on the analysis presented, and acknowledging the inherent uncertainties of predicting future market movements, a bullish Bitcoin market scenario favors a direct Bitcoin investment over MSTR in terms of potential returns. However, a more cautious approach might suggest a balanced allocation across both assets to mitigate risk. Ultimately, deciding between MicroStrategy and Bitcoin for investment in 2025 requires careful consideration of your risk tolerance and investment goals. Share your thoughts on the future of MicroStrategy and Bitcoin in the comments below!

Featured Posts

-

The Daily Fox News Appearances Of The Us Attorney General Whats Really Going On

May 09, 2025

The Daily Fox News Appearances Of The Us Attorney General Whats Really Going On

May 09, 2025 -

23

May 09, 2025

23

May 09, 2025 -

Wynne And Joanna All At Sea A Comprehensive Review

May 09, 2025

Wynne And Joanna All At Sea A Comprehensive Review

May 09, 2025 -

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

May 09, 2025

Open Ai Under Ftc Scrutiny Implications Of The Chat Gpt Probe

May 09, 2025 -

Nyt Strands Answers For Wednesday April 9 Game 402

May 09, 2025

Nyt Strands Answers For Wednesday April 9 Game 402

May 09, 2025