MicroStrategy Vs Bitcoin In 2025: Which Is The Better Investment?

Table of Contents

The cryptocurrency market, with its inherent volatility, presents both exhilarating opportunities and daunting risks. Bitcoin, the original and most established cryptocurrency, continues to be a topic of intense debate, alongside companies like MicroStrategy, which have made significant bets on its future. This article tackles the burning question: Is MicroStrategy stock or a direct Bitcoin investment the better choice in 2025? We'll compare the investment potential of MicroStrategy and Bitcoin, considering various factors to help you navigate this complex investment landscape. This analysis will explore MicroStrategy Bitcoin investment strategies and offer insights into Bitcoin investment strategies in general.

H2: Understanding MicroStrategy's Bitcoin Strategy

H3: MicroStrategy's Business Model and Bitcoin Holdings:

MicroStrategy is a publicly traded company primarily known for its business intelligence software. However, its audacious strategy, spearheaded by CEO Michael Saylor, has made it synonymous with Bitcoin. MicroStrategy has amassed a substantial Bitcoin treasury, making it one of the largest corporate holders of the cryptocurrency. This significant holding directly impacts its balance sheet and financial performance, creating a unique investment proposition.

- Core Business: Business intelligence, analytics, and mobile software.

- Bitcoin Holdings: As of [Insert Latest Data - e.g., October 26, 2023], MicroStrategy held approximately [Insert Number] Bitcoins, representing a substantial portion of its assets.

- Michael Saylor's Influence: Saylor's strong belief in Bitcoin as a long-term store of value has significantly shaped the company's strategy.

H3: Risks and Rewards of Investing in MicroStrategy:

Investing in MicroStrategy carries inherent risks, primarily linked to Bitcoin's price volatility. If Bitcoin's price declines significantly, MicroStrategy's stock price will likely suffer. However, the potential rewards are equally substantial.

- Risks:

- Significant exposure to Bitcoin price fluctuations.

- Dependence on the success of the Bitcoin market.

- Potential for regulatory changes impacting Bitcoin or MicroStrategy's operations.

- Rewards:

- Potential appreciation in Bitcoin's value, directly impacting MicroStrategy's assets.

- Growth potential in MicroStrategy's core software business, independent of Bitcoin's performance.

- Exposure to a potentially disruptive technology.

H3: MicroStrategy's Future Outlook and Projections:

Predicting MicroStrategy's future is challenging, as it hinges heavily on Bitcoin's trajectory and its own business performance. However, several factors are worth considering:

- Software Business Growth: MicroStrategy's continued success in the business intelligence market is crucial for its overall health.

- Bitcoin Adoption: Increased institutional and mainstream adoption of Bitcoin could positively impact MicroStrategy's holdings.

- Regulatory Landscape: Changes in regulations surrounding Bitcoin could significantly affect MicroStrategy's strategy and valuation.

H2: Bitcoin's Projected Value and Market Position in 2025

H3: Bitcoin's Technological Advantages and Adoption Rate:

Bitcoin's decentralized nature, robust security features, and limited supply are key drivers of its potential long-term value. Its increasing adoption by institutions and individuals points toward continued growth.

- Decentralization: Resistance to censorship and single points of failure.

- Security: Cryptographic security makes it highly resistant to hacking.

- Scarcity: A fixed supply of 21 million Bitcoin creates potential for price appreciation.

- Adoption: Increasing acceptance by major corporations and governments.

H3: Predicting Bitcoin's Price in 2025:

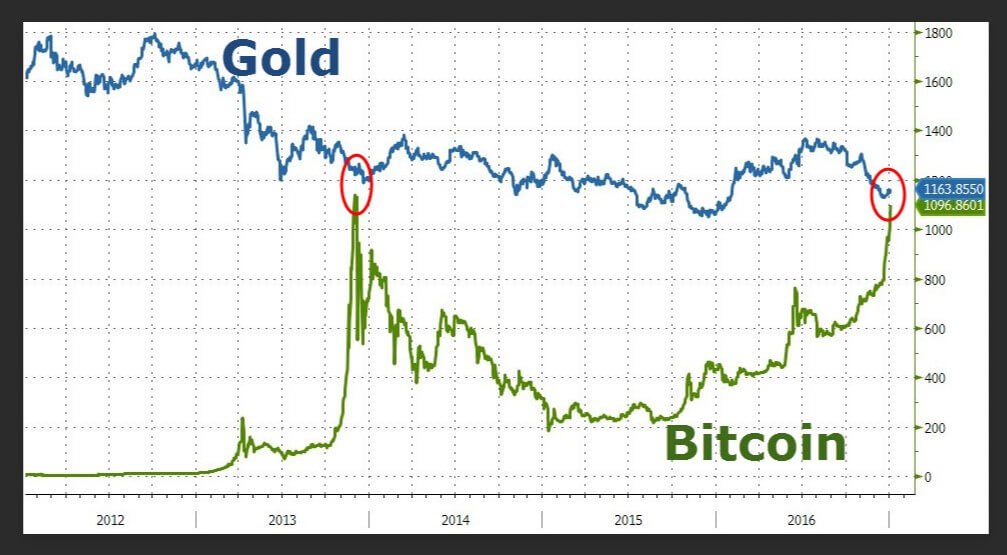

Predicting Bitcoin's price is notoriously difficult due to its volatility. However, several factors can inform projections:

- Halving Events: Periodic reductions in Bitcoin mining rewards can impact price.

- Macroeconomic Conditions: Global economic factors such as inflation and interest rates play a significant role.

- Analyst Predictions: Various analysts offer price predictions, but these should be viewed with caution. (Examples of predictions and sources should be included here.)

H3: Risks Associated with Direct Bitcoin Investment:

Investing directly in Bitcoin carries significant risks:

- Volatility: Extreme price swings can lead to substantial gains or losses.

- Security Risks: Losing access to your private keys can result in irreversible loss of funds.

- Regulatory Uncertainty: Changes in regulations could impact Bitcoin's market.

H2: MicroStrategy vs. Bitcoin: A Comparative Investment Analysis

H3: Comparing Risk Tolerance and Investment Goals:

The choice between MicroStrategy and Bitcoin depends heavily on individual risk tolerance and investment goals:

- MicroStrategy: Offers a degree of diversification through its software business but is still significantly exposed to Bitcoin's price.

- Bitcoin: Offers higher potential returns but with significantly higher risk.

- Risk Tolerance: Investors with higher risk tolerance might prefer Bitcoin; those with lower risk tolerance may favor MicroStrategy.

- Investment Goals: Long-term investors might find both attractive, but short-term traders may find Bitcoin more appealing despite the increased volatility.

H3: Diversification and Portfolio Management:

Diversification is key to managing risk. Neither MicroStrategy nor Bitcoin should represent a significant portion of your portfolio unless your risk tolerance is very high.

- Portfolio Allocation: Consider your overall investment strategy and allocate funds appropriately.

- Asset Classes: Diversify beyond just Bitcoin and MicroStrategy into other asset classes.

- Risk Management: Regularly review your portfolio and adjust your allocation as needed.

3. Conclusion: Making the Right Investment Choice: MicroStrategy or Bitcoin in 2025?

Choosing between MicroStrategy and Bitcoin requires careful consideration of your risk tolerance, investment timeline, and overall financial goals. MicroStrategy offers a less volatile entry point into the Bitcoin market, but its success remains intrinsically linked to Bitcoin's performance. Direct Bitcoin investment presents significantly higher risk but potentially greater rewards. Both options present substantial opportunities and risks. Remember to conduct thorough research and, if necessary, consult with a qualified financial advisor before investing in either MicroStrategy or Bitcoin. Invest wisely in Bitcoin, make informed decisions about MicroStrategy, and carefully compare MicroStrategy vs. Bitcoin investments to determine the best strategy for your unique circumstances.

Featured Posts

-

Trumps Tariffs 174 Billion Loss For Top 10 Billionaires

May 09, 2025

Trumps Tariffs 174 Billion Loss For Top 10 Billionaires

May 09, 2025 -

Conseil Metropolitain De Dijon Le Projet De 3e Ligne De Tramway Adopte Apres Concertation

May 09, 2025

Conseil Metropolitain De Dijon Le Projet De 3e Ligne De Tramway Adopte Apres Concertation

May 09, 2025 -

Sensex Today 700 Point Surge Nifty Reclaims 18800 Live Market Updates

May 09, 2025

Sensex Today 700 Point Surge Nifty Reclaims 18800 Live Market Updates

May 09, 2025 -

Weight Watchers Bankruptcy Filing Impact Of Weight Loss Drugs

May 09, 2025

Weight Watchers Bankruptcy Filing Impact Of Weight Loss Drugs

May 09, 2025 -

Senator Warner Trumps Reliance On Tariffs As His Primary Weapon

May 09, 2025

Senator Warner Trumps Reliance On Tariffs As His Primary Weapon

May 09, 2025