Massive Payout For Credit Suisse Whistleblowers: $150 Million Settlement

Table of Contents

The Allegations: What Did the Whistleblowers Report?

The whistleblowers' reports detailed a range of alleged wrongdoing, encompassing serious instances of financial misconduct and regulatory breaches. These allegations involved a pattern of illegal activities, potentially violating several significant laws and regulations. The specifics remain partially undisclosed due to confidentiality agreements, but the following examples illustrate the severity of the accusations:

- Money Laundering: Allegations included facilitating the movement of illicit funds through Credit Suisse's accounts, potentially violating both domestic and international anti-money laundering regulations.

- Fraudulent Activities: The whistleblowers reportedly uncovered instances of fraudulent transactions, misrepresentation of financial information, and potential market manipulation.

- Regulatory Violations: The alleged breaches encompassed multiple regulatory frameworks, including those concerning banking secrecy, client confidentiality, and anti-bribery laws. Specific regulations potentially violated may include (but are not limited to) the Bank Secrecy Act, the Foreign Corrupt Practices Act, and various Swiss and international financial regulations.

These accusations represent serious violations of financial integrity and trust, potentially leading to significant repercussions for both Credit Suisse and the individuals involved.

The Whistleblower Protection Program and its Effectiveness

The effectiveness of whistleblower protection programs in uncovering corporate misconduct is paramount. This case raises crucial questions about Credit Suisse's internal reporting mechanisms. While Credit Suisse has a stated whistleblower protection program, its effectiveness in preventing and addressing these alleged offenses is now under intense scrutiny. Key aspects of the program, or lack thereof, include:

- Accessibility and Transparency: The ease with which whistleblowers could report concerns internally may have been a significant factor. The program's clarity and accessibility to employees are key considerations.

- Confidentiality and Retaliation Protection: Concerns regarding potential retaliation against whistleblowers likely influenced the decision to pursue external channels. A robust program needs strong protections against reprisal.

- Investigation Processes: The speed and thoroughness of internal investigations are critical. If the internal processes were slow or inadequate, this could explain why whistleblowers felt the need to go outside the company.

This case highlights the need for improvements to whistleblower protection programs, emphasizing the importance of creating a truly safe and effective environment for reporting potential wrongdoing. Moving forward, Credit Suisse and other financial institutions should review and enhance their programs, focusing on clear communication, robust investigation processes, and unwavering protection against retaliation.

The Settlement Details: $150 Million and its Implications

The $150 million settlement agreement represents a significant financial penalty for Credit Suisse. While the exact terms remain partially confidential, key aspects include:

- Distribution of Funds: The settlement will distribute funds to the whistleblowers involved, though the precise allocation remains undisclosed.

- Admission of Guilt: Credit Suisse may have made some level of admission of guilt or acknowledgement of wrongdoing as part of the settlement, though specific details are generally kept private in such agreements.

- Financial Impact on Credit Suisse: This substantial financial penalty will inevitably impact Credit Suisse's financial statements and overall profitability. The settlement represents a substantial cost, signaling the potential for severe financial consequences related to corporate misconduct.

This settlement sets a significant precedent, demonstrating that corporations can face substantial financial liabilities for failing to address allegations of wrongdoing and for deficiencies in their internal whistleblower programs. This case underscores the growing financial risk associated with neglecting proper compliance procedures.

The Future of Whistleblowing at Credit Suisse and Beyond

The settlement's impact on Credit Suisse's reputation and future operations is significant. The long-term consequences include:

- Reputational Damage: The scandal will undoubtedly damage Credit Suisse's reputation, potentially affecting client trust and investor confidence.

- Increased Regulatory Scrutiny: Credit Suisse can expect increased regulatory scrutiny and potential further investigations into its practices.

- Policy and Procedure Changes: The bank is likely to implement significant changes to its internal policies and procedures, particularly regarding its whistleblower protection program, risk management, and corporate governance.

The implications extend beyond Credit Suisse, impacting the broader financial industry. Other financial institutions will likely review their own internal reporting mechanisms and compliance procedures to avoid similar situations. The $150 million settlement serves as a stark reminder of the importance of robust corporate governance, effective risk management, and a strong compliance culture within financial institutions.

Conclusion: Learning from the Credit Suisse Whistleblower Payout

The massive payout for Credit Suisse whistleblowers, totaling $150 million, highlights the severe consequences of corporate misconduct and the crucial role of effective whistleblower protection programs. The allegations of money laundering, fraud, and regulatory violations underscore the need for stronger internal reporting mechanisms and robust compliance measures across the financial industry. This settlement sets a significant precedent, emphasizing the substantial financial risk associated with neglecting proper ethical and legal standards. Understanding the implications of this massive payout for Credit Suisse whistleblowers is crucial. Learn more about protecting yourself and your organization from financial misconduct – report suspected wrongdoing today! Consider seeking legal counsel if you have information concerning potential large whistleblower settlements in the financial industry whistleblowing arena.

Featured Posts

-

Wildfires And Wagers Exploring The Los Angeles Betting Landscape

May 10, 2025

Wildfires And Wagers Exploring The Los Angeles Betting Landscape

May 10, 2025 -

Edmonton Oilers Force Game 3 After Overtime Win Against Kings

May 10, 2025

Edmonton Oilers Force Game 3 After Overtime Win Against Kings

May 10, 2025 -

Tomas Hertl Dominates Golden Knights Win Over Red Wings

May 10, 2025

Tomas Hertl Dominates Golden Knights Win Over Red Wings

May 10, 2025 -

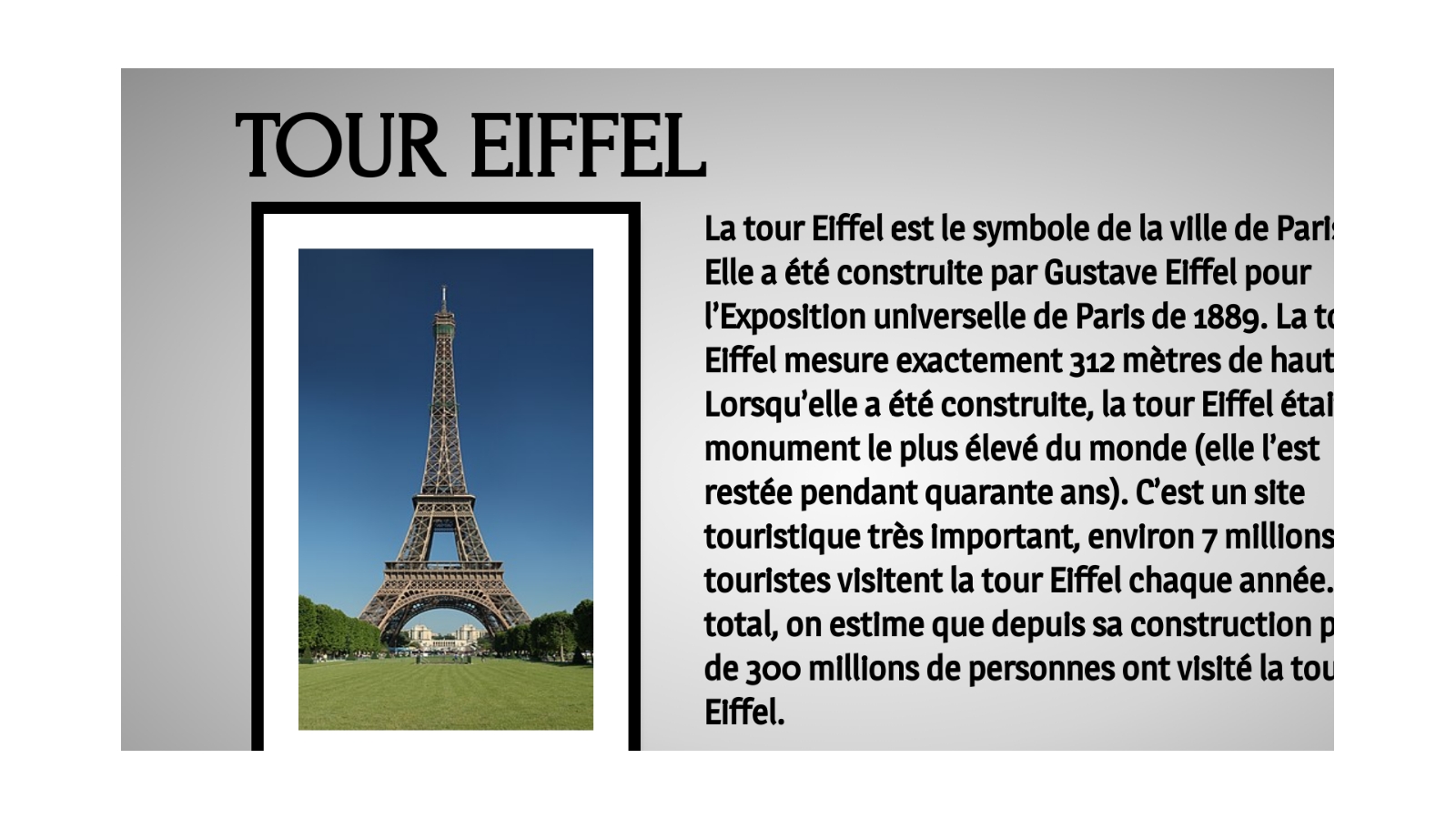

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025 -

Les Miserables Actors Consider Protest Against Trumps Kennedy Center Attendance

May 10, 2025

Les Miserables Actors Consider Protest Against Trumps Kennedy Center Attendance

May 10, 2025