Market Volatility: Uncertainty Surrounding US Finances Impacts Stocks

Table of Contents

Understanding Market Volatility and its Causes

Defining Market Volatility

Market volatility refers to the rate and extent of price fluctuations in the stock market. It signifies a degree of stock market instability, making it harder to predict future price movements. High volatility indicates significant price fluctuations in a short period, reflecting uncertainty and risk. Understanding market volatility is crucial for effective risk assessment.

- Volatility Indices (VIX): The VIX, or CBOE Volatility Index, is a popular measure of market expectations of near-term volatility. A higher VIX indicates higher expected volatility.

- Investor Sentiment: Volatility is closely tied to investor sentiment. Fear and uncertainty often drive increased volatility, while confidence tends to dampen it.

The Role of US Financial Uncertainty

Several factors contribute to US financial uncertainty and subsequent market volatility:

- Inflation: High inflation erodes purchasing power and increases uncertainty about future earnings, prompting investors to re-evaluate their holdings.

- Interest Rate Changes: Federal Reserve actions on interest rates significantly impact borrowing costs for businesses and consumers, influencing investment decisions and market sentiment. Rate hikes, especially, can trigger market sell-offs.

- Government Debt: High levels of national debt can raise concerns about the government's ability to meet its financial obligations, impacting investor confidence.

- Geopolitical Events: Global events such as wars, political instability, and trade disputes can introduce significant uncertainty into the market, leading to increased volatility.

Examples include the impact of the war in Ukraine on energy prices and global supply chains, contributing to inflation and market uncertainty. Similarly, rising interest rates in response to inflation can create significant volatility.

The Ripple Effect on Global Markets

The US economy's size and influence mean its financial instability can quickly spread globally. The interconnected nature of global markets means that events in the US often trigger volatility in other economies.

- Interdependence: Many global companies rely on the US market, making them susceptible to US economic downturns.

- Capital Flows: Investor reactions to US financial news often lead to rapid capital flows into or out of other markets.

- Currency Fluctuations: The US dollar's strength significantly influences global currency exchange rates, impacting international trade and investment.

For example, a significant drop in US stock prices can trigger sell-offs in other markets, as investors seek safer havens or fear contagion.

Impact of Market Volatility on Stock Prices

Short-Term vs. Long-Term Effects

Market volatility has different effects depending on the investment timeframe:

- Short-Term: Short-term investors (day traders, swing traders) may experience significant losses or gains during volatile periods, depending on their trading strategies. They often react more dramatically to price swings.

- Long-Term: Long-term investors tend to be less affected by short-term volatility. Their focus remains on long-term growth, enabling them to ride out market fluctuations.

Sectoral Impact

Market volatility doesn't affect all sectors equally:

- Technology: The tech sector, often associated with higher growth potential, tends to be more volatile than more established sectors.

- Energy: Energy prices are inherently volatile, influenced by global supply and demand dynamics, geopolitical events, and government policies.

- Healthcare: The healthcare sector is often considered less volatile, although specific companies within the sector may still experience significant price swings.

Assessing Investment Risk

Managing risk during periods of market volatility is paramount:

- Diversification: A diversified portfolio reduces risk by spreading investments across different asset classes (stocks, bonds, real estate, etc.).

- Hedging: Hedging strategies, like using options or futures contracts, can help protect against potential losses.

- Risk Tolerance: Understanding one's risk tolerance is crucial for making informed investment decisions, choosing strategies that align with their comfort level.

Strategies for Navigating Market Volatility

Diversification and Portfolio Management

- Asset Allocation: A well-defined asset allocation strategy should consider the investor's risk tolerance and financial goals.

- Asset Classes: Diversification across different asset classes helps to mitigate risk by reducing the impact of any single asset's poor performance.

- Rebalancing: Periodic portfolio rebalancing ensures the asset allocation aligns with the investor's risk profile.

Long-Term Investing Perspective

Maintaining a long-term perspective is crucial for weathering market storms:

- Stay Invested: Panic selling during periods of volatility is often counterproductive, leading to losses.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals helps mitigate the impact of market fluctuations.

- Emotional Discipline: Sticking to a well-defined investment plan despite market volatility is crucial for long-term success.

Seeking Professional Financial Advice

Seeking professional guidance from a financial advisor offers several benefits:

- Personalized Strategies: Financial advisors help create investment plans tailored to individual circumstances, risk tolerance, and financial objectives.

- Risk Management: They help assess and manage risks, ensuring a robust strategy to navigate market volatility.

- Objective Perspective: Advisors provide an objective viewpoint, helping investors avoid emotionally driven decisions during market fluctuations.

Conclusion

Market volatility, driven by uncertainty surrounding US finances, significantly impacts stock prices. Understanding the causes of this volatility, its effects on various sectors, and appropriate risk management strategies is crucial for investors. By diversifying portfolios, adopting a long-term perspective, and seeking professional financial advice, investors can navigate periods of market volatility more effectively. To learn more about managing your investments during periods of high market volatility and developing a robust financial plan, explore additional resources on investment strategies and market analysis. Don't let market volatility dictate your financial future; take control by planning strategically.

Featured Posts

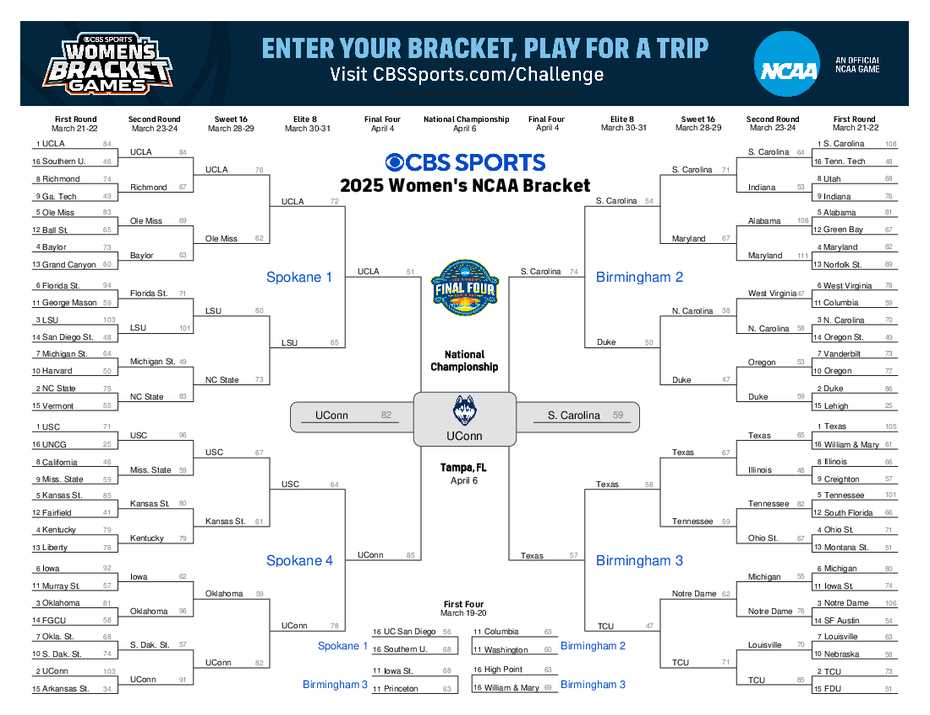

-

2025 Ncaa Tournament Bishop Englands Contribution To Louisvilles Dance

May 23, 2025

2025 Ncaa Tournament Bishop Englands Contribution To Louisvilles Dance

May 23, 2025 -

Bangladesh Vs Zimbabwe First Test Match Report

May 23, 2025

Bangladesh Vs Zimbabwe First Test Match Report

May 23, 2025 -

Family Honor Tradition Legacy The New Karate Kid Legends Trailer

May 23, 2025

Family Honor Tradition Legacy The New Karate Kid Legends Trailer

May 23, 2025 -

S Assurer Un Avenir Meilleur Grace A La Transformation De Maxine

May 23, 2025

S Assurer Un Avenir Meilleur Grace A La Transformation De Maxine

May 23, 2025 -

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Love

May 23, 2025

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Love

May 23, 2025

Latest Posts

-

Emissary Reveals Hamas Deception Witkoffs Account Of Events

May 23, 2025

Emissary Reveals Hamas Deception Witkoffs Account Of Events

May 23, 2025 -

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025 -

Witkoff Representative Alleges Hamas Fraud

May 23, 2025

Witkoff Representative Alleges Hamas Fraud

May 23, 2025 -

Witkoff Emissary Claims Hamas Deception

May 23, 2025

Witkoff Emissary Claims Hamas Deception

May 23, 2025 -

Ooredoo Qatar And Qtspbf Renewed Partnership For Future Growth

May 23, 2025

Ooredoo Qatar And Qtspbf Renewed Partnership For Future Growth

May 23, 2025