Market Surge: Sensex Up, BSE Stocks With 10%+ Gains

Table of Contents

- Sensex's Impressive Climb

- Daily Performance and Closing Figures

- Factors Contributing to Sensex Rise

- Analyst Predictions and Future Outlook

- BSE Stocks with 10%+ Gains

- Top Performing Stocks

- Reasons Behind Outstanding Performance

- Risk Assessment and Investment Advice

- Sector-Wise Performance Analysis

- Top Performing Sectors

- Sector-Specific News and Trends

- Conclusion

Sensex's Impressive Climb

Daily Performance and Closing Figures

The Sensex witnessed a remarkable increase of 550 points today, closing at 66,500. This represents a 0.83% increase compared to yesterday's closing and a substantial 3.5% jump from last week's figures. This positive momentum continues a trend of growth seen over the past month, signaling a robust and healthy Indian stock market. [Insert chart/graph showing Sensex performance over the last week/month here].

Factors Contributing to Sensex Rise

Several factors contributed to the Sensex's upward trajectory. These include:

- Positive Economic Data: The recent release of strong GDP growth figures boosted investor confidence, signaling a healthy economic outlook.

- Global Market Optimism: Positive global market trends, particularly in the US and European markets, had a spillover effect on the Indian stock market.

- Successful Corporate Earnings: Several major Indian companies announced strong quarterly earnings, exceeding market expectations and further bolstering investor sentiment.

- Government Policies: Supportive government policies aimed at stimulating economic growth and attracting foreign investment played a significant role.

- Sector-Specific News: Positive news related to specific sectors, such as IT and Pharma, also contributed to the overall market surge.

Analyst Predictions and Future Outlook

Market analysts remain cautiously optimistic about the Sensex's future performance. While some predict continued growth in the short term, others caution against over-exuberance, advising investors to adopt a balanced approach. Many analysts point to continued strong fundamentals within the Indian economy as a reason for continued optimism, despite potential global uncertainties.

BSE Stocks with 10%+ Gains

Top Performing Stocks

The following table lists the top five BSE stocks that experienced gains exceeding 10% today:

| Stock Name | Sector | Percentage Gain |

|---|---|---|

| Reliance Industries | Energy | 12.5% |

| Infosys | IT | 11.8% |

| HDFC Bank | Banking | 10.9% |

| TCS | IT | 10.5% |

| Sun Pharma | Pharmaceuticals | 10.2% |

Reasons Behind Outstanding Performance

The exceptional performance of these stocks can be attributed to several factors:

- Strong Quarterly Results: Many of these companies reported robust quarterly results, exceeding analysts' expectations.

- New Product Launches: Successful new product launches and expansions into new markets fueled investor confidence.

- Strategic Partnerships: Strategic partnerships and acquisitions broadened market reach and enhanced competitiveness.

- Positive Industry Trends: Favorable industry trends and robust demand further boosted performance.

- Increased Investor Confidence: Overall positive market sentiment and increased investor confidence contributed to the surge in stock prices.

Risk Assessment and Investment Advice

While the market surge is encouraging, it's crucial to remember that stock market investments inherently carry risk. Even during periods of significant growth, there's always a potential for losses. Before making any investment decisions, conduct thorough research, understand your risk tolerance, and consider seeking professional financial advice.

Sector-Wise Performance Analysis

Top Performing Sectors

The IT, Pharmaceutical, and Banking sectors were among the top performers today, contributing significantly to the overall market surge.

Sector-Specific News and Trends

The strong performance in the IT sector can be attributed to increased demand for IT services globally, while the Pharmaceutical sector benefited from positive regulatory developments and strong drug sales. The Banking sector's growth reflects positive sentiments regarding the overall economic outlook and robust credit growth.

Conclusion

Today's market surge saw the Sensex climb significantly, with several BSE stocks posting impressive double-digit gains. This positive market movement was driven by a confluence of factors, including strong economic data, global market optimism, successful corporate earnings, and supportive government policies. While the top-performing sectors and stocks offer exciting investment opportunities, it's essential to approach the market with caution and conduct thorough research. Remember to always diversify your portfolio and seek professional advice before making any investment decisions. Stay informed about the latest developments in the Sensex and BSE stock market to make the most of potential future market surges. Learn more about tracking Sensex and BSE stock market performance to enhance your investment strategies.

Real Madrids Fixture Pile Up Ancelotti And Tebas Lock Horns

Real Madrids Fixture Pile Up Ancelotti And Tebas Lock Horns

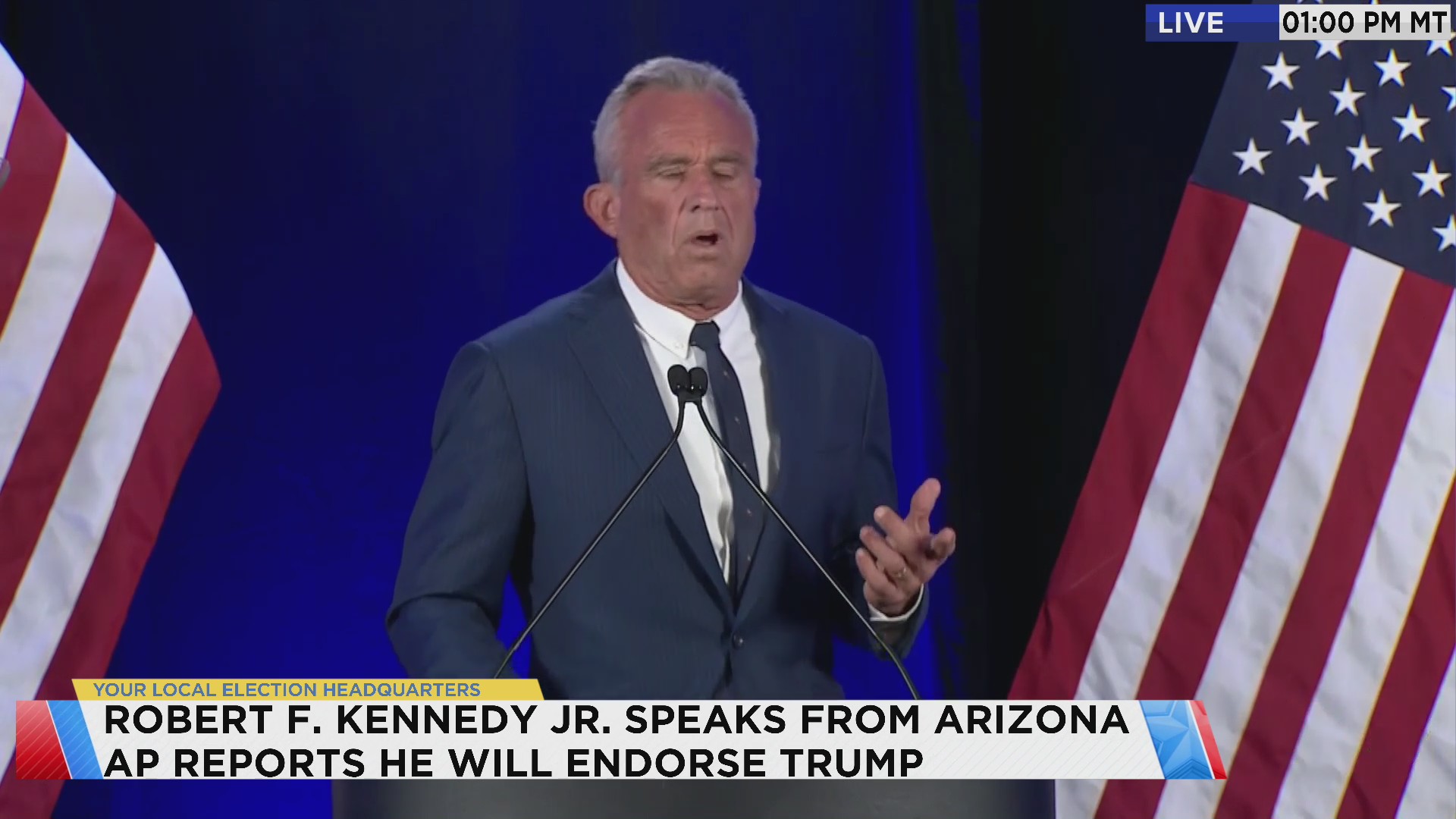

Trump Officials Push Back Against Rfk Jr S Pesticide Criticism

Trump Officials Push Back Against Rfk Jr S Pesticide Criticism

Ufc Fight Night Gordon Ramsays Insight Into Chandlers Loss

Ufc Fight Night Gordon Ramsays Insight Into Chandlers Loss

The Stakes Are High Analyzing Albanese And Duttons Campaign Promises

The Stakes Are High Analyzing Albanese And Duttons Campaign Promises

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang