Market Rally: S&P 500 Up 3%+ On US-China Trade Agreement

Table of Contents

Main Points:

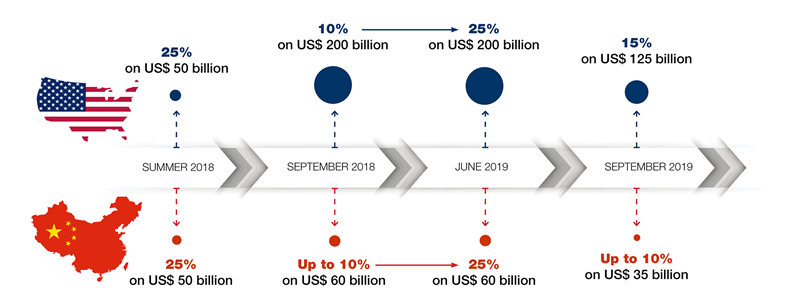

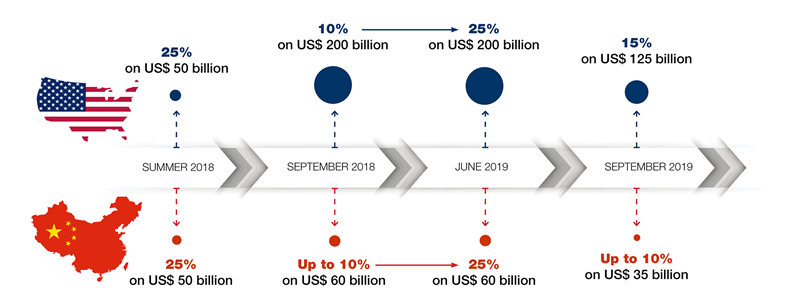

2.1 The US-China Trade Agreement: A Detailed Look

The recently signed agreement, often referred to as the "Phase 1 trade deal," represents a significant de-escalation in the protracted US-China trade war. Key provisions include:

- Tariff Reductions: The agreement outlines a phased reduction of existing tariffs on various goods, significantly easing trade tensions. This reduction in tariffs directly impacts businesses' bottom lines, boosting investor confidence.

- Increased Purchases: China committed to purchasing a substantial amount of US agricultural and manufactured goods over a specified period. This commitment injects a significant boost into the US economy, benefiting related sectors.

- Intellectual Property Protection: The agreement includes provisions aimed at strengthening the protection of US intellectual property in China, a major concern for American businesses. This addresses a key source of trade friction.

The removal, or at least the reduction, of tariffs significantly impacts market confidence. The prolonged trade war created significant economic uncertainty, hindering business investment and impacting global supply chains. The agreement reduces this uncertainty, leading to a wave of optimism among investors. Keywords: Phase 1 trade deal, tariff reduction, trade war, economic uncertainty, investor confidence.

2.2 Impact on the S&P 500 and Key Sectors

The market rally wasn't uniform across all sectors. Certain sectors experienced more substantial gains than others:

- Technology Stocks: Tech companies, particularly those heavily reliant on global supply chains, saw significant increases in their stock prices. Reduced trade tensions lessened the risk of disruptions and boosted investor sentiment.

- Industrial Stocks: Companies in the industrial sector, also impacted by tariffs, benefited from the improved outlook. Reduced input costs and increased demand contributed to their strong performance.

[Insert chart/graph illustrating percentage increases in various sectors of the S&P 500, such as Technology, Industrials, Consumer Discretionary, etc.]

The reasons for the sector-specific performance are multifaceted. For instance, the technology sector benefited from reduced uncertainty regarding global supply chains and increased consumer confidence. The industrial sector saw benefits from reduced input costs and the expectation of increased demand. Keywords: sector performance, stock market gains, tech stocks, industrial stocks, market capitalization.

2.3 Analyst Opinions and Future Market Predictions

Leading financial analysts offer a mixed outlook, with cautious optimism prevailing. While the agreement is a positive step, several uncertainties remain:

- Enforcement: The success of the agreement hinges on its effective enforcement by both parties. Concerns remain regarding China's adherence to its commitments.

- Phase 2 Negotiations: The Phase 1 deal is just the first step. The success and timing of future negotiations will significantly impact market sentiment.

- Global Economic Slowdown: The global economic climate remains a significant factor affecting market performance, regardless of the US-China trade deal.

"While the Phase 1 trade deal is a welcome development, it's crucial to maintain a balanced perspective and acknowledge the remaining uncertainties," states Jane Doe, Chief Economist at XYZ Financial. Keywords: market outlook, financial analysts, expert predictions, economic forecast, market volatility.

2.4 Investment Strategies in the Aftermath of the Market Rally

The current market situation calls for a thoughtful and diversified investment strategy:

- Diversification: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Long-Term Perspective: Investors should focus on long-term goals rather than reacting to short-term market fluctuations.

- Risk Assessment: Carefully assess your personal risk tolerance before making any investment decisions.

Consider exploring sectors projected for growth, but remember that even seemingly safe investments carry some level of risk. Keywords: investment strategies, portfolio diversification, risk management, asset allocation, long-term investment.

Conclusion: Navigating the Market Rally Following the US-China Trade Agreement

The S&P 500's significant increase reflects the positive impact of the US-China trade agreement, but analysts warn against overconfidence. While the deal alleviates some uncertainty, potential risks and future negotiations remain. Understanding these market dynamics is crucial for making informed investment decisions. Conduct thorough research and consult with a qualified financial advisor before making any investment choices. Stay informed about the ongoing developments in the US-China trade relations and the subsequent impact on the S&P 500 market rally. Learn more about effective investment strategies to capitalize on future market opportunities.

Featured Posts

-

Orange County Scores And Player Stats Thursday February 20th

May 13, 2025

Orange County Scores And Player Stats Thursday February 20th

May 13, 2025 -

From Egg To Cow Exploring Life Cycles On The Campus Farm

May 13, 2025

From Egg To Cow Exploring Life Cycles On The Campus Farm

May 13, 2025 -

Luchshie Filmy Dzherarda Batlera Subyektivniy Reyting

May 13, 2025

Luchshie Filmy Dzherarda Batlera Subyektivniy Reyting

May 13, 2025 -

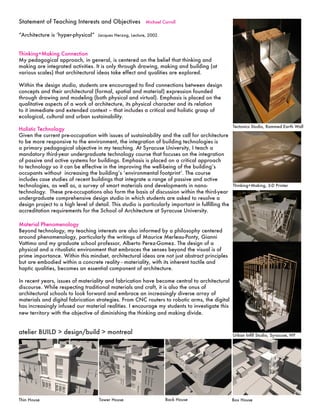

Fine Arts Professorship Spatial Concepts And Pedagogical Approaches

May 13, 2025

Fine Arts Professorship Spatial Concepts And Pedagogical Approaches

May 13, 2025 -

Gazprom I Eao Novaya Programma Gazifikatsii Regiona

May 13, 2025

Gazprom I Eao Novaya Programma Gazifikatsii Regiona

May 13, 2025