Market Analysis: D-Wave Quantum Inc. (QBTS) Stock Decline On Thursday

Table of Contents

Main Points: Understanding the QBTS Stock Plunge

2.1. Pre-Market Factors Affecting QBTS Stock Price

Several factors brewing before the market opened likely contributed to the negative sentiment surrounding QBTS stock on Thursday. These pre-market influences set the stage for the day's significant decline.

- Lack of Positive News: The absence of positive news or announcements regarding D-Wave Quantum, particularly concerning new contracts, technological breakthroughs, or partnerships, could have fueled investor apprehension. In the volatile tech sector, positive news is often crucial for maintaining investor confidence.

- Broader Market Trends: The overall tech sector experienced a downturn on Thursday, likely influenced by rising interest rates and concerns about inflation. This broader market trend negatively impacted many tech stocks, including QBTS, as investors adopted a more risk-averse stance.

- Analyst Downgrades (Potential): While no specific analyst downgrades were publicly reported before the market opened on this specific Thursday, the possibility of negative analyst sentiment circulating privately amongst institutional investors could have contributed to the early selling pressure. Such private information can significantly influence the actions of large investors.

- Interest Rate Hikes: The anticipation or announcement of further interest rate hikes by central banks can lead to a general sell-off in the stock market, especially affecting growth stocks like those in the quantum computing sector. This macroeconomic factor plays a significant role in investor sentiment.

2.2. Intraday Trading Activity and Volume Analysis

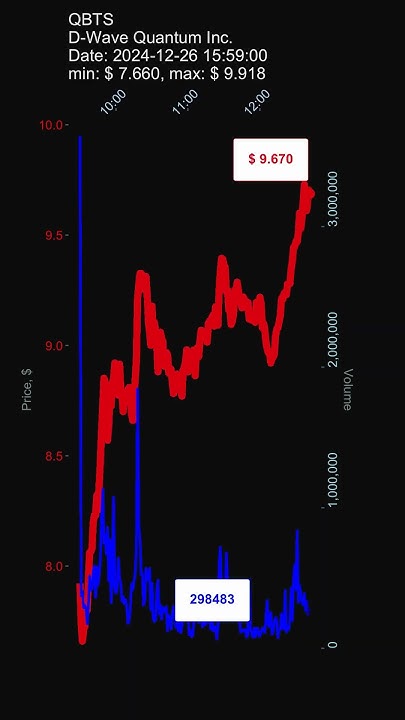

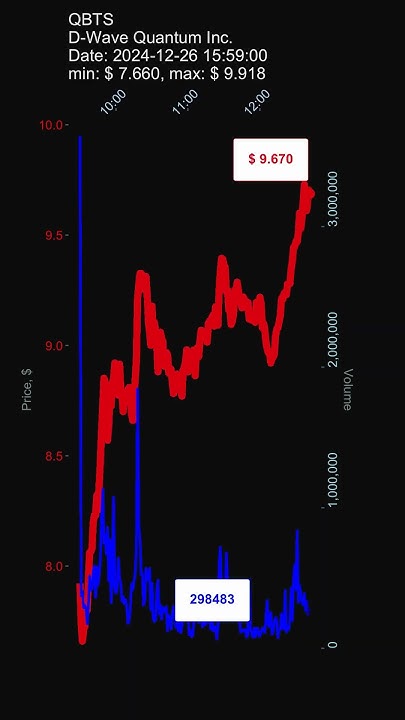

Analyzing the intraday trading patterns of QBTS stock on Thursday provides valuable insights into the intensity and timing of the selling pressure. High trading volume often accompanies significant price drops.

- Sharp Price Drops: The QBTS stock price likely experienced several sharp declines throughout the trading day, indicating significant selling pressure at specific times. Examining the intraday chart is crucial to identifying these periods of heightened volatility. A detailed QBTS stock chart for Thursday is necessary for precise analysis.

- Increased Trading Volume: A substantial increase in trading volume accompanied the price drops, suggesting a large number of investors were actively selling their QBTS shares. High volume confirms the significance of the price movement and isn't simply a result of minor fluctuations.

- Correlation with Market Indices: Observing the correlation between the QBTS stock price movements and major market indices (e.g., NASDAQ) on Thursday can help determine whether the decline was driven by company-specific factors or broader market trends.

- Visual Representation: Charts and graphs depicting the intraday QBTS stock price movement and trading volume are essential for a thorough understanding of the market dynamics. This visual representation clarifies the intensity and timing of the sell-off.

2.3. Potential Reasons for the QBTS Stock Decline

The QBTS stock decline on Thursday could be attributed to a combination of company-specific factors and broader market sentiment.

- Disappointing Earnings (Potential): While not explicitly mentioned in the prompt, the possibility of disappointing earnings reports or missed financial projections, if released around this time, would significantly impact investor confidence and likely trigger selling.

- Competitive Pressures: Increased competition in the burgeoning quantum computing market could also contribute to negative investor sentiment. New entrants or advancements by competitors might raise concerns about D-Wave Quantum's market share and future prospects.

- Negative Sentiment in Quantum Computing Sector: A general decline in investor confidence in the quantum computing sector as a whole could impact all companies within the industry, including D-Wave Quantum. Broader market anxieties can disproportionately affect emerging technologies.

- Lack of Significant Milestones: If D-Wave Quantum failed to meet anticipated milestones in its development roadmap, it could fuel uncertainty and lead investors to re-evaluate their holdings.

2.4. Technical Analysis of QBTS Stock Performance

Employing technical analysis tools provides further insight into the QBTS stock decline.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) helps determine the stock's short-term and long-term trends. A break below key moving average levels could indicate a bearish trend.

- RSI (Relative Strength Index): The RSI is a momentum indicator that helps assess whether the stock is overbought or oversold. An extremely low RSI could suggest the stock is oversold and may be poised for a rebound.

- Support and Resistance Levels: Identifying key support and resistance levels helps predict potential price reversals. A break below a significant support level often triggers further selling pressure.

- Chart Patterns: Examining chart patterns (e.g., head and shoulders, double top) can offer clues about future price movements. These patterns often provide early indications of potential market reversals or further declines.

Conclusion: Assessing the Future of D-Wave Quantum Inc. (QBTS) Stock

The QBTS stock decline on Thursday was likely a result of a confluence of factors, including broader market trends, potential company-specific news (or lack thereof), and prevailing sentiment within the quantum computing sector. While the short-term outlook for QBTS stock may remain uncertain, a thorough understanding of these underlying factors is crucial for informed investment decisions. Investors should conduct thorough market research, including fundamental and technical analysis, before making any investment decisions regarding QBTS stock. Remember, investing in volatile stocks like QBTS requires a higher risk tolerance and a well-defined investment strategy. Stay informed about D-Wave Quantum Inc. and its performance to make more informed choices. Conduct your own due diligence before investing in QBTS or any other quantum computing stock.

Featured Posts

-

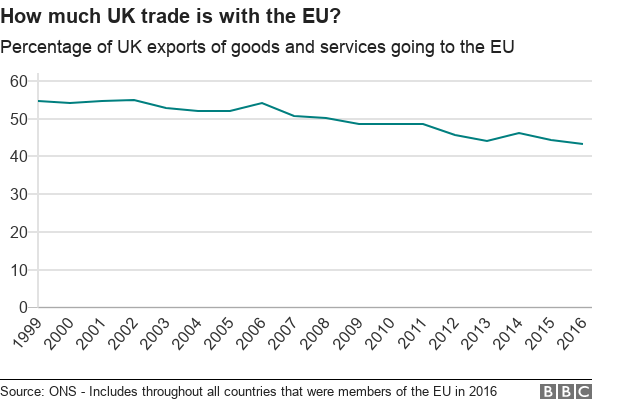

Brexits Impact Uk Luxury Goods Exports To The Eu

May 21, 2025

Brexits Impact Uk Luxury Goods Exports To The Eu

May 21, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025 -

Tyler Bate Back On Wwe Raw What To Expect

May 21, 2025

Tyler Bate Back On Wwe Raw What To Expect

May 21, 2025 -

Kane Absence Adds To Bayerns Bundesliga Frustration Following Leverkusen Defeat

May 21, 2025

Kane Absence Adds To Bayerns Bundesliga Frustration Following Leverkusen Defeat

May 21, 2025 -

Optimalisatie Van Uw Verkoopstrategie Voor Abn Amro Kamerbrief Certificaten

May 21, 2025

Optimalisatie Van Uw Verkoopstrategie Voor Abn Amro Kamerbrief Certificaten

May 21, 2025

Latest Posts

-

Racial Hatred Tweet Ex Tory Councillors Wifes Appeal Delayed

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wifes Appeal Delayed

May 22, 2025 -

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

May 22, 2025

Ex Councillors Wife Challenges Racial Hatred Tweet Conviction

May 22, 2025 -

Wife Of Ex Tory Councillor Appeals Conviction For Racist Tweet

May 22, 2025

Wife Of Ex Tory Councillor Appeals Conviction For Racist Tweet

May 22, 2025 -

Detroit Tigers 8 6 Victory Over Rockies A Deeper Look

May 22, 2025

Detroit Tigers 8 6 Victory Over Rockies A Deeper Look

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Latest

May 22, 2025