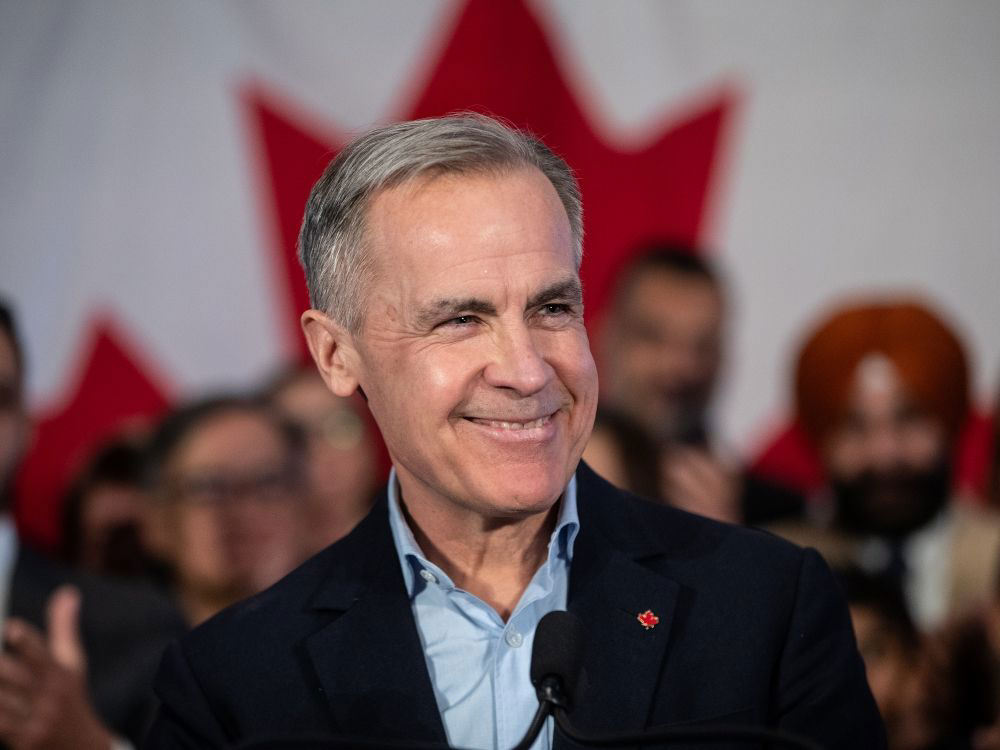

Mark Carney's White House Meeting With Trump: What To Expect

Table of Contents

Potential Topics of Discussion

The meeting between Mark Carney and President Trump promises to be a fascinating clash of perspectives on several crucial economic issues. Several key areas are likely to dominate the conversation.

Financial Regulation and the US Economy

Carney's expertise in financial regulation and his outspoken views on climate risk will likely be central to the discussion. Expect discussions around the stability of the US financial system, potential regulatory reforms, and the impact of current policies. The Trump administration's approach to deregulation may clash with Carney's emphasis on robust oversight.

- Stress testing: Discussions will likely involve the adequacy of current stress testing methodologies for assessing the resilience of US financial institutions to economic shocks.

- Capital requirements: The level of capital banks are required to hold is a critical point of contention, with differing views on the optimal balance between promoting lending and mitigating risk.

- Climate-related financial risks: Carney's strong advocacy for incorporating climate change risks into financial decision-making will be a key discussion point, potentially highlighting the vulnerability of the US financial system to climate-related events.

- Fintech regulation: The rapid growth of fintech companies presents both opportunities and challenges for regulators. The meeting could explore the need for a balanced regulatory approach to encourage innovation while protecting consumers.

Global Economic Outlook and Trade

The meeting will inevitably touch upon the global economic outlook, particularly in light of ongoing trade tensions and Brexit's lingering impact. Carney's insights on international trade, currency fluctuations, and global economic stability will be valuable, especially given his experience navigating the complexities of Brexit.

- Trade wars: The lingering effects of past trade disputes and the potential for future conflicts will likely be discussed, focusing on their impact on global growth and stability.

- Tariff impacts: The meeting could involve an analysis of the economic consequences of tariffs, examining their effects on both domestic industries and global supply chains.

- Global growth forecasts: Carney's perspective on global economic growth prospects, considering various factors such as geopolitical risks and technological advancements, will be valuable.

- The role of international institutions: Discussions could touch upon the importance of international cooperation and the role of organizations like the IMF and World Bank in addressing global economic challenges.

Climate Change and Sustainable Finance

Given Carney's strong advocacy for incorporating climate change risks into financial decision-making, this is a crucial area of potential discussion. The Trump administration's stance on climate change contrasts sharply with Carney's, potentially leading to a significant clash of viewpoints.

- ESG investing: The growing trend of Environmental, Social, and Governance (ESG) investing will likely be a topic of conversation, with differing perspectives on its impact on capital allocation and corporate behavior.

- Carbon pricing: Discussions on carbon pricing mechanisms and their effectiveness in incentivizing emissions reductions are likely, given the significant differences in approach between the two sides.

- Climate risk disclosure: The importance of transparent and comprehensive climate risk disclosure by companies will be a key area of discussion, with Carney likely advocating for stricter regulations.

- The green transition: The economic opportunities and challenges associated with the transition to a low-carbon economy will undoubtedly be debated, exploring the potential for job creation and economic disruption.

Possible Outcomes of the Meeting

While the meeting is unlikely to yield immediate policy changes, the exchange of views will have lasting implications.

Areas of Agreement

Despite significant policy differences, potential areas of agreement might focus on maintaining financial stability and promoting economic growth, albeit through different approaches.

- Importance of strong financial institutions: Both sides likely agree on the importance of maintaining a strong and resilient financial system, although their approaches to achieving this might differ.

- Need for economic growth: The pursuit of sustainable economic growth is a shared objective, although the strategies employed to reach this goal may vary significantly.

- Supporting free markets (with caveats): While both sides generally support free markets, they are likely to disagree on the extent of government intervention needed to correct market failures and address systemic risks.

Areas of Disagreement

Significant disagreements are anticipated on climate change policy, the role of regulation, and the handling of trade disputes.

- Differing views on climate change: The fundamental disagreement on the urgency and importance of addressing climate change will be a significant hurdle to overcome.

- Regulatory burdens on businesses: The Trump administration's focus on reducing regulatory burdens will likely contrast with Carney's emphasis on stronger oversight to mitigate systemic risks.

- Approach to international trade agreements: Differing approaches to international trade negotiations and the role of multilateral institutions will likely emerge as a point of contention.

Impact and Significance of the Meeting

The meeting's significance lies in its potential to shape public discourse on key economic issues and influence future policy debates. Carney's reputation and influence could lead to a reconsideration of certain policies, even if no immediate changes are implemented.

- Impact on public perception of climate risk: Carney's presence might raise public awareness of climate-related financial risks, influencing public opinion and potentially impacting future policy discussions.

- Potential influence on future regulatory decisions: While unlikely to directly lead to immediate regulatory changes, the meeting could shape future policy discussions and influence the direction of regulatory reform.

- Impact on US-UK relations: The meeting could symbolize a continued effort to maintain strong economic ties between the US and the UK, despite differing policy approaches.

Conclusion

Mark Carney's White House meeting with President Trump presents a unique opportunity to discuss critical issues facing the global and US economy. While areas of significant disagreement are likely, the meeting’s impact on financial regulation, climate policy, and international trade will be closely watched. Understanding the potential topics of discussion and possible outcomes is crucial for anyone following the trajectory of the global economy. Stay informed about the fallout from this pivotal Mark Carney White House meeting to gain insights into the future of global finance and policy. Continue to follow updates regarding the Mark Carney and Trump meeting for further developments.

Featured Posts

-

Re Examining Dumas The Count Of Monte Cristo A Critical Review

May 04, 2025

Re Examining Dumas The Count Of Monte Cristo A Critical Review

May 04, 2025 -

Analyzing The Opening Odds Ufc 314 Volkanovski Vs Lopes Main Event

May 04, 2025

Analyzing The Opening Odds Ufc 314 Volkanovski Vs Lopes Main Event

May 04, 2025 -

Ufc Des Moines Expert Fight Predictions And Analysis

May 04, 2025

Ufc Des Moines Expert Fight Predictions And Analysis

May 04, 2025 -

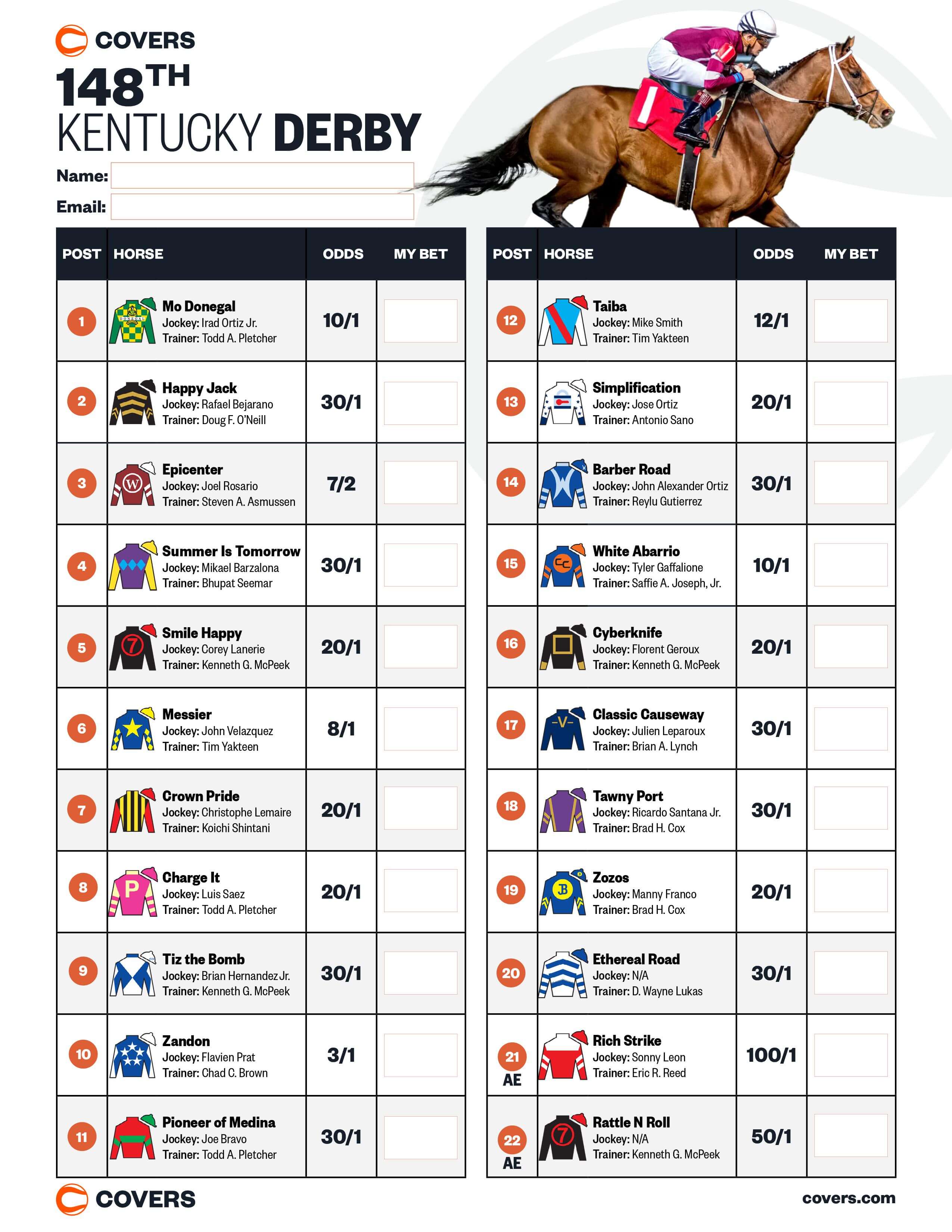

Predicting The 2025 Louisiana Derby Odds Horses To Watch And Kentucky Derby Outlook

May 04, 2025

Predicting The 2025 Louisiana Derby Odds Horses To Watch And Kentucky Derby Outlook

May 04, 2025 -

Bengal Heatwave Warning 4 Districts On High Alert

May 04, 2025

Bengal Heatwave Warning 4 Districts On High Alert

May 04, 2025