March 6th: QNB Corp's Presentation At The Virtual Banking Investor Conference

Table of Contents

Key Highlights from QNB Corp's Presentation

QNB Corp's March 6th virtual banking presentation provided a detailed look into the bank's performance and future outlook. Let's break down the key highlights.

Financial Performance Review

QNB Corp's financial results for [Insert Reporting Period, e.g., Q4 2023] showcased strong performance across key metrics.

-

Revenue Growth: QNB Corp reported a [Insert Percentage]% increase in revenue compared to the same period last year, reaching [Insert Amount] in total revenue. This growth reflects the bank's successful strategies in [Mention specific areas contributing to growth, e.g., retail banking, corporate lending]. This positive trend reinforces QNB's position as a leading financial institution. Analyzing QNB's financial results further reveals robust underlying performance.

-

Profitability: Net profit increased by [Insert Percentage]%, reaching [Insert Amount]. This signifies improved efficiency and strong risk management within the organization. The improved profitability is a key indicator of QNB's strength in the current competitive landscape. Understanding QNB's financial results provides insight into their future performance.

-

Asset Growth: Assets under management (AUM) experienced significant growth, reaching [Insert Amount], showcasing QNB Corp's expanding client base and successful investment strategies. The impressive asset growth highlights the confidence placed in QNB by both individual and institutional investors. The growth in assets reflects both organic growth and strategic acquisitions.

Strategic Initiatives and Future Outlook

QNB Corp outlined ambitious strategic initiatives to drive future growth and maintain its competitive edge.

-

Digital Transformation: QNB Corp emphasized its commitment to digital transformation, investing heavily in innovative technologies to enhance customer experience and operational efficiency. This includes significant investments in mobile banking applications, online platforms, and fintech integrations. The strategy focuses on providing seamless and secure digital banking experiences.

-

Expansion into New Markets: Plans were unveiled for expansion into new geographical markets, leveraging opportunities in [Mention specific regions or market segments]. The successful expansion into new markets will leverage existing partnerships and build on QNB's already strong international presence.

-

Sustainable Finance Initiatives: QNB Corp highlighted its dedication to sustainable finance, outlining its commitments to Environmental, Social, and Governance (ESG) principles. The bank emphasized investments in renewable energy projects and sustainable financing options. The initiative includes establishing clear ESG goals and reporting mechanisms.

Discussion on Market Trends and Challenges

QNB Corp addressed current market challenges and trends, demonstrating its proactive approach to risk management.

-

Interest Rate Volatility: The presentation acknowledged the impact of interest rate volatility on the banking sector and outlined QNB Corp's strategies to mitigate these risks. QNB's market analysis highlights the proactive nature of their risk-management strategies.

-

Geopolitical Uncertainty: The impact of geopolitical uncertainty was also discussed, along with QNB Corp's plans to navigate this challenging environment and protect its assets. Understanding the market's complexities enables QNB to strategically respond to changing circumstances.

-

Increased Competition: QNB Corp recognized the intensifying competition within the banking industry and highlighted its competitive advantages, including strong brand reputation, diverse product offerings, and robust customer relationships. This highlights QNB's long-term strategy for sustained growth.

Q&A Session Insights

The Q&A session provided valuable insights into investor concerns and QNB Corp's responses.

-

Investor focus on digital transformation: Investors showed strong interest in QNB Corp's digital transformation strategy, particularly regarding its impact on cost efficiency and customer acquisition. QNB Corp clarified its progress and future plans regarding this strategy.

-

Questions on risk management: Concerns surrounding geopolitical risks and interest rate fluctuations were addressed, demonstrating QNB Corp's transparency and proactive risk management approach. The answers highlighted QNB's comprehensive risk management framework and its ability to navigate the challenges effectively.

Importance of QNB Corp's Participation in the Virtual Banking Investor Conference

QNB Corp's participation in the virtual banking investor conference was crucial for several reasons. The event provided a platform to:

-

Showcase QNB Corp's achievements: The presentation highlighted the bank's strong financial performance and strategic initiatives.

-

Enhance investor relations: Direct engagement with investors fostered transparency and strengthened investor confidence.

-

Reach a wider audience: The virtual format allowed QNB Corp to connect with a broader investor base globally.

Conclusion: Recap and Call to Action

QNB Corp's presentation at the virtual banking investor conference on March 6th delivered positive news regarding its financial performance, strategic direction, and commitment to innovation. Key announcements included robust revenue and profit growth, ambitious digital transformation plans, and a proactive approach to market challenges. The Q&A session further cemented investor confidence in QNB Corp's vision and leadership.

To learn more about QNB Corp's presentation and its future plans, we encourage you to visit their investor relations page [Insert Link to QNB Corp Investor Relations Page] and explore their latest press releases [Insert Link to Press Releases]. Stay updated on QNB's progress and explore the detailed information available on their website [Insert Link to QNB Corp Website]. Learn more about QNB Corp's commitment to innovative virtual banking solutions.

Featured Posts

-

Turnuvaya Katilacak Eski Doktor Yeni Boksoer

Apr 30, 2025

Turnuvaya Katilacak Eski Doktor Yeni Boksoer

Apr 30, 2025 -

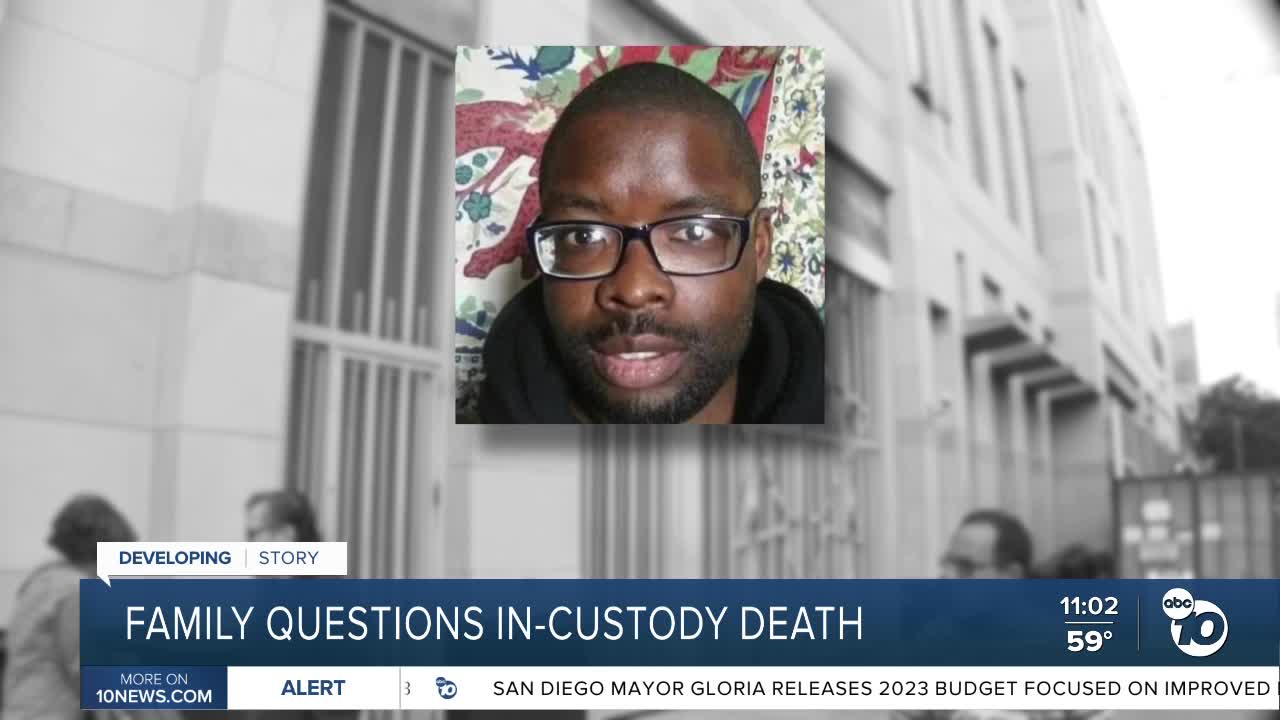

Inmates Death In San Diego County Jail Prompts Family Lawsuit Alleging Torture And Murder

Apr 30, 2025

Inmates Death In San Diego County Jail Prompts Family Lawsuit Alleging Torture And Murder

Apr 30, 2025 -

Trumps Congressional Speech Early Presidency Accountability

Apr 30, 2025

Trumps Congressional Speech Early Presidency Accountability

Apr 30, 2025 -

Spds Coalition Path In Germany Addressing Youth Discontent

Apr 30, 2025

Spds Coalition Path In Germany Addressing Youth Discontent

Apr 30, 2025 -

Ru Pauls Drag Race Live 1000th Show A Las Vegas Celebration Streamed Worldwide

Apr 30, 2025

Ru Pauls Drag Race Live 1000th Show A Las Vegas Celebration Streamed Worldwide

Apr 30, 2025