Major XRP Whale Acquisition: 20 Million Tokens And Market Implications

Table of Contents

The Identity and Impact of the XRP Whale

Uncovering the identity of the mysterious XRP whale behind this colossal acquisition is proving to be a significant challenge. The anonymity inherent in many cryptocurrency transactions makes pinpointing the buyer difficult. This lack of transparency raises questions about the buyer's motivations.

-

Speculative Motivations: Is this a long-term investment strategy by a seasoned investor who believes in XRP's long-term potential? Or is it a short-term speculative play, aiming to capitalize on anticipated price increases? Another possibility, albeit a controversial one, is market manipulation. A large purchase like this could be designed to artificially inflate the price, allowing the whale to profit from subsequent sales.

-

Influence on Market Capitalization: The acquisition of 20 million XRP represents a substantial portion of the daily trading volume, significantly impacting XRP's market capitalization. This level of influence can sway market sentiment and potentially drive price movements. Analyzing the XRP whale wallet activity is crucial to understand the full scope of this influence.

-

Historical Impact of Large Acquisitions: History shows that large XRP acquisitions often precede periods of increased price volatility. While not always directly causal, such events often trigger a wave of buying and selling, creating short-term price swings. Chart analysis from past similar events would be informative here, although specific data requires extensive research and is beyond the scope of this article. Finding reliable resources for historical XRP price data linked to whale activity is key to confirming this impact.

Market Reactions and Price Volatility

The immediate market reaction to the news of the 20 million XRP acquisition was a noticeable surge in trading volume. The price of XRP experienced a significant, albeit temporary, increase in the hours following the news. This initial jump highlights the market's sensitivity to large-scale transactions.

-

Short-Term and Long-Term Effects: While the initial price jump was substantial, its long-term effects remain uncertain. Sustained price increases depend on a multitude of factors, including overall market sentiment, regulatory developments, and continued investor confidence.

-

FUD vs. FOMO: The acquisition generated a mix of fear, uncertainty, and doubt (FUD) among some investors and a fear of missing out (FOMO) among others. This psychological tug-of-war significantly impacts trading decisions and the overall market sentiment. Understanding this dynamic is crucial for navigating the volatile XRP market.

-

Trading Volume Changes: As mentioned, the trading volume spiked considerably after the news broke, indicating heightened investor interest and activity. Analyzing these volume changes provides insight into the market's response to the whale's actions. Tracking this data will be crucial in future analysis.

Ripple's Legal Battle and its Influence

The ongoing SEC lawsuit against Ripple Labs continues to cast a shadow over XRP's future. The 20 million XRP acquisition occurs amidst this legal uncertainty, raising questions about its implications for the case.

-

Court Perception: The acquisition might be viewed differently by the court. Some could interpret it as a vote of confidence in XRP's future, while others may see it as a potential attempt to manipulate the market. The court's interpretation will heavily influence the overall trajectory of the XRP price.

-

Impact of Court Ruling: A favorable ruling could significantly boost XRP's price and investor confidence. Conversely, an unfavorable ruling could severely damage XRP's reputation and cause a drastic price drop. This uncertainty makes the situation volatile and unpredictable.

-

Uncertainty and Investor Confidence: The ongoing legal battle contributes to the uncertainty surrounding XRP's future, affecting investor confidence and creating market volatility. Clear regulatory clarity is needed to stabilize the market.

Technical Analysis of XRP Chart Patterns (Optional)

(This section would include charts and technical analysis based on available real-time data. This would involve analyzing support and resistance levels, moving averages, and other indicators to interpret the chart patterns in light of the whale acquisition. For example, one might look for confirmation of the price increase on a particular moving average.)

Conclusion

The recent acquisition of 20 million XRP tokens by a major whale has undeniably shaken up the cryptocurrency market. Its impact on XRP's price and market sentiment is substantial, although the long-term consequences remain uncertain. The ongoing Ripple lawsuit further complicates the picture, highlighting the considerable regulatory uncertainty surrounding XRP. To summarize, this situation underscores the volatility of the cryptocurrency market and the significant influence major players (“whales”) wield.

To stay informed about the unfolding situation, continue to monitor XRP whale activity and market trends closely. Regularly review resources specializing in XRP price analysis and market predictions to stay updated on this dynamic and ever-evolving market. By diligently monitoring XRP and understanding its market dynamics, investors can make more informed decisions. Keep a close eye on the XRP market and continue your research on XRP whale activity and market implications!

Featured Posts

-

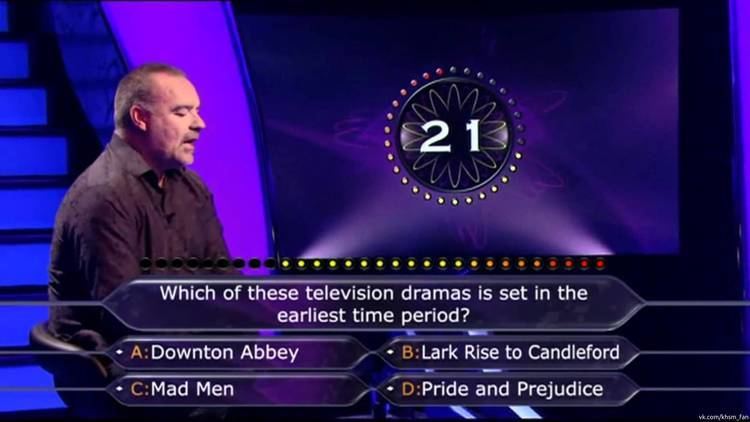

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025 -

Svedska Nhl Dominance Na Ms Hokeji Analyza Slozeni Tymu

May 07, 2025

Svedska Nhl Dominance Na Ms Hokeji Analyza Slozeni Tymu

May 07, 2025 -

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025 -

The Evolution Of Who Wants To Be A Millionaire Celebrity Specials A Comprehensive Look

May 07, 2025

The Evolution Of Who Wants To Be A Millionaire Celebrity Specials A Comprehensive Look

May 07, 2025 -

The Karate Kid Exploring The Films Enduring Popularity

May 07, 2025

The Karate Kid Exploring The Films Enduring Popularity

May 07, 2025

Latest Posts

-

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025 -

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

Nuggets Vs Bulls De Andre Jordan Achieves Nba Milestone

May 08, 2025

Nuggets Vs Bulls De Andre Jordan Achieves Nba Milestone

May 08, 2025 -

De Andre Jordans Nba History Making Night Nuggets Bulls Game

May 08, 2025

De Andre Jordans Nba History Making Night Nuggets Bulls Game

May 08, 2025 -

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Performance Nuggets Vs Bulls

May 08, 2025