Major Saudi Regulatory Shift: Unlocking A Booming ABS Market

Table of Contents

New Regulations Driving ABS Market Growth in Saudi Arabia

The recent surge in the Saudi Arabia ABS market is directly attributable to proactive regulatory reforms. These reforms have significantly improved the environment for securitization, attracting both domestic and international investors. Key regulatory changes include:

-

Amendments to the Securitization Law: The updated legislation provides a clearer and more streamlined framework for securitization transactions, reducing ambiguity and accelerating the process. This simplification has been instrumental in boosting investor confidence and attracting new players to the market.

-

New Licensing Frameworks: The introduction of clearer licensing frameworks for institutions involved in the ABS market (e.g., credit rating agencies, trustees) has enhanced transparency and accountability, further bolstering investor trust. This reduces uncertainty and promotes greater participation.

-

Changes in Capital Requirements: Adjustments to capital requirements for banks and other financial institutions involved in ABS transactions have freed up capital, allowing them to engage more actively in securitization activities. This has increased the volume of ABS issuance available in the market.

-

Government Incentives: The Saudi Arabian government has implemented several incentives to encourage ABS issuance, including tax breaks and other financial support for qualifying transactions. This active governmental support plays a significant role in the growth of the "Saudi Arabia securitization" market.

These "regulatory reforms" have had a profound impact on market liquidity and investor confidence, creating a more favorable environment for "ABS issuance Saudi Arabia." The improved regulatory framework has led to a significant increase in the volume and value of ABS transactions, signaling a healthy and growing market.

Types of Assets Driving the Saudi ABS Boom

The Saudi ABS boom is fueled by a diverse range of underlying assets, reflecting the Kingdom's dynamic economy. Several asset classes are driving this growth:

-

Saudi Mortgage-Backed Securities (MBS): The burgeoning real estate sector in Saudi Arabia is providing a robust pipeline of mortgage loans suitable for securitization. Growth in this area is expected to continue as the Saudi government invests heavily in infrastructure and housing projects.

-

Auto Loan ABS Saudi Arabia: The increasing popularity of car ownership in the Kingdom is driving significant growth in the auto loan ABS market. This asset class presents a relatively low-risk investment opportunity with steady returns.

-

Credit Card Receivables: The expanding consumer credit market presents another major source of underlying assets for ABS transactions. This sector reflects the increased spending power of Saudi consumers.

-

Other Asset Classes: Other assets, such as consumer loans and receivables from various sectors are also contributing to the growth of the "asset classes Saudi Arabia" used for ABS issuance.

Each asset class presents a unique risk profile, requiring careful due diligence and risk assessment. However, the overall diversity of underlying assets contributes to the resilience and stability of the Saudi ABS market. Understanding the "risk profiles" associated with each asset type is crucial for informed investment decisions.

Increased Investor Participation and Foreign Investment in Saudi ABS

The Saudi ABS market is attracting significant interest from both domestic and foreign investors. Several factors are contributing to this increased participation:

-

Higher Returns: Compared to other investment options, Saudi ABS offer potentially higher returns, attracting investors seeking attractive yields. The relatively new nature of the market offers potentially higher yields while also offering diversification benefits.

-

Increased Investor Confidence: The regulatory reforms and improved transparency have significantly increased investor confidence, leading to greater participation in the market. This increased confidence is attracting foreign capital to a wider range of ABS opportunities.

-

Institutional Investors: Major institutional investors, including pension funds, insurance companies, and sovereign wealth funds, are actively participating in the Saudi ABS market, further bolstering its growth and liquidity. This demonstrates the attractiveness of the market in the eyes of significant institutional investors.

-

Foreign Investment in Saudi Arabia: The Kingdom's economic diversification strategy is attracting significant foreign direct investment (FDI), a portion of which is flowing into the ABS market. This increases the demand for and depth of the market, creating opportunities for both foreign and domestic investors.

This increased participation strengthens market depth and liquidity, creating a more robust and sustainable ABS market in Saudi Arabia.

Challenges and Opportunities for the Future of Saudi ABS Market

Despite the impressive growth, challenges remain for the Saudi ABS market:

-

Standardization of Processes: Further standardization of processes and documentation would enhance efficiency and attract greater investor participation. This includes developing clear and consistent standards for the documentation and securitization of asset types.

-

Development of a Robust Secondary Market: The development of a liquid secondary market for Saudi ABS is crucial to enhance liquidity and provide investors with exit strategies. The creation of secondary markets will help reduce risk and attract more investors.

-

Addressing Potential Risks: Thorough risk assessment and management are essential to mitigate potential risks associated with different asset classes and market volatility. A proactive approach to mitigating risks will build confidence and encourage continued growth.

However, significant opportunities also exist:

-

Product Diversification: Further diversification of products and underlying assets will expand the market's appeal and attract a wider range of investors. Innovation and creativity will drive the development of new and exciting ABS products.

-

Further Regulatory Improvements: Continued regulatory improvements and simplification will further enhance investor confidence and accelerate market growth. Ongoing improvements and refinements will allow the market to mature and become even more attractive to investors.

-

Technological Advancements: Embracing technological advancements, such as blockchain technology, could further streamline processes and improve efficiency within the Saudi ABS market. The use of new technologies will make the market more competitive, transparent, and efficient.

The "future of Saudi ABS" is bright, promising continued growth and innovation. Addressing these challenges and capitalizing on the opportunities will be key to unlocking the full potential of the Saudi ABS market.

Conclusion: Major Saudi Regulatory Shift: Unlocking a Booming ABS Market

The significant regulatory shifts in Saudi Arabia have unlocked tremendous potential within the Kingdom's ABS market. New legislation, improved licensing frameworks, and government incentives have created a favorable environment for growth. The diversification of underlying assets, increased investor participation (both domestic and foreign), and higher returns have fueled this remarkable expansion. While challenges remain, such as standardization and developing a robust secondary market, the opportunities for future growth are substantial. To learn more about investment opportunities in this exciting sector, explore resources dedicated to understanding the opportunities in the Saudi ABS sector. Invest in Saudi ABS and be a part of this dynamic and rapidly growing market! Explore Saudi Arabia's asset-backed securities market and understand the potential for significant returns.

Featured Posts

-

The Psychology Of Misinformation Cnns Perspective

May 03, 2025

The Psychology Of Misinformation Cnns Perspective

May 03, 2025 -

Fortnite Refund Hints At Cosmetic Changes

May 03, 2025

Fortnite Refund Hints At Cosmetic Changes

May 03, 2025 -

Fortnite Refund Indicates Potential Overhaul Of Cosmetic System

May 03, 2025

Fortnite Refund Indicates Potential Overhaul Of Cosmetic System

May 03, 2025 -

School Closings And Trash Pickup Issues Fridays Winter Weather Challenges

May 03, 2025

School Closings And Trash Pickup Issues Fridays Winter Weather Challenges

May 03, 2025 -

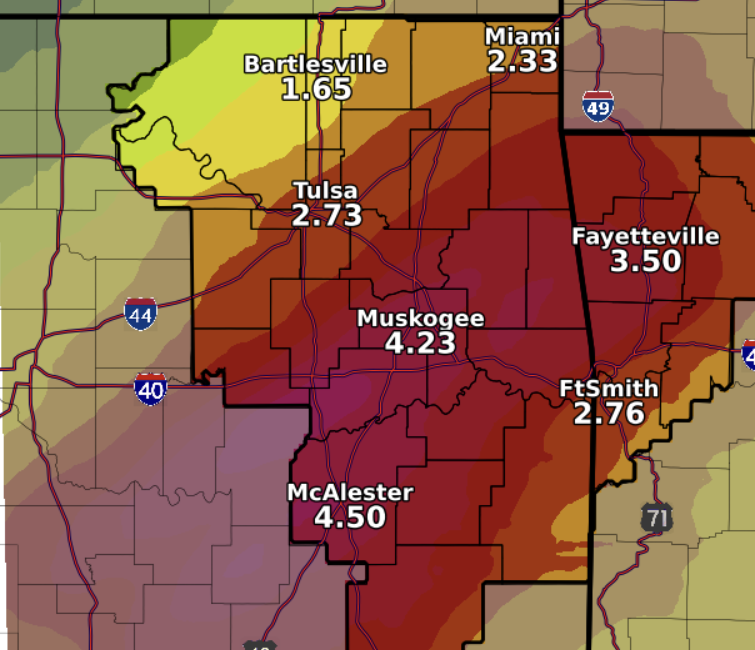

Severe Weather Alert Nws Tulsa Predicts Near Blizzard Conditions

May 03, 2025

Severe Weather Alert Nws Tulsa Predicts Near Blizzard Conditions

May 03, 2025