Major Crypto Purchase: Strategy Invests $555.8 Million In Bitcoin

Table of Contents

The Significance of Strategy's Bitcoin Investment

Strategy's $555.8 million Bitcoin investment carries profound implications for the cryptocurrency market. Such a large-scale purchase directly increases the demand for Bitcoin, potentially driving up its price. This demonstrates a significant vote of confidence in Bitcoin's long-term potential, influencing market sentiment and boosting investor confidence. Many analysts had already predicted a bullish trend for Bitcoin in the coming years, and this massive investment adds significant weight to those predictions. The injection of such a substantial sum into the Bitcoin market could accelerate the price appreciation many experts have forecast.

- Increased Bitcoin demand: The sheer scale of the purchase creates immediate upward pressure on Bitcoin's price due to increased demand.

- Potential price appreciation: Analysts anticipate a significant price increase following such a substantial investment, influencing short-term and long-term market trends.

- Boost to institutional investor confidence in Bitcoin: This major crypto purchase acts as a powerful endorsement, encouraging other institutions to consider similar investments and further legitimizing Bitcoin in the financial world.

Analyzing Strategy's Investment Strategy

Understanding the rationale behind Strategy's decision requires examining its broader investment strategy. Several motivations are plausible. Diversification into alternative assets like Bitcoin is a key strategy for mitigating risk in a volatile market. The long-term growth potential of Bitcoin, as many predict, likely played a significant role. We need to further investigate Strategy's overall investment portfolio to fully understand Bitcoin's role within its risk management and asset allocation framework.

- Risk tolerance assessment: A major investment like this suggests a high risk tolerance and a long-term outlook on Bitcoin’s potential.

- Diversification strategies employed: This large Bitcoin purchase is likely part of a wider diversification plan to reduce dependence on traditional assets.

- Long-term investment horizon: The magnitude of the investment implies a long-term commitment to Bitcoin, rather than a short-term speculative play.

- Potential for future Bitcoin investments: This substantial purchase could signal further investments in Bitcoin by Strategy in the future, further cementing their position in the crypto market.

Market Reactions and Future Outlook for Bitcoin

The announcement of Strategy's $555.8 million Bitcoin investment immediately caused ripples in the cryptocurrency market. The price of Bitcoin experienced a noticeable surge in the immediate aftermath of the news, reflecting the positive market sentiment surrounding the investment. Expert opinions and predictions on Bitcoin's future performance vary, but generally show a positive outlook, influenced by this significant institutional involvement. However, inherent risks and uncertainties remain, including regulatory changes and overall market volatility.

- Price fluctuations following the announcement: A significant price increase immediately followed the news, although price volatility is expected to continue.

- Analyst forecasts and predictions: Many analysts have revised their Bitcoin price predictions upward following this major crypto purchase.

- Potential regulatory changes impacting Bitcoin: Regulatory uncertainty remains a risk factor for Bitcoin, though increasing institutional adoption may lead to greater regulatory clarity.

- Long-term price prediction analysis: Long-term projections for Bitcoin remain positive, driven in part by this sizable institutional investment.

Comparing this Bitcoin Purchase to Other Large Institutional Investments

To contextualize Strategy's investment, comparing it to other significant institutional Bitcoin purchases is crucial. Several large firms have already invested heavily in Bitcoin, reflecting a growing trend of institutional adoption. While the specific investment strategies and reasons may differ, the overall trend showcases a growing acceptance of Bitcoin as a valuable asset class.

- List of other major institutional Bitcoin investments: [Insert a list of notable institutional Bitcoin investments here with links to sources if available].

- Comparison of investment sizes and strategies: Analysis should compare the size of the investment, the investment timing, and the rationale behind each decision.

- Analysis of the overall trend of institutional Bitcoin adoption: This trend demonstrates a shift in the perception of Bitcoin, moving away from solely speculative asset to a more legitimate investment option for institutions.

Conclusion: The Impact of Major Crypto Purchases and Future Implications

Strategy's $555.8 million Bitcoin investment represents a pivotal moment in the cryptocurrency market. This major crypto purchase not only significantly impacts Bitcoin's price but also serves as a powerful signal of growing institutional confidence in Bitcoin's long-term potential. The market's positive reaction and analysts' revised predictions underscore the investment's significance. However, investors must remain aware of inherent risks and volatility. Stay tuned for more updates on major crypto purchases and their impact on the market. Learn more about the evolving landscape of Bitcoin investment and other cryptocurrencies to make informed decisions in this dynamic market.

Il Cardinale Becciu Condannato A Risarcire 40 000 Euro

Il Cardinale Becciu Condannato A Risarcire 40 000 Euro

For Sale Established Farmers And Foragers Business In Charlottes Old Lantern Barn

For Sale Established Farmers And Foragers Business In Charlottes Old Lantern Barn

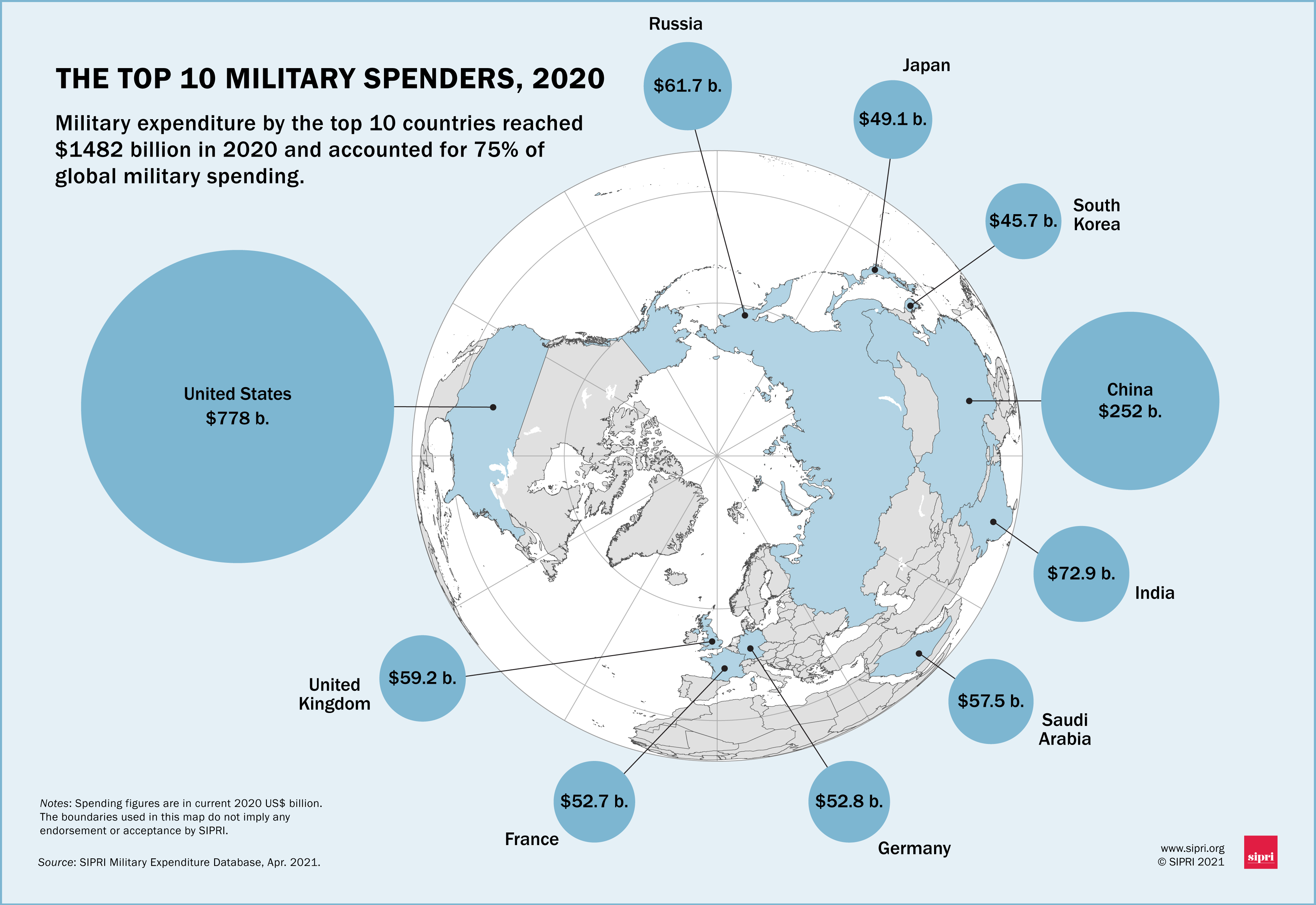

Global Military Spending Europes Response To The Russian Threat

Global Military Spending Europes Response To The Russian Threat

60 Million F 35 C Lost Overboard From Us Navy Aircraft Carrier

60 Million F 35 C Lost Overboard From Us Navy Aircraft Carrier

Naacp Image Awards 2024 Beyonce Blue Ivy And Kendrick Lamars Big Night

Naacp Image Awards 2024 Beyonce Blue Ivy And Kendrick Lamars Big Night