LVMH Shares Plunge 8.2% Following Disappointing Q1 Sales

Table of Contents

Q1 Sales Figures and Market Expectations

LVMH's released Q1 2024 sales figures fell short of analyst expectations and previous year's performance, triggering the substantial share price drop. While the company hasn't disclosed precise figures for all categories yet, early reports indicate a significant shortfall. This underperformance raises serious questions about the overall health of the luxury goods market.

- Specific Sales Figures (Preliminary): While complete breakdowns are pending, initial reports suggest that overall revenue growth was significantly lower than anticipated, with some key product categories experiencing declines.

- Percentage Changes: Compared to Q1 2023, early estimates point to a single-digit percentage decrease in overall revenue, a sharp contrast to the robust growth seen in previous years. This represents a substantial deviation from the positive growth trajectory LVMH had maintained.

- Geographic Performance: While some regions may have shown resilience, others, particularly those heavily impacted by economic slowdown, likely contributed to the overall disappointing results.

- Analyst Forecasts: Prior to the announcement, analysts had predicted a more optimistic growth scenario for LVMH. The actual figures prompted immediate downward revisions of earnings estimates and stock price targets across the board.

Factors Contributing to the Decline in LVMH Share Price

The decline in LVMH's share price is attributable to a confluence of factors, highlighting the complex challenges facing the luxury goods sector. Macroeconomic headwinds are playing a significant role, impacting consumer spending and investor confidence.

- Macroeconomic Pressures: Inflation, rising interest rates, and geopolitical uncertainty are all contributing to reduced consumer spending power, particularly in the discretionary luxury goods sector. These factors have created a more cautious environment for luxury purchases.

- Changing Consumer Habits: Consumers are increasingly discerning and prioritizing value, potentially shifting their spending towards experiences rather than high-priced goods. This shift demands a strategic response from luxury brands.

- Supply Chain Disruptions: Lingering supply chain issues, though less acute than in previous years, still contribute to production constraints and increased costs, impacting profitability.

- Increased Competition: The luxury market is fiercely competitive, with emerging brands challenging established players like LVMH. This competitive landscape necessitates constant innovation and adaptation.

The Impact on Specific LVMH Brands

The impact of the disappointing Q1 results is not uniform across all LVMH brands. Some brands may have been more severely affected than others, necessitating brand-specific strategies for recovery.

- Brand-Specific Performance: While precise figures are still awaited, it's expected that the performance variation between brands will be significant. Some brands may have shown greater resilience than others, offering valuable insights into evolving consumer preferences.

- Brand Challenges and Opportunities: Certain brands might be better positioned to navigate the current economic climate, while others may need to undertake significant strategic adjustments.

- Marketing and Product Strategies: LVMH will likely adapt its marketing campaigns and product launches to better resonate with the current consumer sentiment and purchasing power.

Analyst Reactions and Future Outlook for LVMH

The market reacted swiftly to LVMH's Q1 results, with analysts expressing mixed reactions and revising their future outlook.

- Analyst Reactions: Several leading financial analysts have downgraded their price targets for LVMH stock, reflecting the concerns surrounding the company's performance and the broader luxury market outlook.

- Revised Price Targets: The immediate consequence of the disappointing results was a widespread reduction in the price targets set by analysts for LVMH shares.

- Long-Term Growth Prospects: Despite the setback, many analysts maintain a positive long-term outlook for LVMH, citing the brand's strong global presence and resilient customer base. However, the path to recovery will require strategic adaptation.

Conclusion

The 8.2% plunge in LVMH shares following its disappointing Q1 sales reflects the growing challenges facing the luxury goods sector. The combination of macroeconomic headwinds and shifting consumer behavior has created uncertainty, leading to investor apprehension. While the long-term prospects for LVMH remain positive, the company must adapt to the evolving market landscape. Further analysis is needed to understand the full extent of the impact on LVMH's financial health and strategy.

Call to Action: Stay informed about the latest developments in the luxury goods market and LVMH's performance by following our ongoing coverage of LVMH share prices and the evolving luxury sector. Keep up to date with further analyses of LVMH's financial performance and their impact on the wider luxury market.

Featured Posts

-

The Phones Silent Ring My Story Of Unrequited Love

May 24, 2025

The Phones Silent Ring My Story Of Unrequited Love

May 24, 2025 -

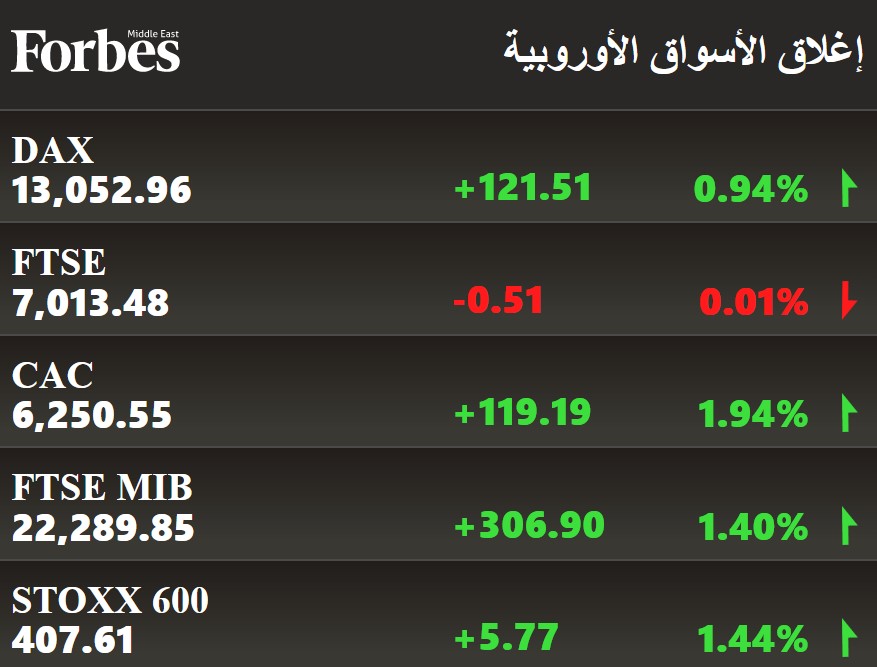

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025 -

Neal Mc Donoughs Last Rodeo Discussing Bull Riding And His Role As The Pope

May 24, 2025

Neal Mc Donoughs Last Rodeo Discussing Bull Riding And His Role As The Pope

May 24, 2025 -

Novo Ferrari 296 Speciale Experiencia De Conducao Com 880 Cv Hibridos

May 24, 2025

Novo Ferrari 296 Speciale Experiencia De Conducao Com 880 Cv Hibridos

May 24, 2025 -

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

Latest Posts

-

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025 -

New Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025

New Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025 -

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025 -

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025

Kyle Walker And Annie Kilner A New Ring Sparks Engagement Speculation

May 25, 2025 -

The Kyle Walker Situation Party Photos And Annie Kilners Reaction

May 25, 2025

The Kyle Walker Situation Party Photos And Annie Kilners Reaction

May 25, 2025