LVMH Q1 Sales Miss Expectations, Shares Drop 8.2%

Table of Contents

The luxury goods giant LVMH experienced a significant setback in the first quarter of 2024, with its Q1 sales missing expectations and resulting in an alarming 8.2% plunge in its share price. This unexpected downturn raises crucial questions about the performance of the luxury sector and the future trajectory of this industry behemoth. This article delves into the details of LVMH's Q1 financial results, exploring the contributing factors and analyzing the market's response.

LVMH Q1 Sales Figures: A Detailed Breakdown

LVMH reported disappointing Q1 2024 sales figures, falling short of analysts' predictions and triggering concerns amongst investors. While the exact figures were [Insert precise sales figures reported by LVMH for Q1 2024], this represented a significant [Percentage] decrease compared to the same period last year and significantly lower than anticipated. Let's break down the performance across key segments:

-

Specific sales figures by region:

- Europe: [Insert figures and percentage change]

- Asia: [Insert figures and percentage change]

- North America: [Insert figures and percentage change]

- Other regions: [Insert figures and percentage change]

-

Sales performance breakdown by brand:

- Louis Vuitton: [Insert figures and percentage change]

- Dior: [Insert figures and percentage change]

- Sephora: [Insert figures and percentage change]

- Other brands: [Insert figures and percentage change – consider grouping similar brands]

-

Comparison with Q1 2023 figures: Overall sales were down [Percentage] compared to Q1 2023, indicating a substantial slowdown in growth.

-

Key performance indicators (KPIs): A decline in key metrics such as [mention specific KPIs like same-store sales, average transaction value, etc.] further underscored the weakness in LVMH's Q1 performance.

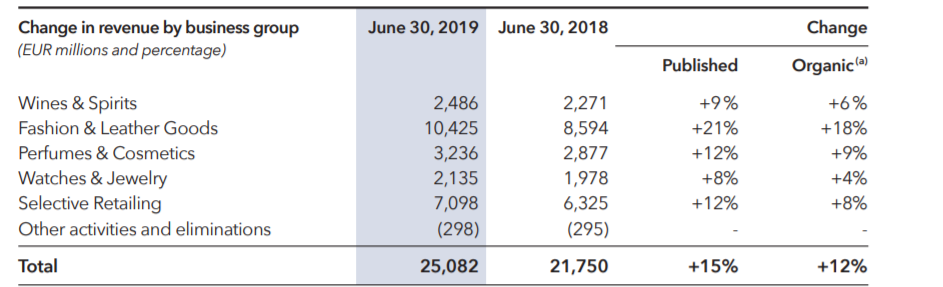

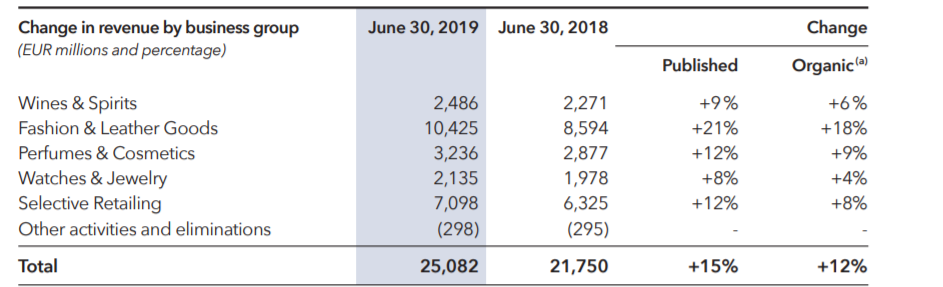

[Insert relevant charts and graphs visually representing the data here. Clearly label all axes and data points for easy understanding.]

Reasons Behind the Disappointing Sales Performance

Several interconnected factors contributed to LVMH's underwhelming Q1 2024 performance. These challenges highlight the vulnerabilities of the luxury goods sector to broader economic headwinds:

-

Impact of macroeconomic factors: Global inflation, persistent recessionary fears in key markets, and significant currency fluctuations negatively impacted consumer spending and luxury purchases.

-

Changes in consumer spending patterns: Consumers, particularly in certain regions, showed increased prudence, shifting spending away from discretionary items like luxury goods.

-

Supply chain disruptions: Though less significant than in previous years, lingering supply chain bottlenecks may have still impacted certain product lines.

-

Competitive landscape: Increased competition within the luxury goods sector, particularly in specific product categories, put pressure on pricing and market share.

-

Specific brand challenges: Individual brands within the LVMH portfolio may have faced unique challenges, such as [mention specific examples if available, e.g., difficulties adapting to changing consumer preferences].

Market Reaction and Investor Sentiment

The market reacted swiftly and negatively to LVMH's disappointing Q1 results. The 8.2% share price drop reflected investor concern about the company's future prospects.

-

Immediate market reaction: The stock price experienced a sharp decline immediately following the release of the Q1 sales report.

-

Analyst comments and predictions: Analysts expressed varying degrees of concern, with some lowering their earnings forecasts for LVMH and the luxury goods sector as a whole.

-

Impact on investor confidence: Investor confidence in LVMH was undoubtedly shaken, leading to a reassessment of its long-term growth potential.

-

Comparison with competitors: The performance of rival luxury brands [mention specific competitors and their Q1 performance if available] provided a context for evaluating LVMH's relative weakness.

-

Potential impact on future investment strategies: LVMH may need to re-evaluate its investment strategies, potentially focusing on cost-cutting measures or strategic acquisitions to regain momentum.

Long-Term Implications for LVMH and the Luxury Goods Sector

LVMH's underperformance in Q1 2024 carries significant implications not just for the company itself but also for the broader luxury goods sector. The results suggest a potential softening of demand within the luxury market, raising concerns about the resilience of the industry to economic uncertainties. Other luxury brands may experience similar headwinds, impacting overall market growth. LVMH’s response to these challenges will be closely watched by investors and industry analysts alike.

Conclusion

LVMH's Q1 2024 sales figures significantly missed expectations, resulting in an 8.2% drop in its share price. Macroeconomic factors, changes in consumer behavior, and competitive pressures all contributed to this disappointing performance. The long-term implications for LVMH and the luxury goods sector remain to be seen, but the results highlight the industry's vulnerability to external economic forces. To stay updated on LVMH's performance and monitor the luxury goods market trends, follow future financial reports and industry news. Learn more about LVMH's Q2 outlook and the evolving landscape of the luxury goods market.

Featured Posts

-

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 25, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 25, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025 -

Le Silence Impose Comment La Chine Muselle Les Dissidents En France

May 25, 2025

Le Silence Impose Comment La Chine Muselle Les Dissidents En France

May 25, 2025 -

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 25, 2025

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 25, 2025

Latest Posts

-

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025

Frank Sinatras Marital History Details On His Four Wives And Relationships

May 25, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 25, 2025 -

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Woody Allen Sexual Abuse

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 25, 2025