Lowest Personal Loan Interest Rates Today: A Complete Guide

Table of Contents

- Factors Affecting Personal Loan Interest Rates

- Credit Score

- Loan Amount and Term

- Debt-to-Income Ratio (DTI)

- Lender Type

- How to Find the Lowest Personal Loan Interest Rates

- Shop Around and Compare

- Pre-qualification vs. Application

- Negotiate Interest Rates

- Check for Fees

- Understanding APR and Interest Rates

- Conclusion

Factors Affecting Personal Loan Interest Rates

Several key factors determine the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing the best possible deal.

Credit Score

Your credit score is the most significant factor influencing your personal loan interest rate. Lenders use your FICO score (Fair Isaac Corporation score) to assess your creditworthiness. A higher credit score indicates lower risk to the lender, resulting in lower interest rates. Conversely, a lower credit score typically leads to higher interest rates, or even loan rejection.

- Improve your credit score by:

- Paying all bills on time.

- Keeping your credit utilization ratio (the amount of credit you use compared to your total available credit) low (ideally below 30%).

- Avoiding unnecessary hard inquiries (credit checks). Multiple hard inquiries in a short period can negatively impact your score.

Loan Amount and Term

The amount you borrow and the repayment period (loan term) directly impact your interest rate. Generally, larger loan amounts command higher interest rates due to increased risk for the lender.

- Loan Term Impact:

- A longer loan term (e.g., 60 months) results in lower monthly payments, but you'll pay significantly more interest over the life of the loan.

- A shorter loan term (e.g., 24 months) leads to higher monthly payments, but you'll pay less interest overall.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. A high DTI indicates a higher level of financial strain, making lenders less likely to approve your loan application or offer lower interest rates.

- Improve your DTI by:

- Reducing existing debt.

- Increasing your income.

Lender Type

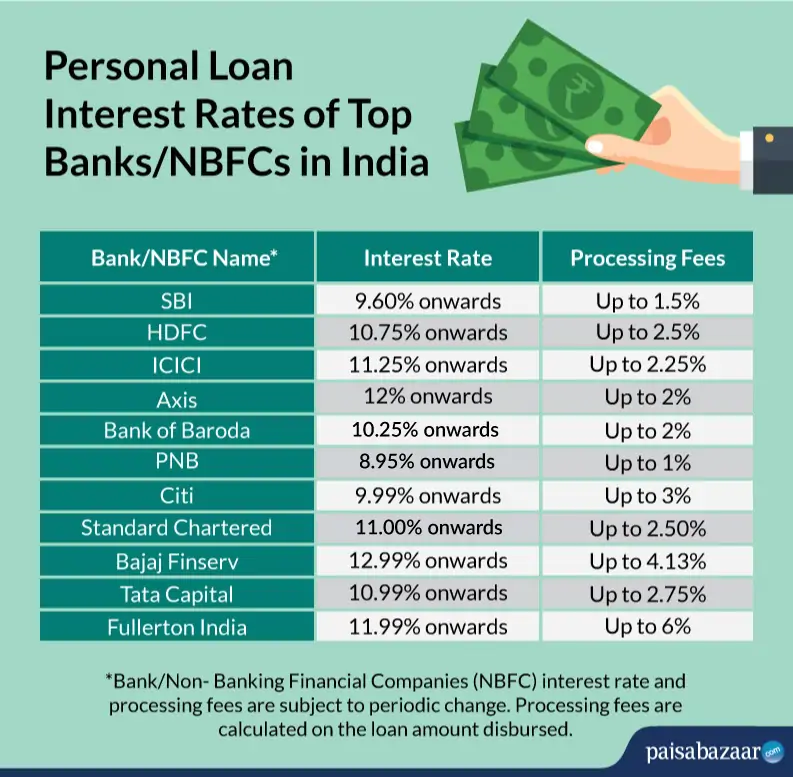

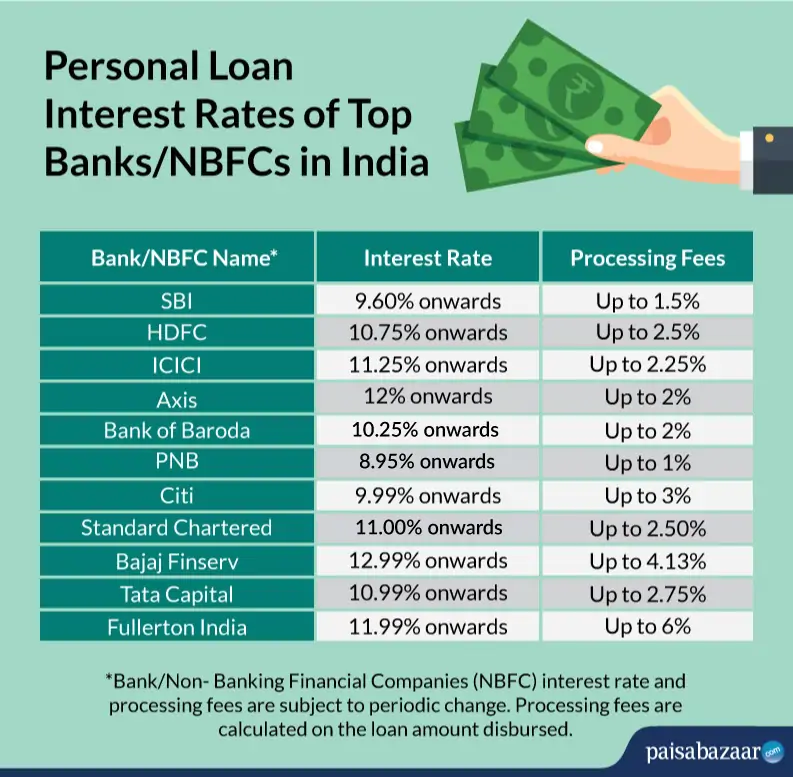

Different lenders—banks, credit unions, and online lenders—offer varying interest rates.

- Lender Types and Rates:

- Banks: Often offer a wide range of loan products but may have stricter lending criteria and potentially higher interest rates than credit unions.

- Credit Unions: Member-owned institutions frequently offer more competitive interest rates and personalized service but may have limited geographic reach.

- Online Lenders: Provide convenient online applications and potentially faster approval processes, but always carefully review their fees and interest rates.

How to Find the Lowest Personal Loan Interest Rates

Finding the lowest personal loan interest rates requires diligence and strategic planning.

Shop Around and Compare

Never settle for the first offer you receive. Compare offers from multiple lenders to find the most competitive interest rates.

- Comparison Strategies:

- Utilize online comparison tools that aggregate loan offers from various lenders.

- Visit the websites of several banks, credit unions, and online lenders directly.

Pre-qualification vs. Application

Pre-qualification involves a soft credit check that doesn't affect your credit score, providing an estimate of your potential interest rate. A formal application involves a hard credit check and impacts your score.

- Pre-qualification vs. Application:

- Use pre-qualification to gauge your eligibility and compare offers before committing to a formal application.

- Only submit formal applications to lenders you're seriously considering.

Negotiate Interest Rates

Don't be afraid to negotiate. Lenders are often willing to adjust interest rates based on certain factors.

- Negotiation Strategies:

- Highlight your strong credit score.

- Offer a larger down payment.

- Inquire about any loyalty programs or discounts.

- Use multiple competing loan offers as leverage.

Check for Fees

Be aware of hidden fees that can significantly increase the overall cost of your loan.

- Common Fees:

- Origination fees: charged by the lender for processing your loan application.

- Prepayment penalties: assessed if you pay off your loan early.

Understanding APR and Interest Rates

The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. It differs from the stated interest rate, which only reflects the interest charged on the principal loan amount.

Understanding the APR is crucial to comparing loan offers accurately. Always calculate the total cost of borrowing (principal plus interest plus fees) over the loan's term to make an informed decision. For example, a loan with a lower stated interest rate but higher fees might have a higher APR than one with a slightly higher stated rate but lower fees.

Conclusion

Securing the lowest personal loan interest rates today involves understanding the key factors influencing rates, such as your credit score, loan amount, DTI, and lender type. By shopping around, comparing offers, negotiating effectively, and checking for hidden fees, you can significantly reduce the overall cost of your loan. Don't delay! Find the lowest personal loan interest rates today and achieve your financial goals!

Boosting Chinas Economy The Crucial Role Of Consumer Spending

Boosting Chinas Economy The Crucial Role Of Consumer Spending

Pepper Premiere Programacion Y Transmision En Vivo De Pepper 96 6 Fm

Pepper Premiere Programacion Y Transmision En Vivo De Pepper 96 6 Fm

Post Series Review Padres Vs Cubs Performance Breakdown

Post Series Review Padres Vs Cubs Performance Breakdown

Increased Torpedo Bat Usage Among Marlin Anglers

Increased Torpedo Bat Usage Among Marlin Anglers

Kochanowiczs Costly Inning Angels Lose To Yankees

Kochanowiczs Costly Inning Angels Lose To Yankees