Low Oil Prices Under Trump: A Blessing And A Curse For The Energy Industry

Table of Contents

The Boon for Consumers

Lower oil prices under Trump translated into tangible benefits for American consumers, primarily through lower gas prices and increased affordability of various consumer goods.

Lower Gas Prices

Lower oil prices directly resulted in lower gasoline prices at the pump. This had a significant positive impact on consumer spending and the broader economy:

- Increased Disposable Income: Lower fuel costs freed up a considerable portion of consumers' disposable income, leading to increased spending on other goods and services. This boosted economic activity and contributed to consumer confidence.

- Reduced Transportation Costs for Businesses: Lower fuel prices reduced transportation costs for businesses, improving their profitability and competitiveness. This ripple effect positively impacted the broader economy, leading to potentially greater employment opportunities.

- Positive Impact on Inflation: Reduced transportation costs helped keep inflation relatively low, benefiting consumers and contributing to a more stable economic environment. The low oil prices under Trump contributed to a period of relatively low inflation compared to previous years.

Increased Affordability of Petrochemicals

Lower oil prices also served as a boon for the petrochemical industry. Crude oil is a key feedstock for many petrochemical products, and reduced oil prices led to cheaper production costs:

- Reduced Manufacturing Costs: Lower feedstock prices resulted in reduced manufacturing costs for plastics, fertilizers, and other petrochemical products, making them more affordable for consumers.

- Increased Competitiveness of U.S. Industries: This cost advantage increased the competitiveness of U.S. industries that rely on petrochemicals, potentially leading to increased exports and job creation.

- Potential for Job Creation in Related Sectors: The lower input costs stimulated growth in industries that utilize petrochemicals, creating a potential for job creation in related manufacturing and processing sectors.

The Bane for Energy Producers

While consumers benefited from low oil prices under Trump, the energy production sector faced significant headwinds. Lower prices directly impacted profitability, leading to various challenges across the industry.

Reduced Profitability for Oil and Gas Companies

The most direct consequence of low oil prices was reduced profitability for oil and gas exploration and production companies. This led to a series of negative outcomes:

- Decline in Oil and Gas Company Stock Prices: Reduced profits and uncertain future prospects led to a decline in the stock prices of many oil and gas companies, impacting investor confidence and the overall market valuation of the sector.

- Decreased Exploration and Drilling Activity: Lower profit margins resulted in decreased investment in new exploration and drilling projects, impacting future oil and gas production and potentially affecting energy security.

- Job Losses in the Oil and Gas Sector: Many companies were forced to implement cost-cutting measures, including layoffs and workforce reductions, leading to significant job losses in the oil and gas sector.

Impact on Shale Oil Production

The shale oil industry, a major contributor to U.S. oil production, was particularly vulnerable to low oil price fluctuations due to its higher production costs.

- Increased Reliance on Fracking Technology: Shale oil production heavily relies on expensive fracking technology, making it particularly sensitive to price changes. Lower prices squeezed profit margins, requiring companies to optimize fracking techniques for efficiency.

- Challenges Securing Financing for New Projects: Lower profitability made it harder for shale oil companies to secure financing for new projects, hindering growth and investment in the sector.

- Mergers and Acquisitions in the Shale Oil Industry: Many shale oil companies faced financial distress, leading to a wave of mergers and acquisitions as stronger companies consolidated assets and market share.

Government Response and Policies

The Trump administration's response to low oil prices under Trump involved a focus on energy independence and various policy initiatives designed to support the domestic energy sector.

Energy Independence Initiatives

The administration actively promoted energy independence as a key policy goal, aiming to reduce reliance on foreign oil and strengthen the domestic energy sector:

- Easing of Environmental Regulations: The administration pursued policies aimed at easing environmental regulations, potentially reducing the cost of energy production and boosting domestic output.

- Support for Pipeline Construction: The administration supported the construction of new pipelines, facilitating the transport of oil and gas, and improving the efficiency of the energy supply chain.

- Promotion of Fossil Fuel Exploration: Policies encouraging the exploration and production of fossil fuels were implemented to increase domestic energy production and reduce reliance on foreign sources.

Trade Policies and Global Oil Markets

Trump's trade policies, including tariffs and trade disputes, had a complex and indirect effect on global oil prices and the U.S. energy sector:

- Impact on International Trade Relations: Trade disputes and tariffs could have affected international trade relationships, potentially impacting global oil supply chains and prices.

- Potential Effects on Oil Demand and Supply: Changes in global trade patterns could influence global oil demand and supply dynamics, leading to indirect effects on oil prices.

- Influence on Global Oil Price Dynamics: The administration's trade policies could have played a role in influencing the overall dynamics of the global oil market, impacting prices both directly and indirectly.

Conclusion

The era of low oil prices under Trump presented a complex and multifaceted economic scenario for the energy industry. While consumers undeniably benefited from lower fuel costs and increased affordability, energy producers faced substantial challenges, including reduced profitability, job losses, and decreased investment. The government's response, prioritizing energy independence, attempted to mitigate some negative impacts, but the overall impact remains a subject of ongoing debate. Understanding the multifaceted consequences of low oil prices under Trump is crucial for informed policymaking and navigating future energy market fluctuations. Further research is needed to fully comprehend the long-term implications of this period, helping to shape a more resilient and adaptable energy sector. A thorough continued analysis of the impact of low oil prices under Trump is essential for predicting and preparing for future energy market volatility.

Featured Posts

-

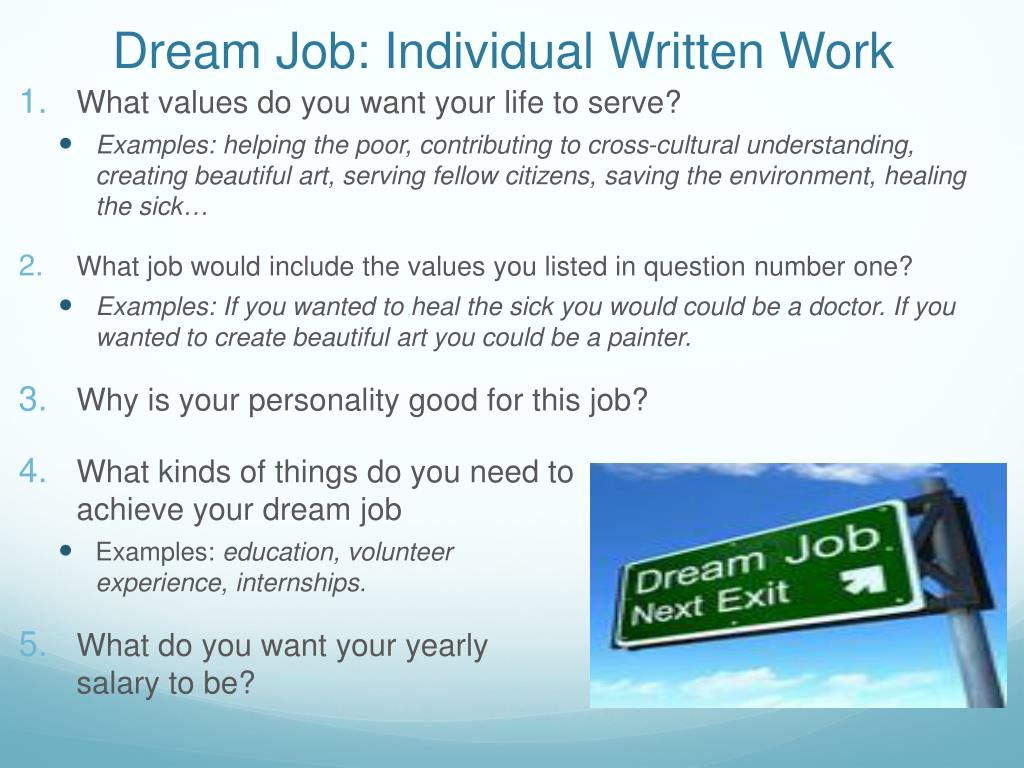

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Sector

May 12, 2025

Land Your Dream Job 5 Dos And Don Ts In The Private Credit Sector

May 12, 2025 -

Selena Gomez Leaks Benny Blancos Personal Belongings Fan Reactions

May 12, 2025

Selena Gomez Leaks Benny Blancos Personal Belongings Fan Reactions

May 12, 2025 -

Ines Reg Et Chantal Ladesou Tensions Sur Le Plateau De Mask Singer

May 12, 2025

Ines Reg Et Chantal Ladesou Tensions Sur Le Plateau De Mask Singer

May 12, 2025 -

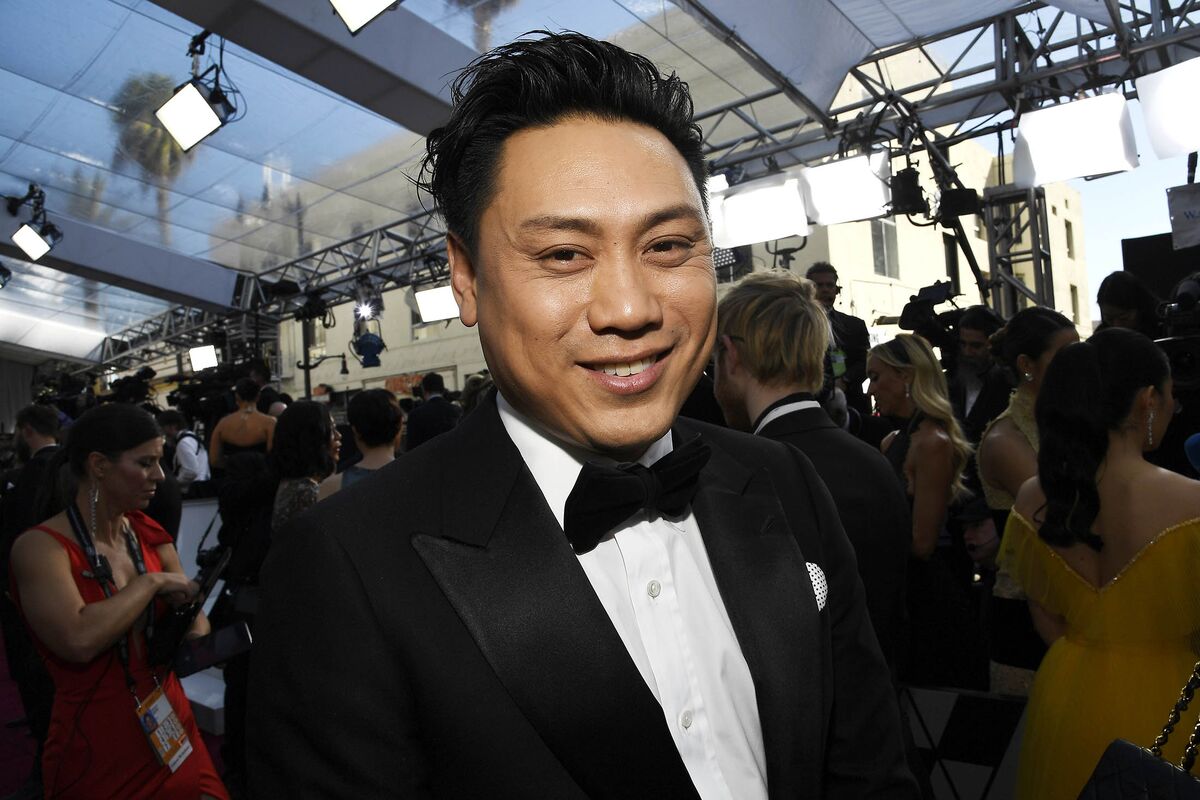

Crazy Rich Asians Tv Series Officially In Development With Jon M Chu

May 12, 2025

Crazy Rich Asians Tv Series Officially In Development With Jon M Chu

May 12, 2025 -

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 12, 2025

Aaron Judges 2024 Season A Yankees Magazine Deep Dive

May 12, 2025

Latest Posts

-

Romska Gromada Ukrayini Rozpodil Naselennya Istoriya Ta Suchasnist

May 13, 2025

Romska Gromada Ukrayini Rozpodil Naselennya Istoriya Ta Suchasnist

May 13, 2025 -

Rozselennya Romiv V Ukrayini Chiselnist Faktori Ta Geografiya

May 13, 2025

Rozselennya Romiv V Ukrayini Chiselnist Faktori Ta Geografiya

May 13, 2025 -

De Zhivut Romi V Ukrayini Kilkist Prichini Ta Detali

May 13, 2025

De Zhivut Romi V Ukrayini Kilkist Prichini Ta Detali

May 13, 2025 -

Southern California Scorched Record Breaking Heat In La And Orange Counties

May 13, 2025

Southern California Scorched Record Breaking Heat In La And Orange Counties

May 13, 2025 -

Government Of India Issues Heatwave Advisory To States

May 13, 2025

Government Of India Issues Heatwave Advisory To States

May 13, 2025