Los Angeles Wildfires: A New Frontier For Disaster Betting Markets?

Table of Contents

The Growing Market for Disaster-Related Bets

The market for disaster-related bets is expanding rapidly, driven by technological advancements in predictive modeling and the growing awareness of extreme weather events.

Types of Disaster Bets:

Disaster betting encompasses a range of financial instruments. These include:

- Prediction markets: These platforms allow users to bet on the likelihood or severity of specific wildfire events, such as the acreage burned in a given fire season or the number of structures destroyed in a specific Los Angeles County area. These markets often utilize sophisticated algorithms and real-time data to assess probabilities.

- Insurance-linked securities (ILS): These are financial instruments where insurance companies transfer some of their wildfire risk to investors. The payout to investors is contingent on the occurrence and severity of wildfires in designated regions, like Los Angeles.

- Catastrophe bonds (CAT bonds): These are debt instruments designed to transfer catastrophic risks, including wildfire damage, from insurance companies to capital market investors. The bond's payout is triggered by a predefined event, such as a wildfire exceeding a certain damage threshold in Los Angeles.

While examples of widespread, publicly traded disaster betting markets specifically focused on Los Angeles wildfires are currently limited, the underlying principles are already applied in broader catastrophe risk markets. The accuracy of these markets relies heavily on sophisticated data analysis and predictive modeling incorporating factors like historical wildfire data, climate projections, and real-time weather patterns.

Regulatory Landscape of Disaster Betting:

The legal and ethical ramifications of betting on natural disasters are complex and vary significantly across jurisdictions.

- Legal ambiguity: Many countries lack specific regulations governing disaster betting, creating a grey area for both operators and participants.

- Ethical concerns: Profiting from the misfortune of others raises serious ethical questions, particularly in the context of events like devastating wildfires that cause significant human suffering and displacement.

- Jurisdictional differences: Regulations regarding gambling and financial derivatives differ widely globally. Some jurisdictions may explicitly prohibit disaster betting, while others might allow it under certain conditions.

The future likely holds increased regulatory scrutiny as this market grows, with a focus on transparency, risk management, and ethical considerations.

Investor and Speculator Interest:

The motivations behind participation in disaster betting markets are multifaceted:

- High-risk, high-reward potential: The possibility of substantial returns attracts investors willing to accept significant risk.

- Hedging strategies: Insurance companies and reinsurers may use these markets to hedge their wildfire exposure.

- Market manipulation concerns: The potential for market manipulation poses a significant risk, particularly given the emotional and unpredictable nature of disaster events.

Media coverage plays a crucial role in shaping public perception and influencing investor behavior. Negative media portrayals can discourage participation, while positive coverage may attract more speculative investment.

Los Angeles Wildfires: A Unique Case Study

Los Angeles wildfires present a unique case study for disaster betting due to several factors.

Predictability and Risk Assessment:

Predicting the timing, location, and intensity of Los Angeles wildfires is challenging. Key factors influencing their unpredictability include:

- Santa Ana winds: These strong, dry winds significantly increase wildfire risk and are notoriously difficult to predict precisely.

- Climate change: Rising temperatures and prolonged drought conditions exacerbate wildfire risks in the region.

- Urban sprawl: The expansion of urban areas into fire-prone wildlands increases both the probability and potential impact of wildfires.

While advanced modeling techniques improve wildfire prediction, accuracy remains a significant challenge, impacting the reliability of any associated betting markets. Accurately assessing the economic impact of these fires, considering factors like property values, infrastructure damage, and business interruption, further complicates the process.

Insurance and Reinsurance Implications:

Wildfires represent a substantial risk for insurance companies and reinsurers operating in Los Angeles.

- Increasing premiums: The escalating frequency and severity of wildfires are driving up insurance premiums for homeowners and businesses.

- Reinsurance market: Reinsurance companies play a critical role in managing wildfire risk, but even their capacity can be strained by major events.

- Innovative insurance products: The integration of wildfire prediction markets into insurance products could potentially offer more efficient risk transfer mechanisms.

The development of these markets could influence insurance pricing and risk management strategies, potentially leading to more sophisticated and responsive insurance solutions.

Socioeconomic Impact and Ethical Concerns:

The ethical implications of profiting from the devastation caused by Los Angeles wildfires cannot be ignored:

- Exacerbating inequality: Disaster betting could disproportionately impact vulnerable communities already struggling with the consequences of wildfires.

- Moral hazard: The existence of these markets could potentially discourage proactive wildfire mitigation and preparedness efforts.

- Incentivizing prevention: Conversely, thoughtfully designed markets could incentivize investment in wildfire prevention and mitigation strategies.

Responsible development of these markets requires a careful consideration of these ethical dimensions.

Conclusion: The Future of Los Angeles Wildfires in Disaster Betting Markets

The potential for Los Angeles wildfires to become a significant factor in disaster betting markets is undeniable, offering both opportunities and significant challenges. The inherent unpredictability of these events coupled with the ethical considerations surrounding profiting from disaster necessitates a cautious and regulated approach. While such markets could potentially provide innovative tools for risk management and incentivize preventative measures, the potential for market manipulation, exacerbation of inequalities, and ethical concerns demands rigorous oversight.

Further research and open discussion are crucial to navigate the complex interplay between the escalating risk of Los Angeles wildfires and the emerging world of disaster betting. Should Los Angeles Wildfires be included in disaster betting markets? This question requires careful consideration from all stakeholders, including policymakers, insurers, investors, and the communities most vulnerable to the devastating impact of these natural disasters.

Featured Posts

-

53

Apr 26, 2025

53

Apr 26, 2025 -

Velikonocni Nakupy Jak Se Vyhnout Zbytecnym Vydajum

Apr 26, 2025

Velikonocni Nakupy Jak Se Vyhnout Zbytecnym Vydajum

Apr 26, 2025 -

Chelsea Handlers No Holds Barred Response To Dating Elon Musk Goes Viral

Apr 26, 2025

Chelsea Handlers No Holds Barred Response To Dating Elon Musk Goes Viral

Apr 26, 2025 -

Middle Managements Impact Driving Results For Companies And Individuals

Apr 26, 2025

Middle Managements Impact Driving Results For Companies And Individuals

Apr 26, 2025 -

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025

Latest Posts

-

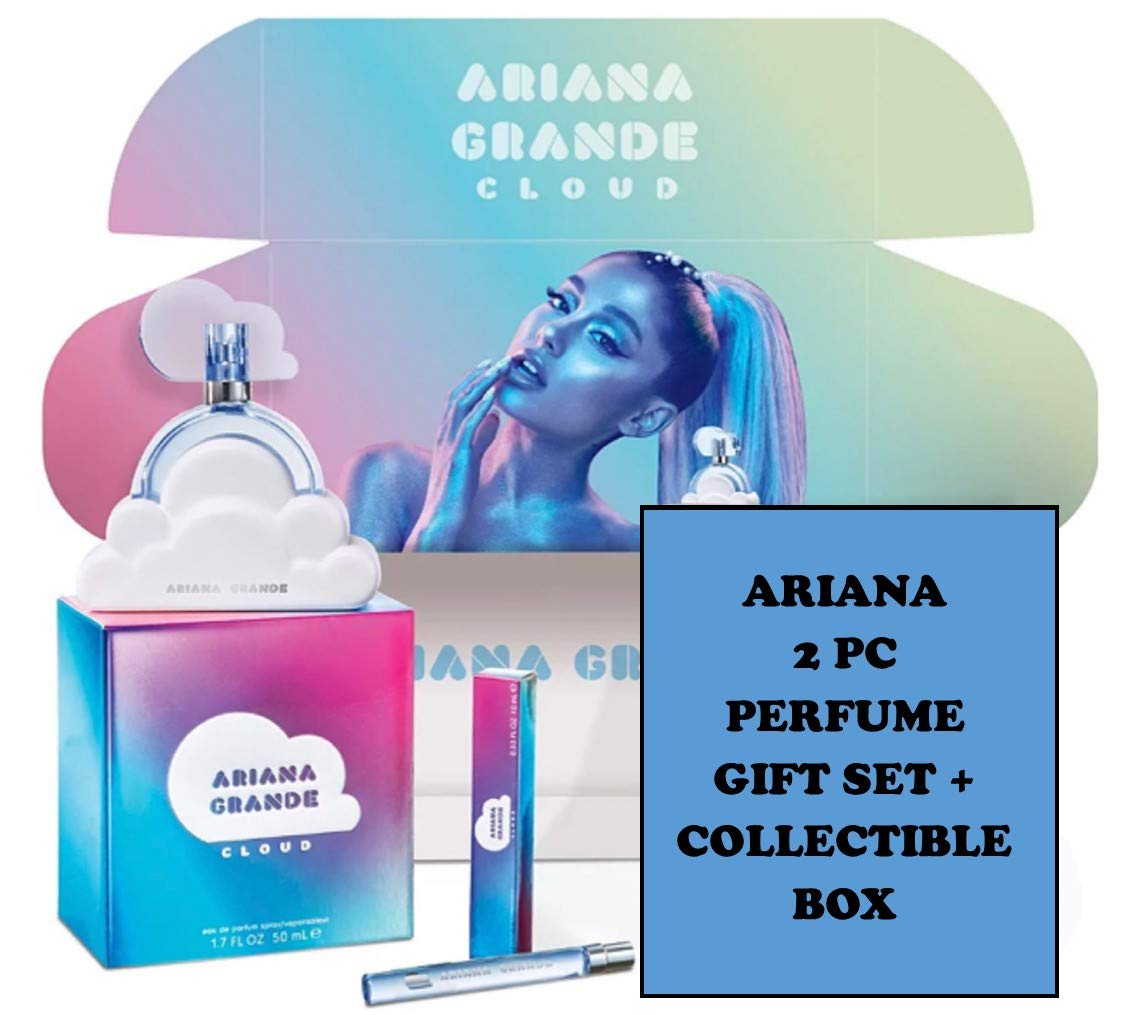

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025 -

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025 -

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025 -

Mafs Star Sam Carraro Joins Love Triangle But For How Long

Apr 27, 2025

Mafs Star Sam Carraro Joins Love Triangle But For How Long

Apr 27, 2025 -

Sam Carraros Love Triangle Stint A Five Minute Wonder Or Not

Apr 27, 2025

Sam Carraros Love Triangle Stint A Five Minute Wonder Or Not

Apr 27, 2025